When Front-Loaded Depreciation Creates Problems Later and How to Plan Around It

For high-net-worth Florida taxpayers, accelerated depreciation strategies — such as cost segregation paired with bonus depreciation — are more than tax tactics. They are multi-year, multi-variable planning decisions with implications for cash flow, exit timing, entity design, and long-term returns.

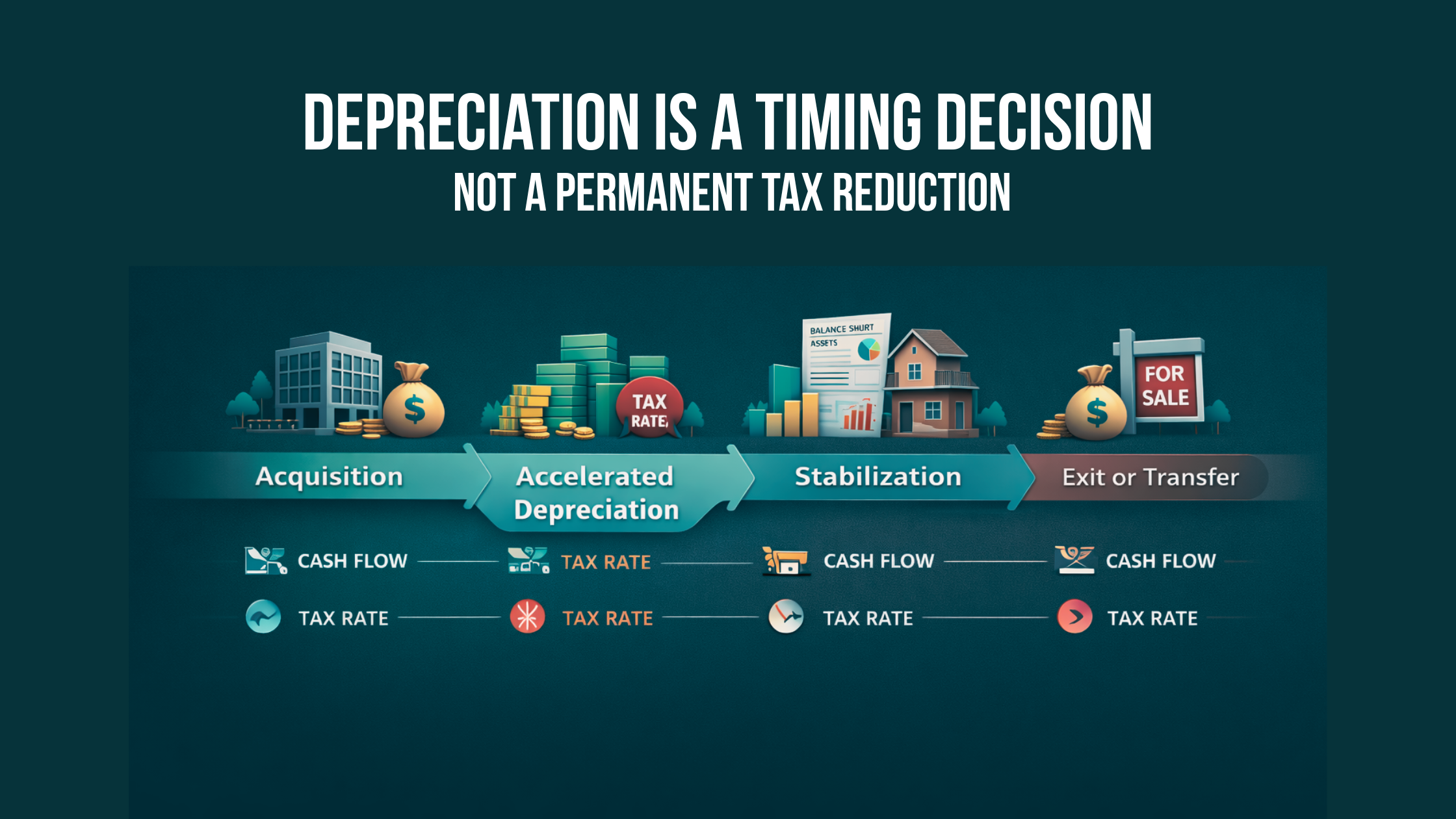

Many investors treat front-loaded depreciation as a “free deduction.” The truth is that all depreciation is timing: you defer tax now, but basis declines and future depreciation availability shrinks. Without sequencing across your entire investment lifecycle, you can inadvertently create higher future tax bills, cash flow mismatches, and exit friction.

In Florida, where there is no state income tax, federal timing errors show up with less buffer and more consequence. Good planning now avoids complications later.

Key Takeaways

Front-loaded depreciation moves taxes rather than eliminates them. The real economic impact depends on future income, exit timing, and entity structure.

Cost segregation and bonus depreciation must be integrated with a multi-year income and exit forecast, not treated as a one-off benefit.

Depreciation recapture risk is tied to when and how you exit — and many taxpayers underestimate its long-term impact.

Declining bonus depreciation rates in 2026 reduce the innate benefit of aggressive front-loading and heighten the need for sequencing.

Florida’s tax profile (no state income tax) increases the real value of strategic timing versus simple acceleration.

Entity design and ownership shifts can dramatically change who benefits from depreciation deductions and who bears future tax costs.

Confirm whether your depreciation strategy supports your long-term plan.

Understanding Front-Loaded Depreciation Beyond the Basics

What Front-Loaded Depreciation Really Does

Depreciation spreads the cost of an income-producing asset over its useful life. Accelerated methods (via cost segregation) or bonus depreciation allow a large portion of that cost to be deducted early, increasing cash flow in the near term. But front-loading is a timing shift — not a permanent elimination of tax.

