Blog

Florida Capital Gains Tax Planning for 2026: What High-Income Investors Actually Need to Think About

Florida capital gains planning is a sequencing problem, not a rate comparison. Learn how timing, structure, and exits shape long-term outcomes.

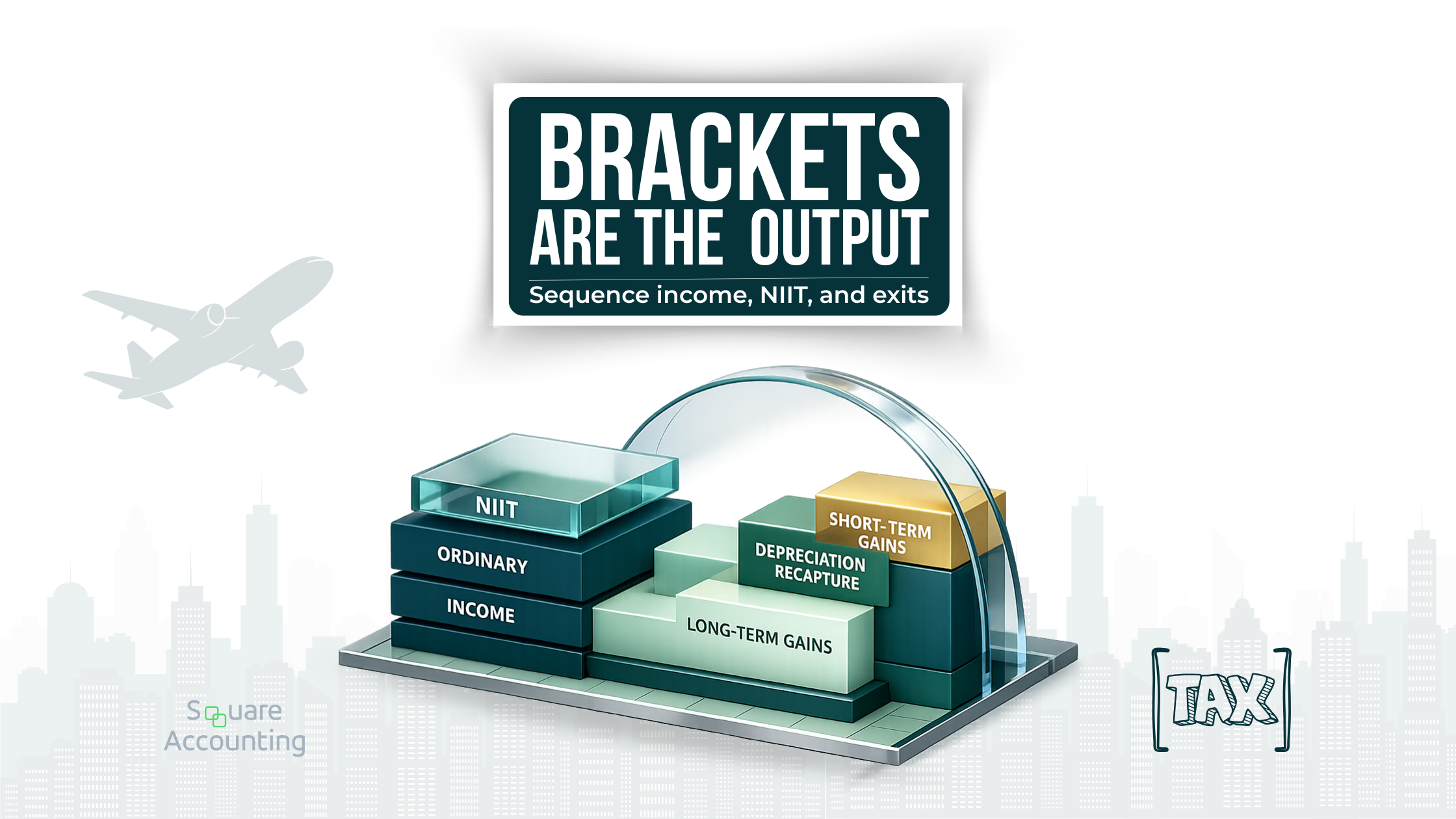

2026 Long-Term Capital Gains Tax Brackets: A Strategic Framework for High-Income Florida Taxpayers

A strategic framework for Florida high-income taxpayers to sequence capital events, manage NIIT layering, and plan real estate exits without exit-year surprises. Built for multi-year outcomes, not one-year rate chasing.

