Desantis Property Tax Proposal Sparks Big Money Debate

Key Takeaways

Governor Ron DeSantis is pushing a long-term plan to eliminate non-school property taxes on homesteaded primary residences in Florida, which would require a constitutional amendment approved by 60% of voters in 2026.

A separate near-term proposal includes a one-time, state-funded $1,000 property tax rebate for each qualifying homesteaded property, aimed at offsetting 2025 school property tax bills, but it still needs legislative approval.

House measures (such as HJR 201 and related bills) target elimination of non-school homestead property taxes and expanded exemptions, which could cut local revenues by roughly $14 billion in the first year alone if fully implemented.

Independent analyses estimate that eliminating homestead property taxes could boost Florida home values by roughly 4.5% to 9%, concentrating gains among existing homeowners and high-value homesteads.

Policy groups warn that fully replacing lost property tax revenue could require large hikes in other taxes, including a potential doubling of the state sales tax, which would shift more of the burden onto renters, consumers, and non-homestead (investment and commercial) properties.

Why Florida Investors Cannot Ignore This Proposal

Florida has always sold a simple story to capital: no state income tax, strong population inflows, and a real estate market that compounds wealth fast.

The desantis property tax proposal aims to add something even more radical to that pitch, by moving toward desantis property tax elimination on primary residences while layering in near term desantis property tax relief in the form of rebate checks and higher exemptions.

For Florida real estate investors and high net worth families, this is not just a political headline. It is a potential structural change to:

How homesteaded property is valued and taxed

How non homestead assets, including rentals and luxury second homes, are treated

How local governments fund the services that make locations investable

Understanding the desantis property tax plan is now part of basic diligence for anyone allocating serious capital in Florida.

Ready to see how the Desantis property tax proposal could hit your portfolio?

2. Snapshot: What Is Actually on the Table Right Now?

Behind the rhetoric, there are three main moving parts.

Governor’s long term vision

Eliminate property taxes “completely” on homesteaded primary residences in Florida, while keeping the state income tax rate at zero.

Put a single, clear constitutional amendment on the November 2026 ballot, which would need 60 percent voter approval.

If enacted, Florida would become the only state with neither an income tax nor property taxes on primary residences.

DeSantis property tax rebate and relief

A proposed desantis property tax rebate averaging $1,000 per homesteaded property, paid as a credit against 2025 school property taxes.

Roughly 5.1 million homesteaded properties could qualify, with checks planned for December 2025 if the Legislature authorizes the program.

This is framed as an “opening salvo” before a broader ron desantis property tax proposal goes to voters.

House package of constitutional amendments

Separately from the Governor, House leaders have advanced their own desantis florida property tax plan variants:

HJR 201: Straight elimination of non school homestead property taxes, projected to cut local revenue by about 14.1 billion dollars in the first year.

Additional measures that would:

DeSantis has criticized the multi measure House approach and still wants a single ballot question, so expect more merging and editing before anything reaches voters.

3. How Florida Property Taxes Work Today

To see what “desantis eliminate property tax” might do, start with the current mechanics.

Homestead exemption and Save Our Homes

Key features for owner occupiers:

Homestead exemption

First 25,000 dollars of assessed value is exempt from all property tax, including schools.

Another 25,000 dollar layer is exempt from non school property taxes, with a third tier indexed to inflation on some non school millage.

Save Our Homes (SOH) cap

Once a property has a homestead exemption, annual increases in assessed value are capped at 3 percent or CPI, whichever is lower.

When the property sells, that cap resets and the new owner can see a sharp jump in taxable value.

This system already produces big disparities between long term homesteaders and recent buyers, especially in markets like Miami, Tampa Bay and Naples.

What property taxes fund

Real property taxes in Florida now exceed 55 billion dollars a year and are a critical pillar of local finance.

