Florida Real Estate Tax Changes in January 2026: The Complete Investor Guide

For high-income Florida real estate investors, January 2026 is not about a single tax law change. It is the point where several long-standing federal provisions converge, quietly reshaping how real estate performs after tax.

Florida’s lack of a state income tax creates a false sense of simplicity. In reality, it increases exposure. Federal decisions carry full weight. Timing errors, structural mistakes, and poorly sequenced strategies have no state-level offset.

This guide is written for investors who already understand depreciation, passive activity rules, and entity basics. The focus here is different: how 2026 changes long-term outcomes, not how to chase deductions.

Key Takeaways

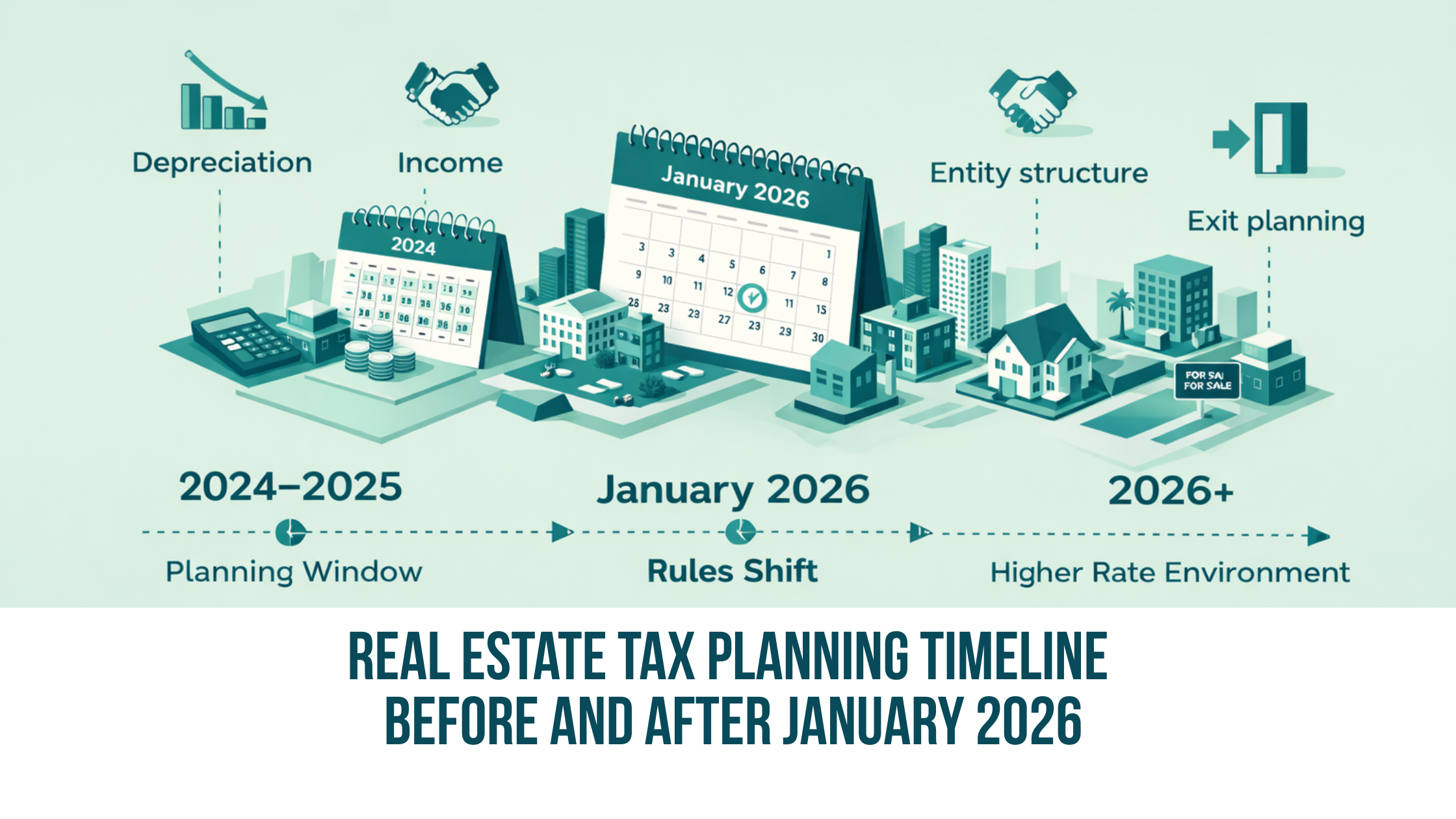

January 2026 amplifies timing risk more than it eliminates tax benefits.

Bonus depreciation still exists, but its reduced impact changes ROI modeling.

Rising marginal rates increase the cost of misaligned income and deductions.

Entity and ownership structures chosen now determine flexibility later.

Florida investors face greater downside from federal planning mistakes.

Exit, recapture, and estate planning matter more than acquisition-year savings.

Planning decisions made before 2026 have outsized impact. A short strategy review can help determine whether your current real estate structure is positioned for the coming tax environment.

What Changes in January 2026 (And What Actually Matters)

