Community Property vs Separate in Florida Property Strategy

Key Takeaways for Florida Investors

Florida is not a community property state, but married couples can opt into community-style treatment using a Florida Community Property Trust for selected assets.

For Florida real estate investors and high-net-worth couples, the choice between community-style and separate property treatment directly affects capital gains tax, basis step-up, creditor exposure, and divorce outcomes.

Tenancy by the entirety (TBE) plus LLCs is often the core asset-protection structure for married Florida investors, while community property tools are primarily tax optimization levers.

A properly structured Community Property Trust can provide a full step-up in tax basis at the first spouse’s death, potentially eliminating millions in future capital gains on appreciated Florida property.

Multi-state and international couples face additional complexity around domicile, marital property rules, and U.S. tax treatment and should coordinate cross-border and multi-jurisdictional advice.

Governance details such as titling, operating agreements, and trust language matter as much as the headline structure. Sloppy documentation can undermine both tax and protection goals.

Square Accounting helps Florida spouses integrate ownership structure, tax planning, asset protection, and estate strategy into one coherent property strategy rather than isolated decisions.

Why Ownership Structure Between Spouses Matters in Florida

Florida remains one of the most active real estate markets in the United States. Median home prices are above national averages, with major metros like Miami, Tampa, Orlando, and Jacksonville leading investor interest. Price growth has cooled from the pandemic boom, but the long-term demand story is still strong, driven by migration, foreign capital, and lifestyle shifts.

For married investors, every acquisition is not just a question of what to buy. It is a question of who owns it, in what form, and under which legal regime. That decision quietly dictates:

How much tax is paid at sale or at death

Who controls the asset in a crisis

How vulnerable the property is to lawsuits and creditors

What your children or other heirs actually inherit

For Florida spouses, the conversation often starts with “community property vs separate,” then quickly expands into tenancy by the entirety, LLCs, and Florida Community Property Trusts. Used strategically, these tools can dramatically improve after-tax returns and resilience. Used casually, they create friction at the worst possible moments.

Community Property vs Separate Property: Core Concepts

Classic community property regimes

In classic community property states (such as California, Texas, Arizona), the basic rule is straightforward:

Most assets and income acquired during marriage are community property, owned 50/50 by both spouses

Property owned before marriage or received by gift or inheritance is usually separate, as long as it stays segregated

For federal income tax purposes, community property regimes can create a major advantage: at the first spouse’s death, all community property typically receives a step-up in basis, not just the decedent’s half. That can wipe out decades of unrealized capital gains in real estate, closely held businesses, or concentrated stock positions.

Separate property in common-law systems

Common-law states, including Florida, follow a different logic:

Legal title is more important. Ownership follows the name on the deed or account.

There is still a distinction between marital property (acquired during the marriage) and separate property (before marriage, gifts, or inheritance).

At divorce, courts use equitable distribution: a fair division of marital assets, but not necessarily a 50/50 split.

From a tax perspective, in these systems only the decedent’s share of property gets a step-up in basis at death. The surviving spouse ends up with a mixed basis and potentially large capital gains when they sell.

Florida’s Default Regime: Equitable Distribution, Not Community Property

Marital vs non-marital property in Florida

Florida is not a community property state. It is an equitable distribution state. Broadly:

Marital property includes assets and debts acquired by either spouse during the marriage, with some exceptions

Non-marital property includes assets owned before marriage and certain gifts or inheritances, if kept clearly separate

For investors, this means a rental portfolio assembled during the marriage may be treated as a shared marital asset, even if held in one spouse’s name. Commingling, refinancing, and casual transfers between accounts can blur the line between marital and separate property.

What “equitable” really means for investors

Equitable distribution means “fair,” not necessarily “equal.” Courts can consider:

Length of the marriage

Each spouse’s financial circumstances and earning power

Contributions to the marriage, including running a business or staying home

Waste or dissipation of marital assets

For high-net-worth spouses, the outcome can differ sharply from a simple 50/50 split. If one spouse expects to keep a larger stake in certain properties, that expectation should be reflected in agreements and structuring, not left to chance.

