Planning for Depreciation Recapture Before You Buy the Asset

High-income Florida taxpayers do not lack deductions. They lack durability.

Depreciation is frequently positioned as a benefit at acquisition, but for sophisticated investors, it is more accurately a multi-year tax timing decision with a known future consequence: depreciation recapture. The real risk is not paying recapture. The risk is designing a depreciation strategy that conflicts with how, when, and why you expect to exit the asset.

For real estate investors and business owners earning $250k+ annually, depreciation should be evaluated the same way as leverage, entity structure, or capital stack decisions. It affects long-term return, optionality, and liquidity. Treating it as a one-year tax reduction is a planning failure.

Key Takeaways

Depreciation is a timing shift, not a permanent tax reduction. The recapture is the other half of the transaction.

Exit assumptions must be defined before acquisition. Holding period and disposition method drive whether depreciation improves or erodes returns.

Accelerated depreciation increases future rigidity. It narrows exit choices if liquidity is not modeled.

Entity structure determines who actually pays the recapture. This is often misunderstood or ignored.

Florida’s no state income tax lowers the real value of depreciation. Over-acceleration is harder to justify than in high-tax states.

The best depreciation strategy preserves flexibility. Short-term savings that impair exit economics are rarely optimal.

Confirm whether your current depreciation approach supports your exit plan.

Depreciation Recapture Starts at Acquisition, Not Sale

Most content frames depreciation recapture as a sale-year event. In reality, the economic outcome is locked in much earlier.

Depreciation reduces adjusted basis. That reduced basis increases taxable gain at disposition. Recapture is simply the IRS mechanism that reclassifies part of that gain based on how aggressively depreciation was claimed.

For high earners, the question is not whether recapture applies. It is whether the time value of the deduction exceeds the cost of the future tax under realistic exit conditions.

That analysis must occur before the asset is purchased.