January 2026 reflects the scheduled expiration of several provisions from the Tax Cuts and Jobs Act. While the headlines focus on depreciation, the economic impact is broader.

Bonus Depreciation Becomes Structurally Weaker

Beginning in 2026, bonus depreciation is scheduled to drop to 20 percent for qualifying property placed in service.

Important clarification:

Bonus depreciation does not disappear.

Cost segregation remains viable.

The issue is reduced front-loaded impact, not eligibility.

For investors with income exceeding $250,000, this weakens the ability to offset high-earning years and increases the importance of long-term modeling.

Individual Marginal Rates Are the Bigger Risk

Absent legislative changes, individual income tax brackets revert to higher pre-2018 levels starting in 2026.

For Florida investors, this matters more than in high-tax states because:

Federal tax is the primary income tax burden.

Passive income, passthrough income, and recapture all face higher exposure.

Poor sequencing now locks in higher lifetime tax cost.

Why Timing and Sequencing Drive Outcomes After 2026

Most tax mistakes are not legal errors. They are timing errors.

Acquisition Timing vs Deduction Timing

With reduced bonus depreciation:

Late-year acquisitions produce weaker first-year offsets.

Passive losses are easier to strand.

Income spikes from short-term rentals or business activity become harder to smooth.

Losses that cannot be used immediately still have value, but their present value declines as rates rise.

