Depreciation Recapture in Florida: Definition, Calculation, and Real-World Examples

The Hidden Tax Investors Overlook

When you sell a Florida investment property, the excitement of profit can quickly fade once the IRS arrives for its share. The often-overlooked depreciation recapture tax can dramatically reduce your after-sale proceeds if not planned for properly.

Understanding how depreciation recapture works — and how to strategically reduce or defer it — is vital for serious investors.

👉 Before you sell your next property, schedule a tax strategy consultation with Square Accounting to avoid unpleasant surprises and optimize your return.

What Is Depreciation and Why It Matters

Understanding Depreciation in Real Estate

Depreciation allows investors to recover the cost of wear and tear on income-generating property. The IRS lets you deduct this “loss in value” over time — 27.5 years for residential rentals and 39 years for commercial properties.

This deduction is powerful because it reduces taxable income every year, improving cash flow.

Why the IRS Requires Depreciation

Even if you never claimed depreciation, the IRS assumes you did. This “allowed or allowable” rule means that you must pay depreciation recapture tax whether or not you took the deduction.

That’s why documentation and proactive planning are essential.

💡 Tip: Keep precise depreciation records. If you’re unsure about past deductions, Square Accounting can audit your records and correct them before you sell.

What Is Depreciation Recapture?

The Concept Simplified

Depreciation Recapture is the IRS’s way of reclaiming some of the tax benefits you received from depreciation deductions. When you sell the property at a gain, the portion equal to your prior depreciation is taxed as ordinary income — up to 25% federally.

How It Differs from Capital Gains Tax

Capital gains tax applies to appreciation in property value.

Depreciation recapture applies to previous deductions that lowered your taxable income.

👉 Let Square Accounting calculate your estimated recapture before listing your property — we’ll show you exactly what to expect and how to minimize it.

When Does Depreciation Recapture Apply in Florida?

Triggering Events

Depreciation recapture is triggered when you:

Sell or exchange property at a gain

Convert rental property to personal use

Do a 1031 exchange incorrectly

Gift or transfer depreciated property

Florida’s Advantage: No State Income Tax

Florida has no personal state income tax, which means you only owe federal recapture tax.

However, federal rates still apply, and depending on your income level, the impact can be significant.

📞 Consult with Square Accounting’s Florida tax specialists to confirm your true tax exposure before closing your next real estate sale.

How to Calculate Depreciation Recapture

The Simple Formula

Depreciation Recapture = Lesser of (Total Depreciation Taken) or (Gain on Sale)

That recaptured portion is taxed at up to 25%. The remaining gain may qualify for 15%–20% long-term capital gains rates.

