Blog

When Front-Loaded Depreciation Creates Problems Later and How to Plan Around It

Front-loaded depreciation can create large early tax savings for real estate investors and business owners — but without proper timing and exit planning, it often leads to higher taxes later. This article explains when accelerated depreciation works, when it backfires, and how Florida investors can plan around recapture, declining bonus depreciation, and long-term ownership strategy.

How Mixed-Use Real Estate Can Shift Income, Deductions, and Risk Across Entities

Mixed-use real estate can shift income, deductions, and risk across entities in ways that materially affect long-term tax outcomes. This guide explains how high-income Florida investors and business owners can structure mixed-use properties for sustainable, multi-year tax efficiency.

Balancing Tax Savings Against Cash Flow in Highly Leveraged Strategies

Highly leveraged tax strategies can produce impressive deductions on paper while quietly straining liquidity over time. This article explains how high-income Florida taxpayers can balance tax savings against cash flow by sequencing depreciation, structuring leverage intentionally, and modeling exit and recapture consequences across multiple years.

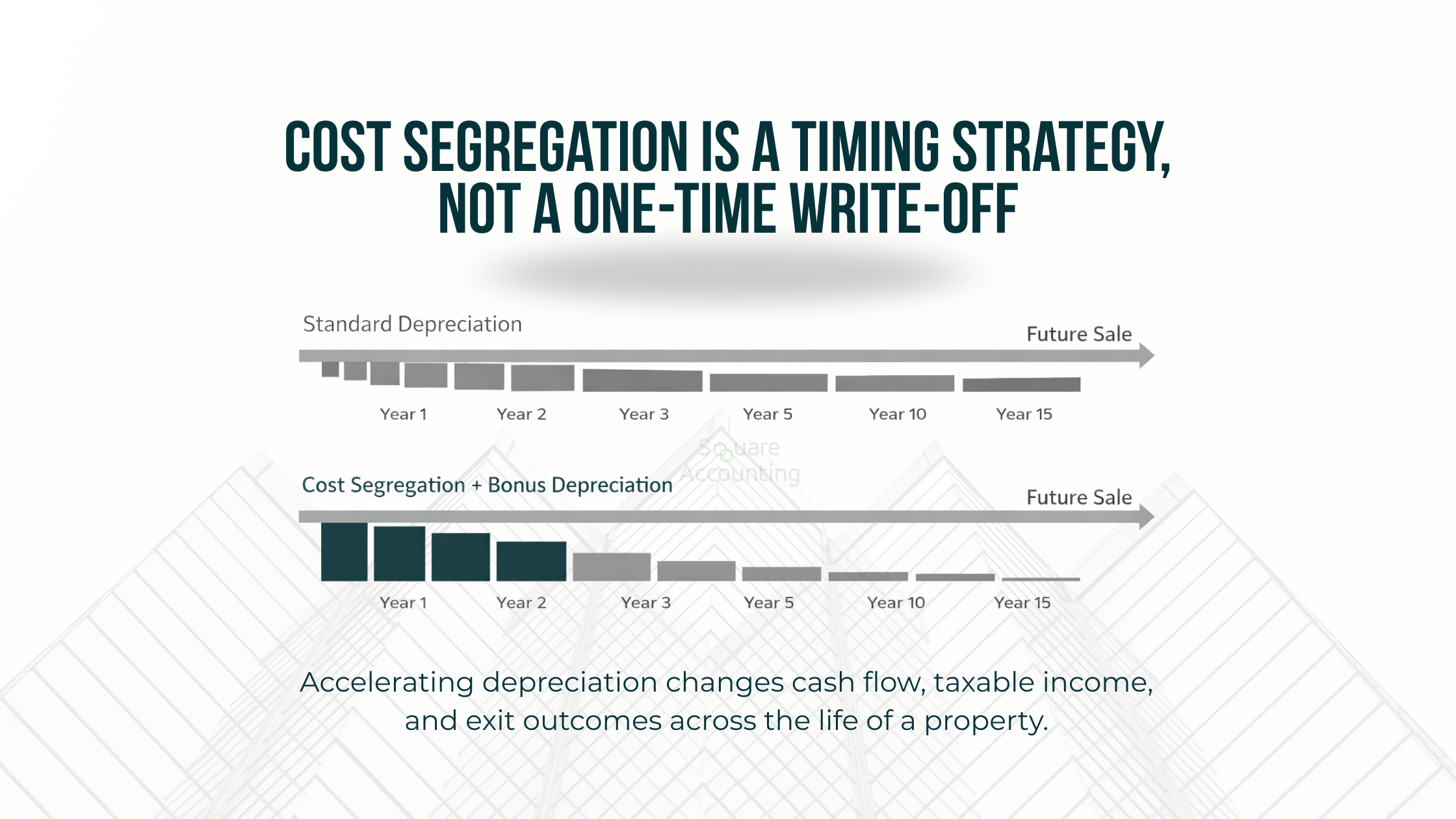

Cost Segregation as a Timing Tool, Not a One-Time Tax Play

Cost segregation is often pitched as a one-time tax savings strategy. In reality, it’s a timing decision that reshapes taxable income, cash flow, and exit outcomes over the life of a property—especially for high-income Florida investors.

Contact us

Talk to our Tax Advisor

Running your operations is demanding—your taxes shouldn’t add to the stress. Whether you need strategic tax planning or ongoing support, we’re here to help.