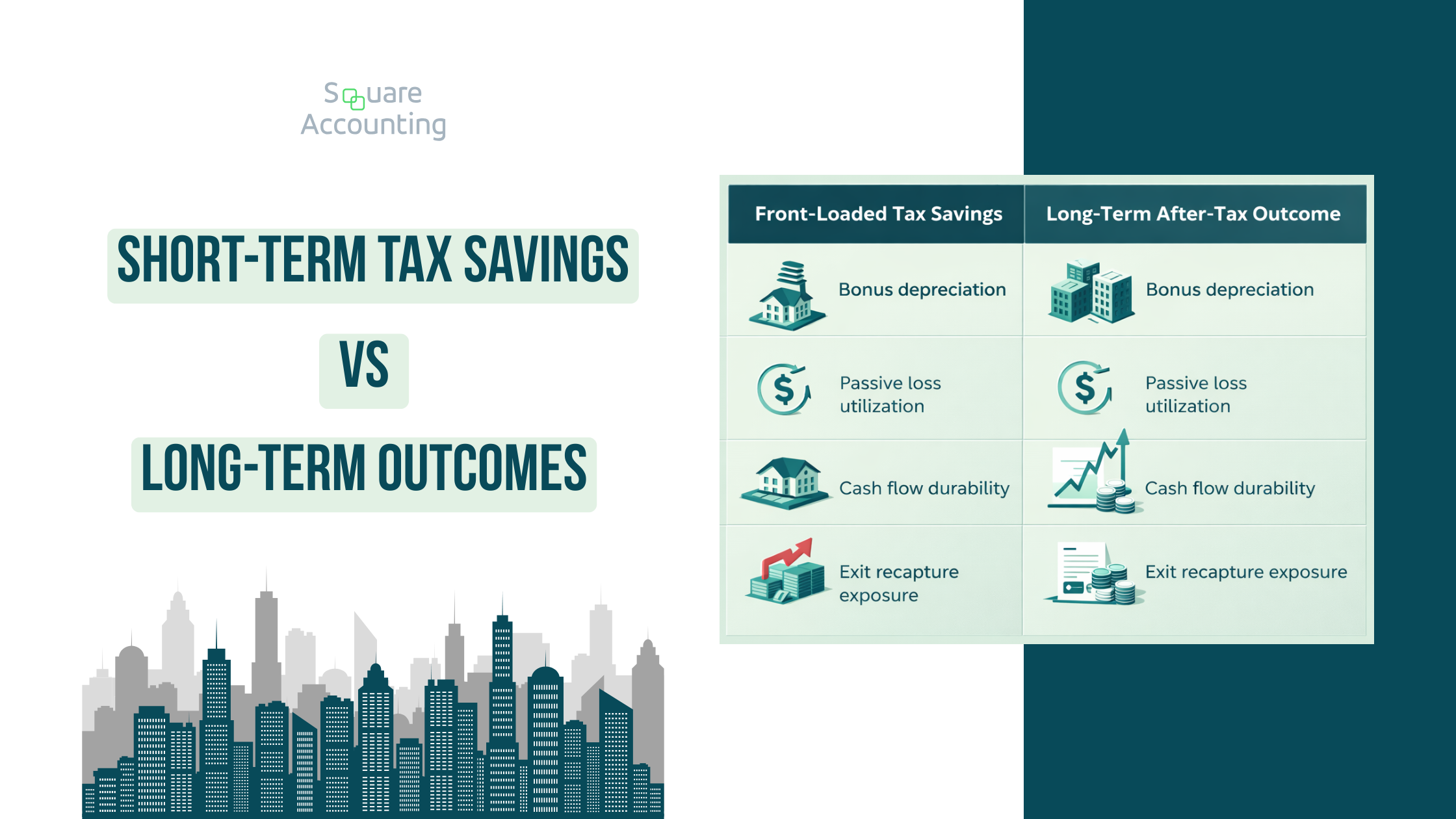

Cash Flow Becomes More Important Than Paper Losses

Florida investors face rising:

Insurance costs

Maintenance reserves

Climate-related capital expenditures

Tax strategies that depend on aggressive depreciation to justify thin cash flow become less durable after 2025. Strong operators will outperform tax-driven deals.

Cost segregation still works in 2026, but only when coordinated with income timing, entity structure, and exit planning. We help investors evaluate whether acceleration improves or harms long-term results.

Entity and Ownership Structure: Decisions You Cannot Undo Easily

Entity choice is not a compliance decision. It is a risk management decision.

Passthrough Exposure Increases

As individual rates rise:

Passthrough income becomes more expensive.

Passive income planning becomes more critical.

Entity inflexibility becomes costly.

This does not mean C corporations are suddenly preferable. It means structure must align with:

Hold period

Reinvestment plans

Exit strategy

Estate objectives

Active vs Passive Classification Becomes More Valuable

The rules around real estate professional status and material participation do not change in 2026. Their economic value increases.

In a higher-rate environment:

Passive loss limitations hurt more.

Poor grouping elections are harder to fix.

Late planning often fails.

