About Us

Going Beyond Tax Compliance

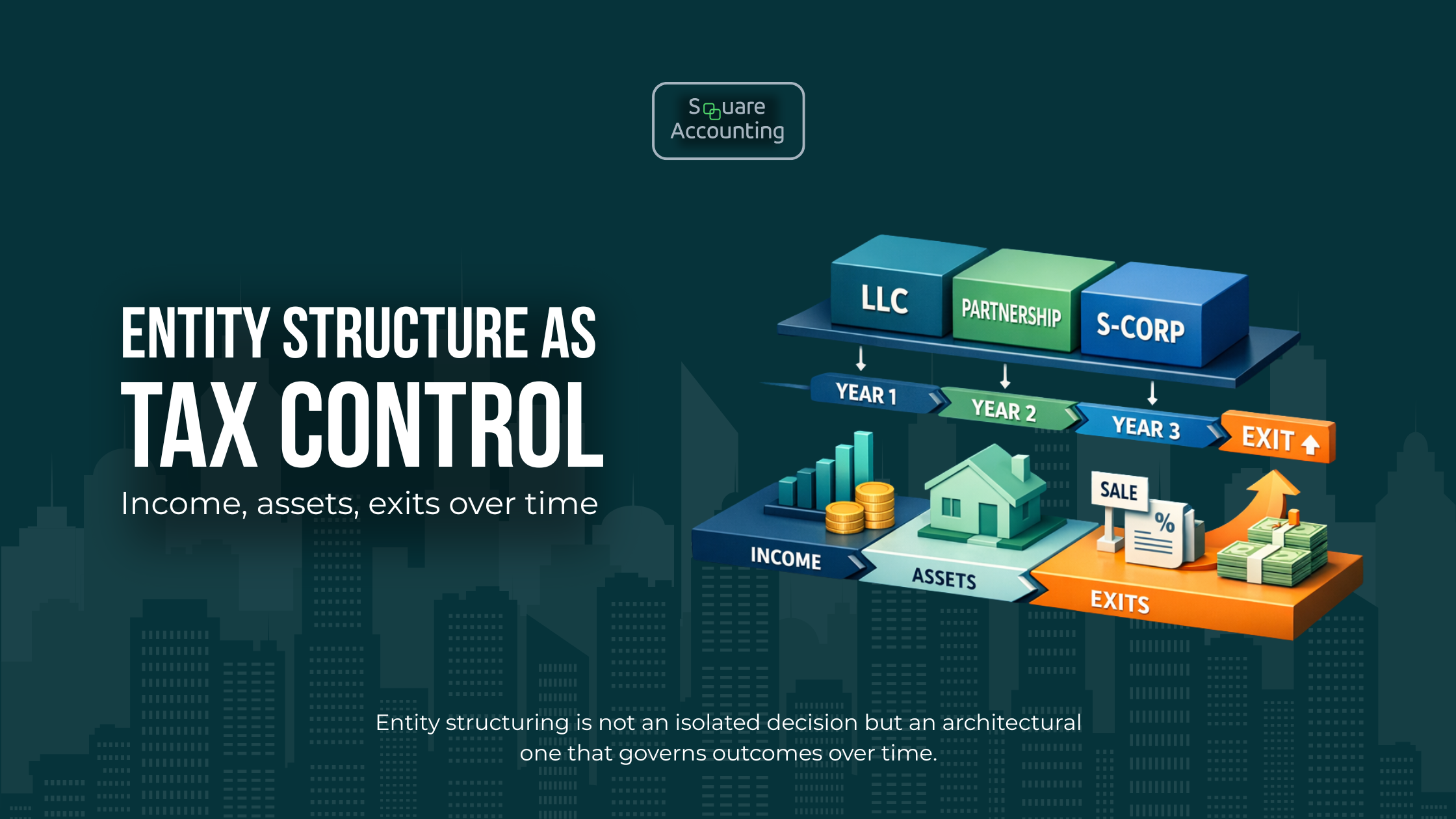

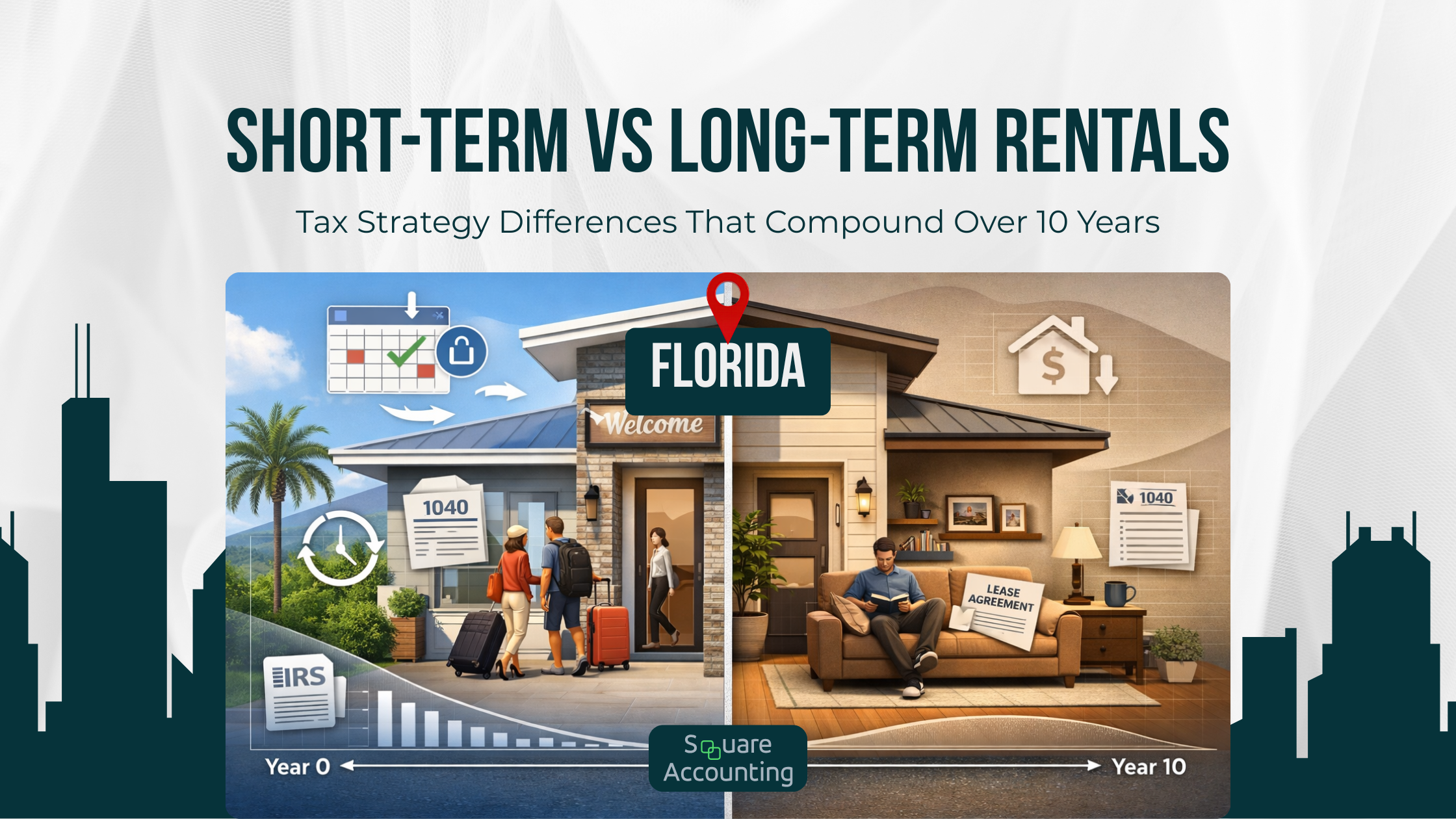

Taxes aren’t just about compliance. They are powerful tool for building a stronger, more profitable business—when done right. And at Square Accounting, we help Florida’s real estate investors make the most of every financial opportunity.

We’re more than tax preparers. We seek to be your financial strategists, problem solvers, and partners. Whether it’s navigating tax regulations, maximizing deductions, or creating multi-year strategies for long-term growth, we do so proactively, comprehensively, and with empathy.

Our goal is simple: help you plan ahead, reduce risk, and build a healthier financial future.

Our Mission

Boosting Your Financial Knowledge

We work One on One with you to map out your goals for the next 3 to 5 years, and the next 30 to 40 years, to ensure we account for all possible tax and income strategies that fit your lifestyle.

