Buying Assets Inside the Operating Company vs a Holding Entity: Tax Outcomes Over 10+ Years

High-income Florida taxpayers rarely fail because they missed a deduction. They fail because they locked assets into the wrong place early and paid for it years later through lost flexibility, excess recapture, or constrained exits.

For business owners earning $250k+, real estate investors with layered entities, and professionals building long-term wealth, the question is not whether an asset is deductible. The real question is where that asset should live over the next decade or longer and how that decision affects cash flow, risk, depreciation, and exit strategy.

Buying assets inside the operating company versus a separate holding entity is not a mechanical tax choice. It is a multi-year structural decision with consequences that most articles oversimplify or ignore entirely.

Key Takeaways

Asset ownership decisions create delayed tax consequences that often surface at sale, not purchase.

Operating-company ownership can optimize near-term deductions but often limits exit and restructuring options.

Holding entities support cleaner exits, stronger liability isolation, and more sustainable tax planning.

Depreciation strategies only work when coordinated with income type, entity purpose, and timing.

Florida’s no state income tax shifts the analysis toward federal exposure, asset protection, and cash flow durability.

The “right” structure depends on how and when you plan to monetize the asset, not how fast you can write it off.

If you’re acquiring assets or restructuring entities in the next 12–24 months, this decision is easiest to optimize before anything is purchased.

The Strategic Question Most Articles Miss

Most content frames this topic as a binary tax comparison. That framing is incomplete.

The real question is:

How do we want income, depreciation, liability, and exit value to behave over time?

Assets are not passive. Where they sit determines:

Who absorbs depreciation and when

Whether losses are active or passive

How much flexibility exists at sale or recapitalization

How exposed the asset is to operational risk

This is why asset placement belongs in asset-based tax planning, not deduction-driven decision-making.

