Can You Write Off a Yacht? Yes, But Only If You Do This (Florida Edition)

Luxury Meets Strategy

In Florida’s sunlit harbors — from Miami to Fort Lauderdale to the Keys — a yacht serves as both status and statement. But for savvy real estate investors and high-net-worth individuals, it can also become a powerful tax planning asset — if structured right. This article shows exactly how to navigate U.S. and Florida tax rules so your yacht becomes a legitimate business deduction rather than an IRS red flag.

Why Florida Real Estate Investors Even Ask This

Florida leads the U.S. in recreational boat registrations (over 8 % of the national share).

The state caps sales/use tax on boats at $18,000, no matter the yacht’s price.

With the “One Big Beautiful Bill” (OBBBA) pushing favorable bonus depreciation, many investors ask: can my yacht expense offset real estate income?

Real estate professionals already understand leveraging depreciation, interest, cost segregation — adding a yacht to that mix is tempting, but only viable if you meet rigid requirements.

Book a consultation with Square Accounting’s Florida tax experts and learn how to structure your yacht for maximum tax savings.

Core Tax Principles: Deductions, Depreciation & “Ordinary and Necessary”

To claim yacht expenses, three tax principles must align:

Ordinary & Necessary — The expense must be customary and appropriate in your business line.

Trade or Business Use — The IRS won’t accept deductions for a vessel used primarily for pleasure.

Substantiation — You must document every business trip, participant, agenda, and cost.

If any of these fail, deductions may be denied.

The 50 % Business-Use Threshold & Listed Property Rules

Yachts qualify as listed property, which means you must separate business vs. personal usage.

To claim accelerated deductions (Section 179, bonus depreciation), the yacht must be used over 50 % for business.

