Our Services

Smart Tax Strategies for Real Estate Investors & Small Businesses

We help Florida-based investors and entrepreneurs minimize taxes, protect wealth, and grow with confidence through proactive planning, tailored strategies, and transparent guidance

Running your business or managing your investments shouldn’t feel like a second full-time job, yet for many, it does.

Tax season brings stress and uncertainty, with missed deductions and costly mistakes.

Inaccurate or inconsistent bookkeeping makes it impossible to see the full financial picture.

Surprise IRS notices leave you scrambling instead of focusing on growth.

Without a clear tax strategy, you risk overpaying year after year.

You’re not alone. These challenges drain time, money, and energy—keeping you from building the wealth and freedom you’re working so hard for.

-

Strategic Tax Services

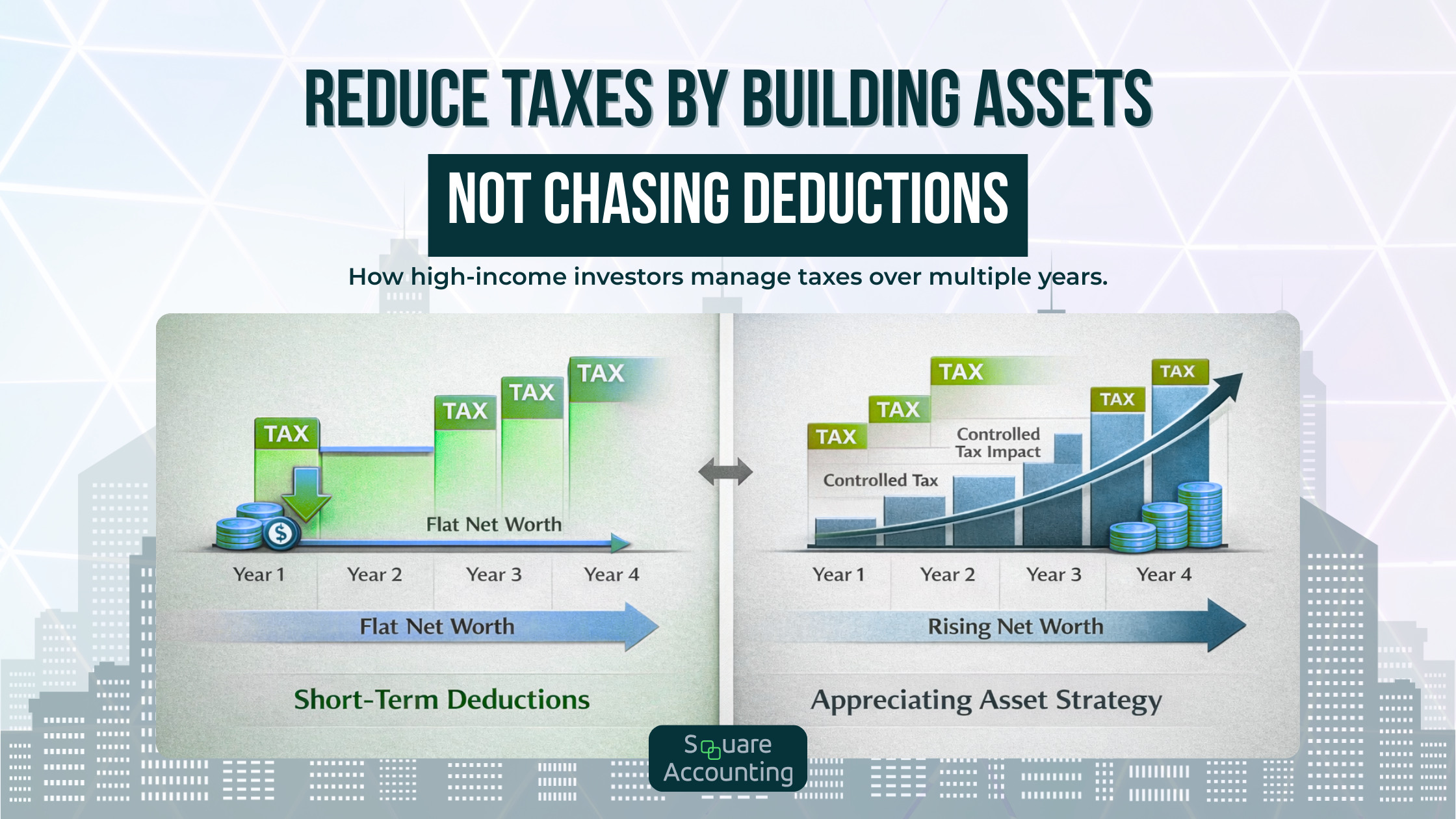

We go beyond basic compliance; We build a tax strategy that grows with you, from the next 3-5 years, to the next 40 years.

-

Profit Maximization

We dive into the granular detail with you; flagging potential opportunities you may want to take advantage of.

