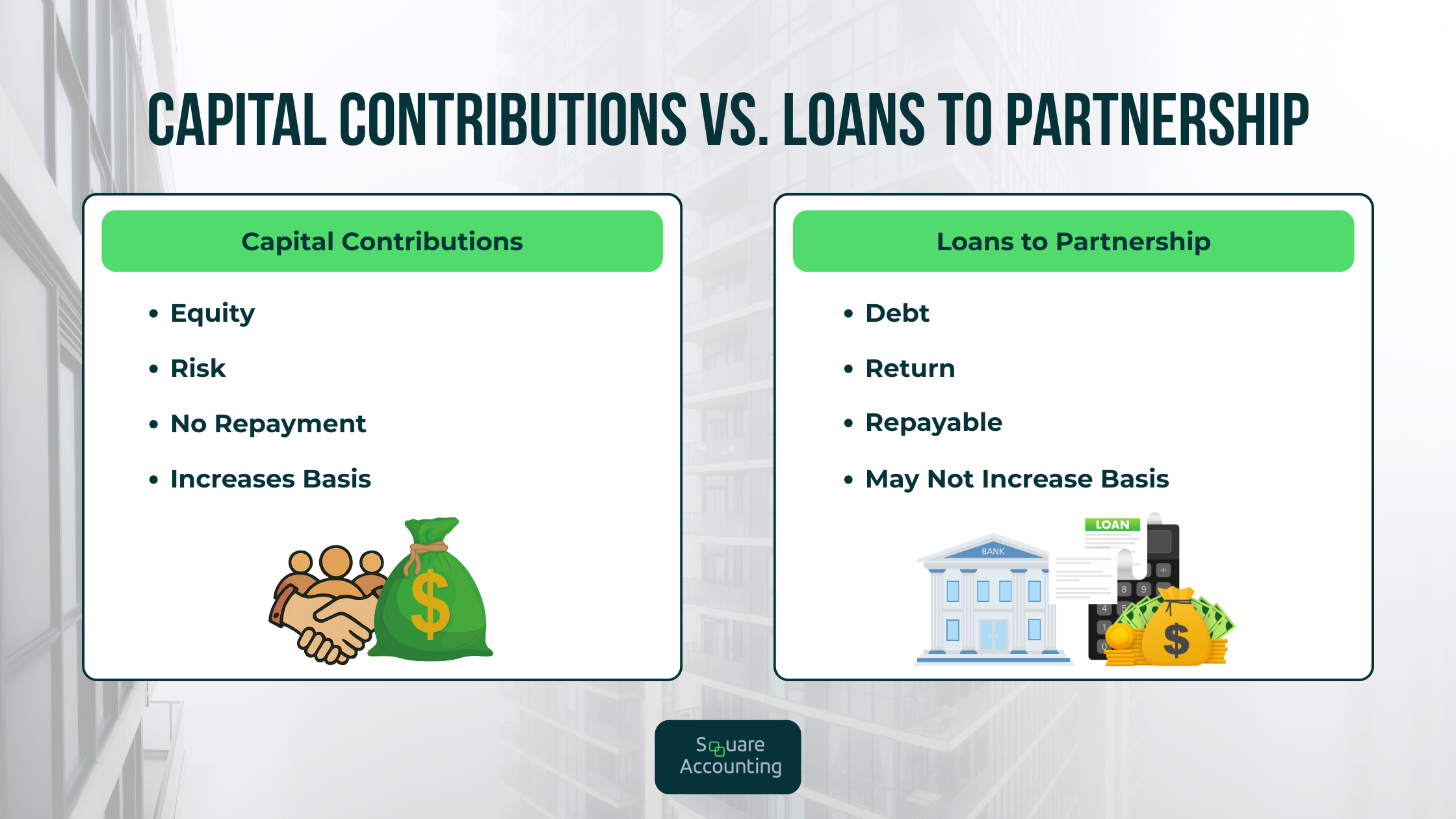

Capital Contributions vs. Loans to Partnership Explained

Why It Matters for Florida Investors

In real estate partnerships, money flows in—but how it's classified determines everything from tax deductions to ownership rights. Mislabel a capital contribution as a loan (or vice versa), and you may face IRS reclassification, denied deductions, or disputes with partners. This is especially crucial for Florida real estate investors, where deal velocity is high, and partnership structuring often complex.

