Blog

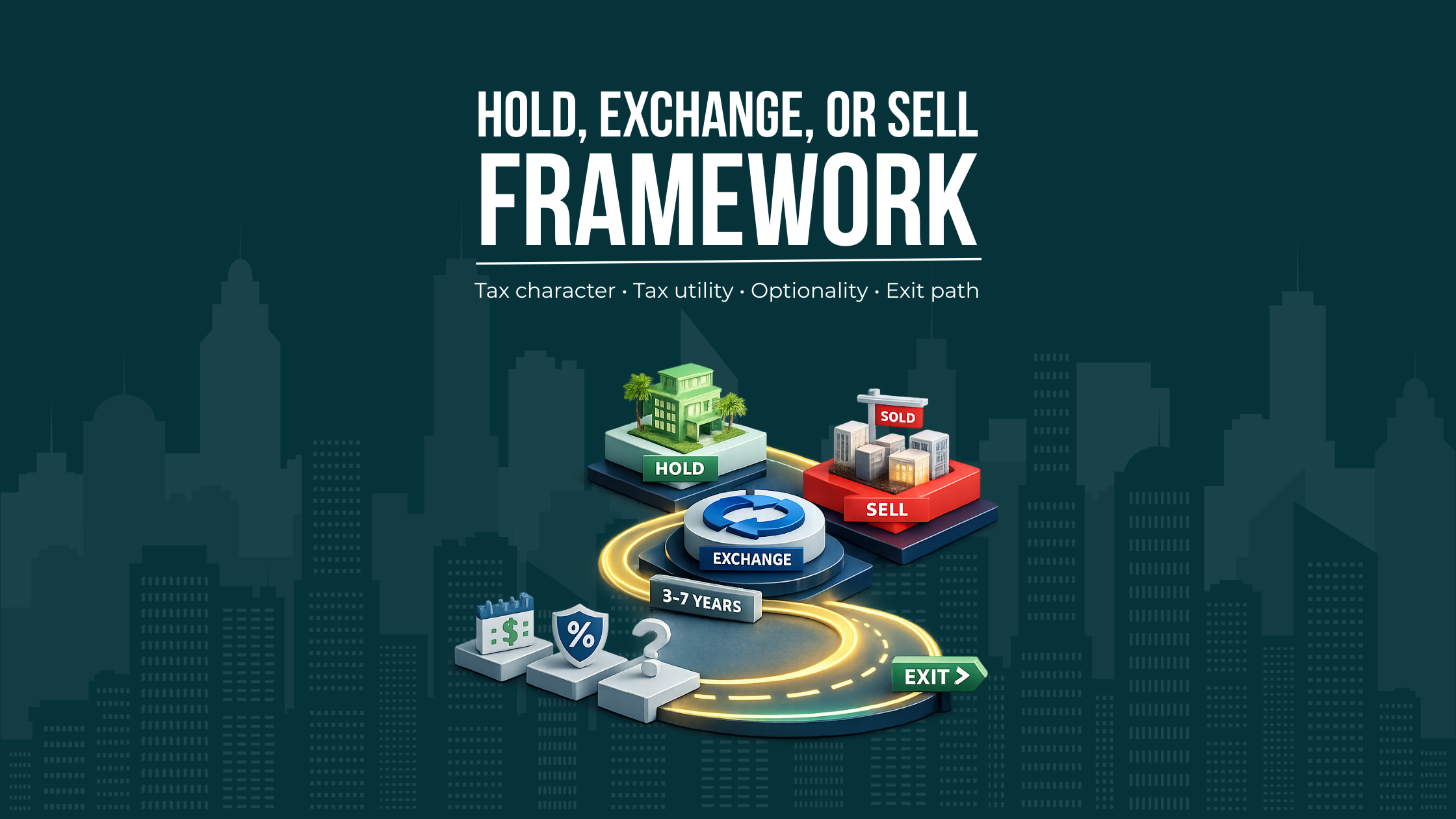

Hold, Exchange, or Sell Real Estate: Tax-Driven Decision Frameworks for Florida Investors

A portfolio-level decision framework for Florida investors weighing hold, exchange, or sell choices. Built around sequencing, optionality, and exit-aware planning.

Florida Real Estate Tax Changes in January 2026: The Complete Investor Guide

Federal tax rule changes taking effect in January 2026 will reshape how Florida real estate performs after tax. This guide explains what high-income investors need to know about timing, structure, and long-term outcomes.