Many guides fail to articulate the long-term basis effect: accelerated depreciation permanently reduces adjusted basis, increasing taxable gain on disposition and magnifying recapture exposure.

Bonus Depreciation Is Changing

Recent federal changes have dramatically transformed bonus depreciation. While past years offered near-100% bonus depreciation, 2026 sees much lower first-year expensing (e.g., around 20%). This shift makes acceleration less powerful and more situational.

That means the priority shifts from how much you can write off up front, to when and why that matters in your entire investment timeline.

Timing and Sequencing: The Strategic Core

The Mechanics of Timing

Depreciation timing affects:

Cash flow in early years

Taxable income across holding periods

Adjusted basis (and future gains)

Recapture exposure on disposition

Many articles talk about accelerated depreciation simply increasing cash flow. That’s true — but only in isolation. Real planning asks: Does this acceleration improve lifetime after-tax cash flow when weighted against future recapture and exit timing?

Holding Period Drives Outcomes

The impact of front-loaded depreciation inverts depending on holding period:

Short to mid-term holds (5–10 years) often see most depreciation benefits reversed via recapture at sale, reducing or even eliminating value.

Long-term holds or estate planning scenarios can preserve more depreciation value — especially if assets receive a stepped-up basis at death.

A strategy that looks optimal in year one may be suboptimal across a decade.

See how today’s depreciation decisions affect future tax, exit, and cash flow.

Cash Flow vs. Lifetime Tax Cost

Immediate Cash Flow Is Not Permanent Savings

Accelerated depreciation boosts early cash flow. But if that advantage comes at the cost of higher future tax, it’s a timing arbitrage, not real savings.

Sophisticated investors model:

Current versus future marginal tax rates

Projected income trajectories

Liquidity needs

Exit timing and method

Recapture effects

Immediate deductions are tempting. But without a long view, they can compress returns and restrict flexibility.

Recapture Isn’t a Surprise — It’s Predictable

Depreciation recapture is the mechanism by which the IRS reclaims part of your accelerated depreciation when property is sold. It’s not an audit penalty — it’s a predictable tax consequence.