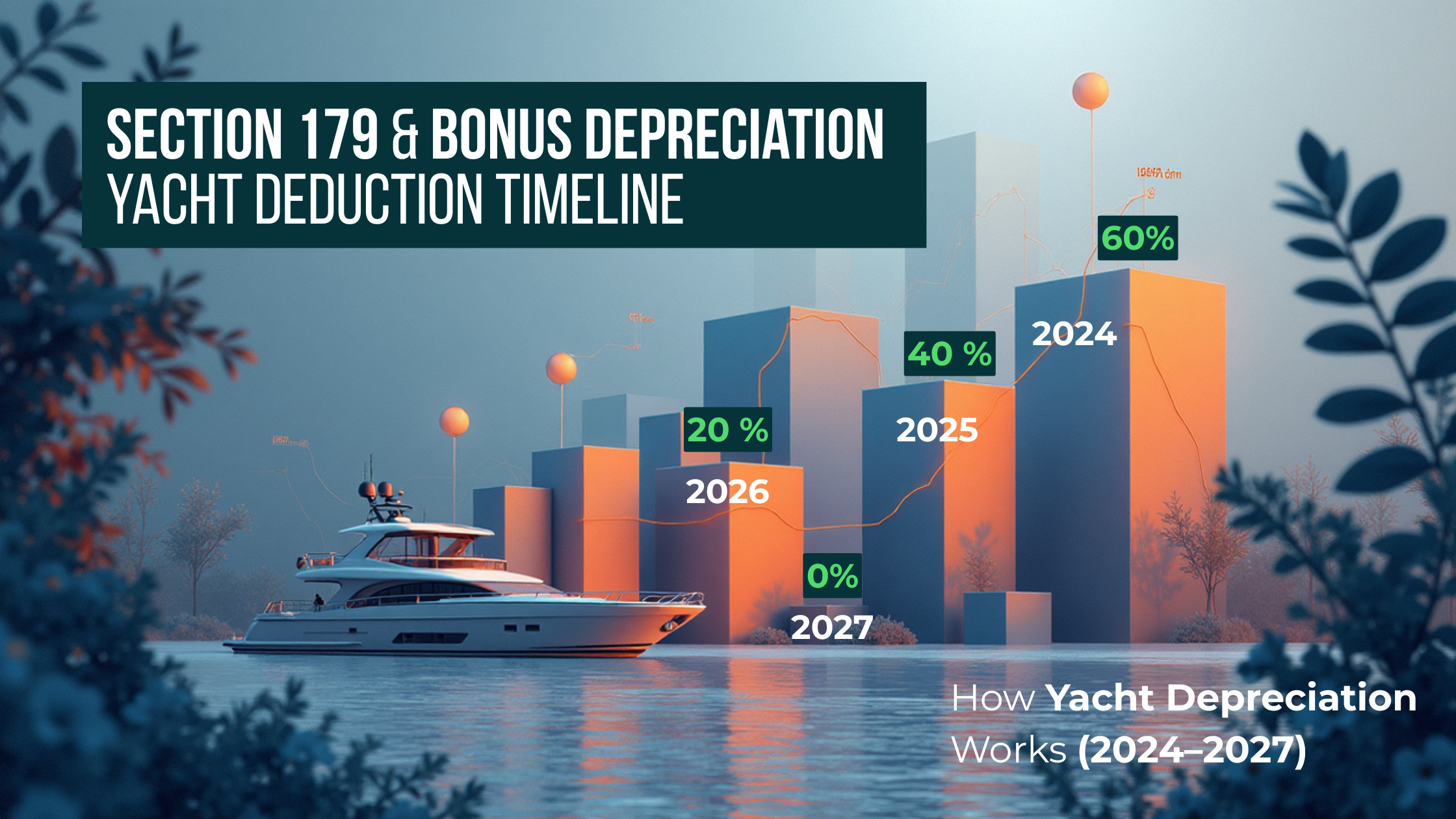

Under current law, bonus depreciation is phasing out:

60 % in 2024,

40 % in 2025,

20 % in 2026,

0 % in 2027 onward.

If business-use falls below 50 %, you lose accelerated deductions and must prorate all deductions based on business-use percentage.

Get personalized yacht tax advice tailored for Florida real estate investors — schedule your private consultation today.

Yacht Integration in Real Estate business

From Client Entertainment to Marketing Platform

Rather than classifying yacht usage as “entertainment,” frame it as a marketing & branding tool. Examples:

Invite prospective high-net-worth buyers to tour waterfront developments from aboard

Host investor retreats or strategy sessions on the yacht

Film property walkthroughs or events hosted from the deck

The IRS expects clear links: signage, agendas, invitations, intention tied to your real estate business.

Investor Events, Site Tours, Board Meetings at Sea

Schedule combined property tours and yacht events: begin with a site visit, then board lunch or presentation. Maintain:

Formal agendas and meeting notes

Attendee lists

Trip logs (times, routes, participants, business purpose)

This builds the narrative that the yacht is a corporate tool, not just a toy.

Chartering the Yacht as a Business

Structuring the Yacht Entity

Best defense: treat the yacht as an independent business. Form a separate entity (e.g. LLC, S-Corp, Partnership), separate accounting, and actively market it for charter. This separation helps shield real estate operations from IRS scrutiny.

Demonstrating Profit Motive & Reporting

Charter the yacht to third parties, track occupancy/utilization, and show revenue growth. The IRS often expects a pattern of profits (3 out of 5 years) for activities to be treated as business.

When this is properly done, you can deduct operating costs and depreciation inside the charter entity.

Discover how to legally write off your yacht while staying 100% IRS-compliant. Talk to a Square Accounting advisor now.

Deductible Expenses & Capital Treatment

Operating Costs

You may deduct pro rata shares of:

Fuel

Docking/slip fees

Insurance

Crew salaries

Repairs & maintenance

Hurricane or winter storage

If mixed use, you must apply business-use percentage.

Depreciation, Section 179 & Bonus Depreciation

Current phase-out schedule: 60 % bonus in 2024, 40 % in 2025, 20 % in 2026, 0 % in 2027.

Section 179 allows immediate expensing (subject to limits), but it phases out if total asset purchases exceed thresholds.

Some recent sources claim the new law restores 100 % bonus depreciation for yachts through 2027, especially for charter operations.

To qualify, the yacht often must be used in U.S. waters predominantly.

IRS Form 4562 Instructions — Depreciation and Amortization

Recapture, Limitations & Mixed-Use Adjustments

If you use less for business later or sell the yacht, depreciation recapture applies.