10 Years

Working with Real Estate Investors

98%

Long-term Client Retention

24-48 Hours

Response Time Provided

Our Statistics

Quick Overview of Our Financial Insights

-

$150k+

Average Yearly Tax Savings

-

98%

Long-Term Client Retention

-

300+

Property Financials Supported

-

$10M+

Taxes Saved

Beyond Compliance: Building Your Roadmap

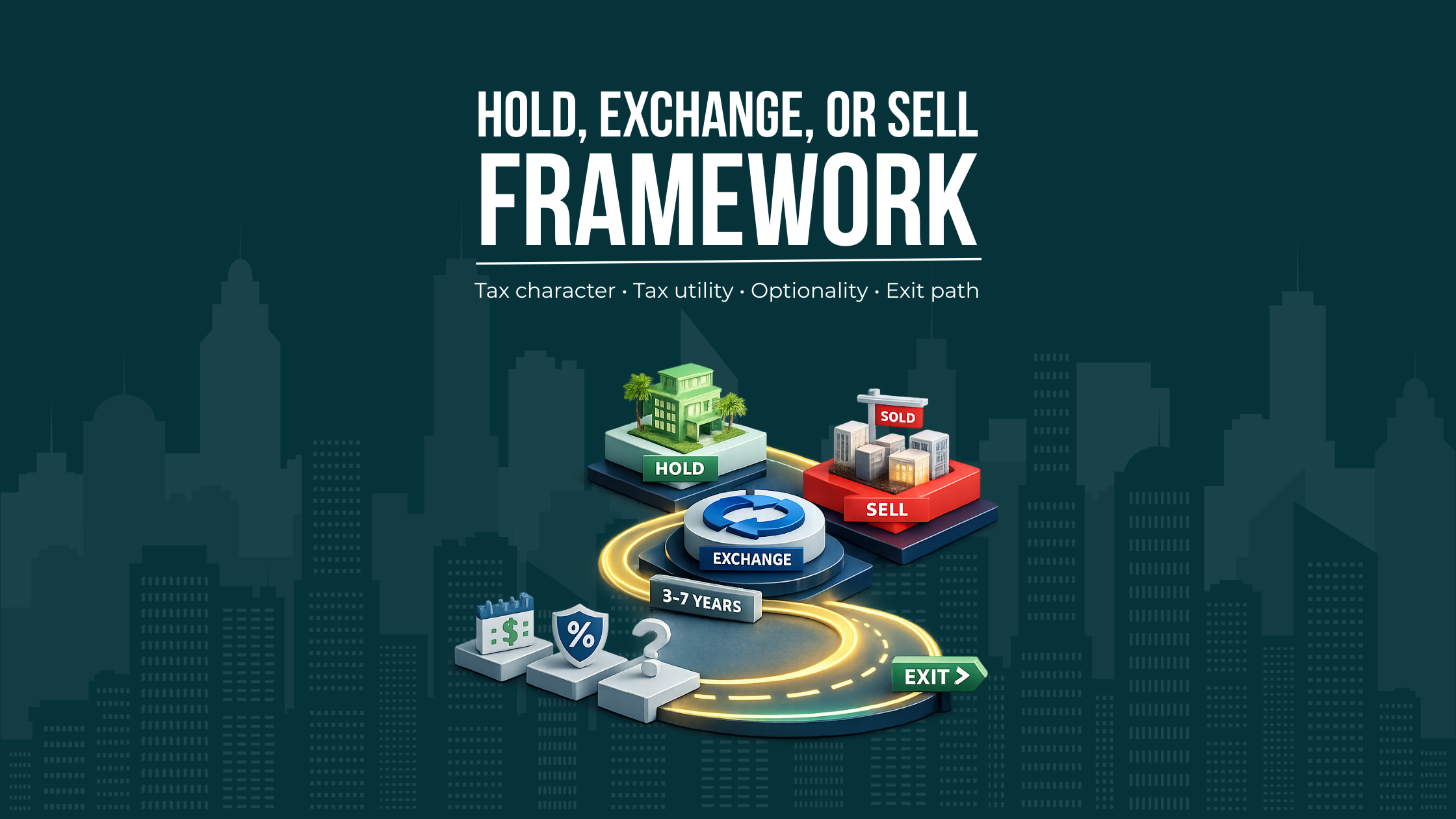

