Hold, Exchange, or Sell Real Estate: Tax-Driven Decision Frameworks for Florida Investors

For high-income Florida real estate investors, the real tax issue is rarely a missing tactic. It’s a missing framework.

Most investors already depreciate property, use entities, and “plan” before year-end. Yet hold, exchange, and sell decisions still get made property-by-property and year-by-year, That creates drift. A better approach is to treat every hold, exchange, or sell real estate decision as a sequencing event in a multi-year plan. The portfolio grows, cash flow looks healthy, and federal tax stays stubbornly high because the decisions aren’t sequenced, and the consequences of exits, recapture, liquidity, and structure are handled late.

The question is not whether a given transaction minimizes tax this year. It’s whether your next decision improves your after-tax position over the next five to ten years and supports a coherent exit path.

This article lays out a tax-driven decision framework for whether to hold, exchange, or sell real estate, designed for sophisticated Florida taxpayers who are optimizing for multi-year or lifetime efficiency.

Key Takeaways

Hold, exchange, and sell decisions work best when treated as sequenced portfolio events, not isolated transactions.

Depreciation is borrowed timing, not permanent savings; its value depends on income timing, classification, and exit design.

Exchanges can be powerful, but they also shift basis, liquidity, and future flexibility in ways that can reduce long-term optionality.

Selling can be the most tax-efficient choice when it resets capital allocation, simplifies structure, or aligns exits with lower-income years.

Florida’s no state income tax environment increases the importance of federal planning discipline because there’s no state layer to absorb mistakes.

The “best” option is the one that supports a durable plan: cash flow, tax character, ownership structure, and exit mechanics must agree.

We’ll map your hold/exchange/sell decisions across multiple tax years and stress-test how entity structure affects flexibility at exit.

Why This Decision Is a Planning Question, Not a Transaction Choice

Most content on this topic implicitly assumes you’re choosing between three buttons:

Hold for cash flow

Exchange to defer

Sell to simplify

That framing is too transactional for high-income investors because it ignores the fact that each choice changes your future tax surface area. It alters:

The type and timing of taxable income you’ll recognize later

How much depreciation capacity you’ll have going forward

How flexible your liquidity and reinvestment options remain

How complicated an eventual unwind becomes across entities and owners

If the decision isn’t anchored to a multi-year plan, the “right” move today often becomes tomorrow’s constraint.

The Florida Context: Less State Tax Noise, More Federal Consequence

Investing from Florida removes state income tax, which makes federal planning carry more weight. There is no parallel state income tax system to soften a mis-timed gain year or a poorly sequenced exit.

Florida also brings structural realities that materially influence hold/exchange/sell decisions:

Many investors have high portfolio concentration in Florida real estate

Short-term rental activity is common, which can change operational complexity and risk profile

Property taxes differ meaningfully between homestead and non-homestead holdings

Insurance pricing, deductibles, and casualty risk can shift quickly and affect carry cost, liquidity needs, and exit urgency

A good framework doesn’t ignore these. It treats them as part of the decision, not background noise.