Mixed-use adjustments: if business-use share changes, deductions may be contested or adjusted retroactively.

You’ve earned the yacht — now make it pay for itself. Let Square Accounting show you how with a tailored deduction plan.

Interest, 163(j) Limits & Real Estate Professional Status

If you finance the yacht, interest may be subject to IRC § 163(j) limitation, capping business interest deduction to roughly 30 % of adjusted taxable income.

Real estate investors may “opt out” of 163(j) under certain conditions — but it has tradeoffs.

Qualifying as a Real Estate Professional allows your yacht’s business income/losses to count as non-passive, which enhances deduction flexibility.

Florida Specifics: Sales Tax, Registration, Titles & Caps

Sales & Use Tax in Florida

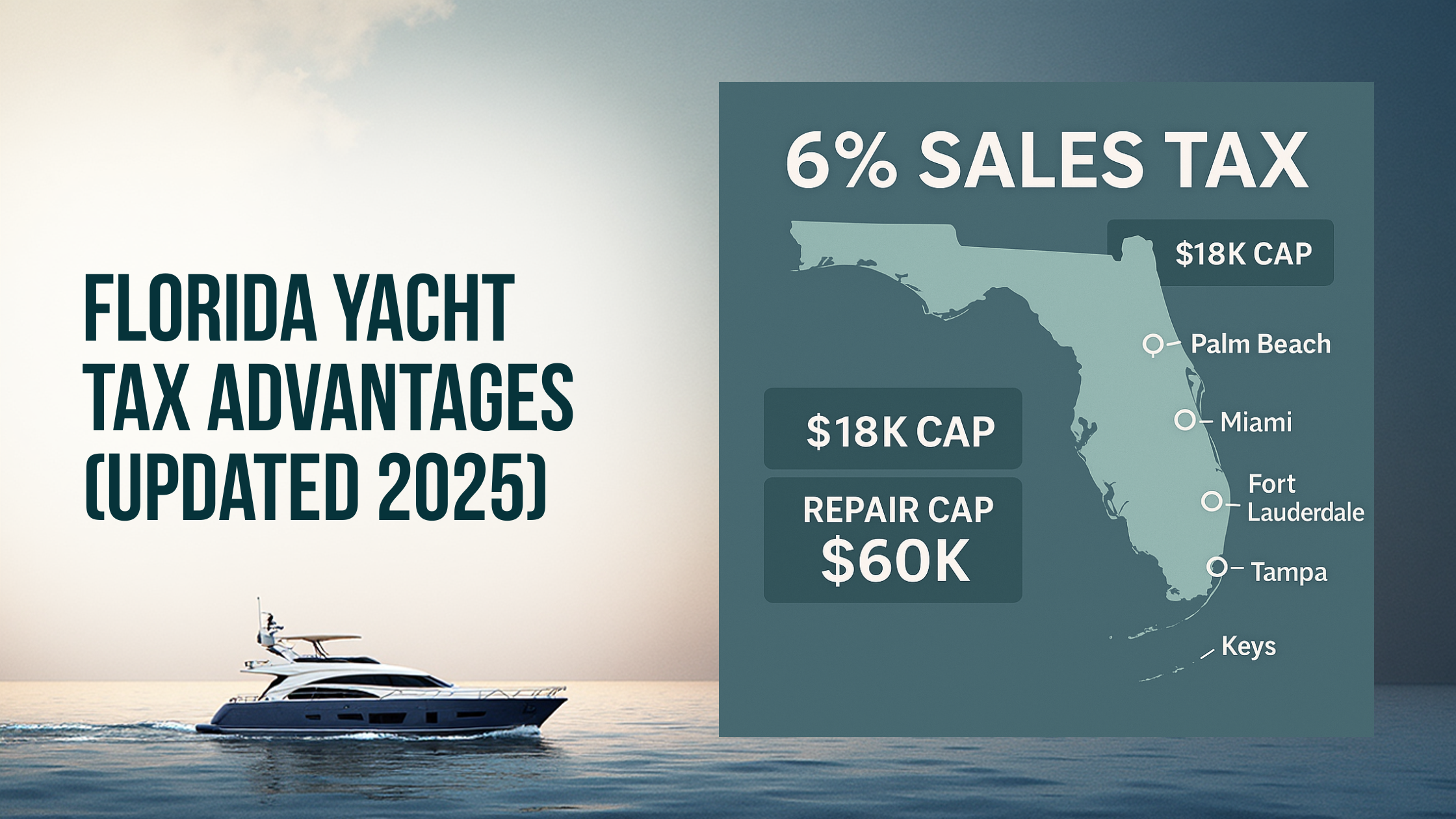

Florida’s base sales/ use tax: 6 % on boats delivered, used, stored in Florida.