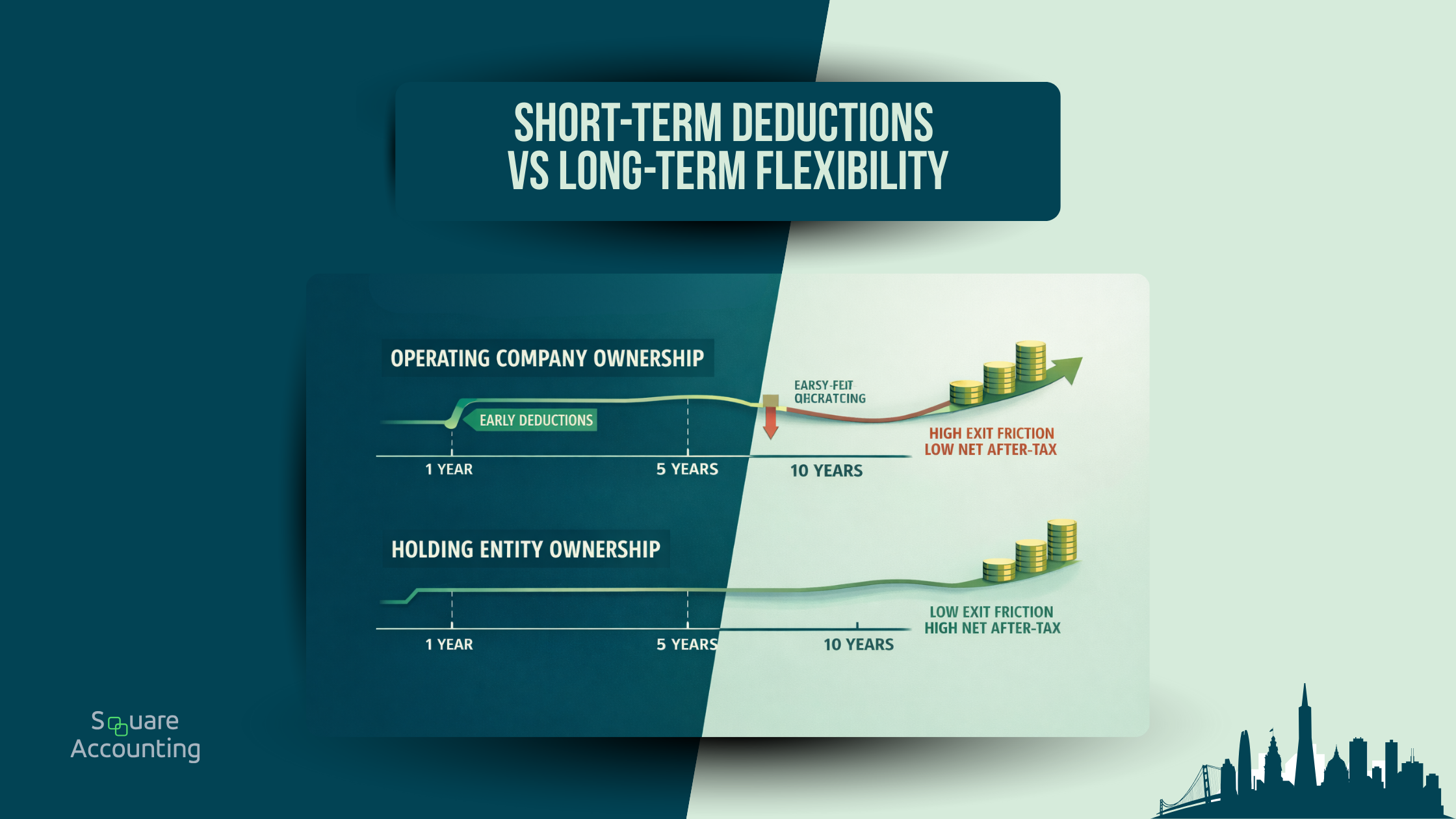

Operating Company Ownership: Efficient Early, Expensive Later

Placing assets directly inside the operating company is common, easy, and often defensible in the short run.

When It Can Make Sense

The business generates consistent, high ordinary income

The asset is operationally inseparable from the business

There is no anticipated partial exit or real estate separation

Depreciation is intended to offset near-term operating income

In these scenarios, accelerated depreciation or cost segregation can meaningfully improve short-term cash flow.

Long-Term Trade-Offs That Are Often Ignored

Depreciation recapture at exit

Accelerated depreciation does not disappear. When the asset or business is sold, recapture can convert years of tax savings into ordinary income exposure, often at the worst possible time.

Reduced buyer appeal

Buyers frequently want the operating business, not embedded real estate or heavy fixed assets. When assets are trapped inside the operating entity, deal structure becomes harder and pricing pressure increases.

Risk concentration

Operational liabilities, employees, contracts, and assets all sit in one entity. In Florida, where insurance costs and casualty exposure are persistent realities, this concentration matters.

Loss utilization constraints

Real estate losses inside an operating company do not automatically behave like standalone rental losses. Misalignment between income type and depreciation can limit real-world benefit.

