How Mixed-Use Real Estate Can Shift Income, Deductions, and Risk Across Entities

For high-income Florida taxpayers, mixed-use real estate is rarely about square footage or cap rates alone. It is a structural decision that affects how income is classified, where deductions land, and which entities absorb risk over decades.

Most discussions of mixed-use real estate focus narrowly on depreciation or cost segregation. That framing misses the real issue. For business owners and investors earning $250,000 or more, the real leverage comes from how mixed-use assets interact with entity structure, income timing, passive activity rules, and exit planning.

This is not a transactional decision. It is a long-term planning choice that influences tax efficiency, balance sheet risk, and flexibility long after the property is placed in service.

Key Takeaways

Mixed-use real estate allows income and deductions to be intentionally distributed across entities, changing how income is taxed over time.

Entity structure determines whether depreciation offsets active income, passive income, or simply accelerates future recapture.

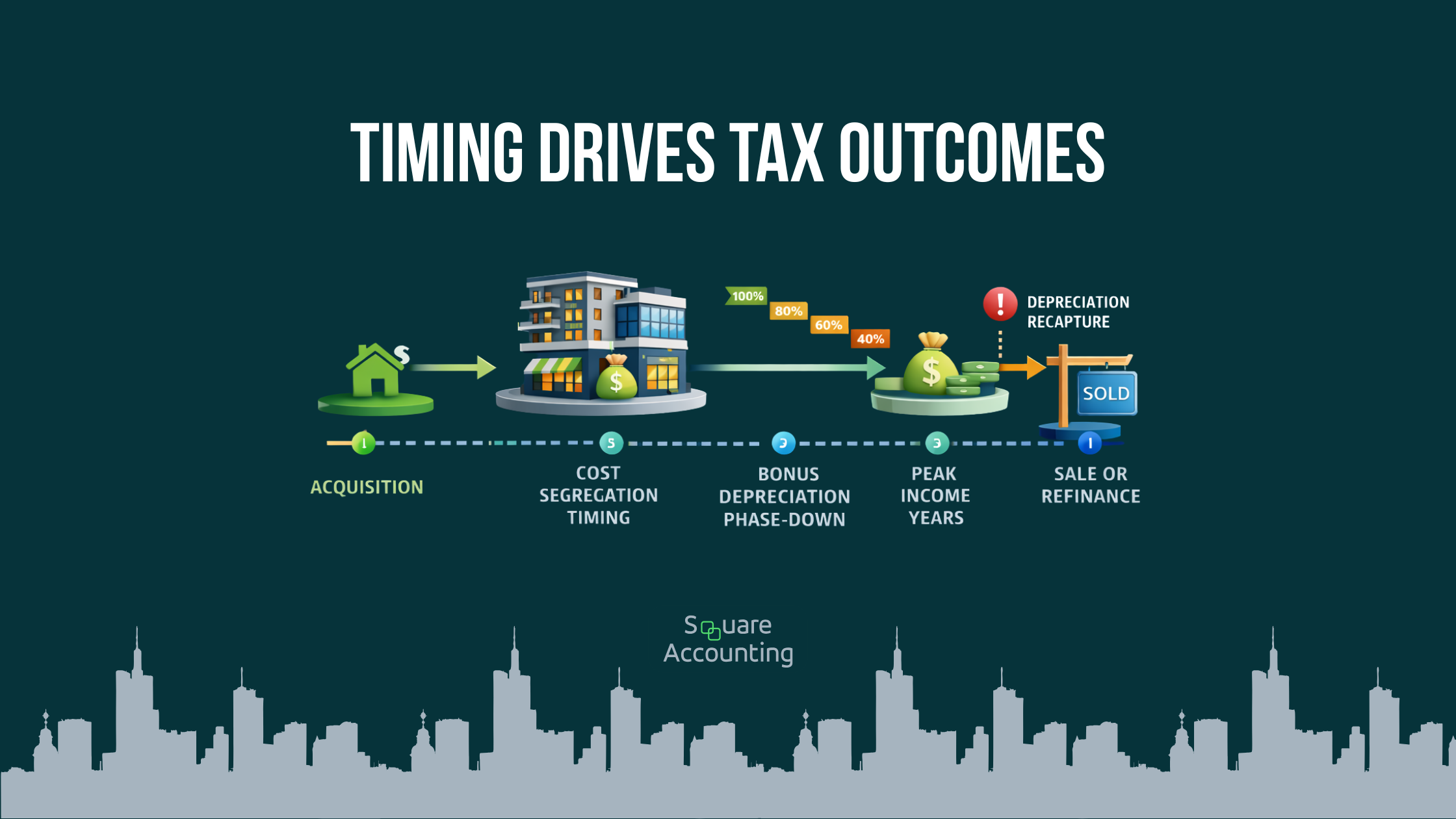

Timing and sequencing of use, ownership, and depreciation often matter more than the size of the deduction itself.

Cost segregation and bonus depreciation are planning tools, not standalone strategies, and can create future tax friction if misapplied.