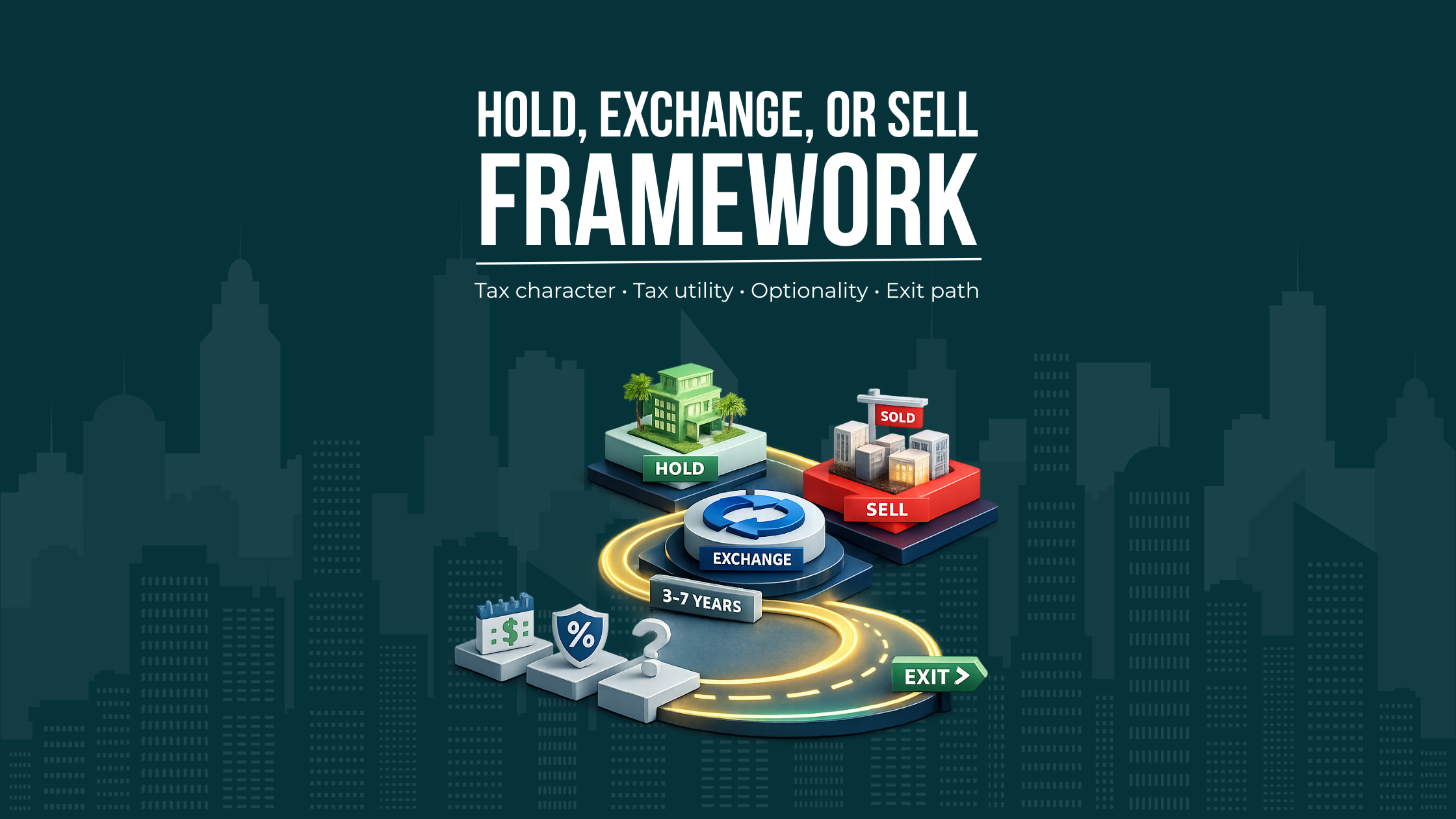

Hold, Exchange, or Sell Real Estate: Tax-Driven Decision Frameworks for Florida Investors

A portfolio-level decision framework for Florida investors weighing hold, exchange, or sell choices. Built around sequencing, optionality, and exit-aware planning.

Defined Benefit and Cash Balance Plans as Long-Term Tax Deferral Vehicles

Defined benefit and cash balance plans are long-term tax deferral vehicles, not year-end tactics. Used correctly, they coordinate income, real estate, and exit planning over time.