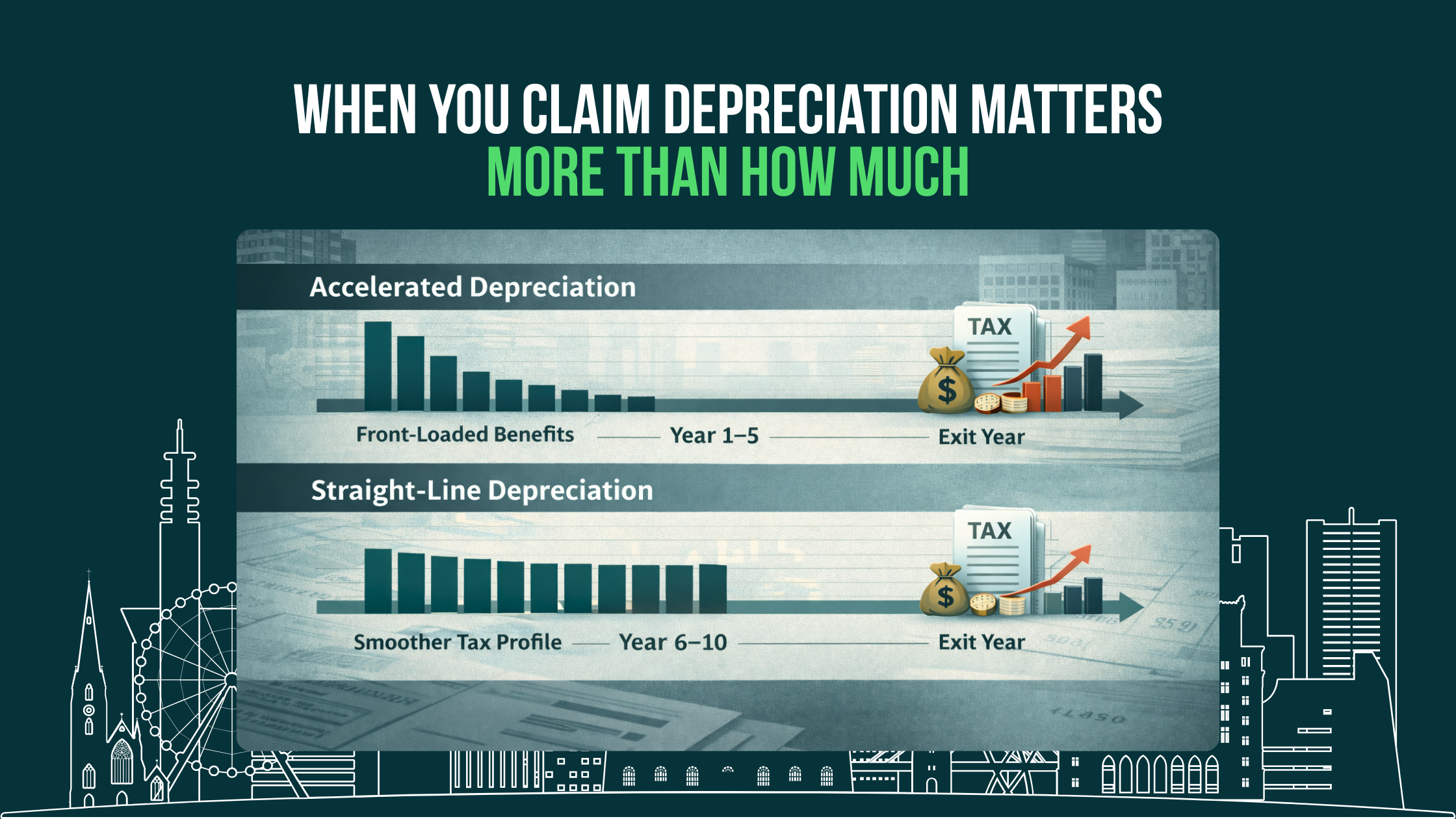

Timing and Sequencing: Why Holding Period Drives the Outcome

Holding period is the most underweighted variable in depreciation planning.

Short to mid-term holds (5–10 years):

Accelerated depreciation often front-loads benefits but concentrates recapture into a single exit year, frequently at a less favorable income profile.Long-term holds (15+ years):

Depreciation can materially improve lifetime returns if the asset aligns with estate, exchange, or long-horizon planning.

If the expected hold is unclear, aggressive depreciation introduces risk. A strategy that requires a specific exit outcome to work is not a resilient strategy.

Cost Segregation and Bonus Depreciation: Leverage, Not Free Money

Cost segregation and bonus depreciation are often presented as automatic wins. They are not.

They increase early deductions by pulling depreciation forward, which:

Improves near-term cash flow

Raises future recapture exposure

Increases sensitivity to exit timing

In 2026, with bonus depreciation no longer at full expensing, the conversation has shifted. Acceleration still exists, but the marginal benefit is lower, while the structural impact on basis remains.

For sophisticated taxpayers, cost segregation should only be deployed when:

High-income years are unusually concentrated

The asset supports a longer or controlled exit horizon

Liquidity planning accounts for future recapture

If the only justification is “it reduces taxes this year,” the analysis is incomplete.

Understand how accelerated depreciation affects future liquidity and exit flexibility.

Entity and Ownership Structure: Who Actually Pays the Recapture

Recapture is not just an asset-level issue. It is an ownership issue.

Entity structure affects:

Allocation of depreciation benefits

Allocation of recapture tax

Flexibility in ownership changes

Exit coordination between partners

Common mistakes include:

Applying aggressive depreciation in partnerships without aligned exit timelines

Changing ownership percentages after significant basis reduction

Assuming recapture aligns proportionally with economic ownership

For business owners, depreciation inside operating entities can also distort future sale negotiations by inflating taxable gain relative to perceived value.

The correct question is not “Can this entity claim depreciation?” but “Does this ownership structure still work after depreciation has run its course?”

Active vs Passive Treatment: A Secondary Question, Not the First One

Many high-income professionals focus on whether depreciation offsets active income. That matters, but it is not the primary decision driver.

Offsetting active income today does not eliminate recapture tomorrow. In fact, it often creates a sharper contrast between benefit year and exit year.

A better framework is:

Does this depreciation improve total after-tax cash retained across the full holding period?

Or does it merely accelerate tax savings into years that are already high-income?

When viewed through that lens, some depreciation strategies lose their appeal.

Exit Is Where the Strategy Is Judged

Every depreciation strategy is tested at exit.

