How Florida Property Tax Law Changes Affect Investors

Florida’s New Tax Reality: What Every Investor Needs to Know

Florida’s appeal to property investors has always been clear: no state income tax, growing demand, and a historically stable tax structure. But in 2025, the rules changed—substantially.

New legislation and local enforcement trends are shifting how real estate is taxed, classified, and reassessed. Investors—especially those holding rental properties, short-term vacation units, commercial assets, or land parcels—must now adapt to maintain profitability.

Understanding how Florida property tax law changes affect investors is not just beneficial—it’s essential.

Maximize returns in 2025—Schedule your Florida Property Tax Strategy Session with Square Accounting

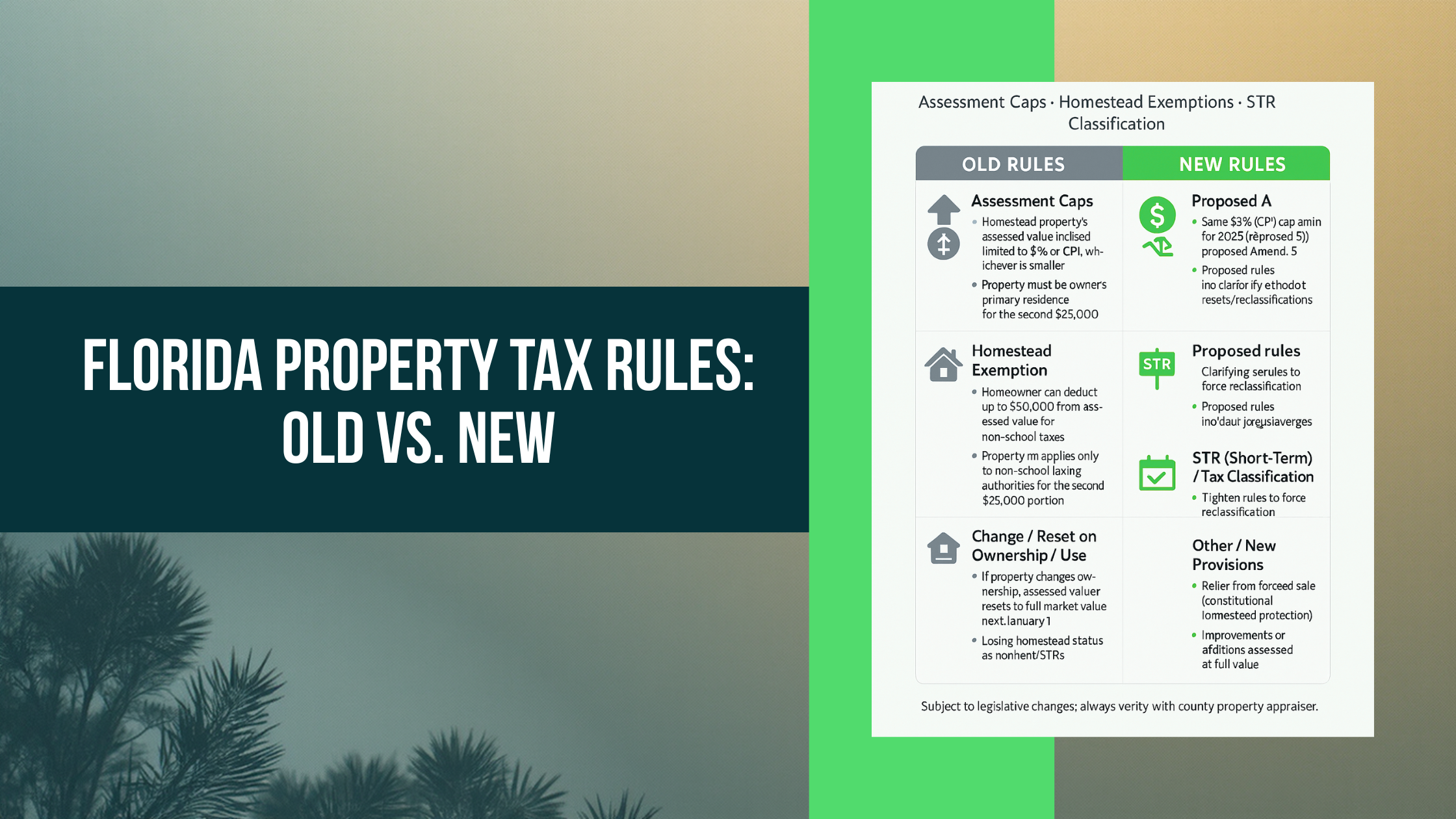

Summary of Florida Property Tax Law Changes in 2025

These are not minor adjustments. Florida's 2025 tax law updates represent a multi-pronged legislative shift, including:

Flexibility for counties to remove non-homestead assessment caps

Tightened enforcement of homestead exemption misuse

Emphasis on income-based valuation for commercial property

Expansion of short-term rental reclassification as commercial

More stringent documentation for agricultural (greenbelt) exemptions

Extended homestead portability window under Amendment 5

Adjustments to Tangible Personal Property (TPP) tax thresholds

Each of these areas touches a different class of investor—and many impact more than one.