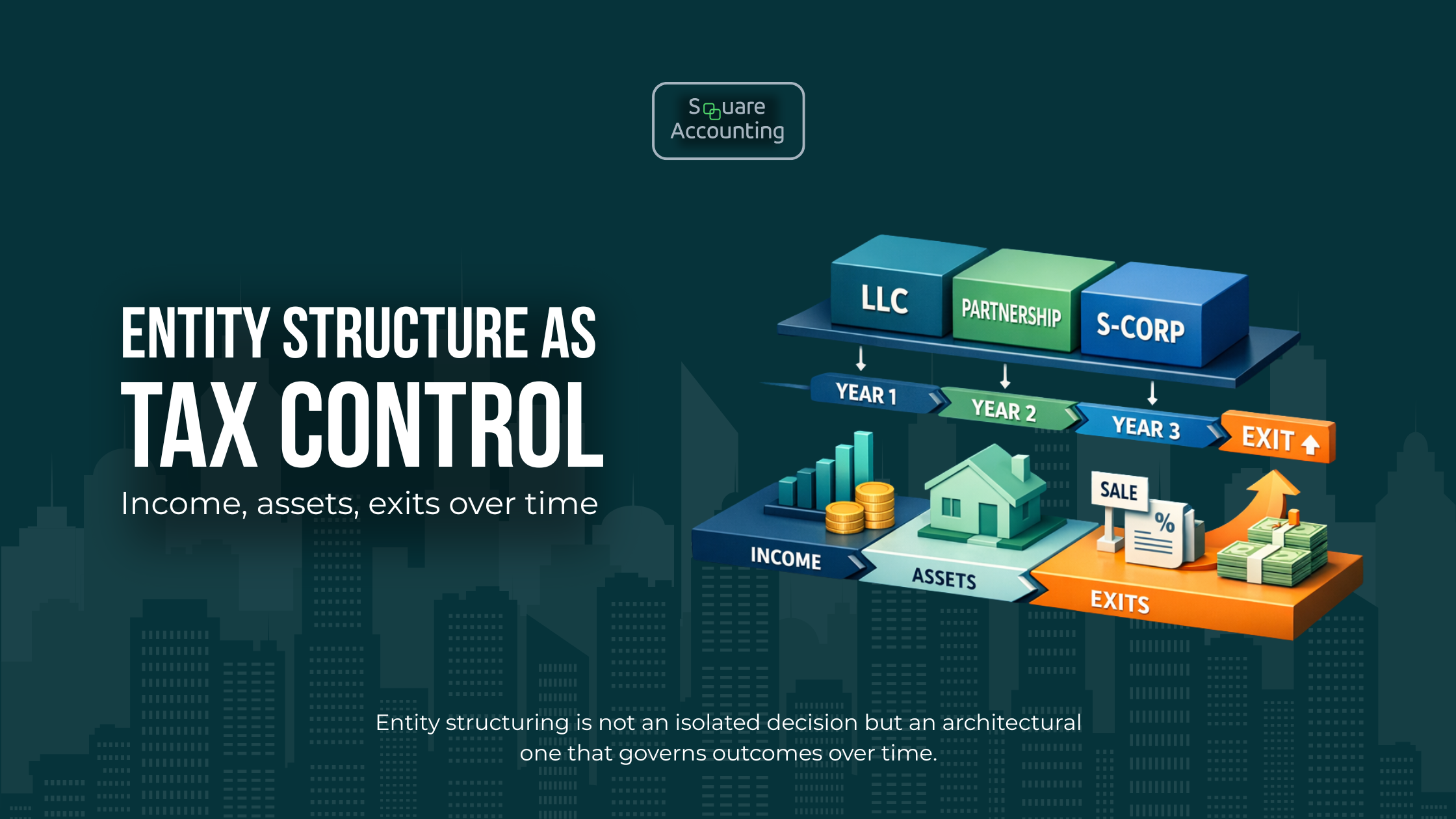

Structuring LLCs, Partnerships, and S-Corps for Long-Term Tax Control

Entity structure shapes income classification, depreciation, and exit outcomes over time. This guide examines LLCs, partnerships, and S-corps through a multi-year planning lens for Florida high earners.

When Front-Loaded Depreciation Creates Problems Later and How to Plan Around It

Front-loaded depreciation can create large early tax savings for real estate investors and business owners — but without proper timing and exit planning, it often leads to higher taxes later. This article explains when accelerated depreciation works, when it backfires, and how Florida investors can plan around recapture, declining bonus depreciation, and long-term ownership strategy.

How Mixed-Use Real Estate Can Shift Income, Deductions, and Risk Across Entities

Mixed-use real estate can shift income, deductions, and risk across entities in ways that materially affect long-term tax outcomes. This guide explains how high-income Florida investors and business owners can structure mixed-use properties for sustainable, multi-year tax efficiency.