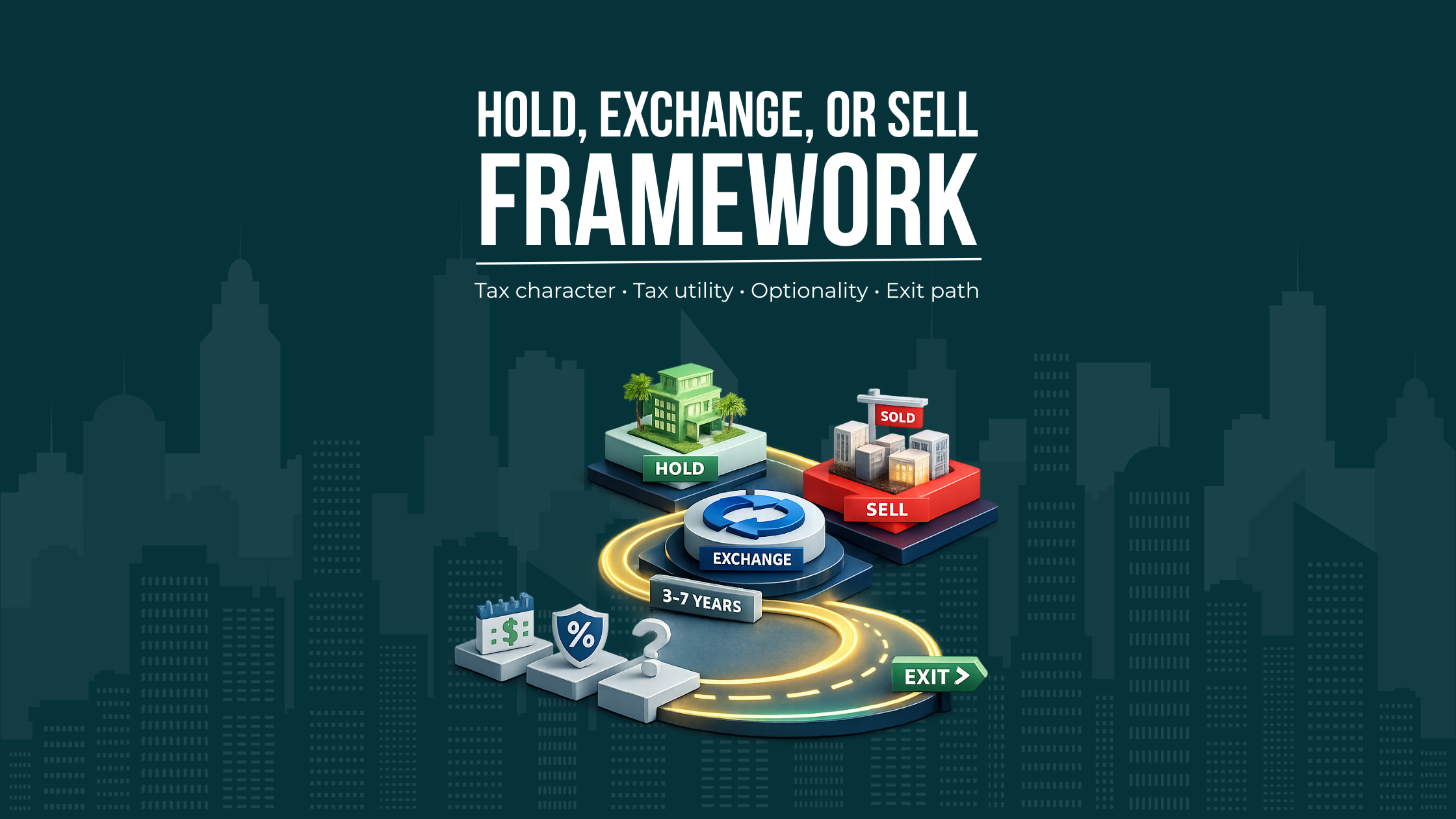

The Core Framework: Three Questions That Decide “Hold, Exchange, or Sell”

Before comparing strategies, we anchor every decision to three planning questions.

1) What is the tax character profile over the next 3–7 years?

For high earners, the driver is not just “how much tax,” but what kind and when. You want to anticipate where taxable income will concentrate and avoid stacking major recognition events into peak-income years.

2) What is the remaining tax utility of the asset?

A property’s tax utility is not permanent. Depreciation value changes as:

Your income mix changes

Passive limitations bind or loosen

The property becomes heavily depreciated

Your exit horizon shortens

A property can be a great investment and still be a weak piece of a long-term tax plan if it no longer meaningfully contributes to your broader income strategy.

3) What optionality are you trading away?

Deferral strategies often reduce flexibility. The right question is: what future choices does this move preserve, and what does it lock in? Optionality is an asset in a multi-year plan, particularly when income, markets, insurance conditions, and family planning change.

With those questions answered, the hold/exchange/sell decision becomes less emotional and more structural.

Holding Real Estate: When Deferral Still Creates Value

Holding is not “doing nothing.” It is a choice to keep your current basis, your current depreciation schedule, and your current operational complexity.

When Holding Is Strategically Strong

Holding tends to be compelling when:

The asset still produces meaningful after-tax cash flow

The depreciation profile still has planning value relative to your income timing

The property serves a role in a longer plan (asset class exposure, operational control, financing strategy, legacy planning)

The exit window you want is later, and you’re intentionally deferring recognition events until income is expected to be lower or more manageable

The Diminishing Returns of Depreciation Over Time

Depreciation is front-loaded value. Over time, its marginal benefit can decline as the property becomes heavily depreciated and your ability to use losses becomes more constrained by classification and income structure.