-

Financials Analysis

Reviewing your revenue, expenses, & cash flow to guide you in the right direction for your long term goals, and helping avoid missteps along the way.

-

Real Estate Tax Advisory

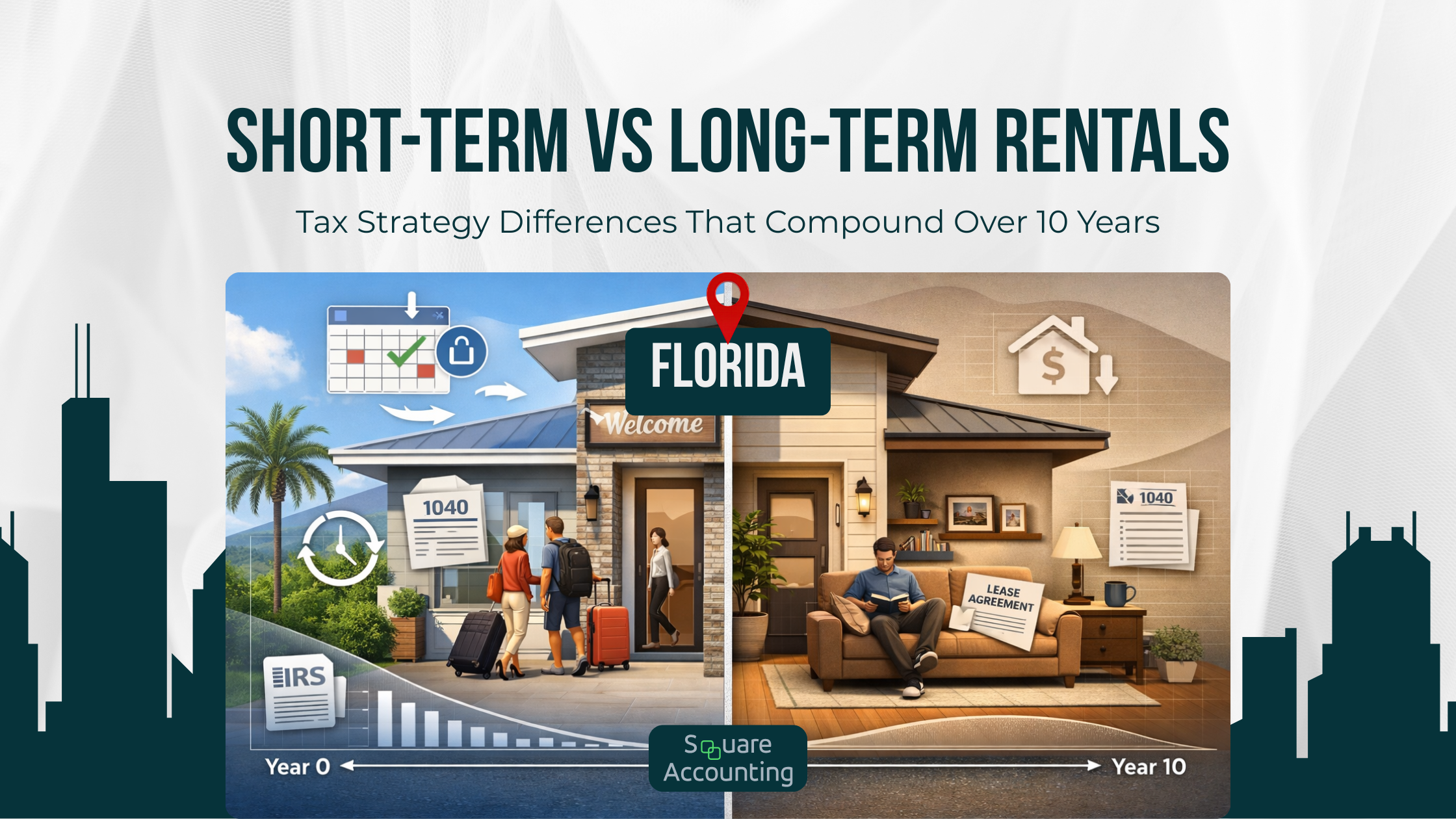

Specialized guidance for investors, flippers, and landlords and Maximizing the the tax savings based on the type of properties invested in.

-

Personalized Solutions

We offer tailored financial strategies designed to meet your unique needs and goals.

-

Tax Preparation

Converting your tax documents and tax strategies into a complete tax summary, to ensure no red flags and the highest tax refund possible.