Florida caps total tax liability on yachts at $18,000 (state + surtax) regardless of value.

Local discretionary surtax applies to the first $5,000 of the price.

Repairs are taxed but capped at $60,000 per repair event.

A recent 2025 Florida law (HB 7031) repeals sales tax on many commercial lease payments as of Oct. 1, 2025—but boat/aircraft storage and docking remain taxable under existing statutes.

Title & Registration Requirements

Florida requires vessels ≥16 ft (or with motor) to be titled and registered, with a decal.

Title fee: $5.25 electronic, $7.75 paper, or $11 expedited.

If out-of-state, you may operate under foreign registration up to 90 days; beyond that, Florida registration is required.

Florida also requires vessel registration within 30 days after purchase.

Audit Risk, Case Studies & Best Practices

IRS / Tax Court Precedents & Warnings

Courts have denied yacht deductions masquerading as advertising when lacking tangible branding, signage, logs, or demonstrable business correlation.

Commentary warns yachts are a common IRS audit target—even when legitimate.

Hobby loss rules (IRC § 183) may apply if charter operations don’t show profit motive.

Documentation, Logs & Usage Evidence

Your strongest protection is rigorous documentation:

Trip logs: date, route, start/stop times, participants, business purpose

Agendas, minutes, contracts, emails, calendar entries

Separate accounting systems for yacht operations

Evidence of charter marketing, booking history

Without that, the IRS may reclassify all yacht deductions as disallowed personal expenses.

Integrating Yacht Strategy into Real Estate Tax Planning

Your yacht deduction must harmonize with your real estate structure:

Align with your entity structure (LLC, S Corp, partnership) and debt allocation

Coordinate with cost segregation, 1031 strategies, and passive activity rules

Use the yacht for client hospitality, investor loyalty, or charter revenue—but always tie back to real estate as the business narrative

Consider exit strategies: resale, recapture, changing use patterns

Conclusion

Yes—you can write off a yacht in 2025, but only under strict conditions. The rules have evolved: bonus depreciation is phasing out, but strategic acquisitions under upcoming laws may restore 100 % in select cases. In Florida, you must navigate caps, registration mandates, and local taxes alongside federal rules.

For real estate investors, the yacht must act as a bona fide extension of your business — not an indulgence. With the right entity, clear usage logs, documented purpose, and integrated tax planning, you can turn that floating asset into a defensible, valuable tax tool.

We specialize in yacht + real estate tax strategy for Florida investors. We’ll assess your situation, structure the vehicle, document correctly, and guide you through audit resistance. Let’s map your path—book your consultation now.

Frequently Asked Questions (FAQ) — Yacht Tax Deductions in Florida (2025 Update)

1. Can you legally write off a yacht in Florida?

Yes — but only if the yacht serves a legitimate business purpose. Under IRS rules, a yacht can be written off as a business asset if it’s primarily used for business activities like client meetings, charter services, investor events, or marketing. The IRS requires that the yacht be used more than 50 % for business and that all use is documented and verifiable.

2. How much of a yacht can you write off on taxes?

You may be able to write off up to 100 % of the yacht’s purchase price through bonus depreciation or Section 179 expensing, if it qualifies as business property. However, bonus depreciation is phasing out under the 2017 Tax Cuts and Jobs Act:

60 % for 2024

40 % for 2025

20 % for 2026

If Congress extends 100 % bonus depreciation (as proposed in the 2025 Tax Reform update), eligible Florida businesses may regain full expensing on qualifying vessels.