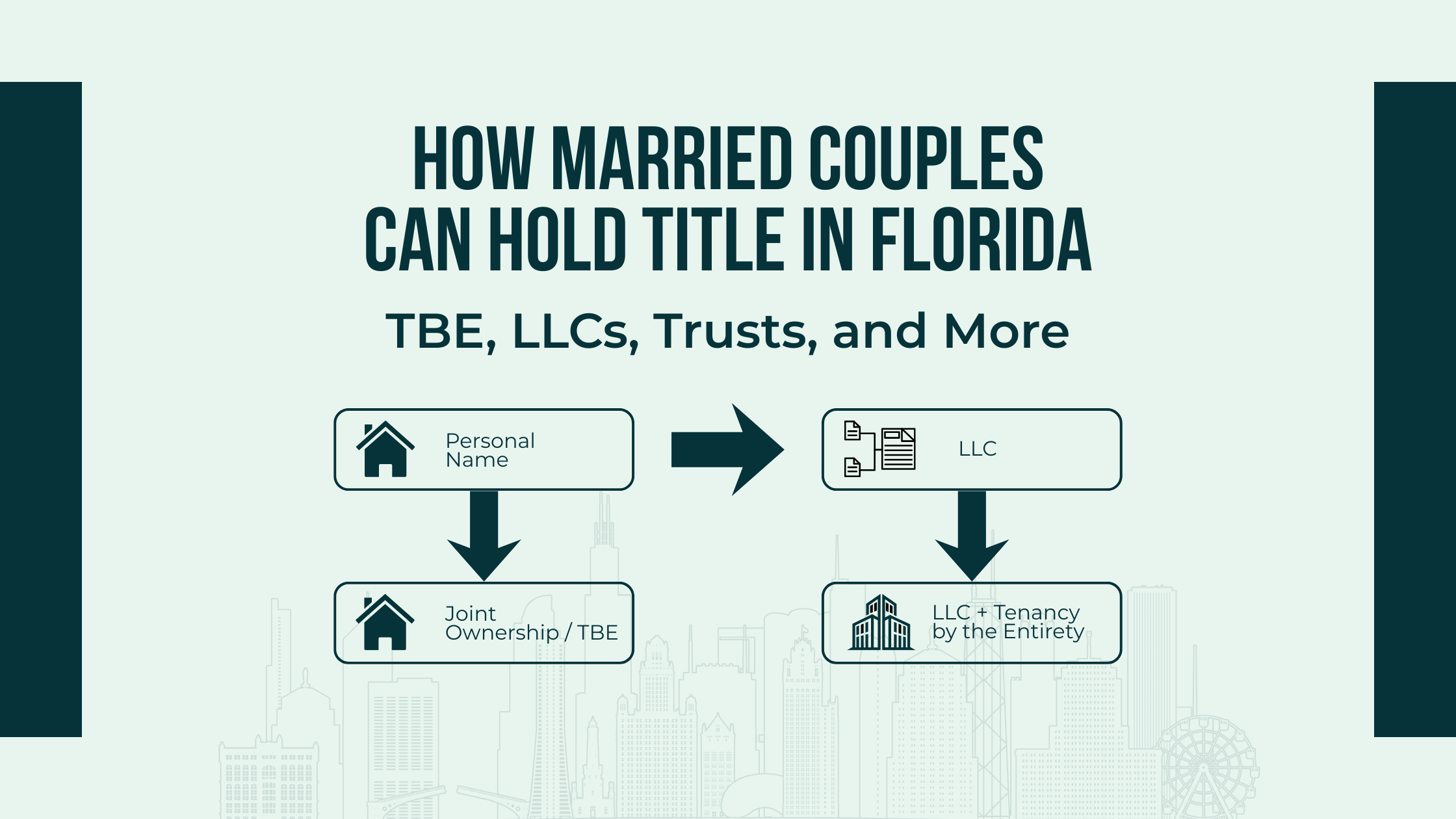

How Married Couples Can Hold Florida Real Estate

Separate ownership in one spouse’s name

A property can be titled solely in one spouse’s name. That does not automatically make it separate:

If acquired with marital funds, it may still be treated as marital property in divorce

Creditors of the titled spouse can more easily reach the asset

Control is centralized, which can be useful in some business contexts but risky in others

For a spouse with high professional or business liability, holding major properties personally is often the worst option.

Joint tenants with rights of survivorship (JTWROS)

JTWROS provides:

Co-ownership during life

Automatic transfer to the surviving owner at death, avoiding probate

However, JTWROS does not provide strong creditor protection. A creditor of one joint tenant can typically reach that owner’s interest. For married couples in Florida, there is usually a better tool.

Tenancy by the entirety (TBE)

Tenancy by the entirety is unique to married couples. Legally, the spouses are treated as one owner. Key benefits:

A creditor of only one spouse generally cannot force the sale of TBE property

Property passes automatically to the surviving spouse at death, outside of probate

TBE can apply not just to real estate, but also to certain financial accounts and, in some structures, to ownership interests in entities

For Florida married investors, TBE is often the foundational asset-protection vehicle, especially when one spouse has heightened exposure (e.g., doctors, developers, guarantors).