Why Choose Square Accounting

-

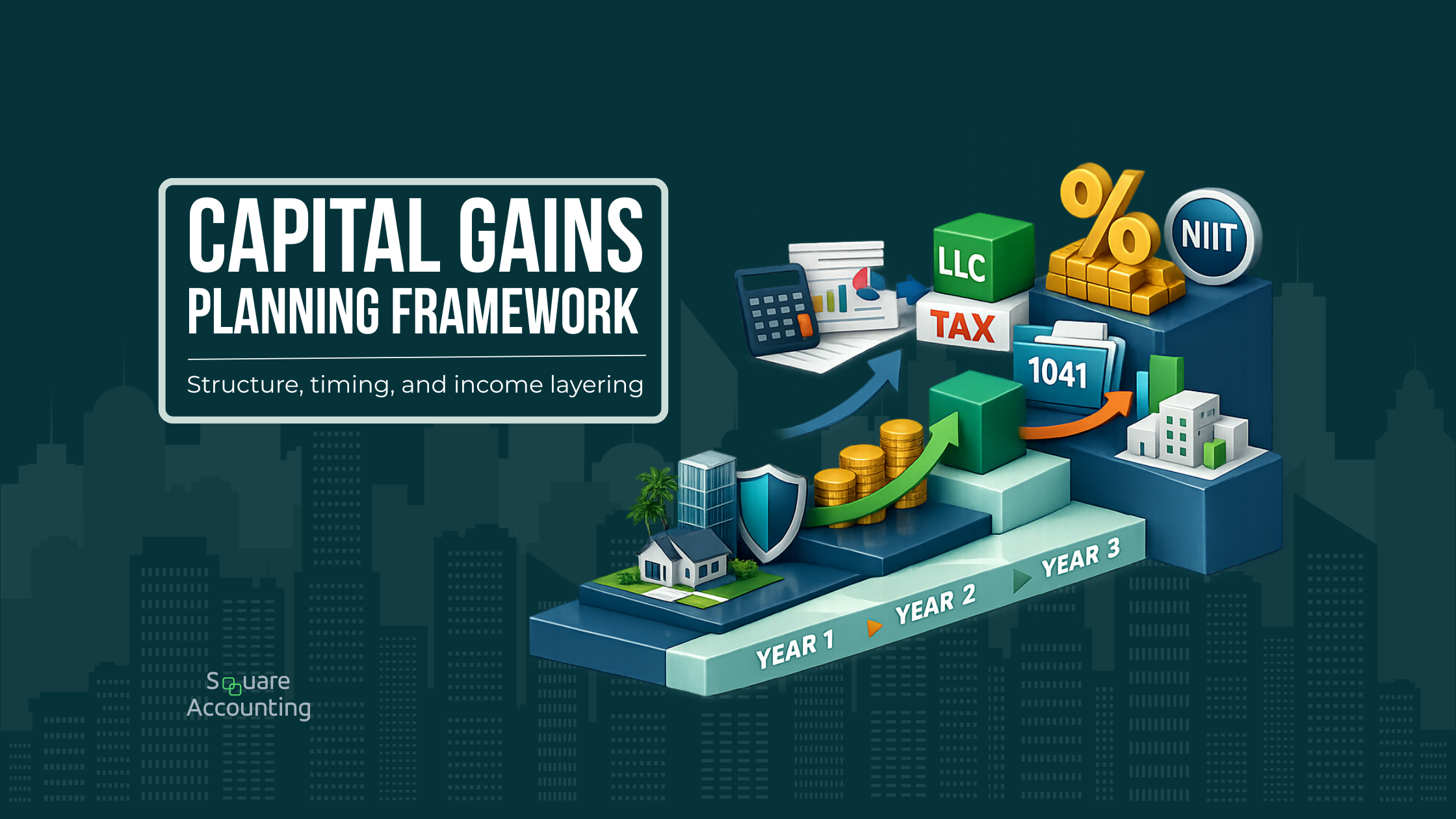

Learn and Implement Advanced Tax Strategies.