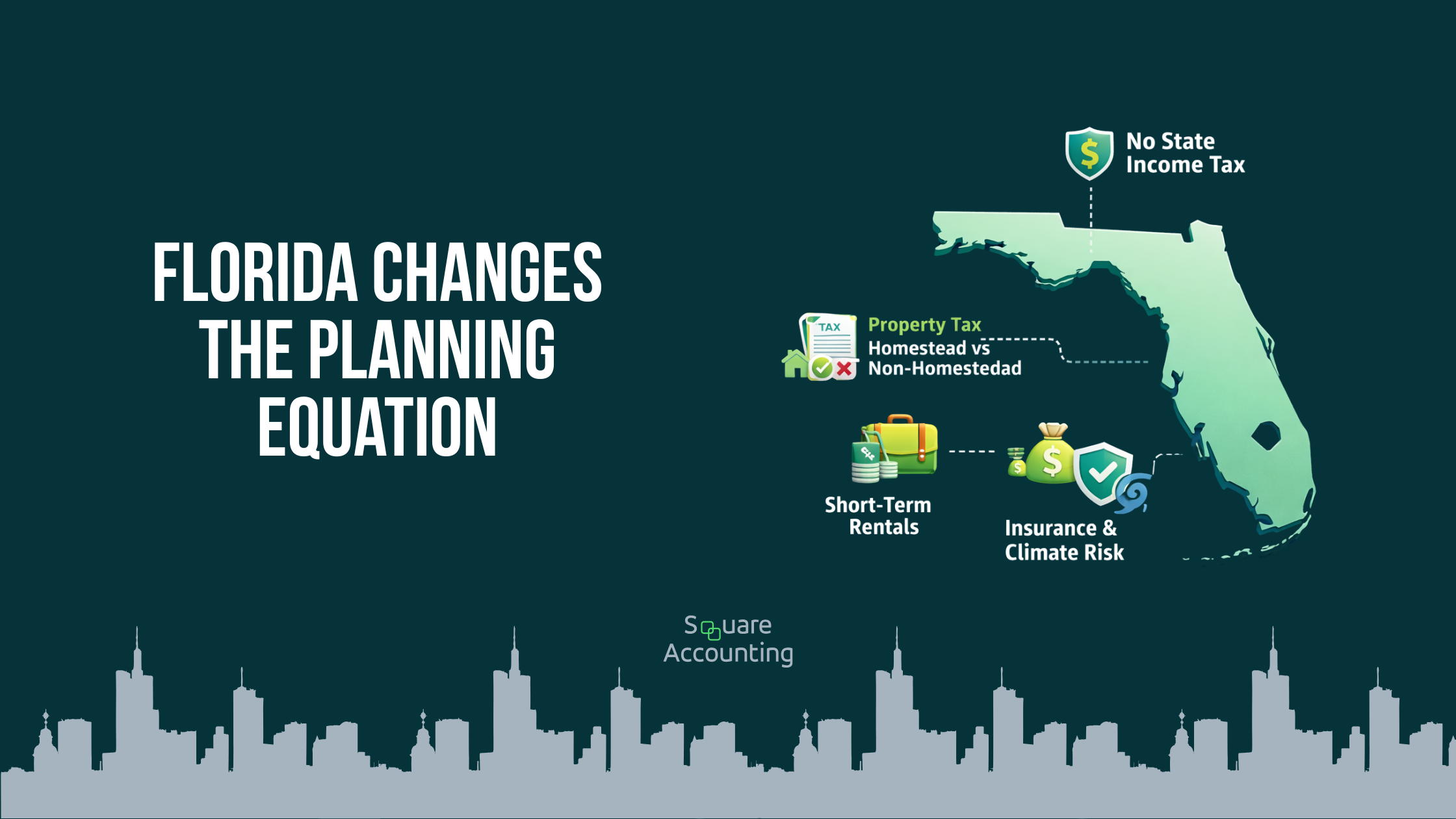

Florida’s tax environment increases the importance of property taxes, insurance exposure, and asset protection over state income tax arbitrage.

Evaluating a mixed-use property? Early structure decisions shape tax outcomes for years.

Why Mixed-Use Real Estate Changes the Tax Conversation

Mixed-use real estate blurs traditional tax categories. A single property may generate residential rental income, commercial lease income, and operating income tied to an active business.

Each income stream follows different tax rules. Some may be passive. Some active. Some eligible for depreciation that offsets ordinary income, others not. The planning opportunity lies in deciding which entity earns which income and owns which assets.

High earners often assume the building itself is the planning lever. In reality, the ownership and use layers create most of the tax impact.

Income Characterization: Active, Passive, and Portfolio Effects

One of the most overlooked aspects of mixed-use planning is income characterization.

Rental income is generally passive unless material participation thresholds are met.

Operating income from a business using the property is typically active.

Lease payments between related entities can shift income from operating companies into real estate entities when structured and priced correctly.

This matters because passive losses cannot automatically offset active income. Many high earners accumulate depreciation that looks valuable on paper but sits unused for years.

Effective planning aligns income streams with existing loss capacity, not just with ownership convenience.

Deductions Follow Structure, Not Intent

Depreciation, interest, repairs, and operating costs follow the entity that owns the asset and the way each portion is used.

In mixed-use properties, this often means deductions are fragmented across entities. That fragmentation can either enhance or dilute their value.

Cost segregation frequently enters the conversation here. Accelerating depreciation can improve early-year cash flow, but only if the deductions can actually be used. With bonus depreciation continuing to phase down (40 percent in 2025 and scheduled to drop further unless extended), the planning emphasis has shifted from acceleration at all costs to placement and timing.