A Florida Policy Institute analysis finds that property taxes provide roughly:

18 percent of county revenue

17 percent of municipal revenue

50 to 60 percent of school district funding

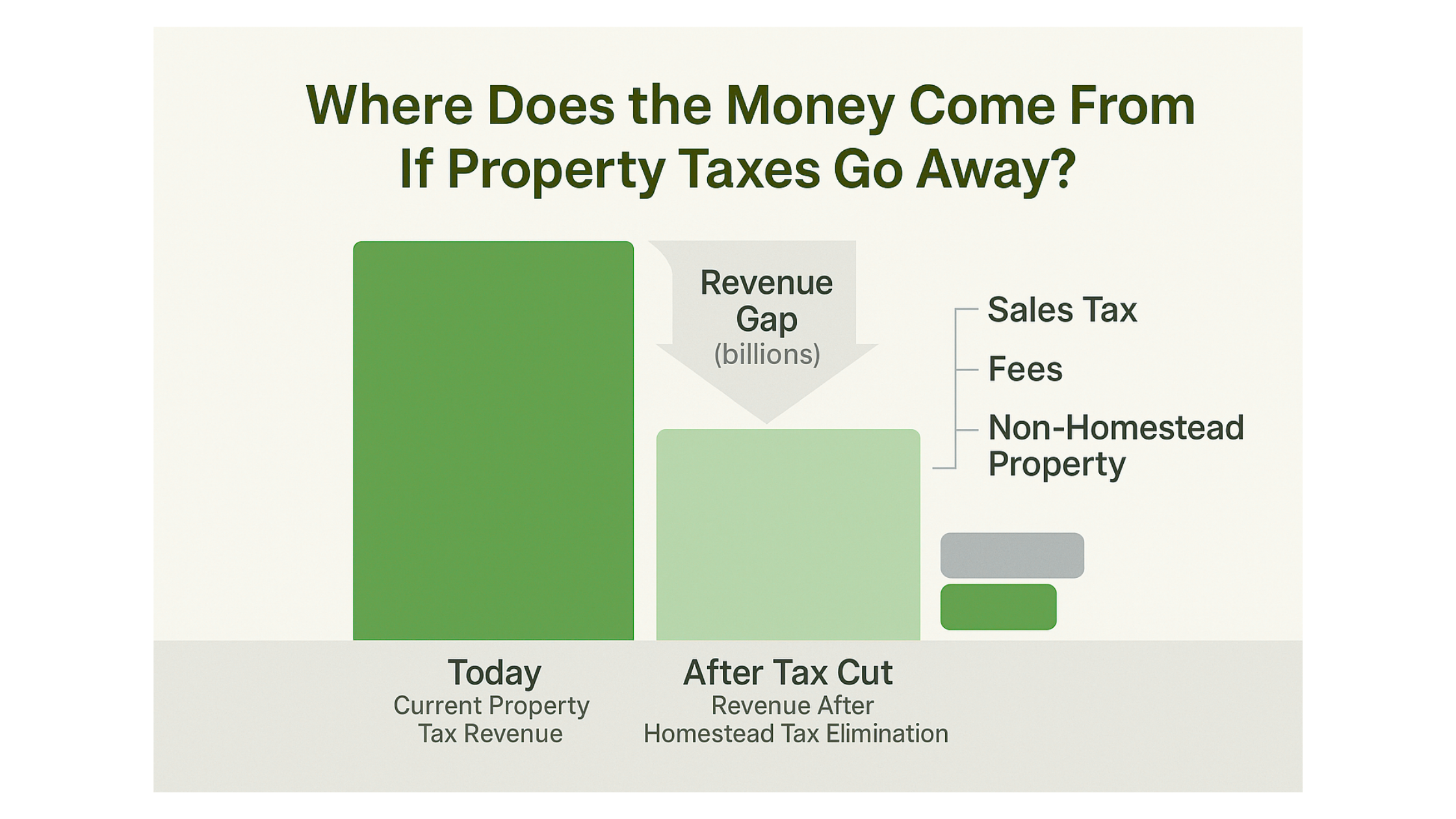

Eliminating or cutting them deeply creates a very real funding gap that has to be addressed with spending cuts, new taxes, or both.

Not sure how homestead rules and Save Our Homes affect your deals?

4. How Big Is the Upside for Homeowners and Prices?

Recent modeling from Realtor.com, highlighted by Investopedia, estimates:

If property taxes on owner occupied homes are eliminated entirely, Florida home prices could rise up to 9 percent.