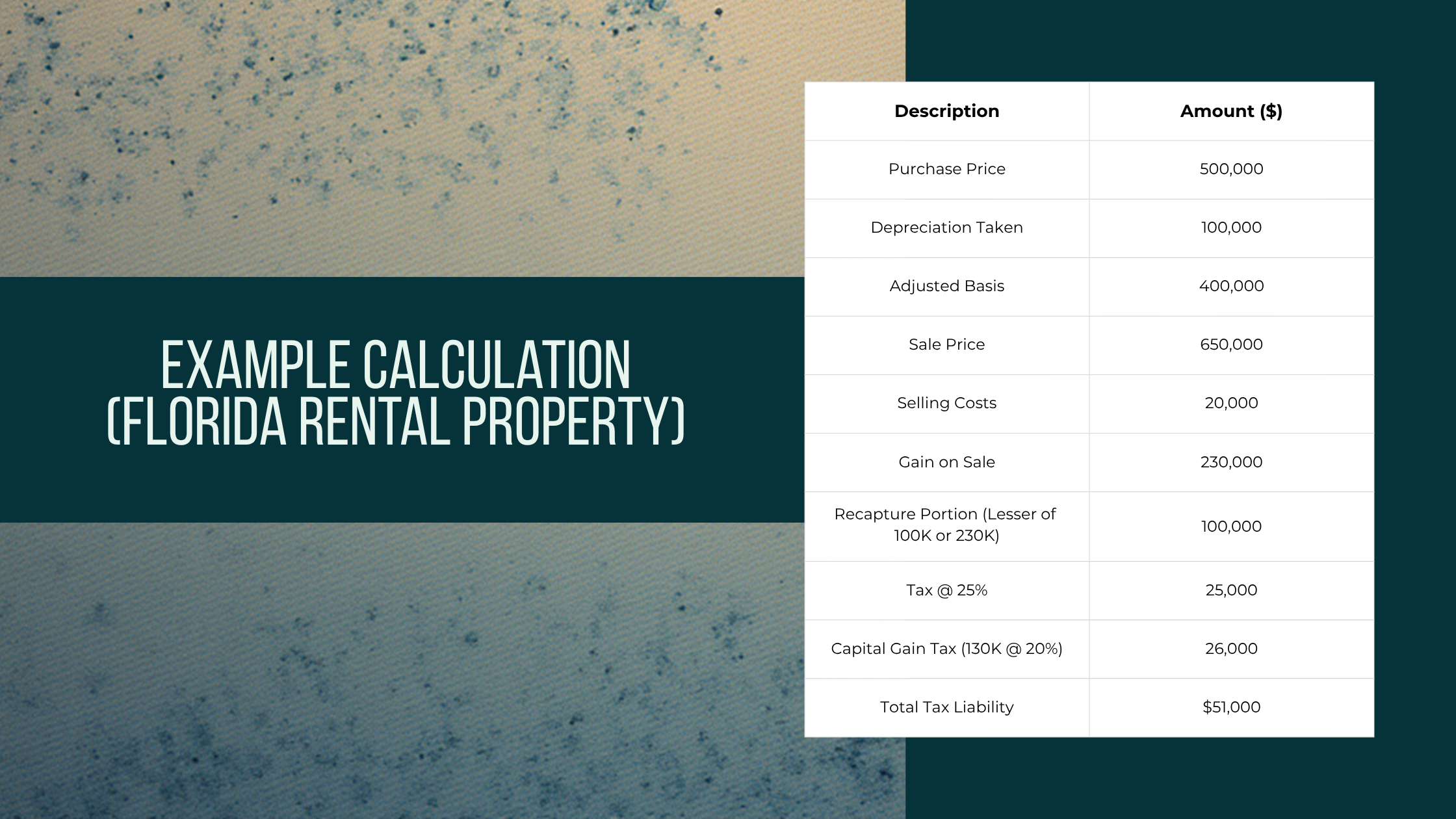

Example Calculation (Florida Rental Property)

💬 Pro Tip: This $51K tax bill could have been deferred entirely through a properly structured 1031 exchange.

👉 Ask Square Accounting to run your 1031 exchange analysis today.

Properties Affected by Depreciation Recapture

Residential vs. Commercial Properties

Residential properties depreciate over 27.5 years and often involve smaller recapture.

Commercial properties use a 39-year schedule, but the dollar amounts can be much larger.

Vacation Homes and Short-Term Rentals

In Florida’s booming short-term rental market (Airbnb, VRBO), properties used partly for personal purposes can still trigger partial depreciation recapture.

👉 Before selling your Florida vacation rental, talk to Square Accounting — we’ll clarify how much of the gain is taxable.

How to Reduce or Defer Depreciation Recapture

Utilize a 1031 Exchange

A 1031 exchange lets you roll proceeds from one investment property into another, deferring both capital gains and depreciation recapture.

Done correctly, you defer taxes indefinitely — or even eliminate them entirely with proper estate planning.

📅 Ready to upgrade or diversify your real estate portfolio?

Square Accounting can structure your 1031 exchange to maximize tax deferral and compliance.

Consider Cost Segregation Studies

Cost segregation accelerates depreciation on short-lived components (carpets, HVAC, fixtures).

While this boosts early deductions, it can increase recapture later — unless paired with a long-term strategy.

📊 Our tax engineers at Square Accounting specialize in cost segregation modeling — we’ll help you find the right balance between short-term deductions and long-term tax efficiency.

Strategic Holding & Estate Planning

If you hold property until death, your heirs receive a step-up in basis, effectively wiping out both capital gains and recapture.

💼 Square Accounting partners with estate attorneys to build legacy-focused tax strategies that minimize your lifetime tax exposure.

Common Investor Mistakes in Florida

Not claiming depreciation at all (you still owe recapture!)

Overlooking records of prior improvements or deductions

Mismanaging 1031 exchanges

Selling without tax projection or CPA review

🚨 Avoid these errors — consult Square Accounting before listing your property.

We’ll perform a pre-sale tax analysis so you know exactly what to expect at closing.

Real-World Example: Florida Commercial Property Sale

Scenario: Naples Investor

Purchase Price: $1.2M

Depreciation Claimed: $200K

Sale Price: $1.8M

Selling Costs: $30K

Adjusted Basis: $1.0M

Total Gain: $770K

Recapture (Lesser of $200K or $770K): $200K → Taxed at 25% = $50K

Remaining Gain ($570K): Taxed at 20% = $114K

Total Tax Liability: $164,000

This investor could have deferred the full $164,000 through a 1031 exchange with proper planning.

💬 Don’t wait until after the sale to plan your taxes.

Contact Square Accounting early in your sales process to ensure your transaction is structured for maximum savings.

10. How Square Accounting Helps Florida Investors

Specialized Tax Planning for High-Net-Worth Clients

At Square Accounting, we don’t just file tax returns — we design integrated real estate tax strategies.

Our clients include property developers, real estate funds, and individual investors who need precision tax management.

Services Include:

Depreciation Recapture Analysis

1031 Exchange Structuring

Cost Segregation Studies

Multi-State Real Estate Tax Planning

Estate and Legacy Tax Design

💼 Protect your gains, preserve your wealth, and plan your next move with confidence.

👉 Book your consultation with Square Accounting today — before your next closing.

Conclusion: Plan Smart, Profit More

Depreciation Recapture in Florida can catch even experienced investors off guard.