The more depreciation you take early, the more taxable gain you’ll see on disposition (assuming sale proceeds exceed adjusted basis). Recapture on real estate is often taxed at a blend of unrecaptured section 1250 and capital gains rates.

Cost Segregation: Planning Tool, Not Tax Hack

When Cost Segregation Adds Strategic Value

Cost segregation breaks property cost into shorter depreciation lives (e.g., 5, 7, or 15 years) to accelerate deductions compared to straight-line depreciation (27.5 or 39 years).

It adds value when:

Income is high and expected to decrease

Holdings are long enough to absorb depreciation timing

Exit and estate plans are in place

Entity structure allows effective deduction use

When It Doesn’t

Cost segregation alone can create problems if:

You sell sooner than planned

Passive activity rules limit use of deductions

Entity structure misaligns benefits among owners

You relied on obsolete bonus depreciation assumptions

In 2026’s reduced bonus depreciation environment, aggressive front-loading is less universally beneficial.

Active vs. Passive Treatment

Whether depreciation offsets active income matters — but only after timing and sequencing.

For real estate, passive activity rules often limit current utilization. High-income professionals with real estate professional status have more flexibility, but many competitors gloss over the nuanced ways this interacts with accelerated depreciation and recapture.

Entity and Ownership Structure Implications

Entity choice determines:

Who receives depreciation benefits

Who bears future tax costs

How exit builds or reduces basis

How ownership changes affect allocations

Failing to align entity design with depreciation strategy can strand value in the wrong partner or force unwanted tax outcomes.

Common Strategic Errors by Investors

Sophisticated investors still make avoidable mistakes:

Over-accelerating depreciation in peak earnings years without modeling future tax rates.

Ignoring how declining bonus depreciation affects long-term benefits.

Failing to link depreciation decisions with planned exit tactics.

Treating federal strategies as if state tax doesn’t matter — in Florida, it does because there is no state tax buffer.

Florida-Specific Considerations

No State Income Tax Changes the Math

Florida taxpayers feel the full force of federal timing decisions because there’s no state tax offset. That amplifies depreciation timing risk and reward.

Real Estate Concentration and Volatility

Florida’s real estate market includes short-term rentals, hurricane risk, and insurance volatility — all factors that influence holding periods and liquidation timing. Depreciation planning must factor these realities into exit scenarios.

Property Tax and Insurance Realities

Property tax strategies (e.g., homestead vs. non-homestead) and rising insurance costs can affect overall returns. Cash flow enhanced by depreciation must be balanced against these ongoing expenses and risk considerations.

Federal-focused planning designed for Florida investors and business owners.

Conclusion

Front-loaded depreciation isn’t inherently detrimental — it’s powerful when sequenced intelligently within a multi-year tax and investment plan.

The real question isn’t how much you can deduct today, but how your depreciation strategy affects liquidity, flexibility, recapture risk, and lifetime after-tax return. In Florida’s federal-tax-dominant environment, that planning discipline is not optional.

Sophisticated investors think not in single tax years, but in lifecycle outcomes. When depreciation acceleration is part of that broader strategy, it enhances returns. When it’s tactical and isolated, it often creates problems — problems that show up when you need cash flow, flexibility, and clean exit outcomes most.

Align depreciation, entity structure, and exit strategy before decisions become locked in.

Frequently Asked Questions About Front-Loaded Depreciation

What is front-loaded depreciation in tax planning?

Front-loaded depreciation refers to strategies that accelerate tax deductions into the earlier years of an asset’s life instead of spreading them evenly over time. Common examples include cost segregation for real estate and bonus depreciation for qualifying assets.

While these strategies increase early-year cash flow, they do not increase total depreciation. They shift deductions forward, reducing future depreciation and increasing the importance of exit and recapture planning.

Is front-loaded depreciation always a good strategy?