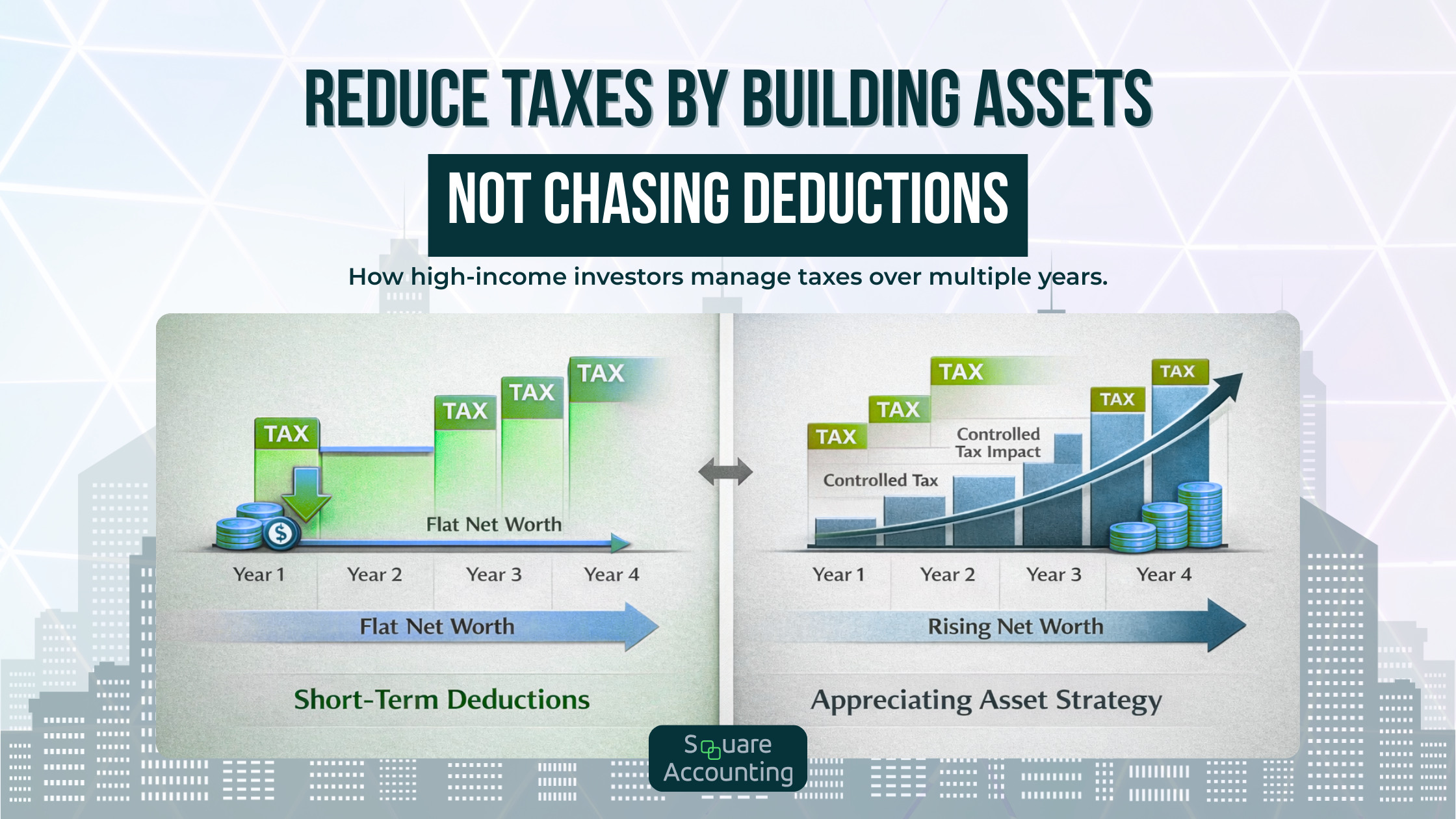

Filing your taxes on time keeps the IRS happy, but it doesn’t help you build wealth. That’s where strategy comes in. We look ahead—not just back—so your tax decisions are always working in harmony with your goals. Think of us as your co-pilot, helping you navigate from where you are today to where you want to be tomorrow.

