Helping Florida Real Estate Investors Save an Average of $150,000 in Taxes Each Year.

Clear advice. Proactive planning. Year-round support. Your financial future deserves more than a once-a-year tax return.

Trusted by real estate professionals and service businesses across Florida

How We Help?

About Square Accounting

Support that keeps you one step ahead

Behind every small business or real estate investor is someone (you) juggling responsibilities, making smart decisions, and keeping everything running. Our job is to make sure taxes and financial planning don’t add to the pressure.

With clarity, care, and expertise, we make taxes and finances work for you, not against you—so you can keep more of what you earn, avoid costly mistakes, and move forward with confidence.

Our Statistics

Quick Overview of Our Financial Insights

-

$150k+

Average Yearly Tax Savings

-

98%

Long-term Client Retention

-

300+

Property Financials Supported

-

$10M+

Taxes Saved

What makes us different?

We go beyond compliance. With thoughtful planning, a broad view of your finances, and consistent, down-to-earth support, we help you make confident financial decisions—before the pressure hits.

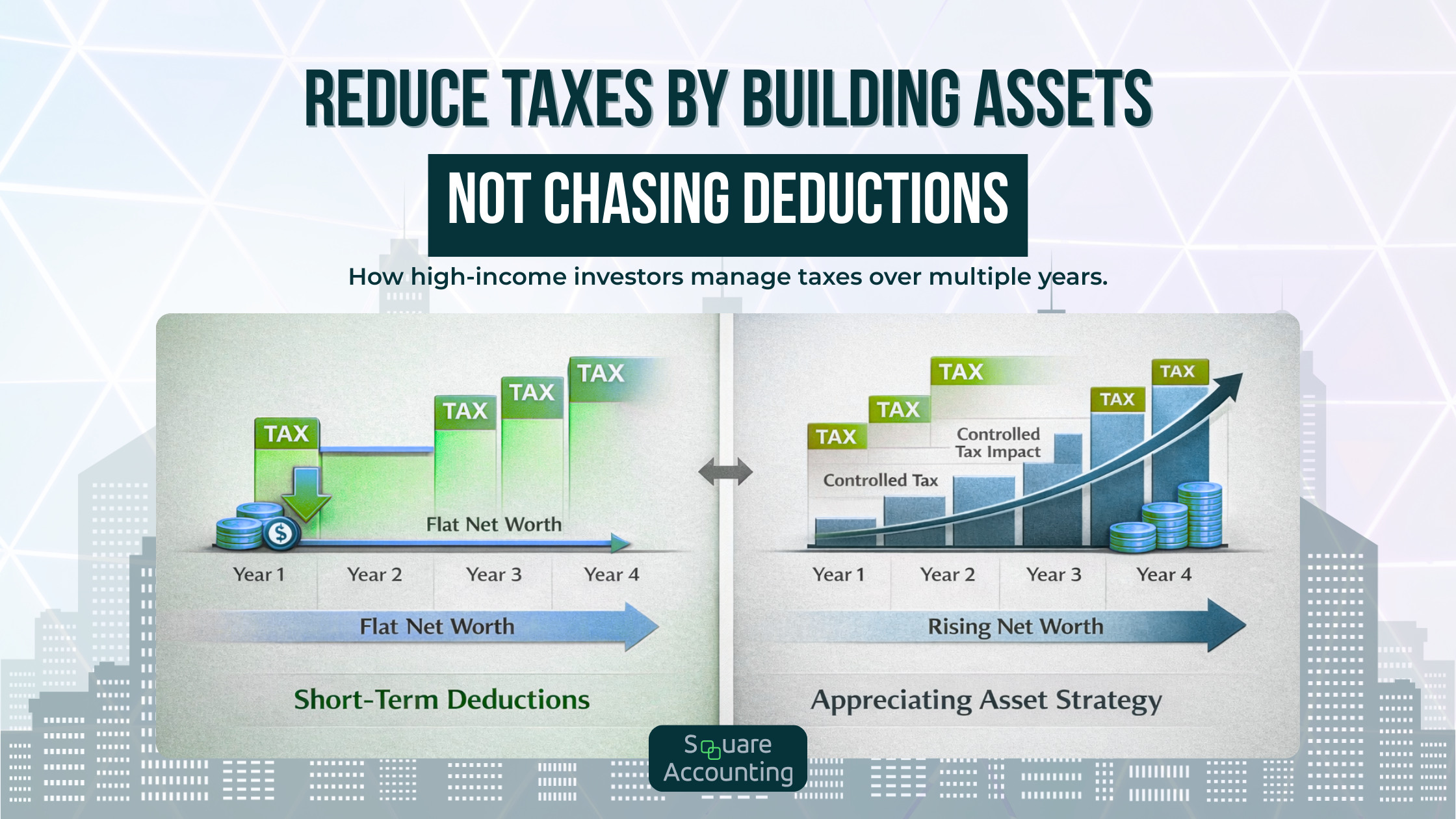

Proactive Planning

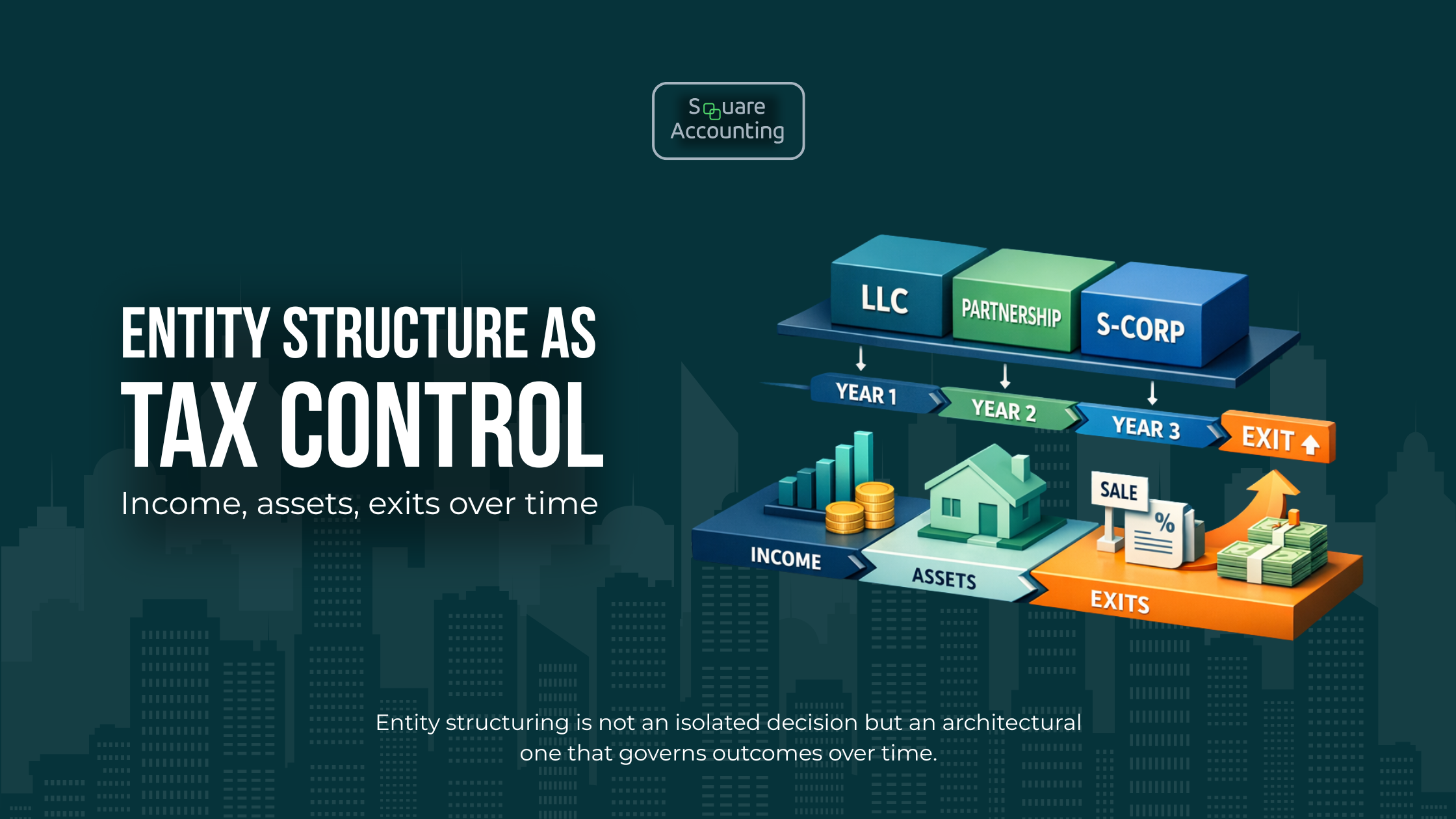

We don’t wait for deadlines to act. You’ll always have time to plan ahead—with multi-year strategies and clear, well-explained options to choose from, based on what works best for your goals.

