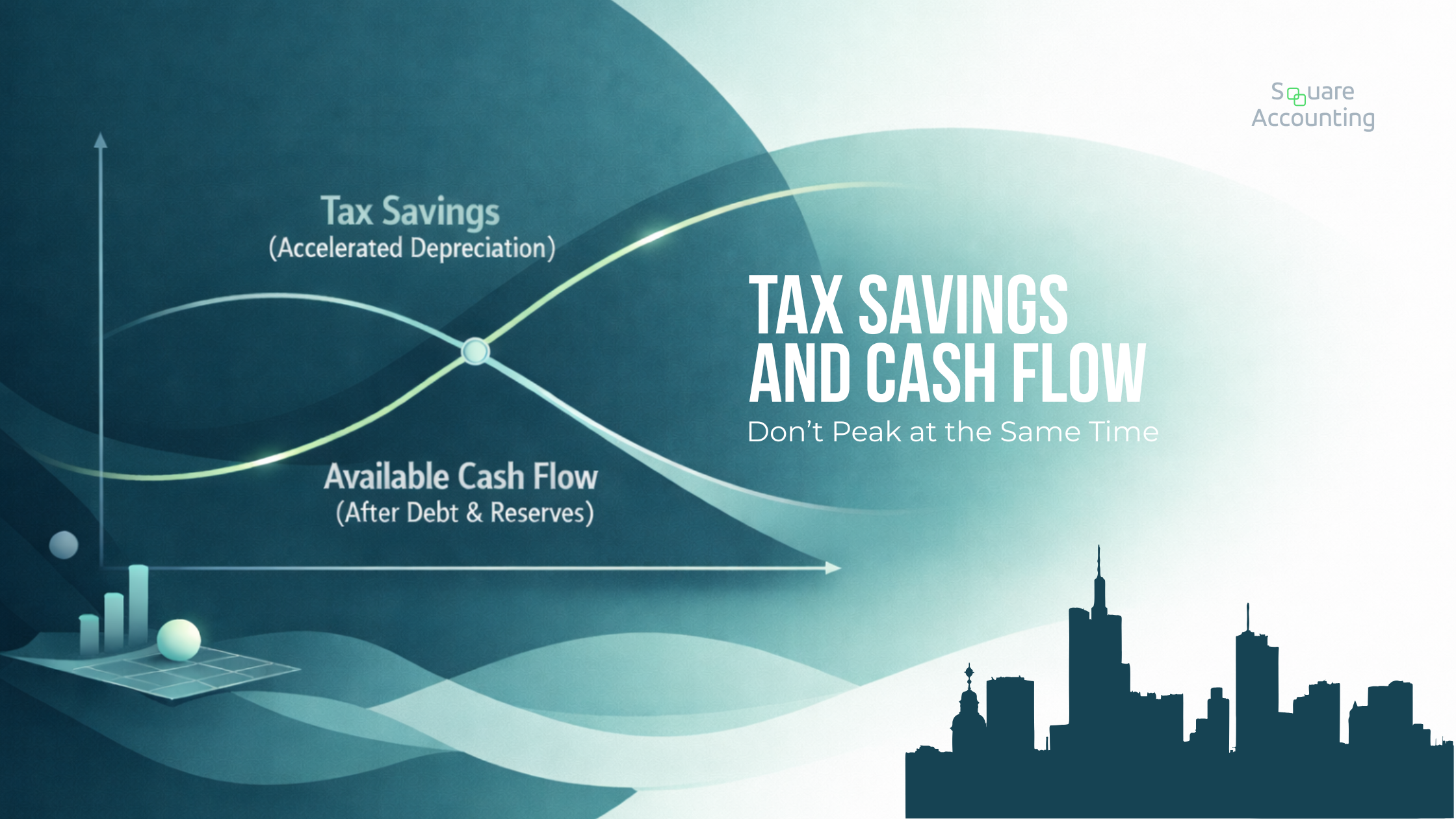

Balancing Tax Savings Against Cash Flow in Highly Leveraged Strategies

For high-income Florida taxpayers, the challenge is rarely “finding deductions.” The real challenge is building a multi-year plan that stays liquid under pressure.