Why This Matters

Taxes aren’t just about this year—they’re about every year that follows. Missing one opportunity today could mean losing out on tens of thousands tomorrow. With a strategy designed around your goals, lifestyle, and peace of mind, you’ll keep more of what you earn and feel secure about where you’re headed.

A Plan That Adapts As Life Changes

Life isn’t static. New properties, new business ventures, growing families—all of these bring both opportunity and complexity. We design flexible, multi-year strategies that adapt as you grow:

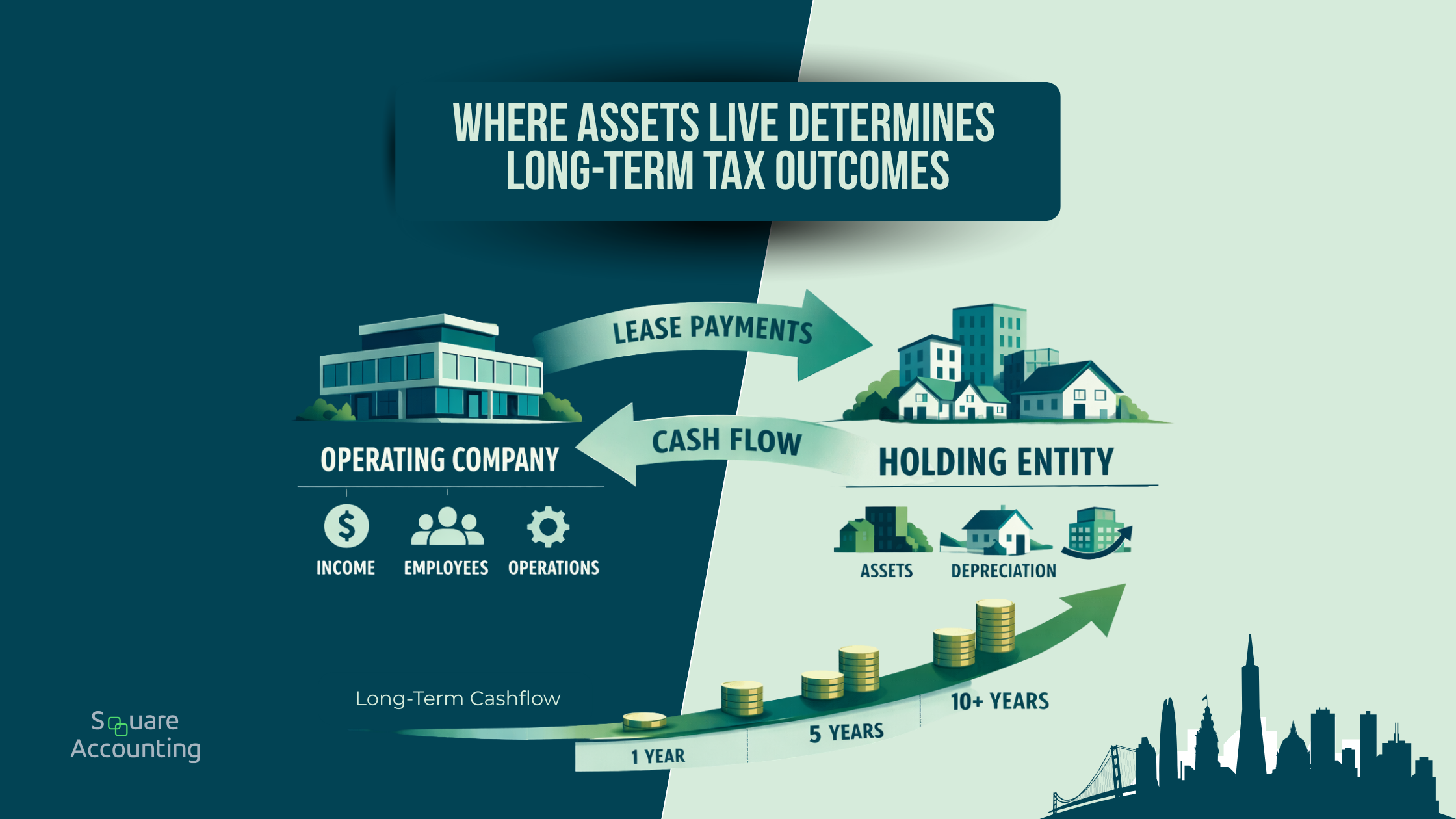

3–5 years: Save money now with entity optimization and smart cash flow planning.