No. Front-loaded depreciation is highly situational.

It works best when:

Income is high and expected to decline

Assets will be held long enough to manage recapture

Exit strategies are planned in advance

Entity structure allows efficient use of losses

It can create problems when assets are sold sooner than expected, income drops unexpectedly, or depreciation decisions are made without modeling long-term outcomes.

How does front-loaded depreciation affect depreciation recapture?

Front-loaded depreciation increases depreciation recapture exposure because it reduces adjusted basis more quickly. When the asset is sold, prior depreciation may be taxed at ordinary income or special recapture rates rather than capital gains rates.

The more depreciation taken upfront, the larger the portion of gain potentially subject to recapture. This is why depreciation decisions should be coordinated with holding period assumptions and exit planning.

Does bonus depreciation still exist in 2026?

Yes, but it is significantly reduced.

Bonus depreciation is no longer 100 percent. It has been phasing down annually and is now a much smaller percentage of qualifying assets. This change makes aggressive front-loading less universally beneficial and increases the importance of timing, sequencing, and long-term modeling.

Tax strategies that worked when bonus depreciation was near full expensing may no longer produce the same results.

How is cost segregation related to front-loaded depreciation?

Cost segregation is one of the primary tools used to create front-loaded depreciation in real estate. It reclassifies components of a property into shorter depreciation lives, accelerating deductions into earlier years.

Cost segregation can be effective, but only when integrated with income planning, entity structure, and exit strategy. Used in isolation, it often increases future tax friction rather than improving lifetime returns.

Can front-loaded depreciation increase taxes later?

Yes. This is one of the most misunderstood aspects.

Front-loaded depreciation often reduces taxes in early years but increases taxable income later through:

Reduced future depreciation

Higher taxable gain on sale

Depreciation recapture

If income is lower or flexibility is reduced in later years, the net tax cost can be higher than if depreciation had been taken more evenly.

How does front-loaded depreciation affect real estate investors differently than business owners?

For real estate investors, front-loaded depreciation is heavily influenced by:

Passive activity rules

Real estate professional status

Holding period and exit strategy

For business owners, accelerated depreciation on equipment and fixed assets interacts more directly with operating income, business sales, and ownership changes.

In both cases, the core issue is the same: depreciation timing must align with income timing and exit planning.

Is front-loaded depreciation more risky for short-term real estate holds?

Yes. Shorter holding periods increase the likelihood that early depreciation benefits are reversed through recapture when the property is sold.

Value-add investors, short-term rental operators, and opportunistic buyers often underestimate how quickly exit timelines compress. Front-loaded depreciation is generally less effective when assets are held for fewer years.

How does Florida’s no state income tax affect depreciation planning?

Florida’s lack of state income tax increases reliance on federal tax outcomes. There is no state-level deduction to offset federal timing errors.

As a result, Florida taxpayers feel the full impact of depreciation sequencing decisions. This makes long-term modeling more important than in high-tax states where state deductions partially cushion federal volatility.

Should depreciation strategy be coordinated with entity structure?

Absolutely.

Entity and ownership structure determine:

Who receives depreciation benefits

Who bears future recapture

How gains are allocated on exit

Whether losses can be used efficiently

Misalignment between depreciation strategy and entity structure is one of the most common causes of avoidable tax friction for high-income investors and business owners.

Can front-loaded depreciation be reversed or corrected later?

In most cases, no.

Once depreciation is claimed, basis is reduced. While some accounting method changes are possible, they rarely undo the economic effects of early depreciation. This is why depreciation decisions should be made with a multi-year perspective before the first deduction is taken.

What is the biggest mistake high-income taxpayers make with front-loaded depreciation?

The most common mistake is treating depreciation as a one-year tax reduction instead of a lifetime planning decision.

High earners often focus on maximizing deductions in peak income years without modeling future income, exit timing, recapture exposure, or changes in tax law. The result is short-term relief followed by long-term constraints.