Ownership through LLCs, LPs, and trusts

Many investors hold Florida property via:

Single-purpose LLCs for each property

Family LLCs or LPs owning multiple assets

Revocable or irrevocable trusts

These structures can:

Isolate property-level liabilities

Allow flexible allocation of income and losses

Provide better succession planning and control

Importantly, spouses can own an LLC interest as tenants by the entirety, combining entity shielding with marital creditor protection. Getting that detail right requires precise drafting and coordination with title companies and banks.

Florida Community Property Trusts: Opting Into Community-Style Treatment

The Florida Community Property Trust Act

Since 2021, Florida law allows married couples to create a Florida Community Property Trust (CPT). This is not a full community property regime. It is an elective overlay for chosen assets.

A qualifying CPT must:

Explicitly state that it is a Community Property Trust

Be signed by both spouses

Include specific statutory warning language about the far-reaching consequences

Have at least one qualified trustee, following the statute’s criteria

In short, Florida allows spouses to opt into community-style treatment for selected assets, often for tax optimization, while the rest of their property remains under standard Florida rules.

Full step-up vs half step-up in basis

Without a CPT, when a Florida spouse dies:

Only the decedent’s share of jointly owned property receives a basis step-up

The survivor’s share typically retains its original basis

With a properly structured CPT:

Assets inside the trust can receive a full step-up in basis at the first spouse’s death

The surviving spouse may be able to sell high-gain properties with little or no capital gains tax immediately after the first death

For couples holding long-term Florida rentals, commercial buildings, or development projects with large embedded gains, this is a powerful planning lever.

If your Florida properties have big unrealized gains, your next move matters. We help couples plan exits that respect both the numbers and the people behind them.

Who typically uses a Community Property Trust

CPTs tend to be most attractive for:

Couples with large unrealized gains in real estate or concentrated portfolios

Investors who expect a sale or recapitalization after the first spouse’s death

High-net-worth spouses who prioritize income tax efficiency and are comfortable with community-style treatment for specific assets

A CPT is not automatically the right answer for everyone. It can intersect awkwardly with divorce planning and creditor protection if used without a broader strategy.

Community Property vs Separate in a Florida Tax Strategy

Income allocation, depreciation, and loss planning

For income tax, the basics remain:

Rental income, expenses, and depreciation are reported by the owners (spouses, LLCs, partnerships, or trusts)

The form of ownership affects who reports what, and how passive activity rules, QBI deductions, and net investment income tax apply

For Florida couples, CPTs are primarily about basis and capital gains, not everyday depreciation. But ownership structure can still influence how efficiently the couple uses losses, deductions, and rate brackets.

Capital gains: a simple numeric comparison

Imagine this scenario:

Married couple buys a Florida multifamily property for $1,000,000

Years later, it is worth $3,000,000

One spouse dies; the survivor plans to sell

Scenario A – Traditional joint ownership (no CPT)

Original basis: $1,000,000

At death, the decedent’s half steps up from $500,000 to $1,500,000

Survivor’s half stays at $500,000

New combined basis: $2,000,000

Sale at $3,000,000 produces roughly $1,000,000 of taxable gain

Scenario B – Property in a Florida Community Property Trust

Same facts, but the building is inside a qualifying CPT

At death, the entire property basis steps up to $3,000,000

Sale at $3,000,000 produces little or no capital gain

Replicate that across several high-value properties and the tax savings can be dramatic.

Asset Protection: Where Community Property Tools Fit

TBE, LLCs, and CPTs in the same plan

Viewed purely through an asset-protection lens:

TBE is often the strongest shield against the creditors of one spouse

LLCs and LPs are the primary shield against property-level liabilities and tenant claims

CPTs are tax-focused and may not enhance creditor protection in the same way

For many high-net-worth Florida couples, the best structure combines:

Properties in single-purpose LLCs

LLC interests owned as tenants by the entirety

Select high-gain assets (or entity interests) placed inside a CPT primarily for basis planning

This layered structure balances tax optimization, asset protection, and succession control.

What if only one spouse is sued?

Consider a few examples:

A malpractice claim hits one spouse personally: TBE property is often shielded, whereas property owned solely by that spouse is exposed.

A tenant sues over an injury at a short-term rental: if the property is in an LLC, the claim is generally limited to the LLC’s assets, not the spouses’ personal wealth.