3. What qualifies as business use of a yacht?

Business use means the yacht contributes directly to generating income or managing operations. Examples include:

Hosting investor strategy sessions or board meetings

Entertaining potential buyers for property viewings

Chartering to clients for revenue

Filming or content creation tied to your real estate portfolio

Every use must be substantiated with trip logs, agendas, invoices, and meeting notes.

4. Can real estate investors write off yacht expenses?

Yes, if you are classified as a real estate professional under IRS rules (spending 750+ hours annually and more than 50 % of your work time on real estate), you may integrate yacht expenses into your broader business deductions. The yacht must advance your real estate business goals, such as client development, marketing, or investor relations.

5. What yacht expenses are tax deductible?

Common deductible expenses include:

Fuel, docking, and storage fees

Insurance and maintenance costs

Crew wages and management fees

Repairs and upgrades

Depreciation or Section 179 expensing (if eligible)

All expenses must correspond to documented business use percentages.

6. Can you deduct a yacht used for both personal and business purposes?

Yes, but only the portion used for business can be deducted. For instance, if 60 % of your yacht’s use is documented for business activities, only 60 % of operating costs and depreciation may be deducted. Personal use (like family trips or vacations) must be clearly separated and excluded.

7. Does Florida tax yachts differently than other states?

Yes. Florida has some of the most yacht-friendly tax laws in the U.S.:

6 % state sales and use tax applies to purchases, with an $18,000 cap regardless of vessel value.

Repairs are taxable but capped at $60,000 per event.

Out-of-state owners can claim limited-time exemptions if the yacht leaves Florida within 90 days.

This makes Florida a preferred home port for yacht ownership.

8. Is yacht financing interest tax-deductible?

Potentially. If the yacht qualifies as a business asset and the loan is in the business’s name, interest may be deductible under IRC Section 163(j) — but subject to the 30 % income limitation. Real estate businesses can elect out of this limitation, though with trade-offs such as longer depreciation schedules.

9. What records do I need to prove yacht business use?

Keep these key documents:

Trip logs (date, purpose, route, participants)

Meeting minutes or client correspondence

Invoices and charter contracts

Photos, emails, and calendar invites

Separate accounting records for yacht income and expenses

These records are critical for IRS audit defense and verifying legitimate business activity.

10. What happens if the IRS audits my yacht deductions?

If the IRS audits your yacht deductions, they’ll scrutinize:

Proof of business purpose

Usage percentage (business vs personal)

Documentation completeness

If you can’t provide detailed logs and business justification, deductions can be reversed, and penalties applied. That’s why working with a specialized firm like Square Accounting ensures compliance and defense-ready documentation.

11. How do I structure a yacht for tax purposes?

Set up a separate LLC or S Corporation for the yacht. This entity should manage revenue (e.g., charter income) and expenses independently. It strengthens your “profit motive” defense under IRS rules and helps isolate liability from your real estate holdings.

12. Is chartering my yacht a good tax strategy?

Yes — if managed as a genuine business. By offering charter services, you turn your yacht into an income-producing asset. This can unlock bonus depreciation, operating deductions, and expense write-offs — while maintaining legal distance from personal use.

13. What is the biggest mistake yacht owners make on taxes?

The biggest mistake is claiming deductions without proper documentation or clear business purpose. Many owners lose deductions because they treat yacht use as “marketing” or “networking” without written proof, agendas, or logs. The IRS calls this “disguised entertainment,” which is non-deductible.

14. Should I consult a CPA before buying a yacht for business use?

Absolutely. A yacht purchase has long-term tax and depreciation implications. A CPA specializing in Florida yacht and real estate taxation can:

Structure your purchase and entity correctly

Determine Section 179 and depreciation eligibility

Align yacht usage with your real estate business plan

Ensure compliance with both IRS and Florida Department of Revenue requirements

15. How can Square Accounting help with yacht tax planning?

Square Accounting specializes in real estate and high-net-worth tax strategies across Florida. We help clients:

Structure yacht ownership under compliant entities

Optimize depreciation and interest deductions

Prepare IRS-ready documentation

Navigate Florida’s sales, use, and registration laws

Integrate yacht deductions seamlessly into broader real estate tax plans

📞 Schedule a consultation with our Florida yacht and real estate tax team to ensure your next investment sails smoothly — and strategically.