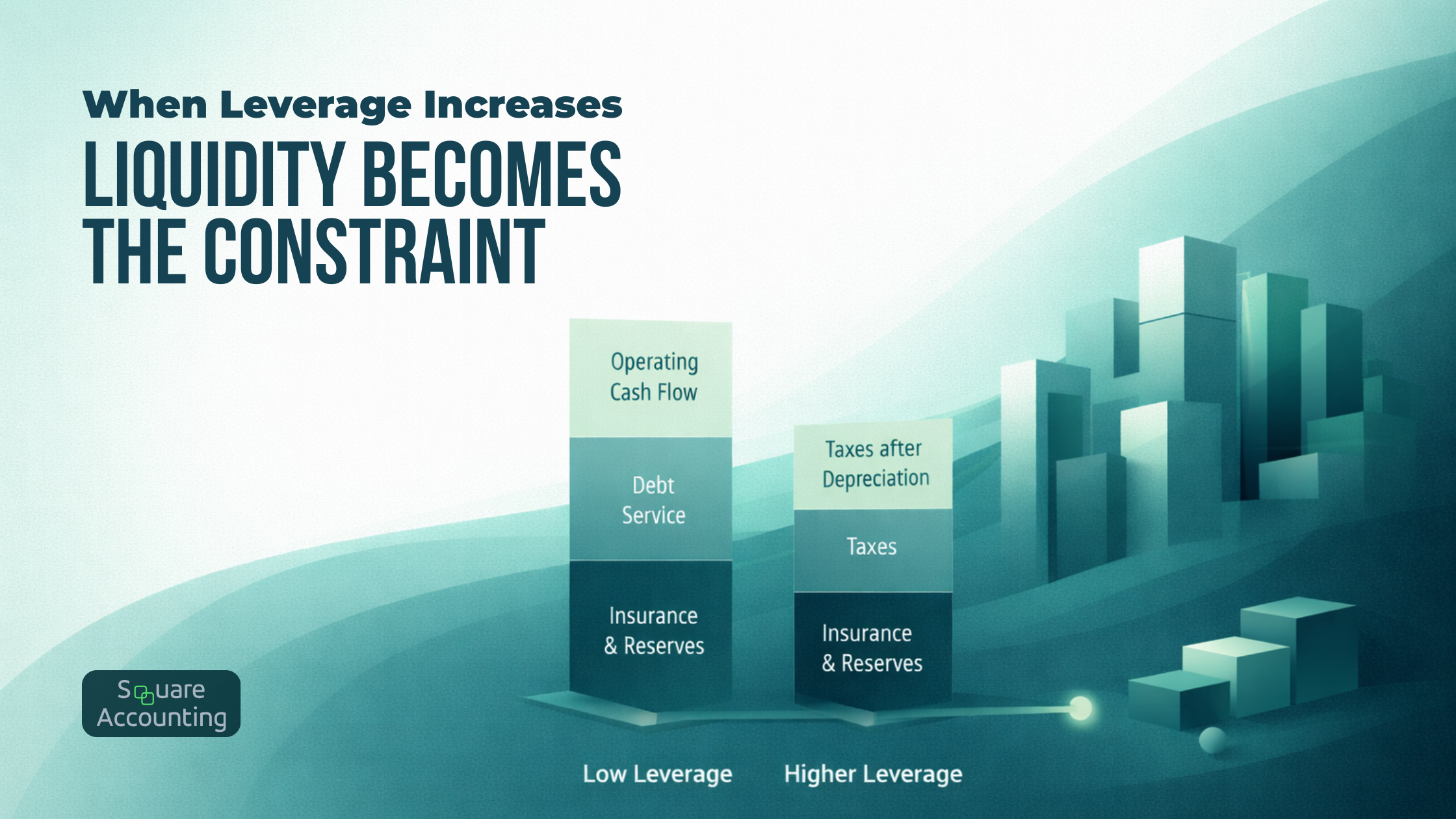

Highly leveraged strategies can generate substantial first-year deductions through accelerated depreciation, cost segregation, or fixed-asset planning. On paper, the tax outcome can look exceptional. But leverage changes the operating reality: interest expense, reserves, insurance, CapEx, and refinancing terms create cash obligations that don’t care what your depreciation schedule says.