1. Assessment Caps on Non-Homestead Properties: Eroding Protections

What Changed:

Counties can now override or reduce the 10% cap on annual assessment increases for non-homestead properties—typically rentals and commercial real estate.

Investor Impact:

Rental properties may see 15–30% YOY taxable value increases

Underwriting assumptions for long-term holds must be re-evaluated

Cap removal in growth-heavy counties (e.g., Orange, Lee, Hillsborough) could rapidly inflate tax bills

Example:

A duplex in Orlando purchased in 2022 for $450,000, previously capped at 10% annual assessment increase, may now be reassessed closer to market value ($580,000+), adding $2,000–$4,000 in annual tax liability.

Concerned about reassessment risk? Get a cap impact simulation from Square Accounting.

2. Crackdown on Out-of-State Owners Abusing Homestead Exemptions

What Changed:

Florida’s DOR now uses automated cross-referencing tools to detect fraudulent or incorrect homestead filings.

Key Triggers:

Driver's license mismatches

Mortgage documents indicating primary residence elsewhere

Voting registration outside Florida

Utility usage patterns inconsistent with primary residency

Penalties:

Back taxes for 10 years

50% penalty on unpaid taxes

15% annual interest

Who’s at Risk:

Snowbirds

Investors converting former primary homes into rentals without notifying the county

Families with dual residencies

Unsure about your homestead filing? Book a compliance check with Square Accounting.

3. Commercial Property Taxation Based on Income Potential

What Changed:

Many counties now base commercial property assessments not on comparable sales, but on income-generating potential using market rent, occupancy rates, and expense ratios.

Investor Impact:

High-performing properties penalized with higher valuations

Even vacant commercial space may be assessed based on projected income

More aggressive depreciation and expense documentation now essential

Example:

An investor in Broward County reports $320K in gross annual income from a strip mall. New valuation rules may peg their property tax value closer to a 6.5% cap rate, regardless of actual appraisal.

4. Short-Term Rentals Reclassified as Commercial

What Changed:

Local jurisdictions (especially tourist-driven counties) are using ordinance powers to reclassify STRs—like Airbnb and VRBO units—as commercial properties.

What Triggers It:

More than 3 rentals under 30 days annually

Lack of long-term lease agreements

Listing on vacation platforms without business license

Complaints from neighbors or HOAs

Consequences:

Higher property tax rates (up to 3x residential rates)

Loss of non-homestead cap protections

Zoning enforcement actions

STR investor? Get a classification risk analysis with Square Accounting.