The wrong structure can turn powerful deductions into deferred benefits with significant recapture exposure.

Entity Structure as a Tax and Risk Management Tool

Entity design is where tax planning and risk management intersect.

Separating real estate from operating businesses can protect assets from operating liabilities, but it also determines:

Whether income is active or passive

Whether depreciation offsets current income

How gains are taxed on sale

How losses are released or trapped

Florida investors often underestimate this interaction because state income tax is not part of the equation. That makes federal characterization, liability exposure, and insurance economics more important, not less.

A structure that looks tax-efficient but concentrates operational risk can undermine long-term wealth preservation.

Entity structure affects both taxes and liability. Fixing it later is rarely simple.

Timing and Sequencing: The Missing Layer in Most Planning

Most articles treat mixed-use planning as static. In reality, timing drives outcomes.

When a portion of the property is placed in service, converted, or leased to a related entity can change depreciation schedules, loss usability, and audit exposure.

Sequencing also affects retirement planning. Depreciation that offsets peak earning years can improve lifetime tax efficiency far more than deductions taken during low-income years.

The best structures anticipate income changes, business exits, and property dispositions before they occur.

Cash Flow Versus Long-Term Tax Efficiency

Accelerated deductions improve early cash flow but often reduce after-tax proceeds on exit through depreciation recapture.

For investors planning to refinance, sell, or convert use, this trade-off must be modeled upfront. A structure that maximizes deductions early may reduce flexibility later.

Sustainable planning often prioritizes after-tax lifetime cash flow, not just early-year tax savings.

Exit Planning and Recapture Exposure

Every mixed-use structure embeds an exit outcome.

When properties sell, entities unwind, or use changes, prior tax decisions resurface. Depreciation recapture, gain recharacterization, and passive loss release can dramatically alter expected results.