When depreciation no longer meaningfully offsets other income, holding becomes primarily a cash flow and appreciation decision, not a tax decision. That’s fine, but it should be explicit. Many investors keep acting like depreciation is still “working” long after its value has faded.

Holding Without an Exit Path Creates Recapture Concentration

Every year you hold and depreciate, you build future recapture exposure. Holding is most effective when paired with a defined exit path, even if that exit is years away. Without that, recapture and gain often land in the same year your income is already high, and the “cheap tax years” you imagined never arrive.

Exchanges: Deferral Is Not the Same as Optimization

Exchanges are often treated as the default solution to embedded gain. For sophisticated investors, the better approach is: exchange only when deferral improves the portfolio’s long-run after-tax economics and preserves the right flexibility.

What an Exchange Really Changes

Conceptually, an exchange defers recognition by carrying basis forward. That does three things that matter in planning:

It defers current tax, improving reinvestment capacity.

It reduces future depreciation potential relative to a full basis reset, because the carried basis limits fresh depreciation capacity.

It shifts the problem into the future, which is good only if the future plan is more favorable than the present.

The Liquidity and Flexibility Cost

An exchange is not just a tax decision; it’s a liquidity and timing decision. It often compresses transaction timelines, increases execution friction, and forces you to prioritize “replacement property compliance” over “best capital deployment.”

For HNW investors, the risk is subtle: you can end up with a suboptimal asset allocation simply because deferral became the goal rather than the means.

When Exchanges Lose Their Edge

Exchanges become less compelling when:

You anticipate lower-income years soon and can time a sale into those years

You need liquidity, restructuring, or simplification more than you need deferral

You are approaching a planning horizon where family ownership, governance, or long-term control matters more than incremental tax deferral

The carried basis will materially reduce the next asset’s tax utility and flexibility

Deferral is valuable. It is not automatically the best outcome.

Selling: The Strategic Reset Most Investors Avoid (and Often Need)

Selling tends to be framed as “pay the tax and move on.” For high earners, selling can be a strategic reset that improves the overall plan even when it increases tax in the sale year.

Selling as a Portfolio Reallocation Tool

A sale can unlock:

Flexibility to redeploy capital into better after-tax opportunities

Simplification of entity structures and ownership arrangements

A cleaner future planning landscape with fewer “legacy constraints” created by past transactions

In many portfolios, tax friction is not caused by a lack of deductions. It’s caused by capital being trapped in assets that no longer fit the plan.

Capital Gains Are Not the Only Variable

A sophisticated sale decision evaluates:

After-tax reinvestment options

Ongoing carry costs (including Florida insurance volatility and property tax trajectory for non-homestead property)

Management time, operating risk, and governance complexity across owners and entities

Whether the sale reduces future recapture concentration by enabling better sequencing

The point is not to “choose tax over wealth.” The point is to choose the move that maximizes long-run after-tax outcomes.