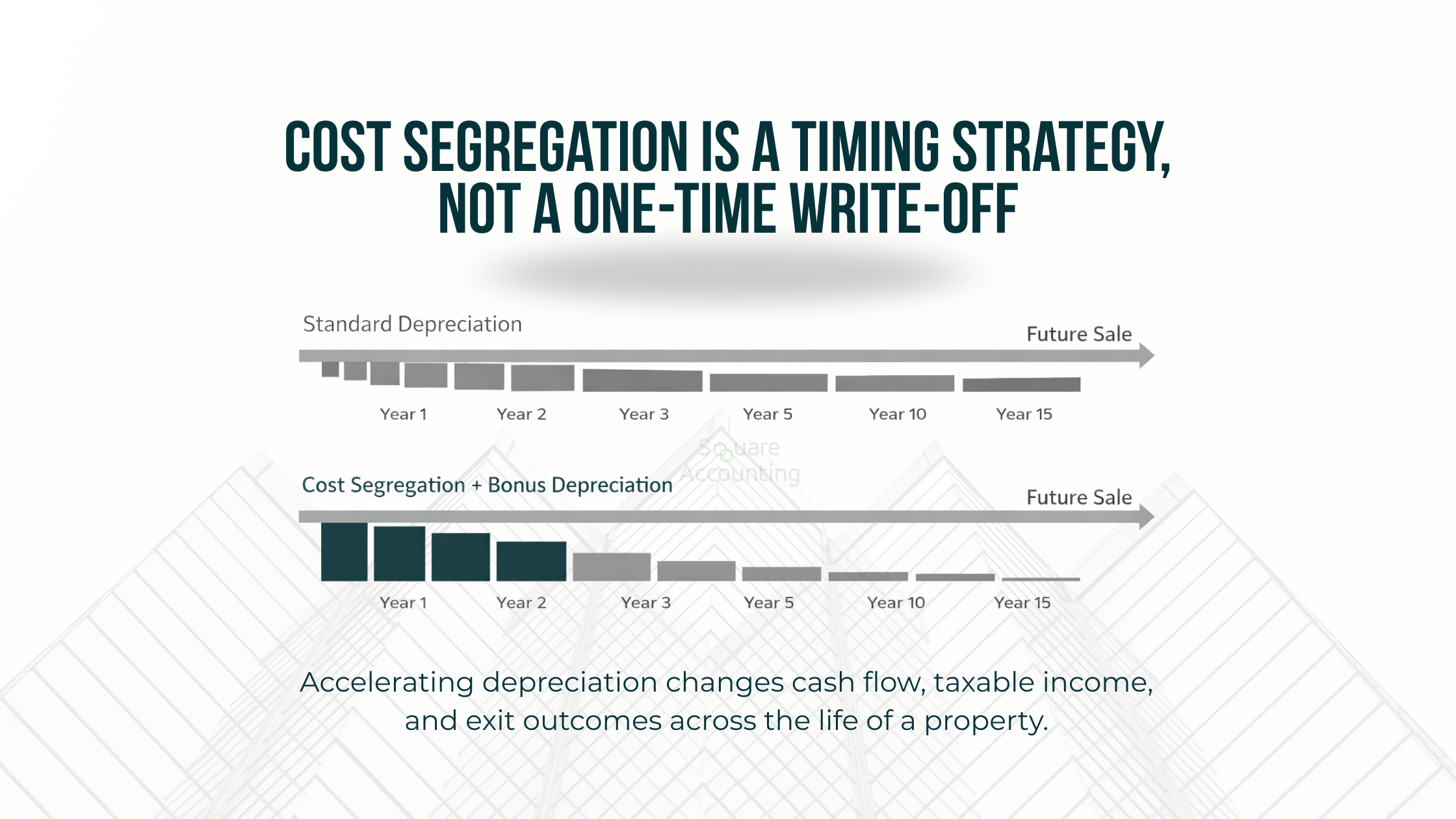

10–15 years: Position yourself for growth with proactive moves like strategic depreciation schedules and reinvestment planning.

20–40 years: Protect what you’ve built with succession planning, wealth preservation, and legacy strategies for the next generation.