Holistic Perspective

We look beyond tax forms and year-end numbers. By understanding how your operation runs—from revenue streams to expenses—we help you make decisions that support long-term financial health.

Multiple Strategies, Clearly Explained

There’s rarely just one way forward. We lay out several possible paths, explain the trade-offs, and help you choose the approach that fits your business best.

Fair, fixed pricing

Our pricing is simple, transparent, and designed to be easy to include in your projections. No hidden fees, no upsells—just thoughtful support at a price that respects your bottom line.

Clear, Responsive Communication

You’ll always know where things stand. We respond within 24 to 48 hours, communicate in plain language, and make space for your questions—no jargon, no pressure.

FAQ'S

Frequently Asked

Questions

Throughout our advisory meetings we answer a lot of questions that new and seasoned real estate investors ask us on a regular basis.

-

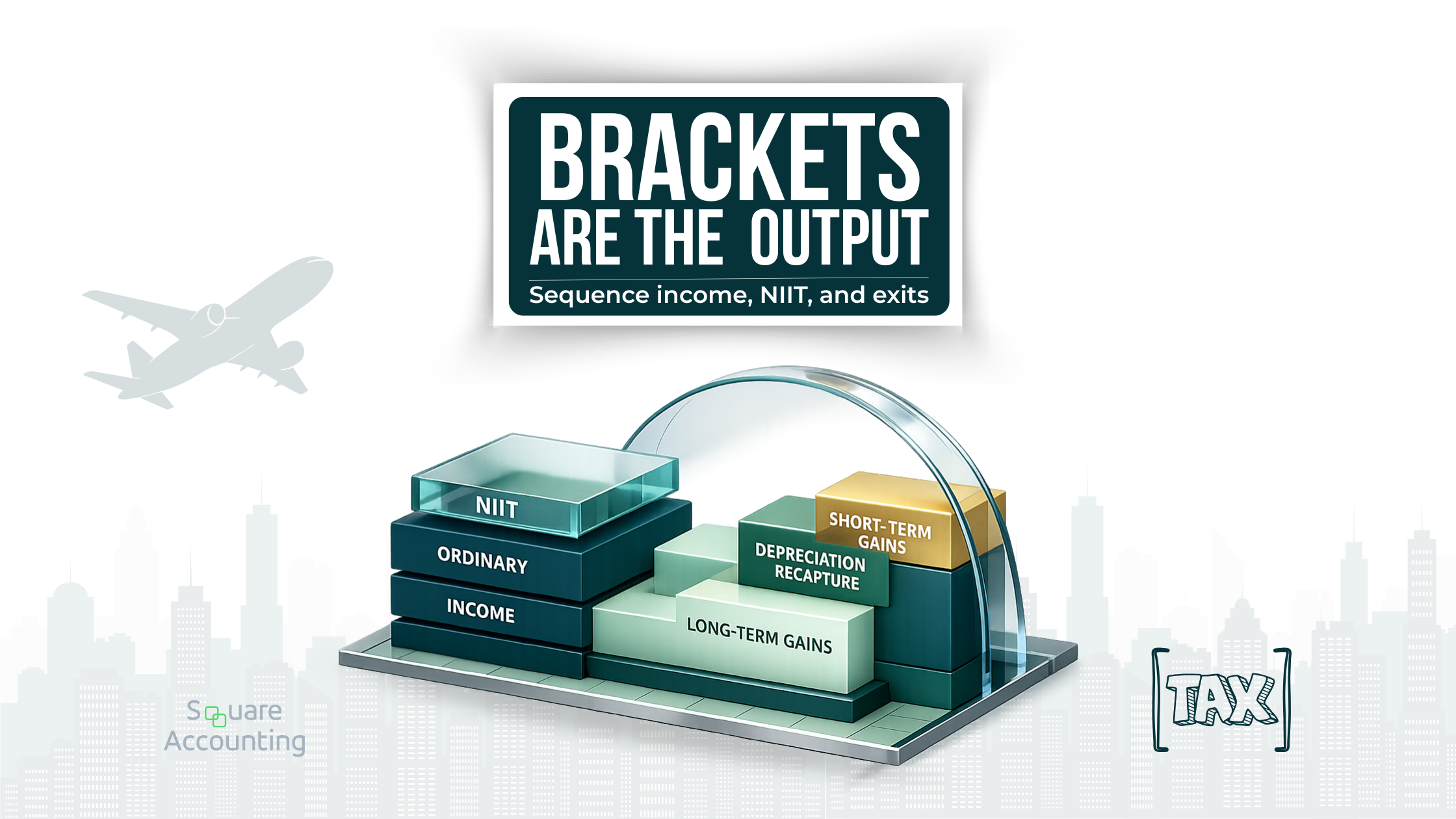

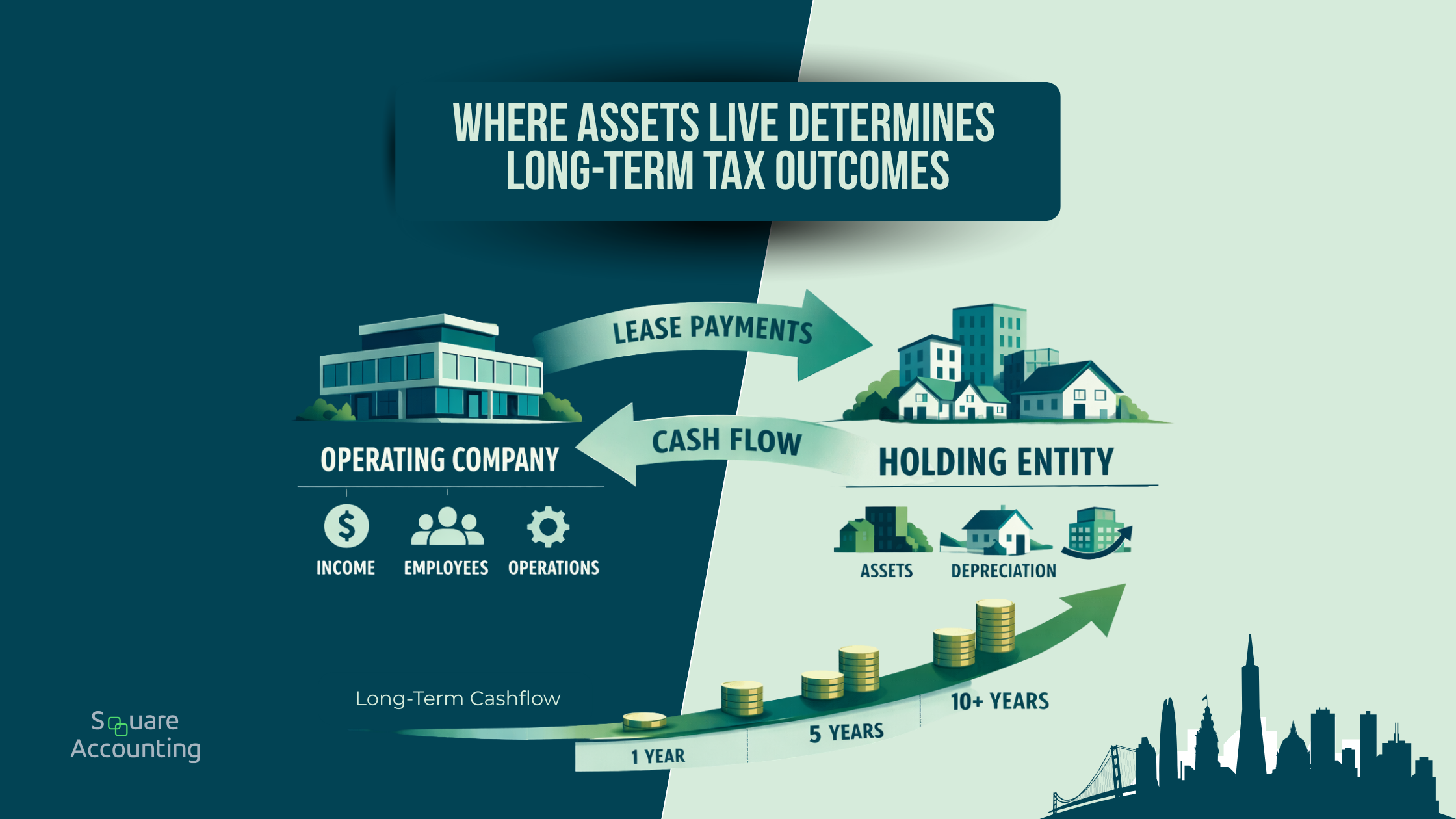

