Blog

Florida Real Estate Tax Changes in January 2026: The Complete Investor Guide

Federal tax rule changes taking effect in January 2026 will reshape how Florida real estate performs after tax. This guide explains what high-income investors need to know about timing, structure, and long-term outcomes.

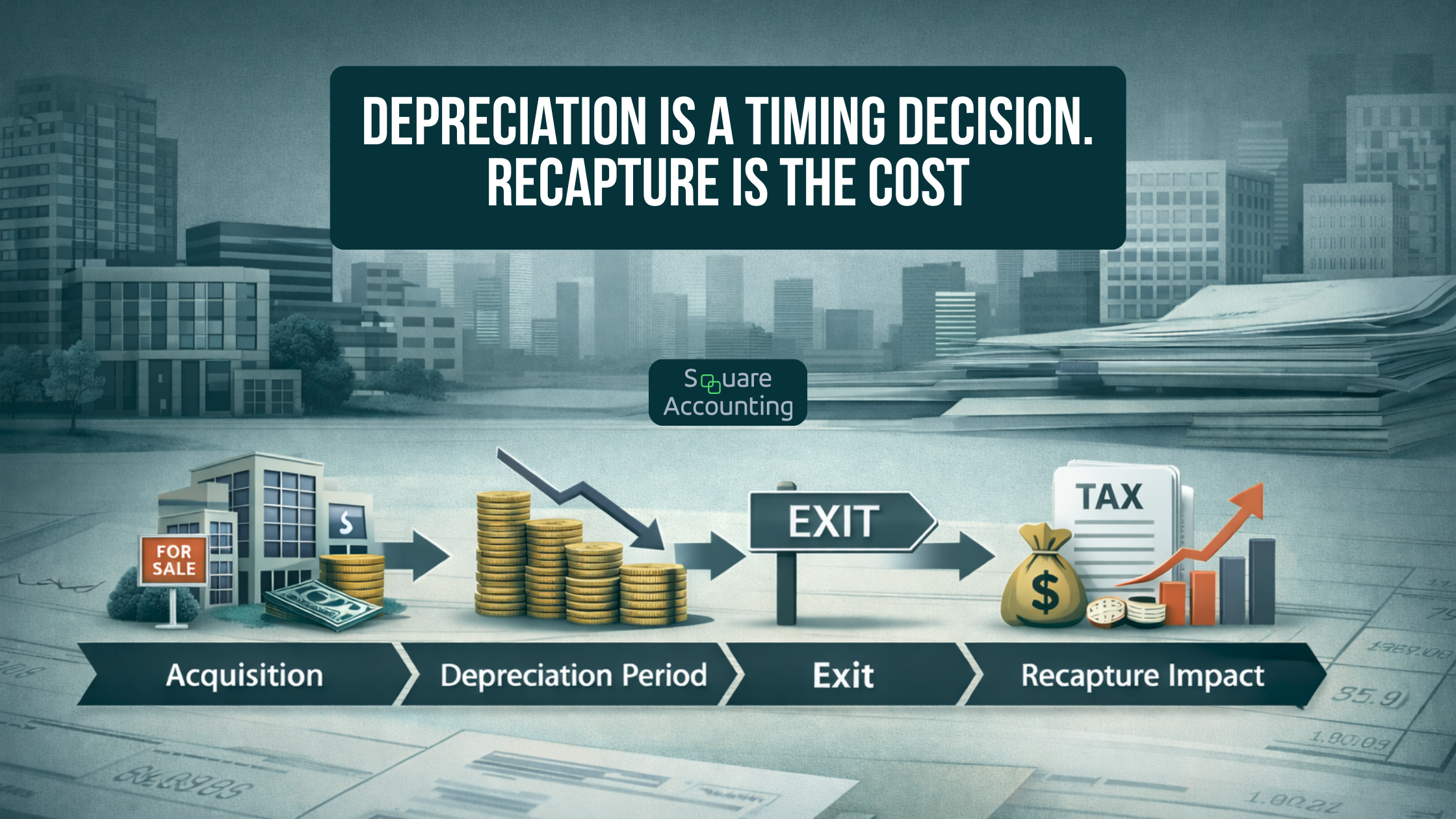

Planning for Depreciation Recapture Before You Buy the Asset

Depreciation reduces taxes today, but recapture determines outcomes later. Learn how high-income Florida investors should plan depreciation before acquiring an asset to protect long-term returns and exit flexibility.