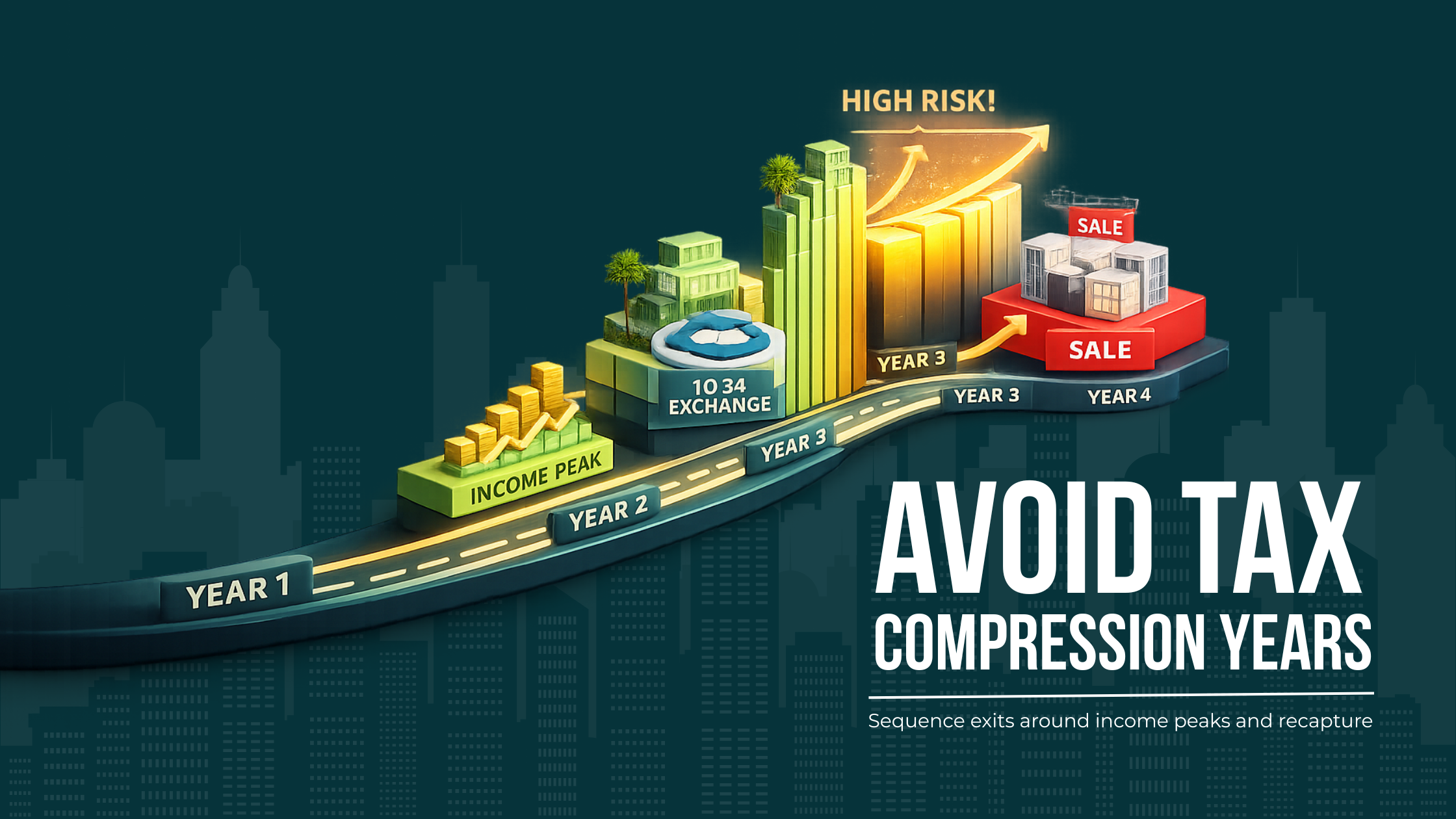

Timing and Sequencing: Where Most Tax Outcomes Are Actually Won or Lost

High-income investors usually do not lose on strategy selection. They lose on timing.

Avoid Stacking Recognition Events into Peak Income Years

The common failure pattern is unintentional stacking:

Depreciation recapture from one sale

Capital gain from another disposition

A business income spike

A reallocation event elsewhere

Each item alone is manageable. Together, they create a “tax compression year” that becomes hard to unwind.

Sequencing as a Portfolio Discipline

Sequencing is the practice of planning the order and spacing of transactions so that:

Depreciation has maximum value when it’s most usable

Gain and recapture recognition occurs when income timing makes it least punitive

Liquidity events support, rather than disrupt, longer-term reinvestment plans

This is where multi-year planning beats reactive planning. Most investors have good tactics. Few have disciplined sequencing.

We’ll create a multi-year decision framework to choose when to hold, exchange, or sell without stacking gain and recapture into peak-income years.

Active vs Passive Treatment: Why Classification Drives Strategy Value

A hold/exchange/sell framework must account for how real estate activity is treated relative to your broader income profile.

If depreciation and losses are constrained while your active income is high, tax benefits can become timing benefits rather than current-year benefits. That changes the value of holding, the urgency of exchanging, and the attractiveness of selling into the right window.

The practical takeaway: we do not evaluate strategies without mapping them to your activity profile and expected shifts over time. The same transaction can be brilliant or wasteful depending on classification and timing.

Cost Segregation Mindset: Planning Tool, Not a Reflex

Accelerating depreciation can be powerful, but it is often used tactically rather than strategically.

The planning question is not “can we accelerate depreciation?” It’s:

Will accelerated depreciation create usable benefit given your income timing and activity profile?

Does it distort the exit by increasing future recapture concentration?

Does it incentivize holding beyond the point where the asset fits the plan?

Used well, accelerated depreciation supports multi-year sequencing. Used poorly, it creates a future tax bottleneck that forces an exchange or an awkward hold simply to avoid recognizing the unwind.