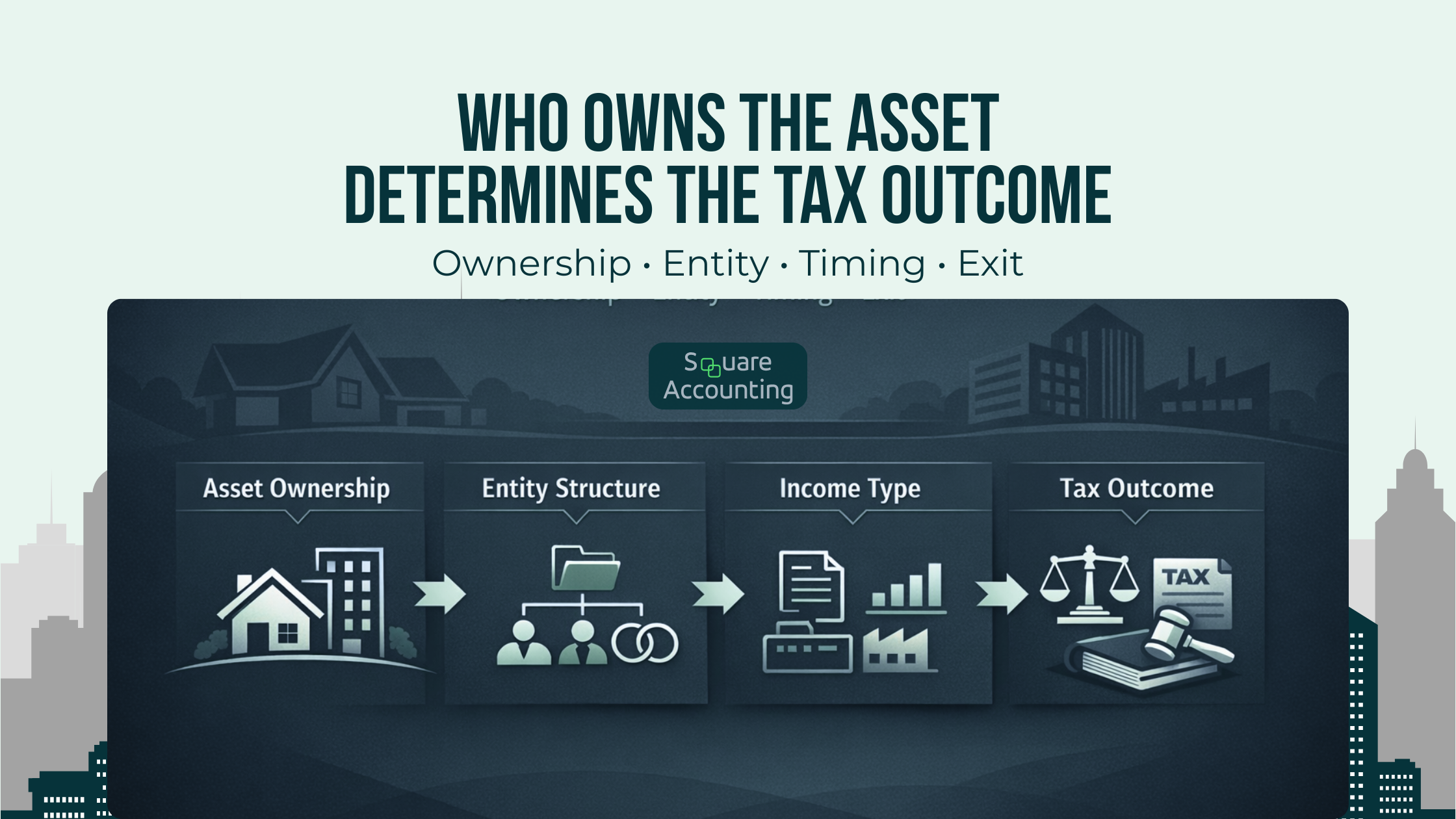

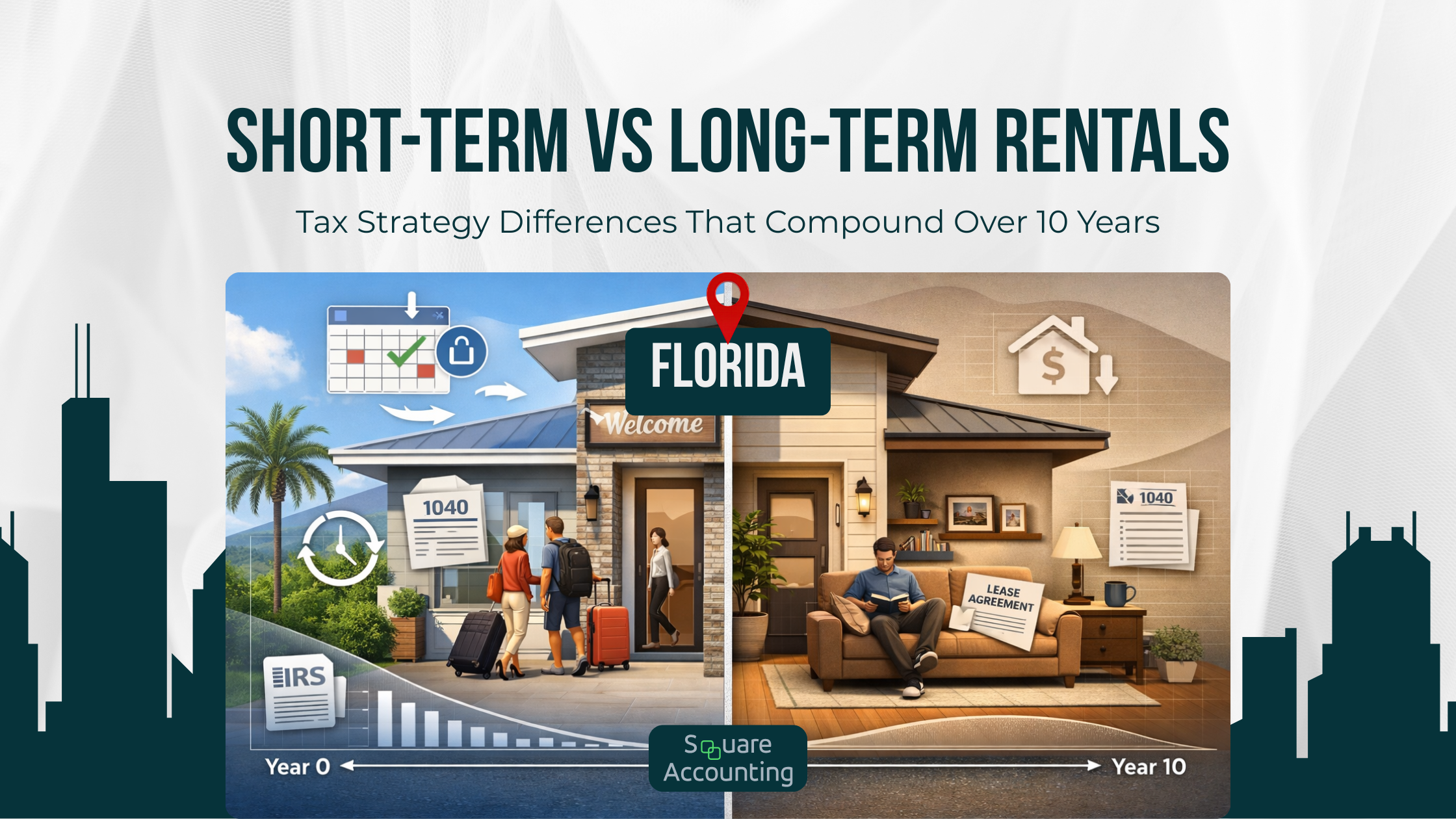

Real estate investors often seek ways to minimize their taxable income. Some popular strategies include cost segregation, tax-deferred exchanges (1031 exchanges), and depreciation planning. Investors also explore entity structuring, such as using LLCs or S-Corps to optimize tax savings.