At Square Accounting, we approach balancing tax savings against cash flow as a planning decision that must hold up across multiple years, interest-rate cycles, and exit outcomes, not just the current return.

Key Takeaways

Tax savings created by leverage and accelerated depreciation are usually timing benefits, and timing can be expensive if liquidity is tight later.

Strong tax results can coexist with weak cash flow when debt service, reserves, and volatility outpace distributable income.

Cost segregation and bonus depreciation are most effective as part of sequenced planning, not as year-one tactics.

Exit, refinancing, and recapture modeling should happen before you close, not after you’ve accelerated deductions.

Entity and ownership structure determine whether losses are usable, limited, or trapped under passive and basis rules.

Florida’s no state income tax shifts the breakeven math, and Florida operating volatility often requires more liquidity, not less.

If you’re considering leveraged tax strategies, the most valuable step is modeling how tax savings and cash flow interact over multiple years. A short call can clarify whether the strategy strengthens or strains your liquidity.

Why Leverage Makes “Great Tax Plans” Fragile

Leverage magnifies outcomes in three directions at once:

Tax timing gets more aggressive

Debt-funded acquisitions and improvements often pair naturally with accelerated depreciation.Cash obligations become less optional

Debt service, reserves, insurance, and CapEx become the limiting factor, especially when rates or premiums rise.Optionality narrows

If the plan assumes you can refinance on demand, sell at will, or hold indefinitely, it’s not really a plan. It’s a market bet.

This is why sophisticated planning starts with a simple distinction:

Tax savings reduce tax paid.

Cash flow is what keeps the strategy alive long enough to benefit from those savings.

Asset-Based Tax Planning vs Traditional Deductions

In Florida, high earners often outgrow traditional deduction planning quickly. With no state income tax, many “high-tax-state” deduction narratives simply don’t apply, and SALT caps reduce the value of the usual moves.

That’s why Florida planning for HNW taxpayers tends to center on asset-based levers:

depreciation strategy for real estate and fixed assets

timing and sequencing of placed-in-service events

ownership structure and loss usability

exit and capital stack design

Asset-based strategies can be excellent, but they’re also where cash flow mistakes get expensive because the strategy is often debt-driven.

Cost Segregation Planning and Bonus Depreciation Strategy (Updated)

Cost segregation can reclassify components of a building into shorter-lived property, accelerating depreciation deductions. The planning mistake is treating the study as “found money” rather than a timing tool that changes your future taxable income profile.

The 2026 reality: bonus depreciation is back at 100% (for many taxpayers)

As of today, major tax technical sources report that 100% bonus depreciation has been permanently reinstated for qualified property acquired and placed in service after a mid-to-late January 2025 effective date, with transitional rules for certain early January 2025 placed-in-service property.

Planning implication:

You can still create substantial front-loaded deductions, but the decision becomes even more important to sequence correctly because the temptation to “pull every lever” in year one is stronger.

What sophisticated modeling includes (and most articles skip)

A cost segregation/bonus depreciation decision should be made alongside:

Distribution policy: Will the entity distribute enough cash to cover taxes in later years when depreciation normalizes?

Debt service trajectory: Are you protected against rate resets and renewal terms?

Capital reserve policy: What’s the plan for insurance deductibles, roof/HVAC, storm hardening, and tenant churn?

Exit path: Sale, 1031, refinance-and-hold, conversion to personal use, or estate step-up planning each produces a different tax/cash outcome.

When these aren’t integrated, the “tax win” can turn into a liquidity constraint.

Accelerated depreciation is powerful, but only when sequenced correctly. We work with clients to test cost segregation and bonus depreciation strategies against real cash flow, debt service, and exit scenarios before execution.

The Cash Flow Trade-Off Most High Earners Misjudge

The most common failure mode is simple: the strategy creates tax savings today, but requires cash tomorrow.