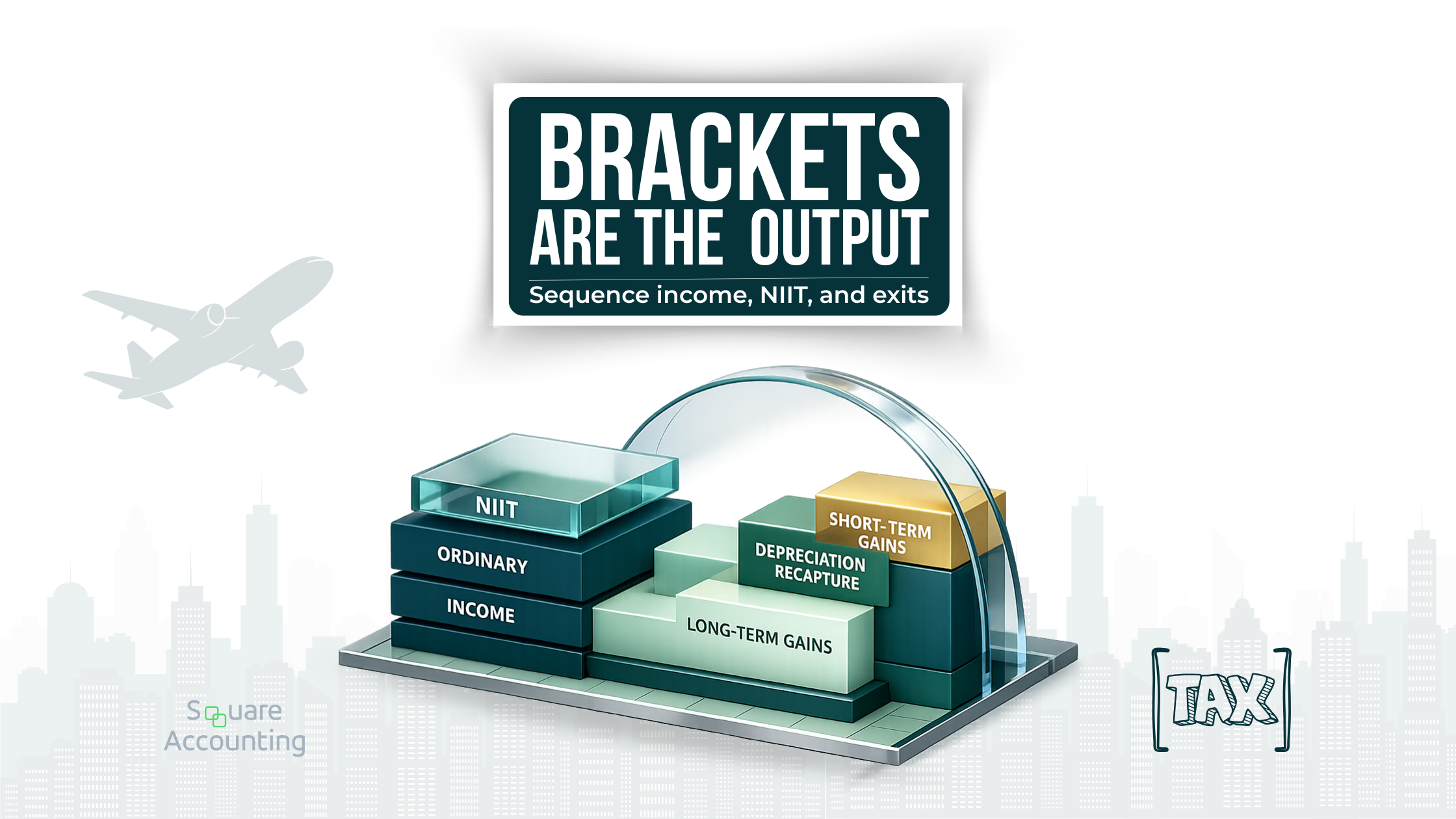

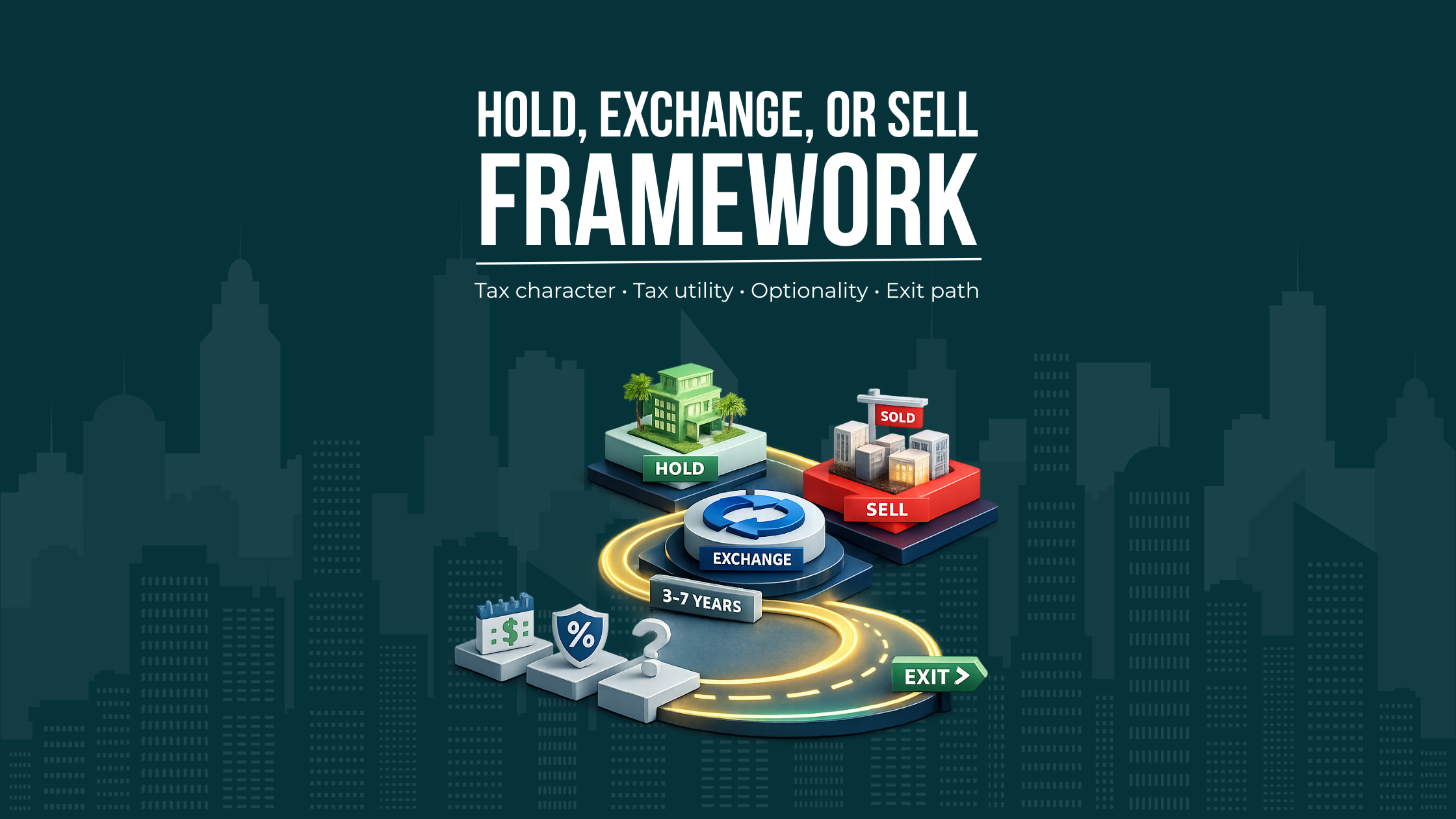

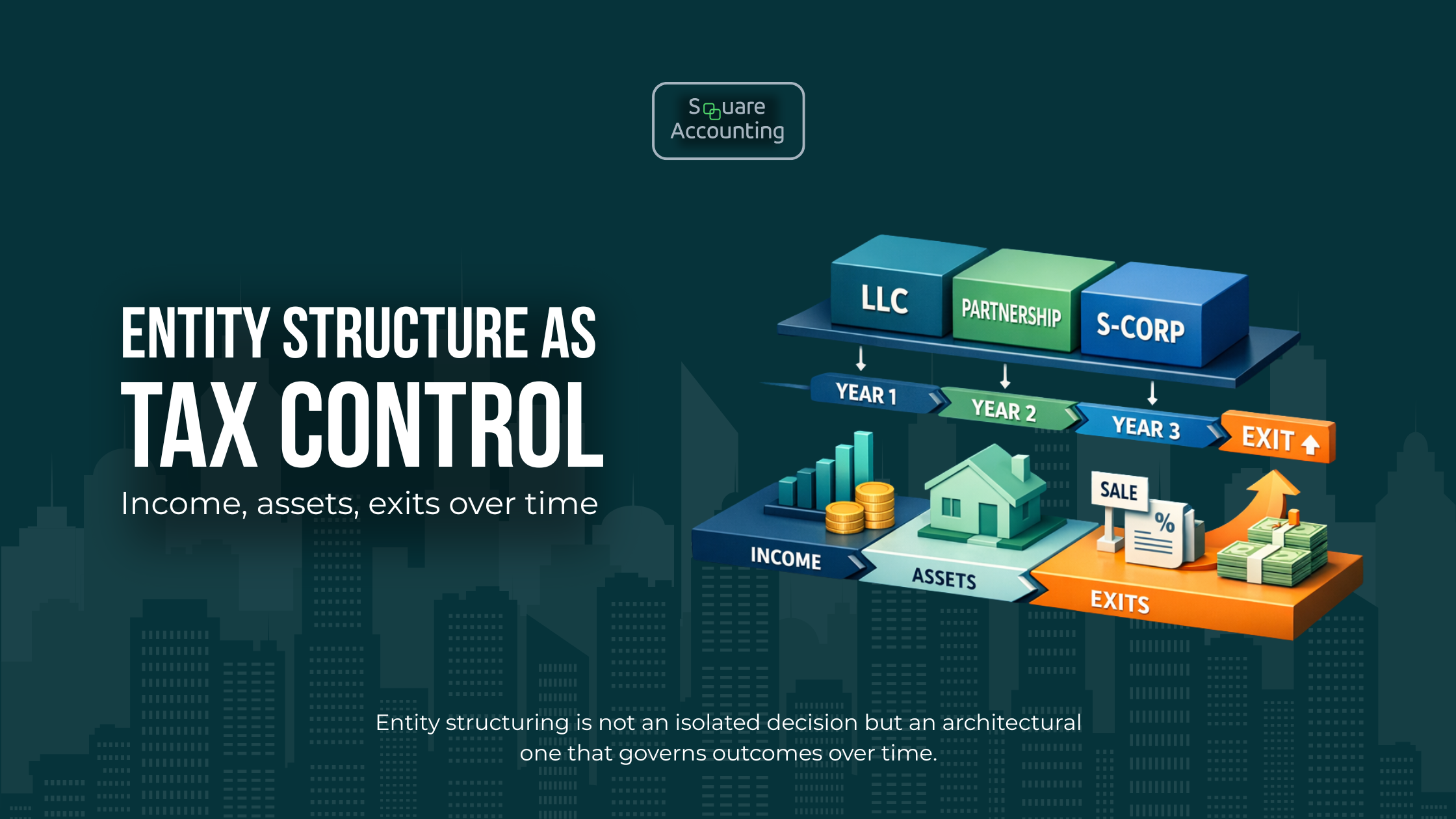

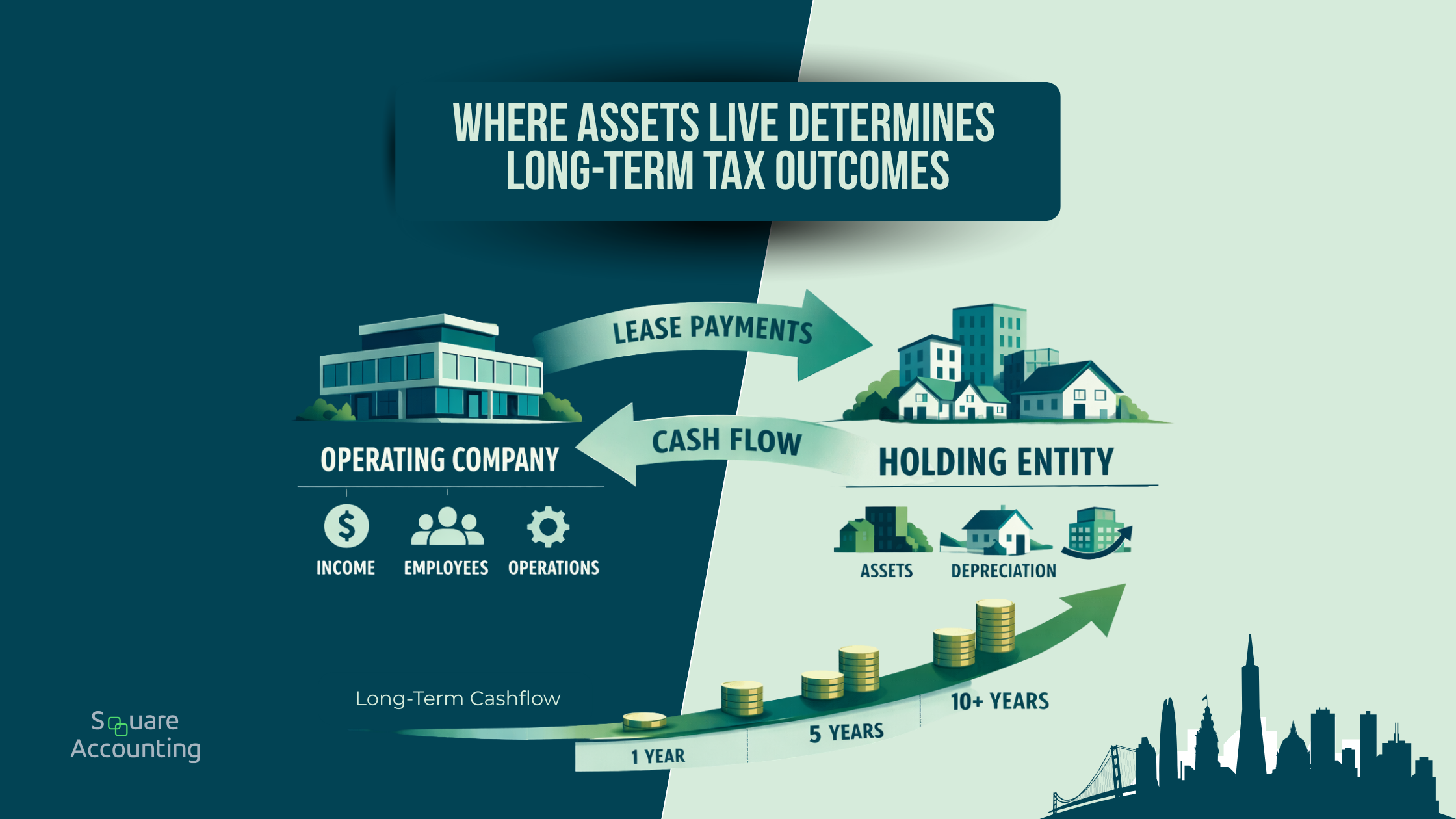

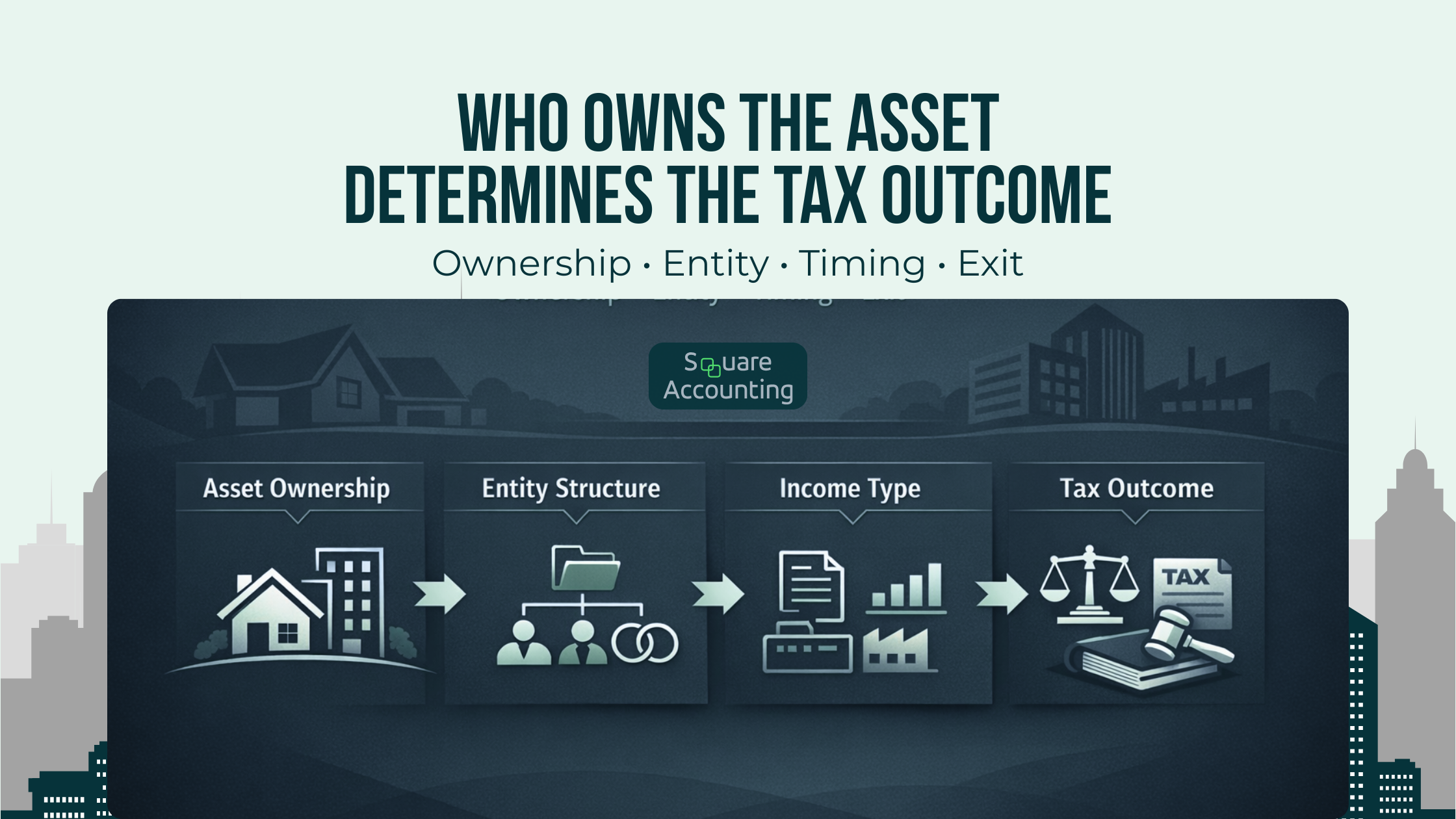

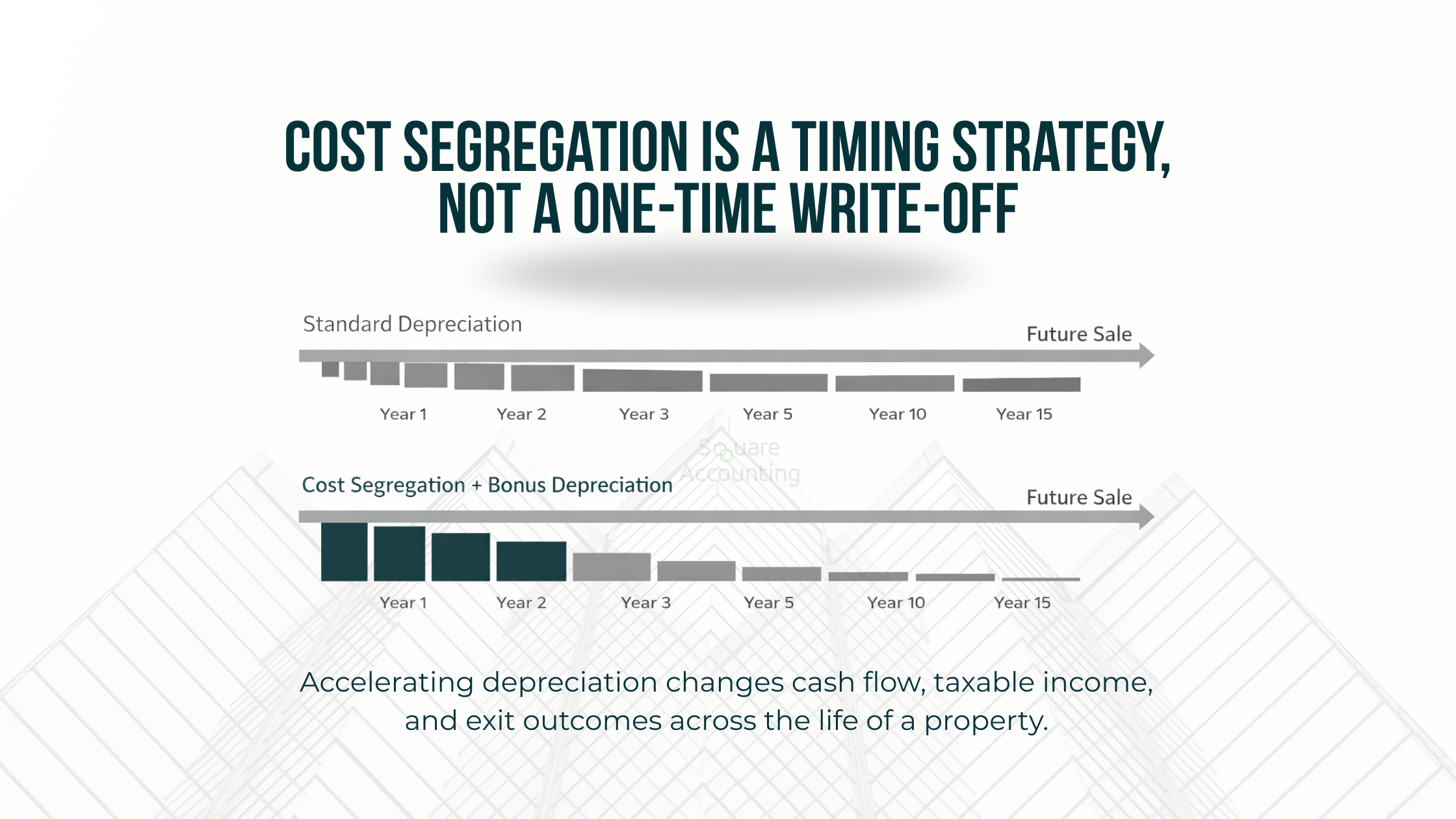

Discover proven tax strategies tailored to real estate investors and business owners, helping you minimize liabilities and keep more of what you earn. We walk you through the benefits of each tax strategy, such as the Cost Segregation Study, 1031 Exchange & Shifting income and losses between passive and active.

-

Create a Long-Term Tax Plan that Works for Your Lifestyle.