-

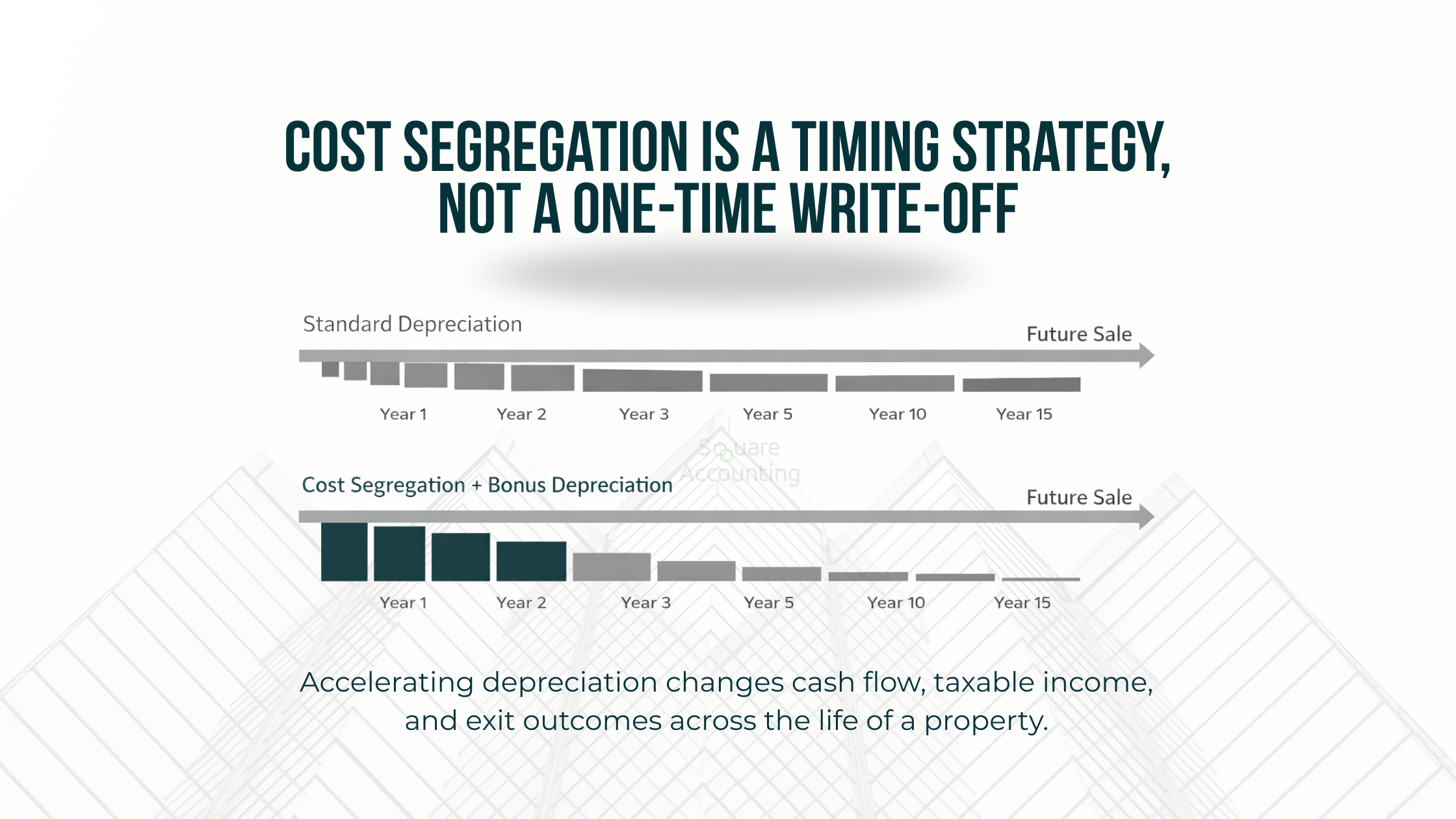

Depreciation allows property owners to deduct a portion of the property's value each year, reducing taxable income. Strategies like accelerated depreciation (e.g., through cost segregation) can provide significant upfront savings, especially in the early years of property ownership.