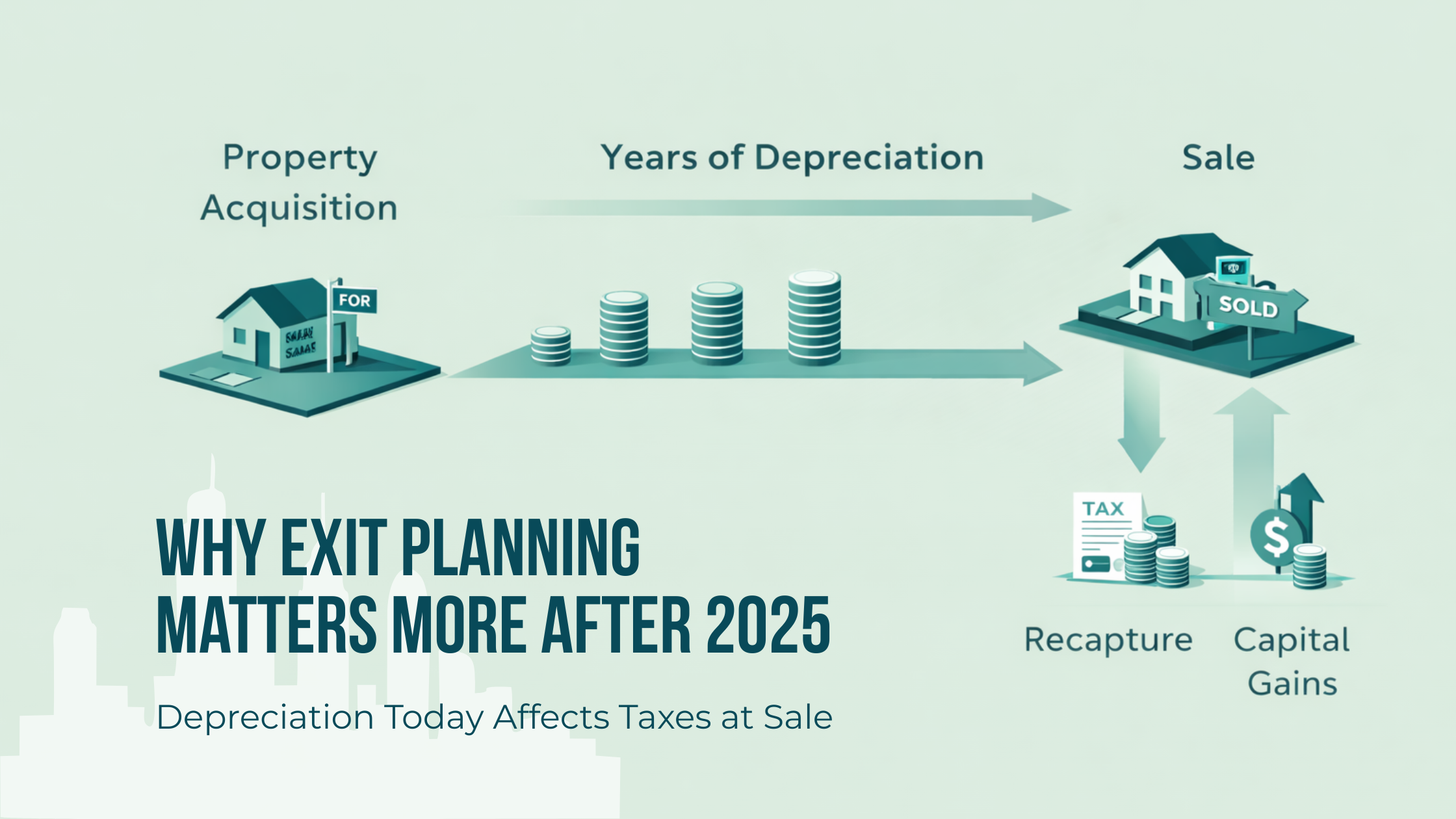

Exit Planning and Depreciation Recapture

Most investors under-plan exits.

Recapture Risk Increases Post-2025

Accelerated depreciation without an exit model can:

Increase recapture taxed at higher rates

Reduce flexibility at sale

Create unexpected liquidity strain

Like-kind exchanges remain available, but effective exchange planning must begin before the asset is marketed.