By understanding how it’s triggered, calculated, and mitigated, you can protect your hard-earned profits and maintain control over your tax destiny.

Whether you’re selling one property or managing a portfolio of many, the difference between a reactive tax bill and a proactive plan can be six figures.

📞 Let Square Accounting guide you. Schedule your personalized tax consultation now and turn complex recapture rules into strategic advantage.

Frequently Asked Questions About Depreciation Recapture in Florida

1. What is Depreciation Recapture in Florida?

Depreciation recapture in Florida is a federal tax applied when you sell a rental or investment property for more than its adjusted basis (the property’s original cost minus depreciation).

The IRS “recaptures” the tax benefits you claimed through depreciation deductions by taxing that portion of your profit — typically at up to 25%.

📊 Florida investors still owe this federal tax, even though the state has no income tax.

👉 Square Accounting helps Florida property owners calculate and minimize depreciation recapture before they sell.

2. How is Depreciation Recapture Calculated in Florida?

The depreciation recapture calculation follows this formula:

Depreciation Recapture = Lesser of (Total Depreciation Taken) or (Gain on Sale)

That portion is taxed at up to 25% under IRS Section 1250.

Any remaining gain (beyond depreciation) is taxed at the capital gains rate of 15%–20%, depending on your income level.

💡 Tip: A simple pre-sale tax projection from Square Accounting can show you exactly how much recapture you’ll owe — before you close the deal.

3. Does Florida Have a Depreciation Recapture Tax?

No — Florida does not impose a state-level depreciation recapture tax because the state has no personal income tax.

However, federal depreciation recapture rules still apply to all Florida property owners.

This means the IRS can still tax a portion of your profits when you sell investment real estate.

✅ Square Accounting ensures your transactions comply with federal rules while maximizing Florida’s state-level advantages.

4. How Can I Avoid or Defer Depreciation Recapture in Florida?

You can avoid or defer depreciation recapture legally through several strategies, including:

Performing a 1031 Like-Kind Exchange to defer taxes by reinvesting proceeds into another property

Using cost segregation and timing strategies to optimize deductions and exits

Holding property until death, passing it to heirs with a step-up in basis, which can erase recapture entirely

🚀 Square Accounting’s tax strategists can customize these tactics for your Florida investment portfolio.

5. What Happens If I Never Claimed Depreciation on My Rental Property?

Even if you never claimed depreciation, the IRS assumes you did — this is called “allowed or allowable depreciation.”

That means you still owe depreciation recapture tax when you sell, based on the amount you could have deducted.

📘 Solution: Square Accounting can perform a catch-up depreciation adjustment (Form 3115) to correct past filings and reduce your exposure before selling.

6. Does Depreciation Recapture Apply to My Primary Residence in Florida?

No — depreciation recapture does not apply to your primary residence, because you cannot depreciate a personal home.

However, if your property was partially used as a rental (such as a home office or Airbnb portion), the IRS may recapture depreciation on that segment only.

📞 If you’ve mixed rental and personal use, Square Accounting can separate these allocations to reduce unnecessary tax liability.

7. What Is the Depreciation Recapture Tax Rate for 2025?

As of 2025, the depreciation recapture tax rate remains capped at 25% under IRS Section 1250.

This rate applies to the portion of gain equal to your depreciation deductions.

Capital gains tax rates remain 15%–20%, depending on your income bracket.

📈 Square Accounting stays current on all IRS updates and Florida-specific tax implications to ensure your sale is fully optimized for 2025 and beyond.

8. Can a 1031 Exchange Eliminate Depreciation Recapture?

A 1031 exchange does not eliminate depreciation recapture — it defers it.

By reinvesting the proceeds into another qualifying property, you delay both capital gains and recapture taxes until the replacement property is sold.

If you continue exchanging properties or hold them until death, you can potentially eliminate the liability entirely.

💼 Square Accounting can structure your 1031 exchange correctly to meet IRS requirements and preserve your tax benefits.

9. What Records Should I Keep for Depreciation Recapture Calculations?

You should maintain:

Original purchase documents and closing statements

Depreciation schedules for all years owned

Records of capital improvements and renovations

Prior-year tax returns showing depreciation deductions

Documentation from cost segregation studies (if applicable)

🗂️ Square Accounting offers full property tax record audits to ensure your basis and depreciation data are correct before you sell.

10. When Should I Consult a Tax Advisor About Depreciation Recapture?

The best time to consult a tax advisor is before listing your property.

Once the sale closes, your options to reduce or defer recapture are limited.

Strategic planning — even 6–12 months ahead — can save you tens of thousands in federal taxes.

📅 Schedule a consultation with Square Accounting today to map your depreciation recapture strategy before your next sale.

Final Takeaway

Understanding depreciation recapture in Florida isn’t just about tax compliance — it’s about preserving your wealth.

Whether you own residential rentals, commercial properties, or short-term vacation assets, proactive tax planning can turn a costly tax bill into a strategic advantage.

✨ Let Square Accounting help you make every dollar of your real estate investment work smarter, not harder.

📞 Book your personalized strategy session today.