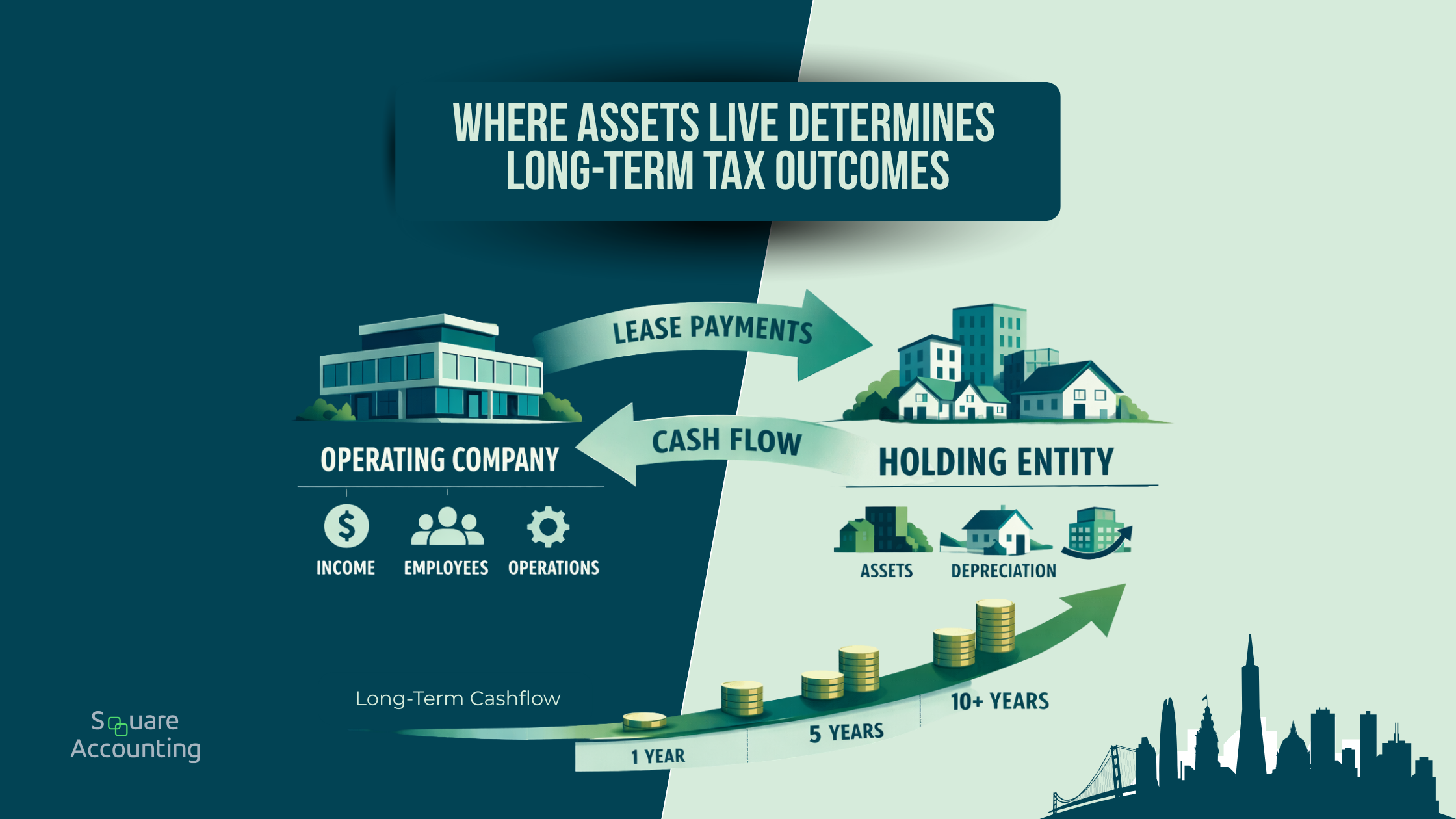

Buying Assets Inside the Operating Company vs a Holding Entity: Tax Outcomes Over 10+ Years

Buying assets inside an operating company or a separate holding entity can quietly shape tax outcomes for decades. For high-income Florida taxpayers, the real impact shows up at exit, not acquisition. This guide explains how asset placement decisions compound over 10+ years and how to structure them strategically.

Advanced Tax Planning Without Crossing the Line: Documentation, Intent, and Substance

Advanced tax planning is not about deductions. It is about structuring income, assets, and ownership decisions over time so tax strategies remain defensible, sustainable, and aligned with long-term goals. This guide explains how documentation, intent, and economic substance separate effective planning from costly mistakes for high-income Florida taxpayers.

Florida Real Estate Tax Changes in January 2026: The Complete Investor Guide

Federal tax rule changes taking effect in January 2026 will reshape how Florida real estate performs after tax. This guide explains what high-income investors need to know about timing, structure, and long-term outcomes.

Balancing Tax Savings Against Cash Flow in Highly Leveraged Strategies

Highly leveraged tax strategies can produce impressive deductions on paper while quietly straining liquidity over time. This article explains how high-income Florida taxpayers can balance tax savings against cash flow by sequencing depreciation, structuring leverage intentionally, and modeling exit and recapture consequences across multiple years.