Taxable sales expose the full recapture cost

Exchanges defer, but constrain reinvestment choices

Long-term holds reduce pressure but increase exposure to policy and market changes

Assets acquired without exit modeling often force investors into decisions driven by tax damage control rather than business logic.

The strongest plans maintain optionality. If depreciation requires a specific exit to avoid harm, it is fragile.

What Most Articles Still Get Wrong

Even advanced articles frequently miss:

The reduced relative value of depreciation in no-state-tax jurisdictions

The liquidity mismatch between paper deductions and real cash obligations

The interaction between depreciation and long-term portfolio balance

Situations where straight-line depreciation outperforms aggressive acceleration

Depreciation is not inherently good or bad. It is context-dependent. Ignoring that context is where most strategies fail.

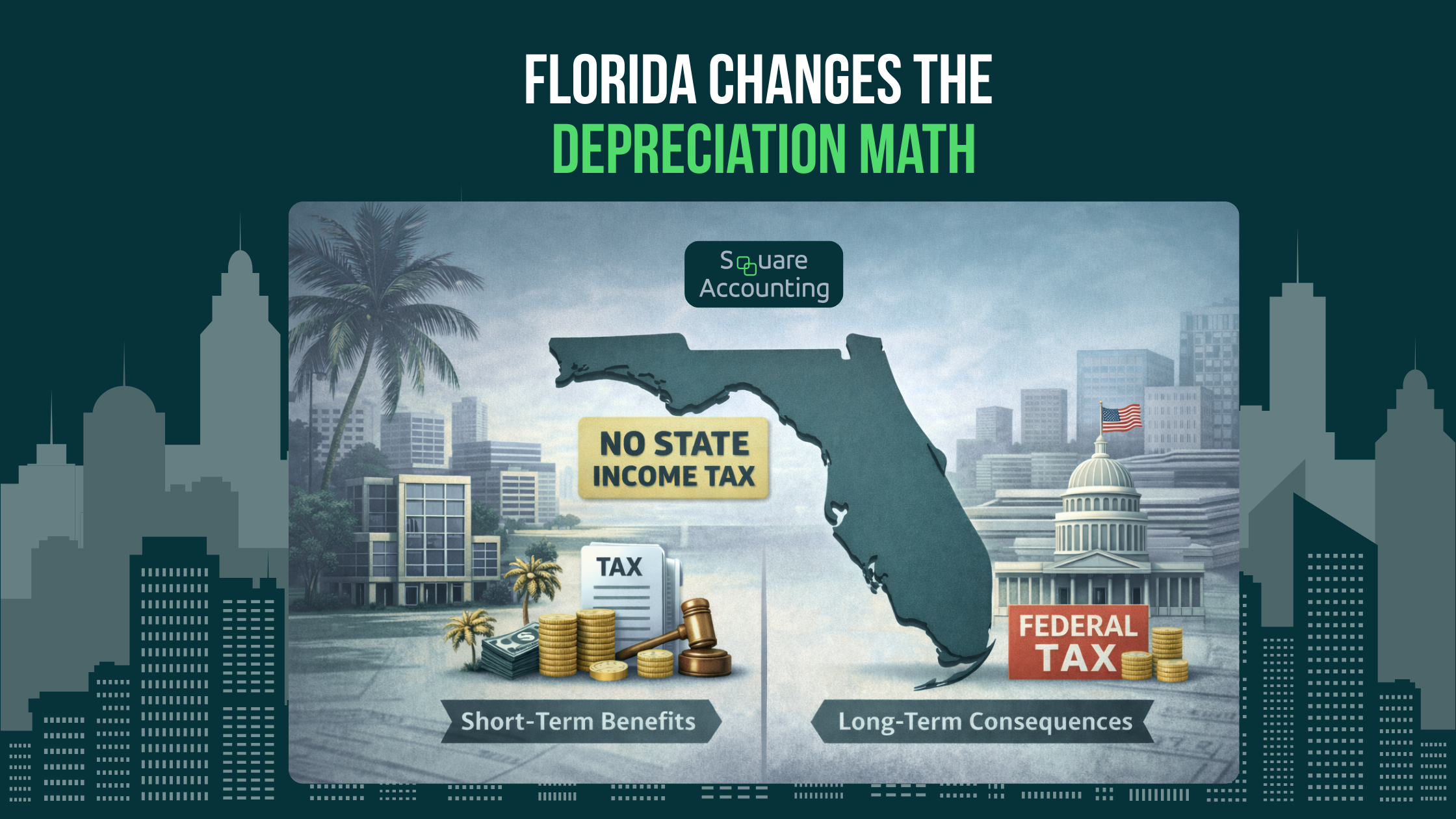

Florida-Specific Considerations That Matter More Than Elsewhere

Florida’s tax environment materially changes the analysis.