A creditor pursues one spouse who signed a personal guarantee: again, TBE and entity structuring may make the difference between nuisance and catastrophe.

CPTs are powerful, but they do not replace the need for robust entity structuring and TBE planning.

Cross-Border and Multi-State Couples

Moving from a community property state to Florida

Couples moving from California, Texas, or similar states bring existing community property with them. When they become Florida residents, several questions arise:

Does the community characterization continue for federal tax purposes?

How will Florida courts treat those assets in a divorce?

Should they preserve community treatment through a Florida Community Property Trust?

Without deliberate planning, legacy community property can drift into a murky hybrid status. A CPT can preserve community-style tax benefits on specific assets, while Florida law governs the rest.

Out-of-state and foreign investors buying Florida property

Out-of-state and international couples face:

U.S. federal rules on foreign ownership and real estate dispositions

Home-country community or separate property laws

Florida’s unique combination of homestead protections, entity rules, and marital property law

Here, community property vs separate becomes a three-dimensional puzzle: home country, U.S. federal, and Florida state. Coordinated advice is essential, especially as property values and stakes increase.

Planning for Divorce, Remarriage, and Legacy

Marital agreements around substantial real estate

For couples with significant assets, pre-nuptial and post-nuptial agreements should address:

Which properties remain separate regardless of titling

How appreciation, refinancing, and capital improvements are treated

Whether CPT assets are included or excluded in a divorce context

Leaving these questions to default rules can produce outcomes neither spouse expected.

Blended families and second marriages

In second marriages and blended-family situations, ownership structure must juggle:

Income needs of the surviving spouse

Capital preservation for children from prior relationships

Timing and control of liquidity events

Some assets may be set up to favor the surviving spouse (for example, via CPT and step-up planning). Others may be funneled more directly to heirs through trusts, entities, or specific bequests. Community-style and separate treatment can be mixed deliberately to align incentives and expectations.

Practical Playbooks for Florida Real Estate Strategies

Long-term buy-and-hold portfolios

A common structure for married Florida investors:

Each property in its own LLC

LLC membership interests owned by the spouses as tenants by the entirety

Over time, select high-gain properties or LLC interests transferred into a Community Property Trust to maximize basis step-up

This approach keeps liability ring-fenced, preserves strong asset protection, and allows the couple to “turn on” community-style tax benefits where they matter most.

Short-term rentals and mixed-use properties

Short-term rentals carry heightened risk:

Many guests

High turnover

Amenities like pools, docks, or rooftop spaces

Here, investors typically rely on:

LLC ownership for the property

Robust insurance

TBE ownership of LLC interests

Optional CPT planning for larger, more appreciated assets

The goal is to avoid catastrophic downside while still capturing upside and tax efficiencies.

Your structures should protect both your wealth and your spouse. We review your entities, titling, and tax position with real care for your family’s future.

Co-investments and syndications

In syndications and joint ventures:

Clarify whether the investing spouse is one or both spouses, or whether the investor is a family entity

Align the operating agreement with marital planning (who votes, who can sell, how interests transfer at death or divorce)

Decide whether large LP or membership interests should sit in a CPT, a family LLC, or a more protective trust structure

These details are often overlooked, even though many Florida high-net-worth investors now access deals primarily through syndications.

Governance, Documentation, and Avoiding Pitfalls

Keeping separate property truly separate

If one spouse wants an asset to remain separate:

Do not fund it with joint accounts

Keep meticulous records of sources of funds and improvements

Consider formal marital agreements and clear trust language

Without discipline, separate property can easily morph into marital property under Florida law.

Titling, agreements, and trust language

To make your structure work as intended:

Ensure deeds and accounts explicitly reference tenancy by the entirety where that is the goal

Align operating agreements with how you expect control, income, and value to be shared

Draft Community Property Trusts carefully, using the statutory language required and tailoring provisions for divorce, death, and creditor questions

Ambiguity is the enemy. It invites disputes from heirs, ex-spouses, and the IRS.

How Square Accounting Supports Florida Spouses

Integrating tax, legal, and estate planning

For Florida real estate investors and high-net-worth couples, the best results come from integrated strategy, not isolated choices.

Square Accounting helps spouses:

Map existing and planned holdings across TBE, LLCs, LPs, trusts, and CPTs

Model capital gains exposure and basis step-up under different death and sale scenarios

Coordinate with legal and estate-planning counsel to align documents and economic intent

The focus is on practical outcomes: lower lifetime tax, better protection, cleaner succession.