-

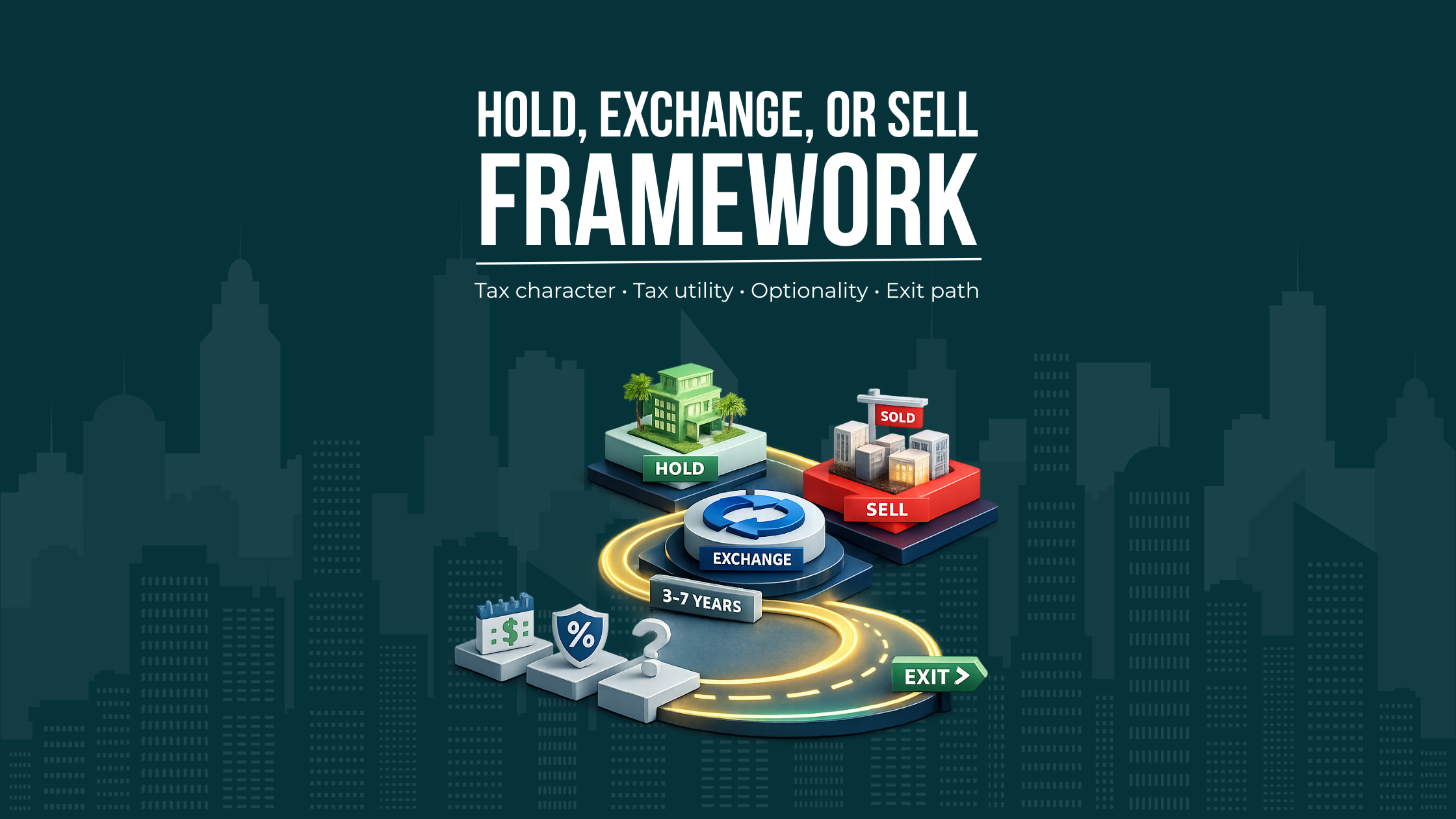

A 1031 exchange allows investors to defer capital gains taxes on an investment property when it is sold, as long as the proceeds are reinvested into a similar property. This strategy helps build wealth without immediate tax implications.

-

Depreciation recapture can be triggered when you sell a property that you’ve depreciated over time. Real estate investors may mitigate recapture through strategies like Section 1031 exchanges or by holding the property long-term to benefit from capital gains tax rates.

-

Stevan Franeta, CPA

Senior Tax Advisor

Stevan is a seasoned tax advisor with 15+ years of experience leading $50M companies, solving complex financial challenges, and building long-term tax strategies that increase profits, reduce risk, and drive sustainable growth.

-

Ramion Puprriqi

Tax Accountant

Ramion is a tax accountant with 10+ years of experience in tax, finance and accounting. He focuses on preparing and reviewing tax returns, developing accurate financial statements, and providing clients with reliable financial reporting that ensures compliance and clarity.

-

Elona Franeta

Project Manager

Elona brings 15+ years of experience in logistics, auditing, and business development across Europe and the U.S. Her expertise lies in leading cross-functional teams, ensuring compliance, and delivering efficient project outcomes in international markets.

Discover Valuable Insights in Our Blog

Contact us Today

Talk to our Tax Advisor

Running your operations is demanding—your taxes shouldn’t add to the stress. Whether you need strategic tax planning or ongoing support, we’re here to help.