Real Estate Expertise, Without the Jargon

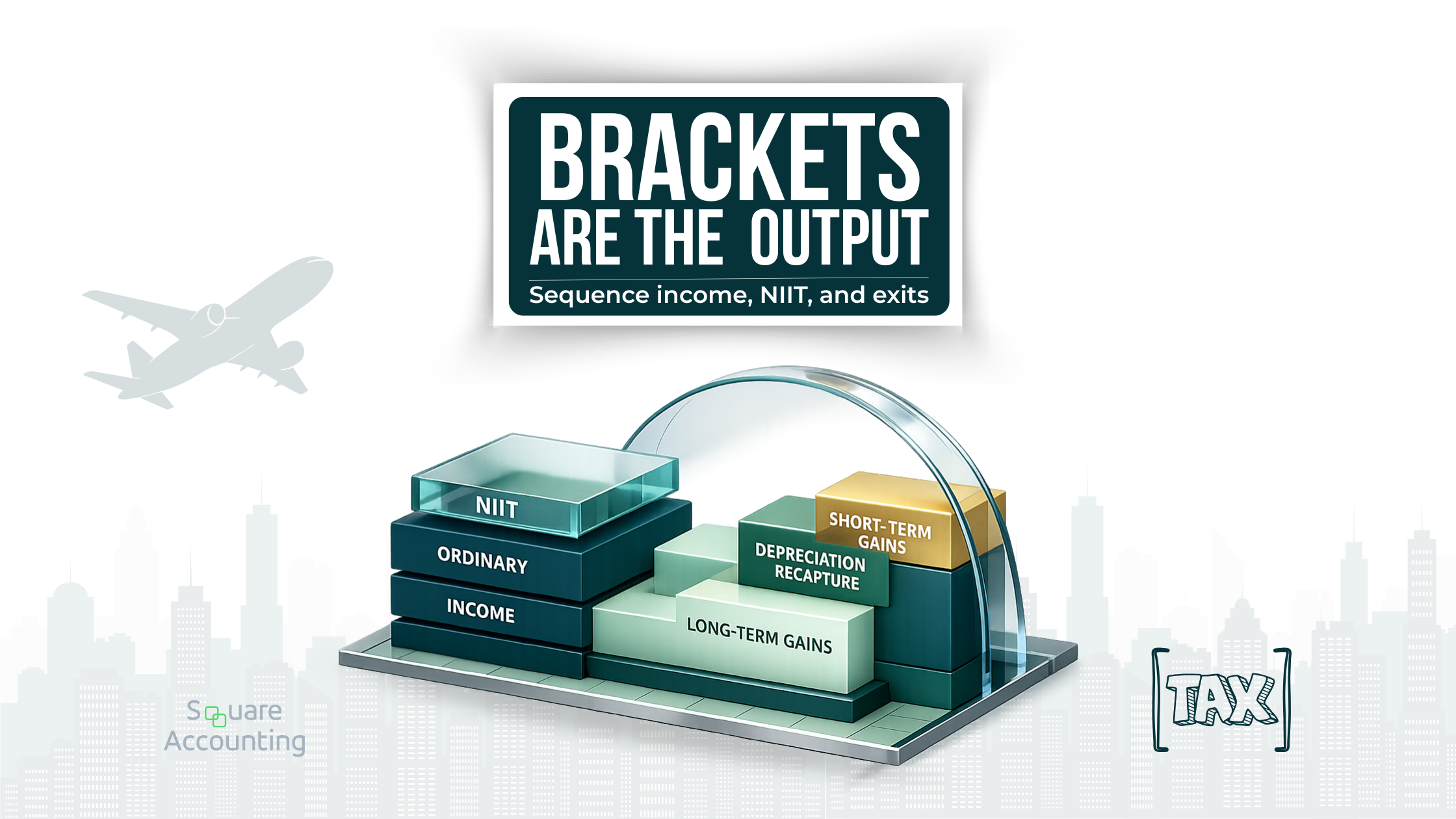

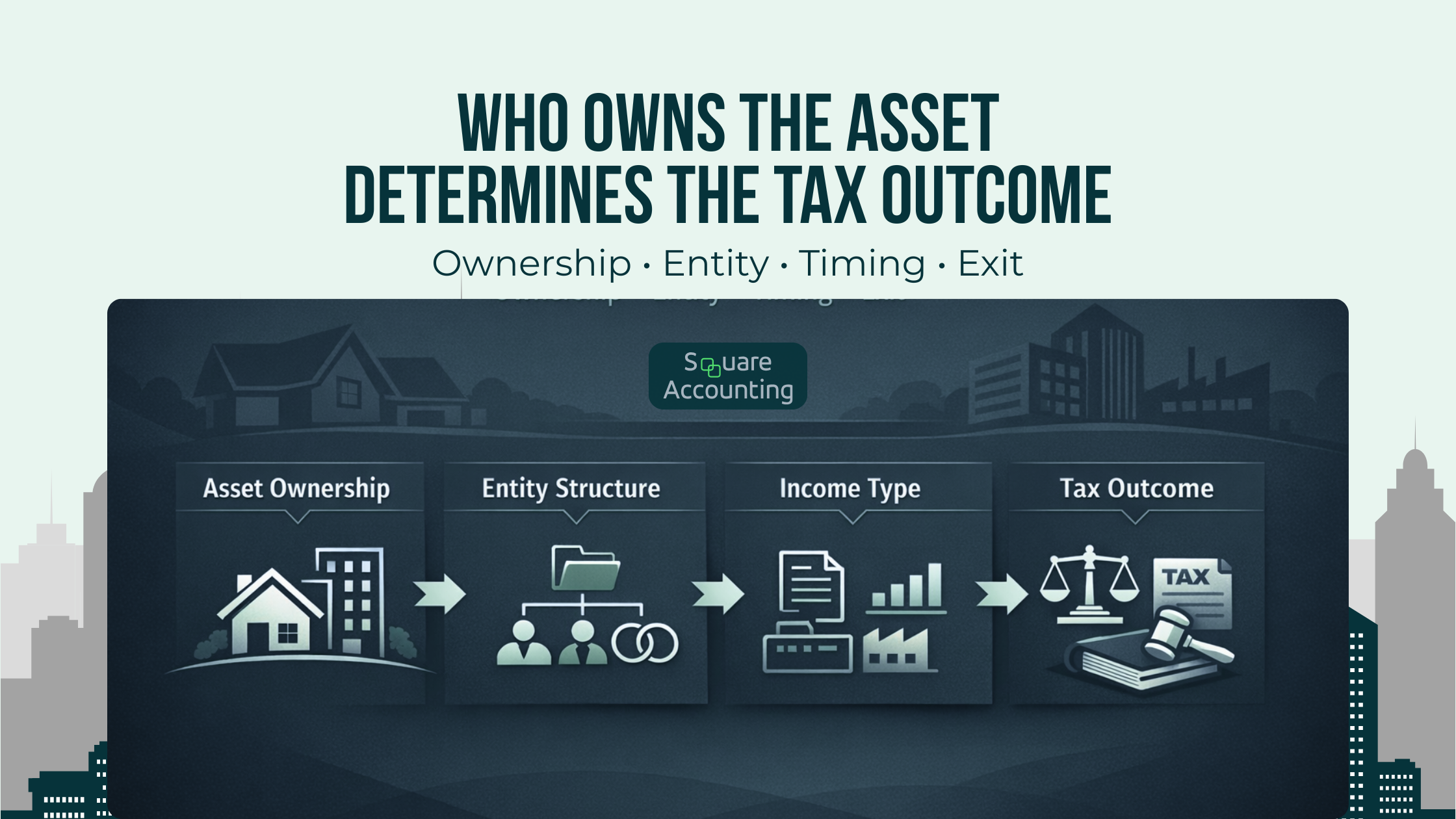

If you’re in real estate, you know the rules can be complicated. Don’t worry—we make them simple. Whether you’re a landlord, a flipper, or a developer, we’ll help you unlock benefits such as:

Cost segregation studies to accelerate deductions

Real estate professional status (REPS) strategies

1031 exchanges to defer capital gains

Smart depreciation and passive loss grouping

Multi-state compliance for growing portfolios

We’ll explain everything in plain language, so you’re never left wondering what it means or how it impacts you.

Let’s Take the Next Step Together

Your taxes aren’t just numbers on a page. They’re a foundation for your future—the life you’re working so hard to create. Our job is to make sure that foundation is strong, flexible, and built to last.

Blogs

Discover Valuable Insights in Our Blog

Contact us

Talk to our Tax Advisor

Running your operations is demanding—your taxes shouldn’t add to the stress. Whether you need strategic tax planning or ongoing support, we’re here to help.