Planning for Depreciation Recapture Before You Buy the Asset

Depreciation reduces taxes today, but recapture determines outcomes later. Learn how high-income Florida investors should plan depreciation before acquiring an asset to protect long-term returns and exit flexibility.

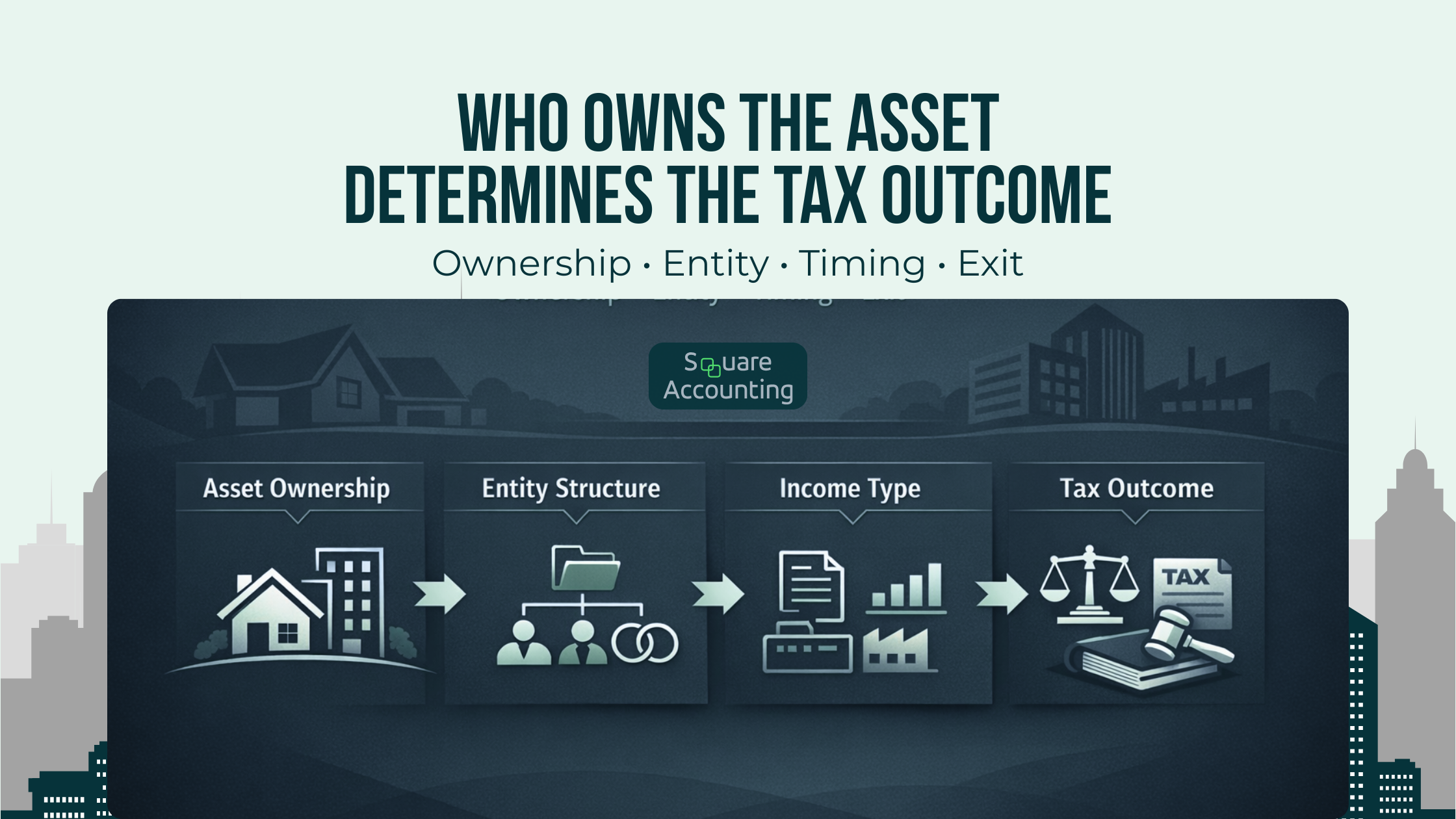

Who Owns the Asset, Who Gets the Deduction, and Why It Changes Everything

Most tax strategies fail not because deductions are unavailable, but because they are placed in the wrong hands. For high-income Florida taxpayers, asset ownership determines who gets the deduction, when it can be used, and what happens at exit. This article explains why ownership structure, entity choice, and timing change everything in long-term tax planning.