Highly leveraged structures create cash pressure through:

interest expense (and sometimes principal amortization)

reserves, insurance premiums, and deductibles

CapEx that doesn’t wait for the market to cooperate

property tax volatility on non-homestead holdings

operating variability in STR-heavy portfolios

Depreciation doesn’t fund any of those. It only changes taxable income.

Better framing:

Instead of asking “How much can we deduct this year?” ask:

“What’s our minimum liquidity requirement to keep the plan stable for the next 36–60 months?”

Entity and Ownership Structure: Whether Losses Are Usable or Trapped

Tax savings aren’t valuable if you can’t use them.

For real estate and operating businesses, loss usability often depends on:

active vs passive characterization

basis and at-risk support

where debt is allocated (and who actually bears economic risk)

how income is distributed across entities and owners

Active vs passive treatment (especially for real estate)

Real estate losses can be powerful when they’re usable against the right type of income, but passive loss rules can suspend losses even when your strategy “worked” on paper. This is where professional status, participation levels, and grouping elections become strategic, not technical.

The core point: structure determines whether accelerated deductions create immediate benefit or deferred benefit.

Section 163(j) and Interest Limitation: The Hidden Constraint in Leverage

Many leveraged strategies assume interest is fully deductible. In reality, interest limitation rules can change the outcome, and elections can involve trade-offs that ripple through depreciation planning. Most public-facing articles ignore this entirely, even though it’s one of the most leverage-sensitive parts of the code for high earners and large portfolios.

This is exactly why we model leveraged tax strategies as a system:

leverage impacts interest treatment,

interest treatment impacts cash taxes,

cash taxes impact liquidity,

liquidity impacts whether you can hold long enough to benefit.

Exit, Depreciation Recapture, and Long-Term Sustainability

If you accelerate depreciation, you are reshaping your basis and often increasing recapture exposure on disposition. Even when the economics still work, the tax bill can arrive at a time when you don’t want to sell, or can’t refinance cheaply.

Sustainability planning includes:

projecting taxable income after the acceleration period ends

modeling sale scenarios (best case, base case, stressed)

planning liquidity for recapture and transaction costs

coordinating with 1031 strategy, holding periods, and estate planning goals

The best strategies are the ones that remain flexible when the exit timing changes.

What Most Articles Get Wrong (and the mistakes we see)

Here’s what most articles leave out and where high earners get hurt:

1) “Tax savings = cash flow”

They’re related, but not the same. Accelerated deductions can reduce tax payments, but cash flow can still decline if leverage, insurance, and reserves rise faster than NOI.

2) No sequencing

Executing cost segregation and bonus depreciation without coordinating:

income timing,

entity structure,

participation and grouping,

and exit planning

creates avoidable volatility in later-year tax bills.

3) No sustainability stress test

Many strategies work in stable markets and fail when:

insurance premiums spike,

interest rates reset,

occupancy drops (especially in STR-heavy markets),

a casualty event forces high-deductible repairs.

4) No discussion of when the strategy does not work

Highly leveraged, front-loaded deduction strategies require caution when:

you’re already liquidity constrained,

you rely on refinancing as the core “plan,”

losses will be suspended or trapped,

you anticipate a near-term sale or major use conversion,

you have concentrated exposure to Florida storm risk without adequate reserves.

Florida-Specific Considerations That Change the Analysis

Florida’s environment changes the leverage and liquidity calculus in ways that are easy to miss if you’re copying strategies designed for high-tax states.

No state income tax shifts the breakeven point

Because Florida does not add state income tax, the incremental benefit of extreme acceleration is often lower than it would be elsewhere. That tends to favor balanced, multi-year smoothing over “year-one maximization,” unless your liquidity and income profile justify it.

Property taxes: homestead vs non-homestead dynamics matter

Homestead rules and non-homestead taxation create planning differences across personal residences, long-term rentals, and investment portfolios. For example, Florida’s Department of Revenue guidance highlights how rental activity can affect homestead qualification rules.