If property taxes remain for schools but are removed for other local purposes, the price gain is still a sizeable 4.5 to 5 percent.

The James Madison Institute calculates that the median Florida homeowner currently pays around 5,400 dollars per year in property taxes. That recurring saving can be capitalized into higher sale prices.

For existing homesteaded owners, this is pure balance sheet accretion. For would be buyers, especially first timers, it is an additional barrier to entry.

Want to quantify a 4.5% to 9% price swing on your holdings? Request a Custom Valuation Scenario from Square Accounting

5. The Other Side of the Ledger: Revenue Gaps and Tax Shifts

How much revenue is at risk?

Estimates vary by proposal, but the order of magnitude is clear.

Eliminating non school homestead property taxes statewide (HJR 201) could cut local revenue by 14.1 billion dollars in the first year alone.

A separate analysis suggests that eliminating homestead property taxes would cost counties about 7.8 billion dollars, before counting municipal and school impacts.

Florida Policy Institute estimates that to keep current service levels with full property tax elimination, policymakers would need to replace around 43 billion dollars in revenue.

To plug such a hole, FPI calculates that the state sales tax might need to double from 6 percent to 12 percent, which would give Florida the highest statewide rate in the country and significantly raise costs for renters and consumers.

Tax cut, or tax shift?

Policy experts at a recent University of South Florida debate described the full ron desantis property tax abolish idea as less a pure cut than a tax shift.

Key concerns:

Renters and multifamily

Rental properties are not the target of desantis property tax elimination, so their taxes would continue and could even rise as homestead owners are exempted.

Those costs would likely be passed through in higher rents, particularly in Class B and C stock where margins are thinner.

Regressive impact

Doubling the sales tax or leaning heavily on consumption levies disproportionately affects low and moderate income households.

Investors and non homestead owners

Vacation homes, second homes and investor owned assets could become the default tax base once homesteads are shielded, leading to higher effective burdens on precisely the assets many real estate investors favor.

This is why many analysts frame the desantis property tax cut discussion as “who pays, not whether someone pays.”

Concerned that tax cuts for homesteads will shift the bill to your rentals and commercial assets?

6. Political Reality Check: Where Things Stand Going Into 2026

The politics around the gov desantis property tax push are as important as the economics.

The Governor wants a single, sweeping amendment centered on eliminating homestead property taxes and has vetoed a study that would have deeply analyzed the impacts, arguing local governments already overspend.

The House has moved its own cluster of amendments, with HJR 201, 205, 209 and 211 already advancing through committee, focusing on non school homestead taxes and expanded exemptions.

Local officials from places like Palm Beach County warn that large cuts would “seriously impair” road building, park operations, emergency services and law enforcement.

Every proposal that reaches the ballot will still need 60 percent voter approval. That supermajority requirement is a crucial speed bump and should be part of any probability weighting in your investment models.

7. Investor Lens: Who Really Wins and Loses?

Homesteaded primary residences

For Florida residents who homestead:

Direct savings from desantis property tax relief and any future desantis property tax elimination

Capital gains as valuations rise 4.5 to 9 percent under the most ambitious scenarios

Stronger “lock in” incentive to stay put, keeping inventory tight in supply constrained metros

High net worth individuals who can declare Florida residency, homestead a high value property, and hold it for the long term stand to gain significantly.

Non homestead residential: rentals, second homes, STRs

For investors, this is where the desantis property tax florida story gets complicated.

Short term rentals, multi family, second homes and pied a terre units generally do not qualify for homestead treatment.

If non school homestead taxes are eliminated or deeply cut, local governments may lean more on this non homestead base.

That implies potential upward drift in effective millage on investor property, even while headlines talk about a desantis property tax cut.

Multi family sponsors, build to rent operators and STR owners should not assume that “desantis to end property tax” means lower taxes on their assets. The opposite may prove true.

Commercial and institutional investors

Commercial investors face a similar dynamic:

Property tax relief narrative is politically anchored in helping “homeowners,” not shopping centers or office towers.

If homesteads are taken off the tax rolls, commercial valuations may have to absorb a disproportionate share of local budgets, or accept service cuts that reduce location appeal.