Understanding the difference between capital contributions vs. loans to partnership is not just a matter of semantics. It’s a strategic financial decision that directly affects your tax exposure, return on investment, and legal standing.

Not sure how to structure your next deal? Schedule a consultation with Square Accounting and protect your investment from day one.

Capital Contributions: The Equity Investment

A capital contribution is an infusion of funds or assets in exchange for an ownership interest in a partnership. These contributions:

Increase the partner’s basis in the partnership

Grant rights to future profits and losses

Reflect long-term risk-bearing intent

In Florida’s thriving real estate environment—especially in syndications and joint ventures—capital contributions are the backbone of deal funding. They're typically tied to ownership percentages and memorialized in the partnership or operating agreement.

No repayment is guaranteed. The partner shares in both profits and losses, and capital is returned only through distributions or liquidation.

Loans to Partnership: Debt with Strings Attached

A loan to the partnership is a debt arrangement. The partner does not receive additional equity. Instead, the funds:

Do not increase ownership interest

May be secured or unsecured

Come with a repayment obligation, typically with interest

This route is favored by investors seeking lower risk, collateral protection, and priority repayment over equity holders. Loans can be either recourse (the partner is personally liable) or nonrecourse (secured only by partnership assets).

For high-net-worth individuals investing in Florida real estate, loans can be used strategically to maintain upside exposure while minimizing risk in down cycles.

Capital vs. Loan: Legal and Tax Distinctions

The IRS applies a substance-over-form test when evaluating whether funds are a capital contribution or a bona fide loan. Key criteria include:

Is there a written promissory note?

Is interest charged and paid?

Are there fixed repayment terms?

Is the lender acting like a creditor or an investor?

Without these formalities, what is called a loan could be reclassified as capital—potentially disallowing interest deductions and changing the partner’s tax treatment.

Fact Check Update (2025):

IRS scrutiny in partnership audits has increased, particularly under the Bipartisan Budget Act of 2015 (BBA) audit rules. If misclassified funds are discovered during audit, penalties and tax adjustments may apply retroactively to all partners under the centralized partnership audit regime.

Equity vs. Debt: Strategic Implications for Investors

Capital contributions expose the investor to project upside—and downside. They provide equity voting power, alignment with long-term growth, and the ability to share in profits.

Loans, on the other hand, provide:

Predictable returns (through interest)

Priority in repayment over equity

Potential collateralization

No ownership dilution

Florida investors often blend both approaches—contributing capital for upside, while loaning additional funds for liquidity and control. This dual strategy is effective in development projects, fix-and-flip funds, and value-add syndications.

How Basis and Loss Deductions Are Affected

Your ability to deduct partnership losses is tied to your basis.

Capital contributions increase both inside and outside basis, unlocking larger loss deductions.

Loans to the partnership increase basis only if recourse or personally guaranteed by the partner.

For example, a Florida investor who injects $250,000 as capital can deduct up to that amount in losses (if other limits like at-risk and passive loss rules are met). If they loan $250,000 but aren’t personally liable, their basis does not increase—potentially limiting deductions.

Updated Tip (2025):

Under IRC Section 752, nonrecourse loans no longer universally increase basis for limited partners unless there's economic risk of loss. Proper structuring with guarantees is essential.

Maximize your tax deductions legally and confidently. Talk to a Florida tax strategist at Square Accounting today.

Repayment and Exit Strategy Considerations

Capital contributions are returned (if at all) only after debts are repaid and profits are distributed. Loans must be repaid according to their terms, regardless of profits.

At exit, this means:

Lenders get paid first, before equity distributions.

Capital investors get whatever remains—potentially much more, or sometimes nothing.

For investors eyeing Florida’s high-growth multifamily or industrial markets, using loans for initial funding can secure a protective stake while maintaining claim to future equity returns through preferred return structures.

IRS Scrutiny: Red Flags and Enforcement Trends

The IRS is targeting disguised sales, unsubstantiated loans, and basis abuse more aggressively under new audit procedures.

Red flags include:

No formal loan documents

No interest charged

Lack of scheduled repayments

No collateral for large advances

If an advance looks like equity but is booked as a loan, it may be recharacterized—resulting in denied deductions, misallocated profits, or back taxes.

Florida investors using passthrough structures like LLCs taxed as partnerships must ensure alignment between documentation and economic reality.