Ongoing monitoring as rules and markets evolve

Markets shift. Laws evolve. Families change. What worked five years ago may no longer be optimal today.

Square Accounting regularly helps clients:

Revisit ownership charts as portfolios grow

Decide when to transfer assets into or out of Community Property Trusts

Adjust structures when investors move, remarry, or scale into larger deals

For married Florida investors, how you own your property is as important as what you own. Thoughtful use of community property vs separate structures, tailored to your risk profile and goals, can turn a good Florida investment story into a truly exceptional one.

Your life will change. Your portfolio will too. We stay with you, adjusting your tax and ownership strategy with the same care we’d want for our own families.

FAQ: Community Property vs Separate in Florida Property Strategy

1. Is Florida a community property state or a separate property state?

Florida is not a community property state. It’s a separate property, equitable distribution state. That means a court first classifies assets as marital or non-marital, then divides marital property fairly, which might not be a strict 50/50 split.

2. What is the difference between community property vs separate property in Florida?

In a true community property system, most assets acquired during marriage are owned 50/50 by both spouses, no matter whose name is on the title. In Florida, the focus is on marital vs non-marital property. Assets acquired during marriage are usually marital, while pre-marital, gifted, or inherited assets can remain separate if they are kept clearly separated and not commingled.

3. How does Florida treat marital vs non-marital property in divorce?

In divorce, Florida courts:

Classify each asset as marital or non-marital

Value the marital assets

Distribute them equitably between the spouses

Non-marital (separate) property generally stays with the original owner. However, if separate property is commingled with marital funds or retitled in joint names, some or all of it can be treated as marital.

4. What is a Florida Community Property Trust and how does it help real estate investors?

A Florida Community Property Trust (CPT) is a special trust that allows married couples to elect community-style treatment for specific assets, including Florida real estate. When properly structured, assets in a CPT can receive a full step-up in basis at the first spouse’s death, which can significantly reduce or even eliminate capital gains when the surviving spouse sells the property.

5. Can non-Florida residents use a Florida Community Property Trust?

Yes. Non-Florida residents can generally use a Florida Community Property Trust if the trust meets Florida’s legal requirements, including using a qualified trustee. This allows couples living in non–community property states to access community-style tax benefits for chosen assets without moving to Florida.

6. How does a Florida Community Property Trust compare to tenancy by the entirety?

A Community Property Trust is mainly a tax-planning tool, focused on basis and capital gains.

Tenancy by the entirety (TBE) is primarily an asset-protection and ownership structure for married couples, treating them as one legal owner and often protecting the property from the creditors of just one spouse.

Many married real estate investors use both:

TBE and LLCs for protection and control

CPTs for targeted tax optimization on high-gain assets

7. How should married real estate investors in Florida hold title: community property vs separate?

Because Florida isn’t a community property state, the real choices are:

Separate ownership in one spouse’s name

Joint ownership

Tenancy by the entirety

Entity structures (LLCs, LPs)

Optional Community Property Trust overlay

A common strategy for sophisticated couples is to hold property in LLCs, with the spouses owning the LLC interests as tenants by the entirety, and then move selected high-gain assets into a Community Property Trust for basis planning.

8. How does community property vs separate treatment affect capital gains on Florida real estate?

Under standard Florida structures, when one spouse dies, only that spouse’s share of jointly owned property usually gets a step-up in basis. The survivor’s share keeps its original basis, which can create large capital gains later.

With a properly structured Community Property Trust, the entire property can receive a step-up in basis at the first spouse’s death, which can dramatically reduce capital gains taxes for the surviving spouse when the property is sold.

9. What happens to multiple properties in Florida at divorce: are they community or separate?

In a Florida divorce, each property is analyzed separately:

When was it acquired?

Was it bought with marital or separate funds?

Was there commingling or retitling?

Properties acquired during the marriage with marital funds are usually marital. Properties acquired before marriage or by gift or inheritance can remain separate, but commingling or adding a spouse to the title can turn them into marital property in whole or in part.

10. Do all married Florida real estate investors need a Community Property Trust?

No. A Community Property Trust is most valuable for couples who:

Own highly appreciated Florida real estate or other low-basis assets

Expect a sale or recapitalization after the first spouse’s death

Are comfortable with community-style treatment for selected assets

Other couples may be better served by focusing on TBE, LLC structures, and traditional estate planning. The right choice depends on your portfolio size, gain exposure, risk profile, and family goals, which is why a tailored review with a firm like Square Accounting is so important.