For institutional capital, the desantis property tax proposal is as much a risk factor for municipal finance as it is a lever on net operating income.

Curious whether your assets sit on the winning or losing side of the proposal?

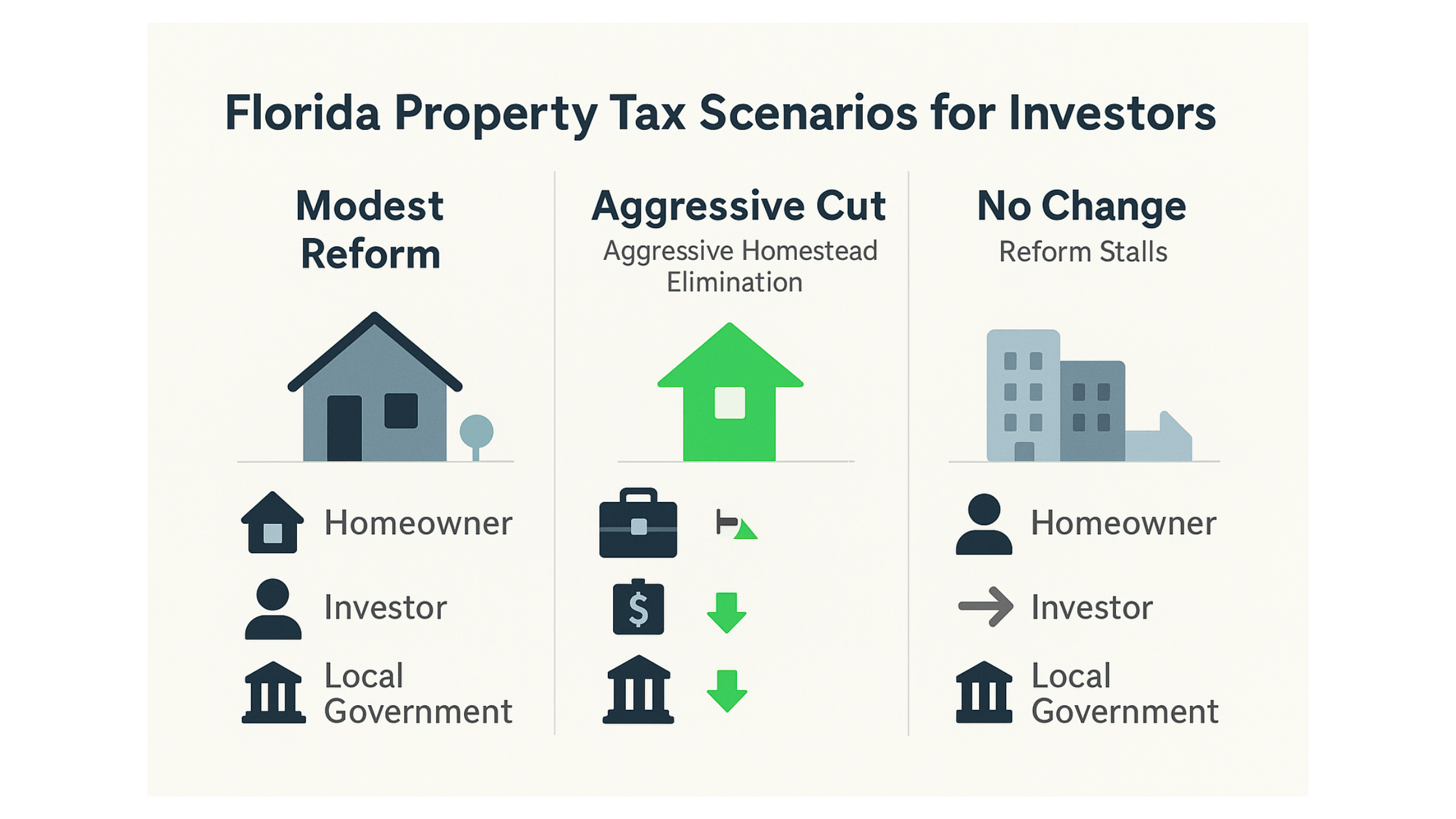

8. Three Core Scenarios Investors Should Model

Modest reform and targeted relief

Features:

1,000 dollar property tax rebate for homesteads in 2025–26

Additional exemptions or protections for seniors and insured homesteads

Save Our Homes portability tweaks, but no sweeping desantis abolish property tax outcome

This is the “small ball” scenario. It relieves pressure, slightly boosts homesteaded values, and leaves the basic system intact.