Because there is no state income tax:

Federal depreciation provides less total benefit

Recapture is not offset by state tax asymmetry

Over-acceleration has a lower payoff threshold

Additional Florida realities:

High real estate concentration increases correlated exit risk

Short-term rental use can complicate income characterization

Non-homestead property taxes affect true holding costs

Insurance and casualty exposure increase the value of liquidity at exit

These factors favor durable, flexible depreciation strategies, not maximum acceleration.

Conclusion: Depreciation Should Survive the Exit, Not Just the Audit

Depreciation recapture is not a surprise. It is the predictable result of an earlier choice.

For high-income Florida taxpayers, the real planning opportunity is not maximizing depreciation. It is aligning depreciation with how the asset will be owned, operated, and eventually exited.

When depreciation is modeled across the full lifecycle, it can meaningfully improve outcomes. When it is applied tactically, it often trades short-term savings for long-term friction.

At Square, we treat depreciation as part of a broader, multi-year tax architecture designed to hold up through exit, not just filing season.

Design a depreciation strategy that holds up through sale, exchange, or transfer.

Frequently Asked Questions

What is depreciation recapture and why should it be planned before buying an asset?

Depreciation recapture is the portion of gain on sale that is taxed based on depreciation previously claimed. It should be planned before acquisition because depreciation decisions made in the purchase year directly affect adjusted basis, taxable gain, and exit flexibility. Once depreciation is claimed, the recapture exposure is largely locked in, regardless of whether the asset is sold years later.

Is depreciation recapture always taxed at ordinary income rates?

No. Depreciation recapture depends on the asset type.

For real estate, most depreciation is subject to unrecaptured Section 1250 gain, generally taxed at up to 25% at the federal level. Certain components identified through cost segregation may be subject to ordinary income recapture. The mix depends on how depreciation was allocated over the holding period.

Does cost segregation increase depreciation recapture risk?

Yes, cost segregation increases recapture exposure because it accelerates depreciation into earlier years and shifts more depreciation into categories that may be recaptured at higher rates. While this can improve near-term cash flow, it also increases taxable gain at exit. Cost segregation should be evaluated based on holding period, income trajectory, and exit strategy, not just first-year tax savings.

Can depreciation recapture be avoided?

Depreciation recapture generally cannot be eliminated, but it can be managed or deferred depending on the exit strategy. Taxable sales trigger recapture immediately. Certain exchanges or long-term holding strategies may defer recognition, but they introduce reinvestment and liquidity constraints. Planning focuses on alignment and timing, not avoidance.

How does Florida’s no state income tax affect depreciation planning?

Florida’s lack of state income tax reduces the overall value of depreciation deductions because there is no state-level offset. However, depreciation recapture still applies at the federal level. This means aggressive depreciation often delivers less net benefit for Florida taxpayers compared to high-tax states, making over-acceleration harder to justify.

Should depreciation strategy change based on expected holding period?

Absolutely. Holding period is one of the most important variables in depreciation planning. Shorter holding periods amplify the impact of recapture and increase the risk that accelerated depreciation reduces long-term returns. Longer holding periods provide more flexibility and may better support accelerated strategies, especially when coordinated with estate or exchange planning.

Does entity structure affect who pays depreciation recapture?

Yes. Entity and ownership structure determine how depreciation benefits and recapture tax are allocated among owners. Partnerships, pass-through entities, and operating businesses can all produce different outcomes at exit. Changes in ownership or allocation after heavy depreciation can create unintended tax consequences if not planned in advance.

Is depreciation still worth it if recapture applies later?

In many cases, yes, but only when depreciation is part of a multi-year plan. The decision should be based on time value of money, income volatility, exit timing, and liquidity. Depreciation that improves lifetime after-tax cash flow is beneficial. Depreciation that only shifts taxes into a less favorable future year may not be.