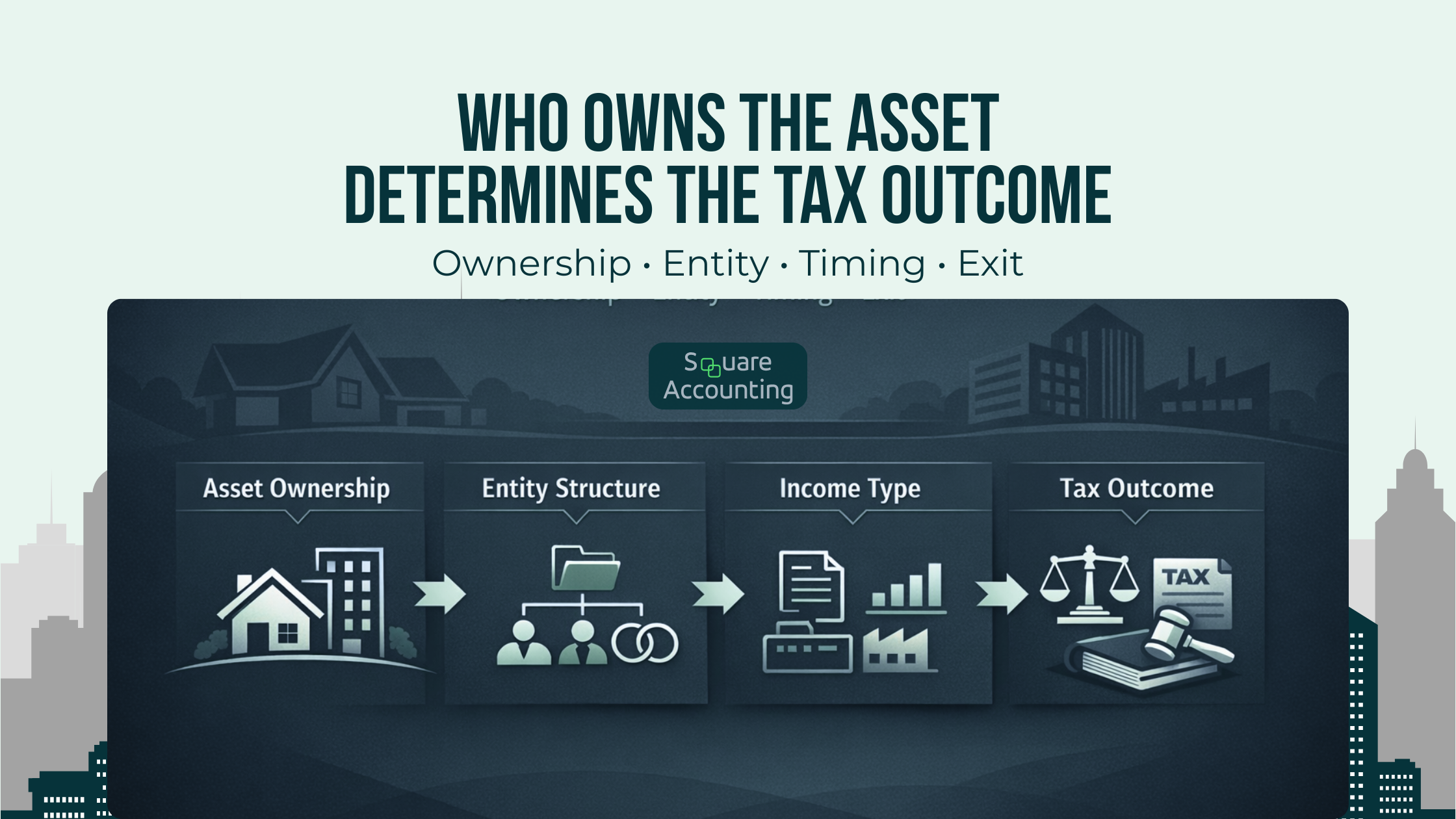

Who Owns the Asset, Who Gets the Deduction, and Why It Changes Everything

Most tax strategies fail not because deductions are unavailable, but because they are placed in the wrong hands. For high-income Florida taxpayers, asset ownership determines who gets the deduction, when it can be used, and what happens at exit. This article explains why ownership structure, entity choice, and timing change everything in long-term tax planning.

Depreciation Recapture in Florida: Definition, Calculation, and Real-World Examples

Depreciation recapture in Florida can surprise even seasoned real estate investors. Learn what it means, how it’s calculated, and how to reduce or defer it through smart tax planning and 1031 exchanges. Square Accounting explains the rules and helps you keep more of your profit.

Contact us

Talk to our Tax Advisor

Running your operations is demanding—your taxes shouldn’t add to the stress. Whether you need strategic tax planning or ongoing support, we’re here to help.