Avoid red flags and audits. Let us review your partnership agreements before the IRS does

Structuring Mistakes That Cost Investors

Common structuring errors include:

Recording capital as debt to avoid dilution

Failing to execute promissory notes for loans

Using loans to manipulate basis artificially

Ignoring at-risk and passive activity loss rules

These missteps often go unnoticed—until an audit or capital event exposes them. Proper upfront planning is critical.

Florida-Specific Factors Real Estate Investors Must Consider

Florida’s no state income tax makes federal compliance even more important. Key local considerations include:

Use of multi-tiered LLCs and series entities

Partnerships involving foreign investors (FIRPTA implications)

Structuring around 1031 exchanges and cost segregation

Lenders and partners must also account for Florida documentary stamp taxes, which may apply to certain loan instruments and transfers of interest.

Ready to structure smarter? Contact Square Accounting for customized partnership planning and bulletproof documentation.

Document Everything: Protecting the Partnership and the Partners

Best practices for clarity and protection:

Record all capital contributions in the operating agreement

Update basis schedules for each partner annually

Use formal promissory notes for loans

Charge and document arm’s-length interest rates

Keep clear amortization schedules and payment histories

Auditors, partners, and courts rely on what’s documented—not what was intended.

Conclusion: Align Structure with Strategy

Florida real estate partnerships move fast—but structure should never be an afterthought. The difference between a capital contribution and a loan isn't just accounting. It's ownership, tax position, repayment priority, and risk profile.

For high-net-worth investors and active real estate players, understanding and documenting the distinction is non-negotiable.

We help Florida real estate investors structure smarter, reduce tax exposure, and stay compliant. Whether you're syndicating your next deal or optimizing your current one, we'll help you capitalize with clarity.

Frequently Asked Questions

Capital Contributions vs. Loans to Partnership

What is the difference between a capital contribution and a loan to a partnership?

A capital contribution is an equity investment that increases a partner’s ownership in the partnership. It carries no guaranteed return and is repaid only through distributions or liquidation. A loan to a partnership, however, is debt with a defined repayment obligation, typically including interest, and does not affect ownership.

Which is better for tax purposes: capital contribution or loan?

It depends on the investor’s goals. Capital contributions increase basis and may allow for greater loss deductions, especially in real estate partnerships. Loans can generate interest income and offer repayment priority but don’t increase equity or share in profits.

Can a partner deduct a loan to a partnership on their taxes?

A partner may be able to deduct interest income received from the loan. However, the loan itself is not deductible. For basis increases and loss deductions, only recourse or personally guaranteed loans count under IRS rules.

Does a loan from a partner increase partnership basis?

Yes—but only if the loan is recourse, meaning the partner is personally liable. Nonrecourse loans generally do not increase a partner’s basis unless specific IRS criteria are met.

How does the IRS determine if a partner’s advance is a loan or capital contribution?

The IRS evaluates intent and documentation. Key factors include the existence of a promissory note, repayment terms, interest, and whether the partner behaves like a creditor or an equity investor. Lack of formal documents may result in reclassification as capital.

Is interest on a loan to a partnership taxable income to the partner?

Yes. If a partner loans money to the partnership and charges interest, that interest is considered taxable income and must be reported accordingly.

Can a capital contribution be reclassified as a loan?

Rarely. The IRS generally respects original classification if properly documented. Attempting to retroactively reclassify equity as a loan—especially during liquidation or audit—can trigger compliance issues and penalties.

What documents are required for a loan to a partnership?

Essential documents include a promissory note, repayment schedule, and interest terms. These protect the lender’s position and help validate the debt classification for IRS purposes.

What happens if a capital contribution is misclassified as a loan?

If a capital contribution is wrongly reported as a loan, the IRS may disallow interest deductions, adjust basis, or reallocate income and losses. It can also increase the audit risk for the entire partnership.

Are there Florida-specific tax rules for loans or capital contributions to partnerships?

While Florida has no state income tax, certain local considerations apply—such as documentary stamp taxes on loan instruments or interest-bearing notes. Real estate investors should also be mindful of entity-level taxes and property transfer rules.

Need help documenting or reviewing your partnership funding strategy? Square Accounting specializes in Florida real estate tax structures.

📩 Contact us today to protect your returns and stay compliant.