Entity and Ownership Structure: The Quiet Constraint Behind Most “Bad Choices”

Many investors try to solve a planning problem with a transaction, when the real constraint is structural.

Ownership and entity decisions influence:

The flexibility to execute an exchange or sale cleanly

Allocation of income, loss, and decision rights

The ability to simplify or unwind without collateral tax consequences

Governance complexity when multiple owners or family members are involved

Structure is not a legal afterthought. It determines what moves are feasible, and how expensive they are to execute.

A high-level rule we follow: if the structure fights the strategy, the structure wins. That’s why we evaluate structure before committing to hold/exchange/sell.

Exit Planning and Depreciation Recapture: Treat the Unwind as a First-Order Problem

Depreciation is not “free.” It is a timing tool that tends to reappear at exit through recapture. Investors who ignore this treat early benefits as permanent savings and then get surprised when the unwind compresses tax into a single year.

Exit-Aware Planning Changes Today’s Decision

When we evaluate hold/exchange/sell, we explicitly model the exit path:

If you will likely hold long-term, how does recapture concentration affect the eventual plan?

If you will likely exchange, how does carried basis affect future flexibility and tax utility?

If you will likely sell, what sequencing and income timing reduces the chance of a punitive recognition year?

Exit planning is not a separate project. It should be embedded in every acquisition, improvement, and disposition decision.

Cash Flow vs Long-Term Tax Efficiency: A Trade-Off, Not a Contest

High earners often overweight current-year cash flow and underweight long-term tax efficiency. That’s understandable. Cash flow is visible. Tax drag is cumulative.

The right comparison is not pre-tax cash flow versus tax savings. It’s after-tax, multi-year performance versus portfolio risk and complexity.

A property can be a strong cash-flowing asset and still be an inefficient piece of the broader plan if it:

Constrains future moves

Forces high-tax exits

Adds operational and insurance risk that requires liquidity reserves

No longer contributes meaningful tax utility

This is where selling becomes strategic: not because the asset is “bad,” but because the portfolio can become better.

Correcting Common Misuse and Oversights

This section is intentionally corrective. These are common errors we see among high-income investors who already “do tax planning,” but whose outcomes remain reactive.

Treating Exchanges as the Default “Best Practice”

Exchanges are often used to avoid confronting portfolio allocation questions. Deferral is valuable, but if it pushes you into inferior assets or reduces flexibility, it can lower long-term after-tax performance.

Confusing Depreciation with Permanent Savings

Depreciation is timing. Without an exit-aware plan, it can create future recapture concentration that forces an exchange or a hold that no longer makes economic sense.

Allowing Liquidity Constraints to Dictate Tax Choices

When investors lack planned liquidity, they become forced sellers or forced exchangers. That leads to rushed decisions and poor sequencing. Liquidity planning is part of tax planning at this level.

Fragmenting Advisors and Creating Structural Drift

When legal, tax, and investment decisions happen in different rooms, structure and sequencing drift apart. The result is a portfolio full of “individually reasonable” decisions that don’t add up to a coherent plan.

We’ll build an exit-aware plan that accounts for depreciation recapture concentration and the timing of recognition events across years.

Florida-Specific Planning Considerations That Change the Analysis

Florida does not change federal tax rules, but it changes the planning environment.

Federal Planning Carries More Weight

With no state income tax, the federal consequences of timing, character, and exit sequencing become more pronounced. There is less “noise” and fewer offsets.

Concentration Risk Is Common and Often Underestimated

Florida investors frequently have heavy exposure to Florida real estate. Holding decisions should incorporate concentration risk, not just cash flow and deferral.

Property Tax Nuance: Homestead vs Non-Homestead

Homestead and non-homestead property tax dynamics can meaningfully alter holding economics. For investors, carrying cost is part of the hold decision, and it should be modeled alongside tax outcomes.

Insurance and Casualty Planning Should Influence Hold and Exit Timing

Insurance volatility and casualty risk in Florida can force liquidity needs, increase deductibles, and change the risk-adjusted return profile of an asset. That matters for whether holding still makes sense and whether an exit needs to be accelerated or staged.

We’ll review your transaction timeline to reduce “tax compression years” by coordinating income peaks with depreciation and exit timing.

Conclusion: Choose the Move That Protects the Long-Run Plan

Hold, exchange, or sell real estate is not a question with a universal answer. It’s a decision framework that should be recalibrated as your income, portfolio, and objectives evolve.