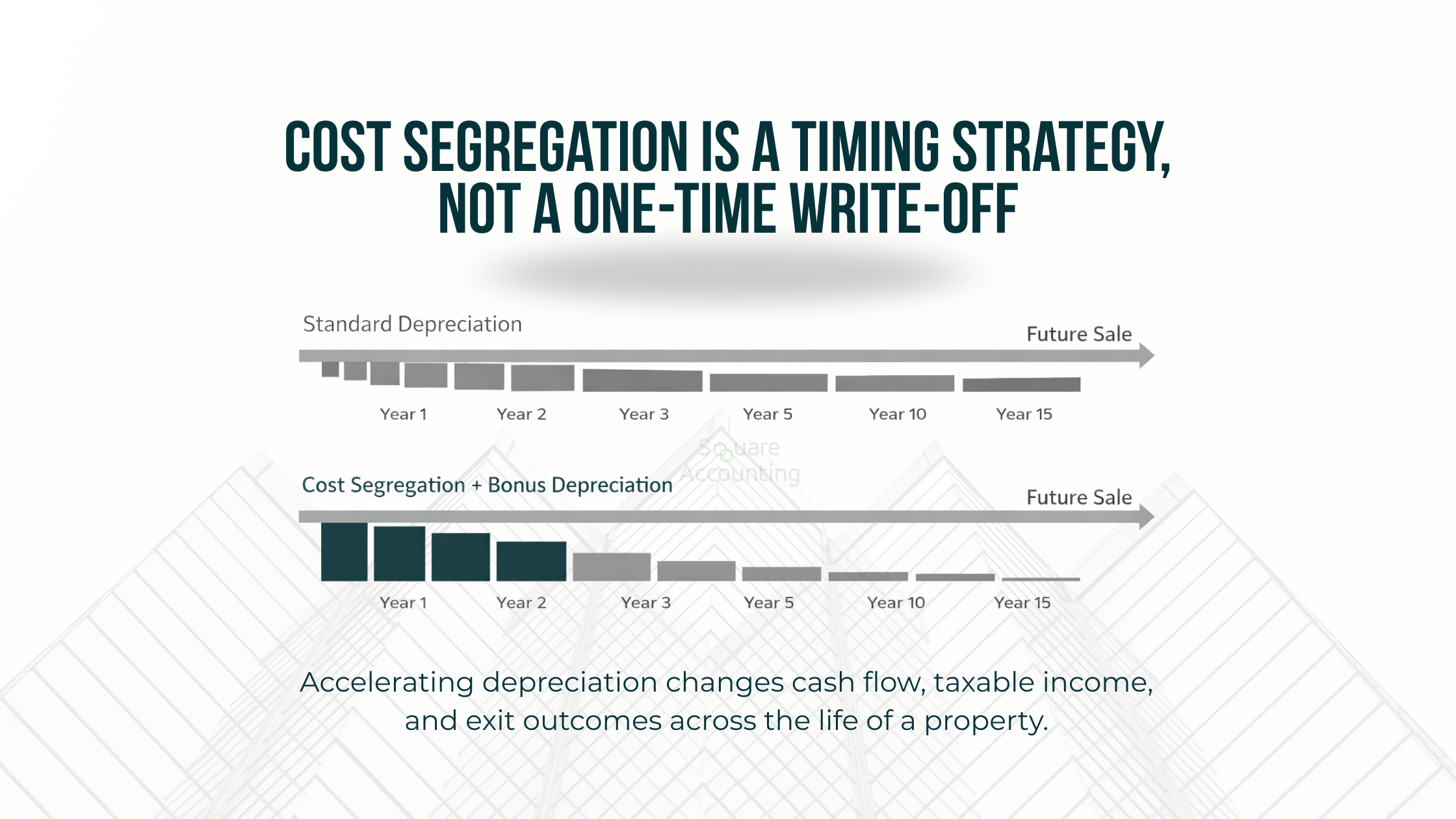

Cost Segregation as a Timing Tool, Not a One-Time Tax Play

Cost segregation is often pitched as a one-time tax savings strategy. In reality, it’s a timing decision that reshapes taxable income, cash flow, and exit outcomes over the life of a property—especially for high-income Florida investors.