Estate Planning Integration Matters More

The scheduled reduction in the federal estate and gift tax exemption increases the importance of:

Ownership structure

Basis planning

Lifetime transfer strategies

Real estate held without regard to transfer strategy often creates avoidable exposure.

Most tax costs surface at exit, not acquisition. Early modeling can preserve flexibility and reduce recapture exposure before a sale is on the table.

What Most Articles Still Get Wrong

Treating bonus depreciation as the primary issue

Ignoring marginal rate increases

Failing to model multi-year income volatility

Assuming Florida investors are insulated from federal risk

Promoting tactics without discussing exit consequences

Sophisticated planning is not about stacking strategies. It is about aligning them.

Florida-Specific Planning Realities

Florida changes the analysis in subtle but important ways:

No state income tax magnifies federal errors

High real estate concentration increases exposure

Short-term rental income creates volatility

Insurance and climate costs alter depreciation economics

Property tax treatment affects long-term holds

Florida is not easier. It is less forgiving.

Conclusion

January 2026 is not a deadline. It is a transition point.

For Florida real estate investors, the advantage lies in foresight. The investors who benefit most are not those who chase expiring provisions, but those who structure assets for durability under tighter rules.

At Square Accounting, we approach real estate tax planning as a multi-year capital strategy. The goal is not maximum deduction. It is maximum after-tax outcome over time.

Real estate tax planning works best when integrated with business income, entity structure, and long-term goals. We work with high-income Florida investors on coordinated, multi-year strategies.

Frequently Asked Questions: Florida Real Estate Tax Changes in January 2026

What tax changes affect Florida real estate investors in January 2026?

January 2026 marks the scheduled expiration of several federal tax provisions that materially affect real estate investors, including higher individual income tax rates and reduced bonus depreciation. While Florida has no state income tax, federal changes fully impact Florida investors, making timing, income classification, and entity structure more important than in prior years.

Is bonus depreciation eliminated for real estate in 2026?

No. Bonus depreciation is not eliminated in 2026, but it is scheduled to drop to 20 percent for qualifying property placed in service that year. Cost segregation studies remain valid, but the reduced first-year depreciation significantly changes how effective acceleration strategies are, especially for high-income investors relying on front-loaded losses.

How do the 2026 tax changes impact cost segregation strategies?

Cost segregation still works after 2025, but it must be evaluated as part of a multi-year tax plan rather than a standalone tactic. With weaker bonus depreciation and potentially higher tax rates, poorly timed cost segregation can create unused passive losses or increase depreciation recapture exposure at exit.

Do Florida real estate investors benefit differently from these changes than investors in high-tax states?

Yes. Florida investors feel federal tax changes more directly because there is no state income tax to offset planning errors. In high-tax states, state deductions can partially cushion poor federal timing. In Florida, misaligned income, depreciation, or exit planning impacts total tax liability immediately and fully.

Will real estate income be taxed at higher rates starting in 2026?

Absent legislative changes, individual income tax rates are scheduled to revert to higher pre-2018 levels starting in 2026. This affects rental income, passthrough income, depreciation recapture, and capital gains. For high-income Florida investors, higher marginal rates increase the cost of inefficient income and deduction timing.

Does real estate professional status still matter after 2025?

Yes. The rules governing real estate professional status and material participation do not change in 2026, but their value increases. As tax rates rise, the ability to offset non-passive income with real estate losses becomes more valuable, making proper classification and grouping elections critical.

How do the 2026 tax changes affect selling or exiting real estate?

The changes increase the importance of exit planning. Accelerated depreciation taken before 2026 can lead to higher depreciation recapture taxed at higher rates later. Investors planning to sell should model exits early, including whether a 1031 exchange, restructuring, or timing adjustment preserves flexibility and reduces long-term tax cost.

Should Florida investors change entity structures before 2026?

Not automatically, but entity structure should be reviewed. Higher individual rates make passthrough income more expensive, and entity inflexibility can limit exit and estate planning options. Any structural changes should be coordinated with long-term holding strategy, income projections, and transfer planning rather than driven by a single tax year.