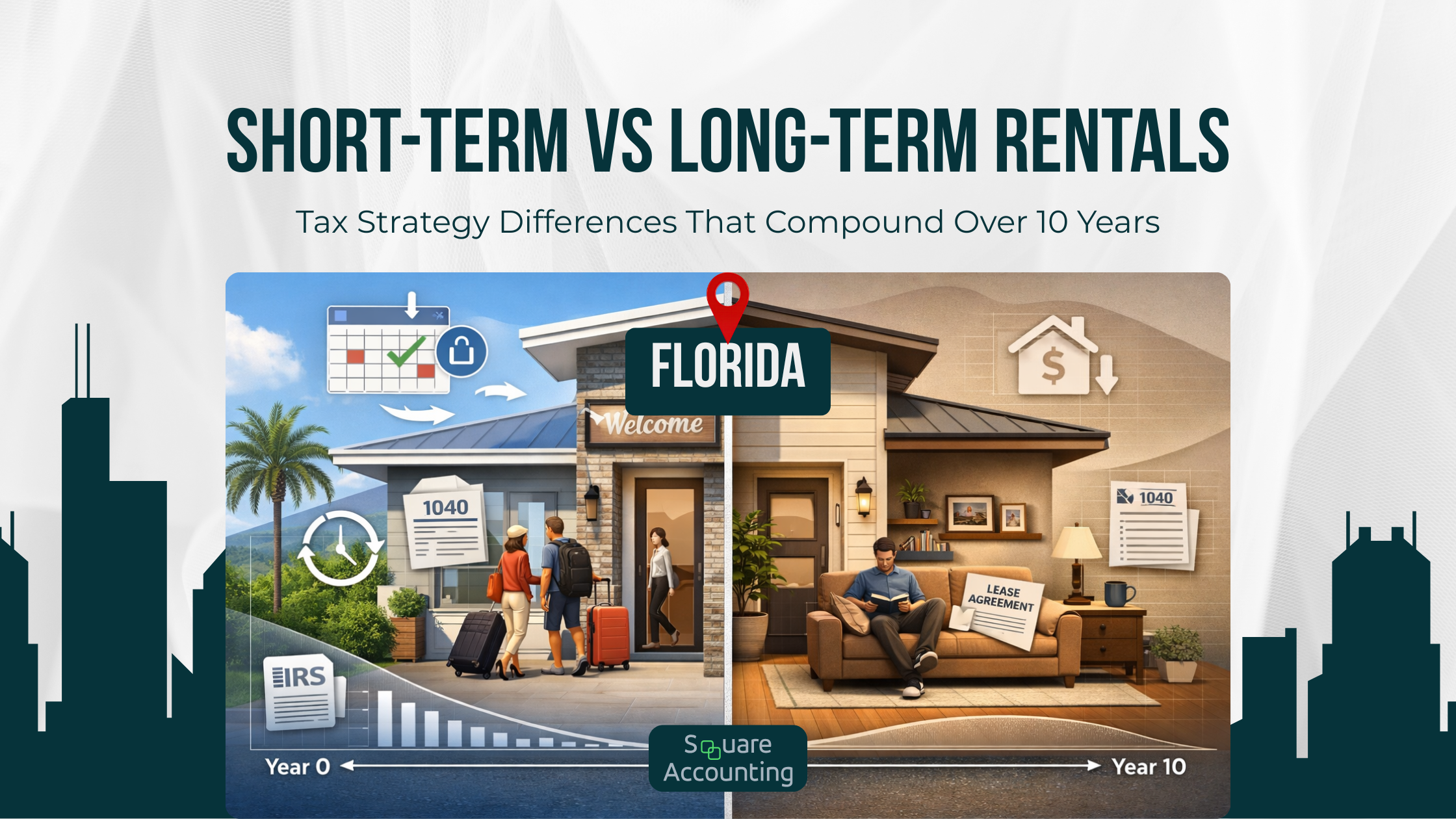

Short-Term vs Long-Term Rentals: Tax Strategy Differences That Matter Over a Decade

Short-term and long-term rentals are not just different operationally. They produce very different tax outcomes once depreciation timing, active versus passive treatment, entity structure, and exit planning are considered. This guide breaks down what matters over a 10-year horizon for high-income Florida investors.

Depreciation Recapture in Florida: Definition, Calculation, and Real-World Examples

Depreciation recapture in Florida can surprise even seasoned real estate investors. Learn what it means, how it’s calculated, and how to reduce or defer it through smart tax planning and 1031 exchanges. Square Accounting explains the rules and helps you keep more of your profit.

Contact us

Talk to our Tax Advisor

Running your operations is demanding—your taxes shouldn’t add to the stress. Whether you need strategic tax planning or ongoing support, we’re here to help.