Aggressive homestead elimination (non school or broader)

Features:

Non school homestead property taxes eliminated, possibly phased in, with a long term political push to include school millage later

Home values for primary residences climb 4.5 to 9 percent; wealth concentration among established owners intensifies.

Non homestead and commercial property become the residual tax base, and local governments experiment with higher sales taxes and fees.

This is the scenario that creates the largest distortion between homesteaded and investor owned assets.

Reform stalls or is heavily watered down

Given legislative tension and local government pushback, there is also a credible path where:

Only incremental desantis property tax relief passes

Voters reject a sweeping amendment in 2026

Florida keeps its homestead and Save Our Homes structure, with occasional tweaks but no revolution

For underwriting, this scenario should be treated as the base case unless and until ballot language and polling say otherwise.

Stop guessing. Model all three Florida tax scenarios with real numbers.

9. Strategy: Positioning Florida Portfolios Around Tax Volatility

Separate homestead optionality from investment fundamentals

A disciplined approach for real estate investors and family offices is to:

Segment holdings into:

Homesteaded or homestead eligible

Long term rentals and second homes

Pure commercial and development land

Underwrite each category with independent tax and value assumptions, instead of applying a single desantis property tax cut factor across the board.

Use the desantis property tax florida narrative as upside optionality, not the core thesis.

Build tax stress tests into every deal

For each acquisition, model:

Status quo taxes under current millage and Save Our Homes rules

A “homestead lifted” case, if a future buyer is likely to homestead the asset

A “burden shift” case where non homestead property faces higher effective rates to compensate for desantis property tax elimination on primary residences

Insert those scenarios directly into cap rate, DSCR and IRR sensitivities.

Watch municipal credit and infrastructure quality

If property tax cuts reduce local revenues, investors need to watch:

Bond ratings and borrowing costs for key counties and cities

Whether road, park, drainage, and school investments lag, affecting location desirability

Whether special districts and impact fees expand to backfill lost property tax dollars

A community’s real value is not just its tax bill but the services those taxes finance.

Want a Florida strategy that works under any tax regime?

10. Structuring Considerations for High Net Worth Investors

Homestead optimization

For high net worth individuals looking to capitalize on any ron desantis property tax florida changes:

Ensure primary residences clearly qualify for Florida homestead status under current rules.

Coordinate homestead with trust, LLC and family office structures so that legal title does not inadvertently disqualify the exemption.

Consider whether reallocating value from investment properties to a higher value homesteaded primary residence makes sense if desantis property tax elimination materializes.

Cross border and multi state planning

For investors with footprints in multiple states:

Model how a no property tax in florida homestead interacts with tax regimes in other jurisdictions, especially those with wealth or worldwide asset taxes.

Revisit residency, day count and presence tests for both U.S. states and foreign jurisdictions to avoid surprises.

Professional advice is essential when combining aggressive state level tax changes with complex cross border structures.

11. Practical Checklist Before You Bet on the Desantis Property Tax Plan

Before leaning heavily on the desantis property tax proposal in your investment strategy, walk through this checklist:

Map exposure

List all Florida holdings by county, property type and homestead eligibility.

Quantify current tax load

Pull current tax bills and assessed values and confirm how Save Our Homes is being applied.

Model three scenarios

Modest reform only

Aggressive homestead elimination

Reform stalls

Review local government dependence

Identify which counties and municipalities derive a high share of revenue from property taxes and may react most forcefully to cuts.

Plan exit strategies

Decide how you would monetize gains if a desantis property tax cut triggers a short lived pricing spike in certain segments.

Engage advisors

Coordinate with tax counsel, estate planners and local property tax specialists on homestead, entity and trust implications.

Monitor policy signals

Track the exact text of bills, committee votes and polling, not just social media or desantis property tax reddit threads.