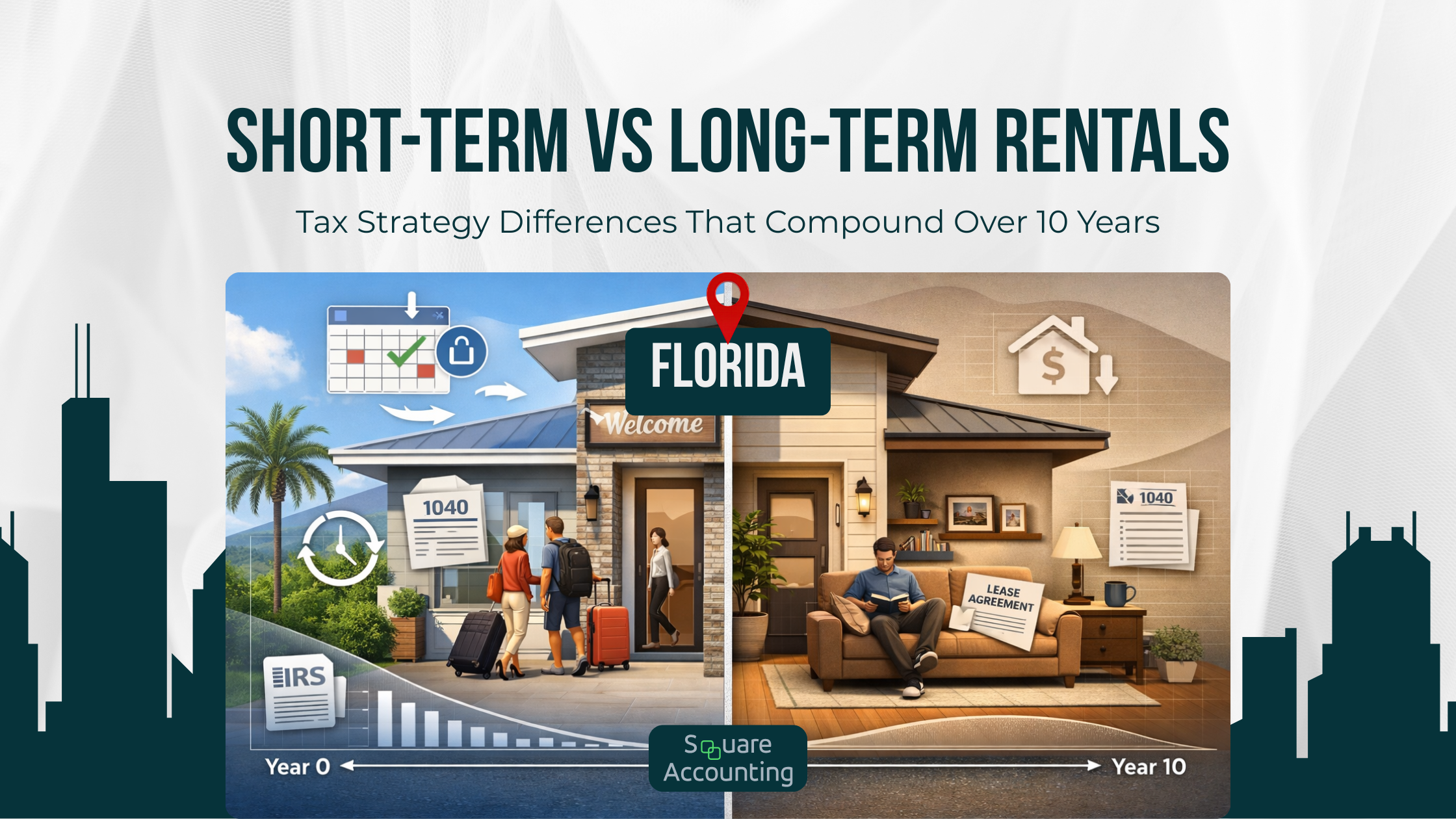

Short-Term vs Long-Term Rentals: Tax Strategy Differences That Matter Over a Decade

Short-term and long-term rentals are not just different operationally. They produce very different tax outcomes once depreciation timing, active versus passive treatment, entity structure, and exit planning are considered. This guide breaks down what matters over a 10-year horizon for high-income Florida investors.