We design tax plans that adapt to your goals—whether building wealth, scaling a business, or securing retirement—so your money works for you, year after year.

-

Clarity & Confidence Year - Round.

Enjoy peace of mind with transparent guidance, proactive updates, and ongoing support—so you’re always prepared, never surprised. We have an average response time of 24 to 48 hours, because we understand that life and decisions move fast.

How Our Process Works

-

Schedule a Call

On our first call, we will find out what you currently have going on in your life, and investments. Then we’ll discuss what your end goal is and the lifestyle you prefer to live. We’ll then discuss possible strategies that work right for you.

-

Information Gathering

Once your confident to move forward, we begin gathering the details needed to estimate the amount of tax savings possible with your unique situation.

-

Implementation

Once we have all required documents, we begin adding the required forms and necessary accounting adjustments on your books and records, in addition to your tax returns. We compare this to our original estimates throughout the year, if circumstances change.

FAQ'S

Frequently Asked

Questions

Throughout our advisory meetings we answer a lot of questions that new and seasoned real estate investors ask us on a regular basis.

-

Unless you qualify as a real estate professional or the short-term rental “loophole”, rental losses are generally “passive” and limited to offsetting passive income. However, active investors with AGI under $150,000 may qualify for a $25,000 passive loss allowance.

-

Yes. If you rent your personal residence for 14 days or less (e.g., for business meetings, events, or short-term stays), that rental income is tax-free while still being deductible to your business entity.

-

LLCs provide liability protection, but the tax treatment often passes through to your personal return. High-net-worth investors may consider holding through LLCs, S-corps, or partnerships depending on their broader tax strategy.

-

Refinance high-interest loans

Use cost segregation to increase deductions

Implement efficient property management (self-manage with automation or outsource strategically)

Increase rents strategically by aligning with market trends

Blogs

Discover Valuable Insights in Our Blog

Contact us

Talk to our Tax Advisor

Running your operations is demanding—your taxes shouldn’t add to the stress. Whether you need strategic tax planning or ongoing support, we’re here to help.