Insurance and casualty planning are not optional inputs

In Florida, insurance pricing, deductibles, and casualty-driven CapEx planning are often the deciding factor for how much leverage is sustainable. A tax strategy that reduces cash reserves in the name of “maximizing deductions” can be backward in this operating environment.

Short-term rental concentration raises volatility risk

STR portfolios can generate excellent returns, but they also create cash variability. Leverage plus volatility is where “paper savings” most often collides with real-world liquidity.

Florida’s tax environment, insurance volatility, and real estate concentration change how much leverage is sustainable. A focused review can identify whether your current structure supports long-term flexibility.

Conclusion

Highly leveraged tax strategies can be effective for high-income Florida taxpayers, but only when they’re built as multi-year systems.

Balancing tax savings against cash flow means:

sequencing cost segregation and bonus depreciation inside a broader plan,

structuring ownership so losses are actually usable,

modeling interest and leverage constraints,

and planning the exit and recapture implications before committing capital.

When those pieces align, leverage can amplify after-tax wealth. When they don’t, the strategy becomes fragile and forces reactive decisions that erase the benefits.

Highly leveraged tax strategies work best when designed as part of a coordinated, multi-year plan. If you want clarity on sequencing, structure, and exit implications, a planning discussion is the right starting point.

Frequently Asked Questions: Balancing Tax Savings Against Cash Flow

How do tax savings affect cash flow in leveraged investments?

Tax savings and cash flow are related but not the same. Tax savings reduce the amount paid in taxes, while cash flow reflects actual dollars available after operating expenses, debt service, reserves, and capital costs. In leveraged strategies, accelerated deductions can reduce near-term taxes while cash flow tightens due to higher interest expense, insurance, and capital requirements. Effective planning evaluates both together across multiple years.

Does cost segregation improve cash flow?

Cost segregation can improve after-tax cash flow by accelerating depreciation and reducing near-term tax payments. It does not improve operating cash flow. In leveraged properties, the benefit depends on whether reduced taxes outweigh increased debt service, reserves, and future taxable income once accelerated depreciation tapers off.

Is bonus depreciation still available for real estate and business assets?

Yes. As of current law, 100% bonus depreciation has been reinstated for qualifying property acquired and placed in service after the applicable 2025 effective date, with transitional rules for certain early-2025 assets. This makes front-loaded deductions more accessible, but it also increases the importance of sequencing, exit planning, and long-term cash flow modeling.

Why can aggressive tax strategies create cash flow problems?

Aggressive tax strategies often front-load deductions while pushing real cash obligations into later years. Leverage amplifies this risk by adding fixed costs such as interest, insurance, and reserves. When depreciation declines or debt terms change, taxable income can rise faster than available cash, creating liquidity pressure despite prior tax savings.

How does leverage change the risk of depreciation recapture?

Leverage does not increase recapture itself, but it reduces flexibility when recapture occurs. Accelerated depreciation lowers basis and increases potential ordinary income recapture on sale. High leverage can limit the ability to absorb the resulting tax without refinancing or selling under less favorable conditions.

Are leveraged tax strategies riskier in Florida?

Florida’s lack of state income tax reduces the marginal benefit of aggressive acceleration compared to high-tax states. At the same time, Florida investors face higher insurance volatility, climate-driven capital costs, and property tax differences between homestead and non-homestead property. These factors make liquidity and cash reserves more important when using leveraged tax strategies.

When does balancing tax savings against cash flow matter most?

This balance matters most when:

Using high leverage

Accelerating depreciation through cost segregation or bonus depreciation

Relying on refinancing to maintain liquidity

Operating in volatile cash flow environments such as short-term rentals

Planning for a sale, exchange, or ownership transition

In these situations, tax savings should be evaluated as part of a multi-year system, not a single-year result.

Can entity structure affect whether tax losses help cash flow?

Yes. Entity and ownership structure determine whether losses are currently usable, suspended, or limited by passive activity, basis, or at-risk rules. Losses that cannot offset current income may still reduce future taxes, but they do not improve current cash flow. Proper structuring aligns deductions with the income they are intended to offset.