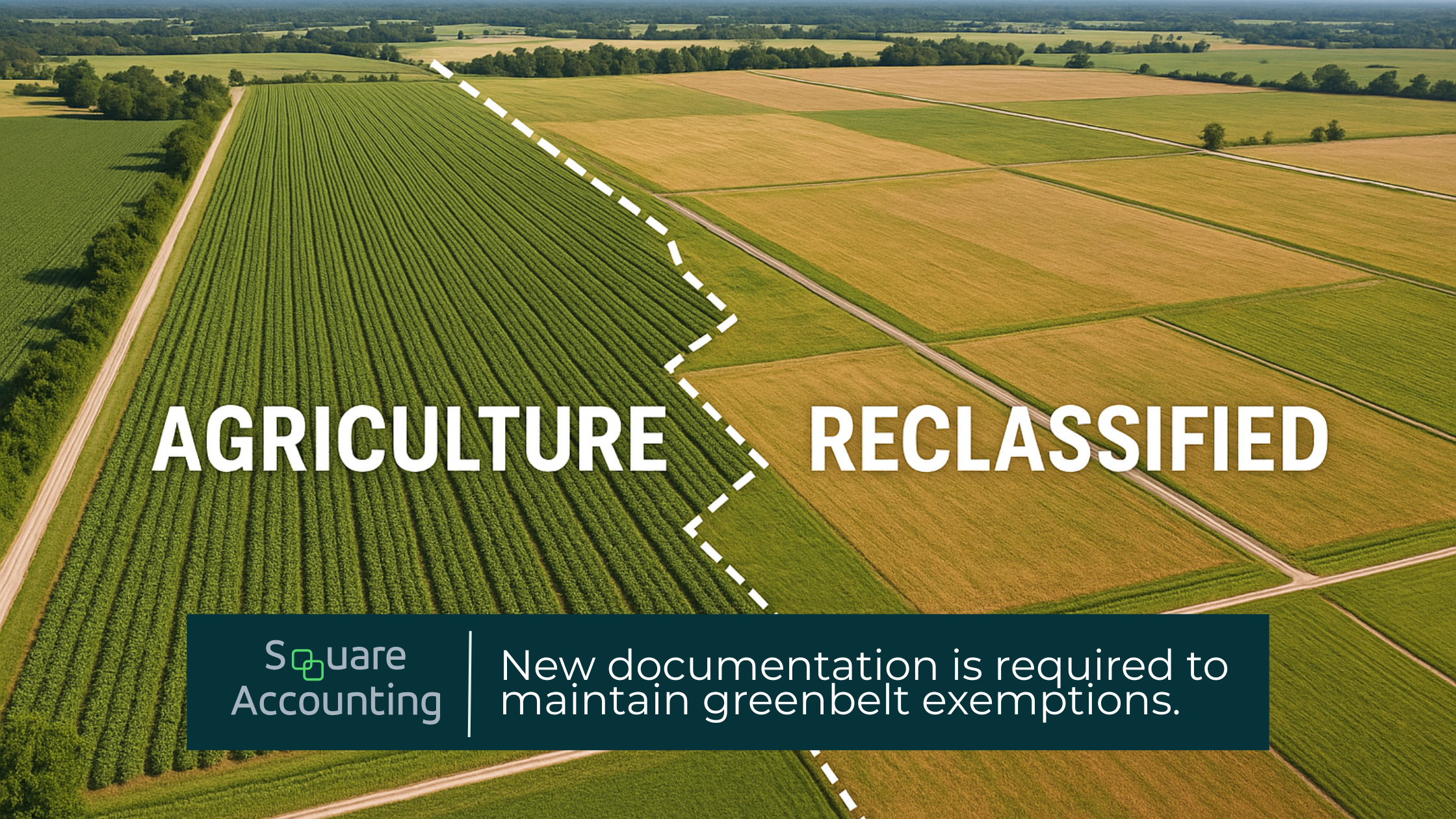

5. Agricultural (Greenbelt) Status Now Requires Active Use

What Changed:

The “greenbelt loophole”—where investors held large parcels with minimal agricultural activity to access reduced tax rates—has been narrowed.

New Requirements:

Actual ag revenue

Grazing records or harvest logs

Professional ag leases

Annual inspections and supporting photos

Investor Impact:

Land banking without a legitimate ag plan is no longer viable. Some counties are applying retroactive penalties for improper use.

6. Amendment 5: Homestead Portability Extended to 3 Years

What Changed:

Previously, homestead exemption portability (carrying your tax savings from one home to another) expired after 2 years. Amendment 5 extends this to 3 years.

Investor Strategy Angle:

Extended runway to convert a primary home into a rental

Ability to move exemptions across investment-focused transitions

Smarter timing for fix-and-hold strategies

Florida Amendment 5 (2024) – Ballotpedia

Planning to convert your home into a rental? Talk to Square Accounting about timing it right.

7. Tangible Personal Property (TPP) Exemption Threshold Increases

What Changed:

The TPP exemption now applies up to $50,000 (up from $25,000 in many counties).

Who Benefits:

Furnished rental operators

STRs with high-end appliance/equipment value

Commercial asset holders with signage, office equipment, etc.

Risk Factor:

Failing to file TPP returns—even if exempt—can result in losing the exemption or triggering audits.

8. 1031 Exchanges Now Need Local Tax Alignment

What Changed:

While federal rules around 1031 exchanges remain intact, Florida counties are reassessing post-exchange properties faster—and sometimes higher—than expected.

Strategic Concerns:

Taxable basis misalignments

Depreciation errors

Reporting mismatches across state/federal filings

Internal Revenue Service – 1031 Like-Kind Exchanges

Planning a 1031 in Florida? Don’t go in blind—book a consultation with Square Accounting.

9. County-Level Enforcement Is Inconsistent—but Risky

There is no true uniformity across Florida counties. Property tax compliance is now localized and unpredictable.