For high-income Florida investors, the objective is not maximum deferral this year. It’s a coordinated plan that produces durable, multi-year tax efficiency while preserving liquidity and flexibility.

When decisions are sequenced intentionally, depreciation is used with exit awareness, and structure supports strategy, planning stops being reactive. It becomes structural.

That’s when the portfolio not only grows, but stays efficient across exits, transitions, and time.

We’ll integrate activity profile (passive vs active), sequencing, and ownership structure so each property decision supports long-term after-tax outcomes.

Freaquently asked Questions

How do we decide when to trigger a sale or exchange if our income varies year to year?

We start by treating the transaction as a multi-year income-matching exercise, not a single-year tax event. For many high earners, the key risk is stacking multiple recognition items in the same year: gain, recapture, and unrelated income spikes. We typically map expected income ranges across several years, then layer in the property’s remaining tax utility and the portfolio’s liquidity needs. The goal is to avoid “tax compression years” and to position recognition events when they are least disruptive to the broader plan.

What does “sequencing” look like across multiple properties, not just one deal?

Sequencing becomes more valuable when you have multiple assets at different points in their depreciation life and risk profile. Instead of choosing hold/exchange/sell one property at a time, we evaluate how each property’s exit affects the next move. That includes which assets still generate meaningful depreciation value, which ones are becoming operationally inefficient, and how liquidity from one event enables the next repositioning. Done well, sequencing reduces the chance that recapture and gains bunch together and increases flexibility for future decisions.

If depreciation is “borrowed timing,” how do we keep recapture from turning into a future tax bottleneck?

The core is to treat recapture exposure as a first-order planning item, not an afterthought at closing. We look at how much depreciation has been taken relative to the likely holding period and whether the asset’s role in the plan justifies continued depreciation. We also consider whether the exit is more likely to be a sale, an exchange, or a longer-term hold that shifts planning toward later-stage outcomes. The objective is to avoid building a recapture wall that forces a rushed exchange or a hold that no longer makes sense economically.

When does selling become the cleaner long-term move even if it creates a painful tax year?

Selling can be the more efficient outcome when it restores flexibility and improves portfolio alignment. If a property’s tax utility has diminished, its carry costs or risk profile has increased, or its structure has become difficult to unwind, continuing to hold may preserve deferral but reduce long-run optionality. In those cases, we focus on timing the sale thoughtfully, coordinating it with your broader income cycle, and using the reset to reduce future complexity. The point is not “pay tax now,” but “improve the plan’s after-tax trajectory.”

How should entity and ownership structure influence our hold/exchange/sell decision?

Structure often determines which options are practical and which become expensive to execute. Ownership arrangements affect how income, loss, and decision rights flow, and they can add friction when a transaction requires speed or alignment among parties. We treat structure as part of the strategy, not a wrapper around it. If the entity setup limits flexibility, creates governance complexity, or makes an unwind difficult, the best “tax move” on paper may underperform in reality. Clean structure supports clean sequencing.

How does Florida’s no state income tax change the sequencing and exit math?

With no state income tax, federal outcomes carry more weight and planning errors are harder to dilute. That increases the importance of timing recognition events and managing character, especially for high-income households where a single year can become unusually concentrated. Florida also introduces planning friction through real estate concentration, non-homestead property tax dynamics, and insurance and casualty volatility. Those factors affect holding economics and liquidity reserves, which directly impact whether deferral still creates value. We integrate those realities into the sequence, not after the fact.

How should short-term rental operations affect a decision to hold or reposition a property?

Short-term rentals can change the practical “cost” of holding, even when headline returns look strong. Operational intensity, variability in net income, and the need for liquidity buffers all influence how resilient the property is inside a multi-year plan. We evaluate whether the property’s operational demands and risk profile still justify its role in the portfolio and whether maintaining it constrains other moves you want to make. The decision is less about whether the strategy is “good” and more about whether it fits your long-range allocation and timing.

How do we evaluate the hidden cost of deferral when an exchange reduces future flexibility?

Deferral can be valuable while still narrowing your future decision set. We analyze what you give up when basis carries forward: reduced future depreciation capacity, fewer clean liquidity exits, and more dependence on future real estate transactions to manage recognition. We also consider whether the exchange forces a replacement choice that prioritizes compliance over best capital deployment. For sophisticated investors, the goal is to defer tax only when the exchange improves the portfolio’s long-run after-tax position and preserves enough optionality to adapt later.