Conclusion

Florida’s tax landscape is at an inflection point. The desantis property tax proposal, combined with House-led measures, could deliver meaningful desantis property tax relief for homesteaded primary residences, and in the most ambitious version, move toward desantis property tax elimination on non-school homestead taxes.

For investors and high net worth families, this is both opportunity and risk. Homesteads may see higher values, while non-homestead and investment property could face a larger share of the tax burden or higher sales and consumption taxes.

The smart move now is to underwrite every Florida deal using today’s rules, layer in clear tax scenarios, and structure holdings so you can capture upside without depending on it. Those who treat the ron desantis property tax proposal as a scenario to model, not a certainty to chase, will be best positioned whichever way the policy breaks.

The policy path is uncertain. Your tax strategy should not be.

FAQ: Desantis Property Tax Proposal

Clear Answers for Florida Investors

What is the DeSantis property tax proposal in Florida?

The desantis property tax proposal is a plan to eliminate property taxes “completely” on homesteaded primary residences in Florida, making the state the first in the nation with no income tax and no property tax on owner-occupied homes. To happen, lawmakers must pass a constitutional amendment and voters must approve it by 60 percent in the November 2026 election. In parallel, House proposals focus on cutting or eliminating non-school property taxes on homesteads and expanding exemptions.

Will DeSantis actually eliminate property taxes in Florida?

Right now, property taxes in Florida have not been eliminated. Gov. Ron DeSantis and Republican leaders are pushing for desantis property tax elimination on homesteads, but the details are still being negotiated in the Legislature, and several lawmakers are skeptical of ending the entire system. Any desantis property tax florida amendment must clear both the Legislature and a statewide vote, so elimination is a live possibility but far from guaranteed.

How would the DeSantis property tax proposal affect homeowners?

If voters approve a robust ron desantis property tax proposal, many homesteaded homeowners would see their annual tax bills fall sharply or even disappear for the non-school portion. Independent modeling suggests desantis property tax elimination on owner-occupied homes could raise Florida home values by roughly 4.5 to 9 percent, with the biggest gains for existing owners of higher-value primary residences. Homeowners may also see shorter-term desantis property tax relief, such as a proposed $1,000 homestead rebate funded by the state.

How will the DeSantis property tax plan impact renters and first-time buyers?

Policy experts warn that a desantis property tax cut focused on homesteads could shift more of the tax burden to renters and non-homestead properties. Local governments would still need revenue, so higher sales taxes, fees, or millage on rental and investor-owned property are likely options, which can translate into higher rents and reduced affordability for first-time buyers. Analyses from Realtor.com and Florida Policy Institute highlight that the ron desantis property tax plan may intensify wealth gains for current homeowners while offering little direct relief to renters.

When could the DeSantis property tax changes take effect?

The earliest major changes from the desantis property tax proposal would likely come after the November 2026 election, if a constitutional amendment is approved by voters. Some near-term desantis property tax relief, like a one-time $1,000 rebate for homesteads, could occur sooner if the Legislature includes it in the 2025 budget. Implementation of any broad desantis property tax bill would then be phased in through follow-up legislation and local adjustments.

How would Florida replace revenue if property taxes are eliminated?

Property taxes currently fund a large share of Florida’s local budgets, including schools, police, fire, and infrastructure. Analysts estimate that eliminating non-school homestead property taxes alone would cost local governments roughly $11 to $14 billion annually, and ending all property taxes could create a revenue gap of tens of billions of dollars. Think tanks note that fully replacing this with sales tax could require a much higher statewide rate, potentially doubling the current 6 percent, which would make the system more regressive and shift costs onto renters and consumers.

Is the DeSantis property tax proposal good or bad for real estate investors?

For homesteaded, high-end primary residences, the ron desantis property tax florida push looks positive, with lower carrying costs and potential price appreciation. For non-homestead assets like rentals, second homes, and commercial property, desantis property tax elimination could be a mixed bag: these properties may not get the same exemptions and could face higher effective taxes or more fees as local governments rebalance their budgets. Serious real estate investors are treating the desantis property tax plan as a scenario to model, not a certainty to price in, and are stress-testing deals under both current law and possible future tax shifts.