Real Examples:

In Sarasota, STRs are subject to a nightly rental tax and commercial reassessment

In Leon County, greenbelt audits are triggered by satellite imagery

In Miami-Dade, incorrect homestead filings led to public tax liens

National Association of Counties – STR Policy Tracker

Multi-county investor? Square Accounting tracks compliance risks across all 67 Florida counties.

10. Why Investors Should Reassess Their Portfolios Now

Given the scale of change, 2025 is the ideal time to:

Identify assets vulnerable to reassessment

Sell underperforming properties before tax liabilities spike

Diversify into lower-risk asset classes (e.g., BTRs, industrial)

Lock in lower tax exposure with correct exemptions

11. Smart Tax Forecasting Tools Are No Longer Optional

Dynamic forecasting models are essential to navigate Florida’s shifting tax landscape.

Modern tools should include:

Scenario analysis (if cap removed, if reclassified, etc.)

Year-over-year assessment simulations

Estimated 1031 depreciation carryovers

Exemption eligibility mapping

Want to future-proof your portfolio? Square Accounting offers full-spectrum forecasting services. Contact us.

How Square Accounting Helps Florida Real Estate Investors Win

We specialize in investor-focused tax strategy, including:

Tax classification audits

Homestead exemption verification

STR compliance and licensing reviews

1031 exchange tax modeling

Portfolio-level revaluation strategy

County-specific advisory

We don’t just file—we strategize.

Contact Square Accounting today for a Florida Real Estate Tax Optimization Plan

Conclusion: Adapt Early or Pay Later

Florida property tax laws have evolved—and will continue to. As legislators tighten loopholes and counties ramp up enforcement, investors need to be more strategic, more proactive, and more precise.

Failing to understand how Florida property tax law changes affect investors could mean the difference between a profitable deal and a painful mistake.

Let Square Accounting help you stay compliant, competitive, and ahead of the next legislative curve.

Book Your Free 1:1 Florida Property Tax Consultation Now.

🕒 Availability: Mon–Fri, 9am–6pm EST

Frequently Asked Questions (FAQ)

What are the latest Florida property tax law changes for 2025?

The 2025 changes to Florida property tax laws include increased scrutiny of homestead exemptions, flexible assessment caps for non-homestead properties, stricter short-term rental classifications, changes to greenbelt requirements, and extended portability for homestead exemptions under Amendment 5.

How do Florida property tax changes affect real estate investors?

Florida's updated property tax laws directly affect real estate investors by increasing assessment volatility, tightening exemption qualifications, and raising taxes on vacation rentals and commercial properties. Investors may see higher costs, classification changes, and reduced ROI if unprepared.

Will the non-homestead 10% assessment cap still apply in 2025?

In some Florida counties, the 10% cap on annual assessment increases for non-homestead properties may be reduced or eliminated. This allows taxable values on rental and investment properties to increase more aggressively, impacting investor cash flow.

Can I still claim a homestead exemption if I live out of state?

Out-of-state property owners must meet strict criteria to qualify for Florida’s homestead exemption. Enhanced verification systems in 2025 now check voter registration, driver’s licenses, and primary residence data to prevent improper claims. Invalid claims can lead to fines and back taxes.

How do new laws affect Airbnb and short-term rental investors in Florida?

Many counties now treat Airbnb and vacation rentals as commercial properties if rented for fewer than 30 days more than three times per year. This reclassification increases property taxes and may require registration and licensing to stay compliant.

What is Amendment 5 and how does it benefit investors?

Amendment 5 extends the homestead exemption portability period from 2 years to 3 years. For investors converting personal homes into rental properties, this allows more time to transfer property tax savings when purchasing a new primary residence.

How do these tax changes affect 1031 exchanges in Florida?

While Florida does not tax capital gains, post-exchange properties may be reassessed more aggressively under 2025 rules. This can impact depreciation schedules, taxable basis, and overall exchange strategy. Careful coordination between state and federal filings is essential.

What happens if my property is reclassified in 2025?

If your property is reclassified—such as from residential to commercial—you may face a significantly higher tax rate, loss of exemptions, and additional compliance requirements. Reclassifications are common for short-term rentals and mixed-use properties under new rules.

Are greenbelt exemptions harder to qualify for in 2025?

Yes, Florida’s 2025 updates require stricter documentation of bona fide agricultural use for greenbelt classification. Investors must now show revenue, activity logs, or leases to retain reduced tax status on agricultural land.

How can I protect my investment from rising property taxes in Florida?

Investors should conduct regular tax strategy reviews, stay compliant with exemption rules, and model future assessments using dynamic forecasting tools. Partnering with a tax advisor like Square Accounting ensures alignment with both state and local property tax laws.