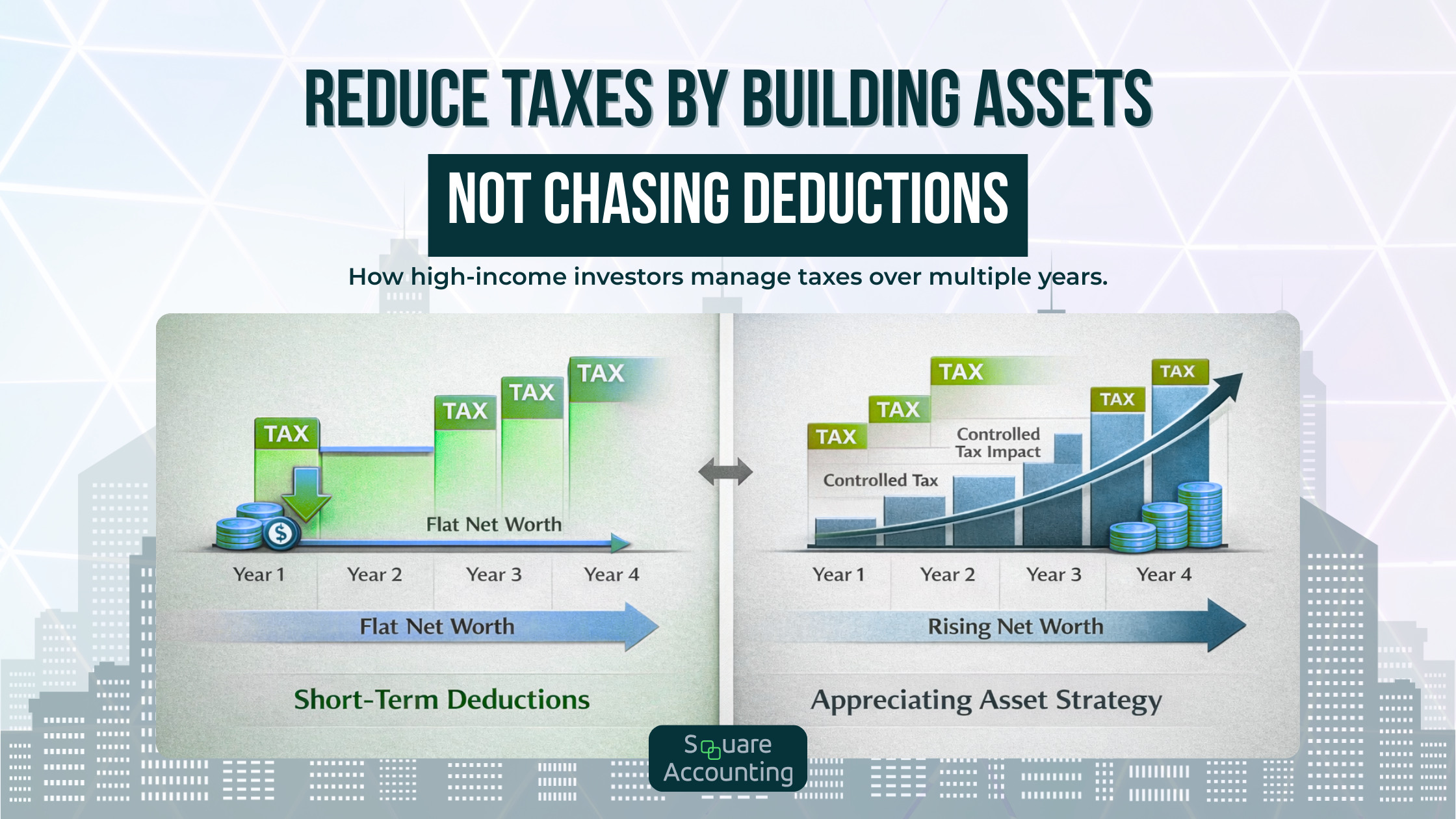

How Purchasing Appreciating Assets Can Reduce Taxes Without Chasing Short-Term Deductions

High-income Florida taxpayers often chase deductions that lower this year’s bill but do little for long-term wealth. This article explains how purchasing appreciating assets can reduce taxes over time through proper timing, structure, and exit planning—without relying on short-term write-offs.

Community Property vs Separate in Florida Property Strategy

Understand how community property vs separate ownership works for married real estate investors in Florida. Learn how trusts, LLCs and tenancy by the entirety shape tax, asset protection and legacy planning with guidance from Square Accounting.

Desantis Property Tax Proposal Sparks Big Money Debate

The Desantis property tax proposal could rewrite how Florida property is taxed, especially for homesteaded homes and investment assets. Discover what potential elimination, rebates and shifting tax burdens mean for Florida real estate investors, high net worth buyers and portfolio strategy ahead of the 2026 decision point.

Florida Real Estate Tax Changes in November 2025: The Complete Investor Guide

Florida’s tax rules are shifting quickly.

The 2025 repeal of the commercial lease sales tax cuts occupancy costs, while proposed reforms—like removing non-school property taxes—create new uncertainty for counties and investors. With values still rising in Miami, Tampa, and Orlando, this guide highlights the key changes and strategies Florida real estate investors need right now.

Florida Cost Seg Bonus Dep: Multifamily vs Mobile Home Parks

Florida investors use Florida Cost Seg Bonus Dep to boost cash flow and reduce federal taxes. This guide explains how multifamily properties and mobile home parks perform in cost segregation studies, which assets generate the strongest deductions, and how investors can capture larger write offs with smart planning.

Contact us

Talk to our Tax Advisor

Running your operations is demanding—your taxes shouldn’t add to the stress. Whether you need strategic tax planning or ongoing support, we’re here to help.