Related-party leases and internal allocations must be defensible and consistent from the beginning. Retroactive cleanup is rarely effective and often expensive.

Exit planning should be part of acquisition planning, not an afterthought.

If exit planning wasn’t built in, recapture and reclassification can reduce returns.

Where These Strategies Break Down or Require Caution

Mixed-use planning is not universally beneficial.

It requires:

Sufficient and predictable income

Long-term ownership horizons

Administrative discipline

Willingness to maintain clean entity separation

High earners often overcomplicate structures without considering compliance costs, audit exposure, or loss limitations. In volatile income situations or short holding periods, simplicity often outperforms complexity.

Florida-Specific Planning Considerations

Florida’s lack of state income tax changes the emphasis of mixed-use planning.

Property taxes matter more, particularly the distinction between homestead and non-homestead treatment. Short-term rental activity introduces operational, regulatory, and insurance considerations that influence entity design.

Climate risk, casualty planning, and insurance availability also play a larger role than in many other states. Entity separation can affect not only tax outcomes but also coverage availability and claim containment.

Because Florida real estate is often held long-term and appreciates significantly, exit and recapture planning deserve more attention than in high-tax states where annual savings dominate the analysis.

Conclusion

Mixed-use real estate is not a tactic. It is a structural planning decision that reshapes how income, deductions, and risk move across entities over time.

When aligned with long-term income patterns, entity design, and exit strategies, it can materially improve after-tax outcomes. When approached piecemeal, it often creates deferred problems that surface years later.

For high-income Florida taxpayers, the real advantage lies in planning, sequencing, and customization, not in chasing deductions. Mixed-use real estate works best when it is integrated into a broader, multi-year tax strategy rather than treated as a standalone opportunity.

Mixed-use real estate works best as part of a multi-year tax plan.

Frequently Asked Questions

How is mixed-use real estate taxed?

Mixed-use real estate is taxed based on how each portion of the property is used and owned, not as a single uniform asset. Residential, commercial, and operational components are treated separately for depreciation, expense allocation, and income characterization. The tax result depends heavily on entity structure, ownership percentages, and whether income is active or passive.

Can depreciation from mixed-use property offset business income?

Sometimes, but not automatically. Depreciation from mixed-use real estate generally creates passive losses, which cannot offset active business income unless specific exceptions apply. Entity design, material participation, and income alignment determine whether depreciation produces current tax savings or deferred losses.

Does cost segregation work on mixed-use properties?

Yes, cost segregation can be applied to mixed-use properties, but only to the qualifying components. The benefit depends on timing, income levels, and long-term plans. With bonus depreciation continuing to phase down, cost segregation is most effective when integrated into a broader, multi-year tax strategy rather than used as a standalone tactic.

Should mixed-use real estate be owned separately from the operating business?

In many cases, yes, but not always. Separating ownership can improve asset protection and income characterization, but it also affects loss utilization, exit taxation, and compliance complexity. The optimal structure balances tax efficiency, liability exposure, and long-term flexibility, not just short-term deductions.

How does mixed-use real estate affect passive activity loss rules?

Mixed-use properties often generate both passive and active income streams across entities. Losses follow the activity that generates them, not the taxpayer’s overall income level. Without proper planning, high earners may accumulate significant passive losses that cannot be used until sale or disposition.

What happens to depreciation when a mixed-use property is sold?

Depreciation previously claimed is generally subject to depreciation recapture, which can be taxed at higher federal rates than long-term capital gains. Poor planning can shift what appears to be capital gain into ordinary income on exit. This is why exit modeling is critical at acquisition, not just at sale.

Does Florida’s lack of state income tax change mixed-use planning?

Yes. Without state income tax, the value of mixed-use planning shifts toward federal tax efficiency, property tax treatment, insurance exposure, and asset protection. Florida investors must also account for homestead rules, short-term rental considerations, and climate-driven risk when designing entity structures.

Is mixed-use real estate a good strategy for high-income taxpayers?

It can be, but only when aligned with income stability, long-term ownership goals, and disciplined entity management. For high earners, mixed-use real estate works best as part of a coordinated tax plan that considers timing, exit strategy, and risk, not as a one-year deduction play.