Holding Entity Ownership: Slower Upfront, Stronger Over Time

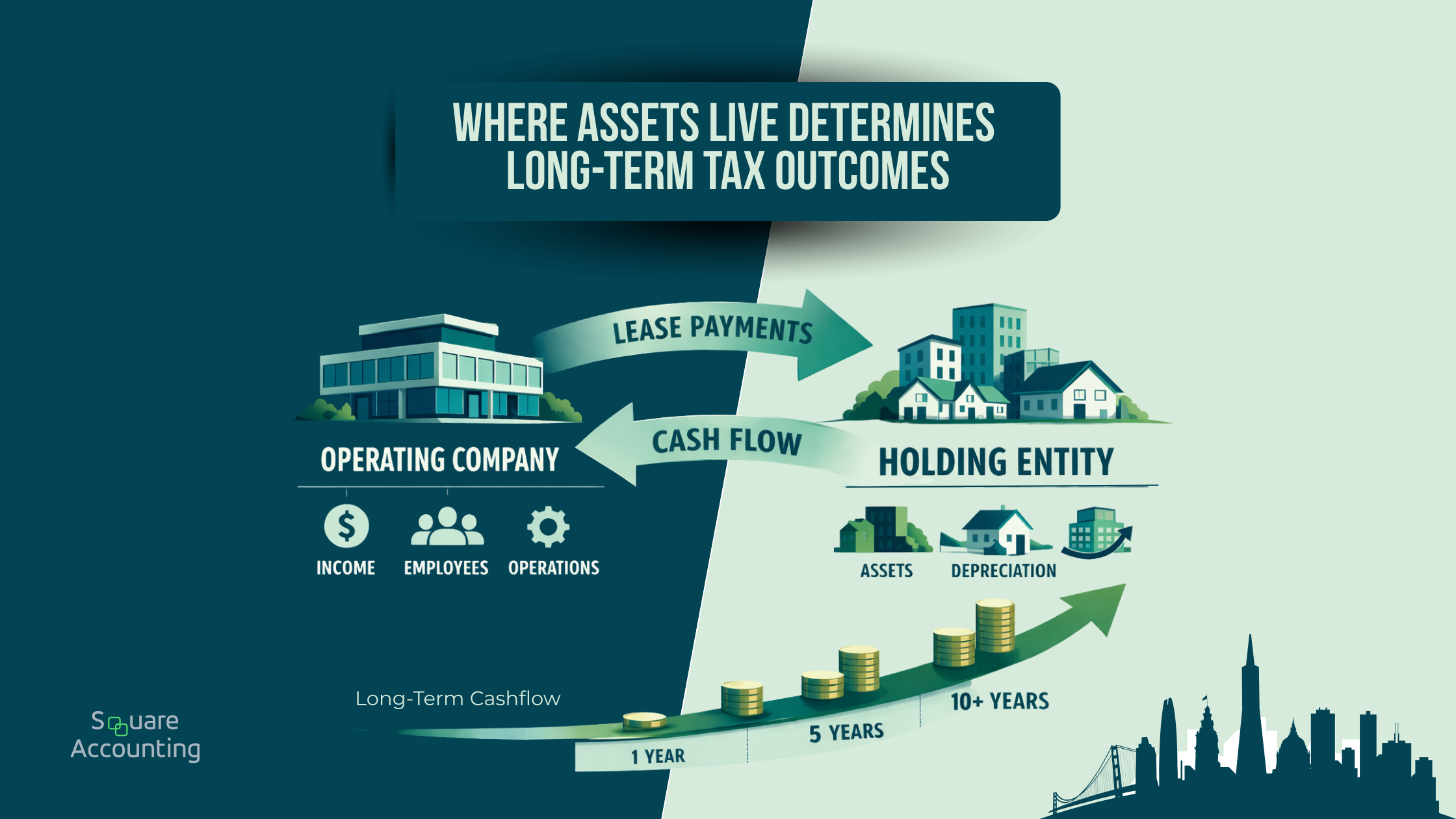

A holding entity owns the asset and leases it to the operating company at arm’s length.

Why Sophisticated Taxpayers Use This Structure

Cleaner income separation

Operating income stays operational. Rental income and depreciation stay with the asset. This clarity improves planning and audit defensibility with the Internal Revenue Service.

Exit flexibility

You can sell the operating company, refinance the real estate, or retain the asset while changing operators. That flexibility compounds in value over time.

Liability insulation

Asset ownership is isolated from operational risk. In Florida, this is often driven as much by insurance economics as by tax considerations.

Depreciation deployed with intent

Cost segregation and accelerated depreciation still apply, but now as part of a coordinated plan across income sources, not a one-off tactic.

Timing and Sequencing: Where Most Planning Breaks Down

The most costly errors are rarely structural alone. They are timing failures.

Common examples we see:

Assets acquired inside an operating company with no exit modeling

Aggressive depreciation taken without forecasting income declines

Attempted restructures years later that trigger unnecessary tax

Lease arrangements that are informal or mispriced, creating exposure on audit

Once depreciation has been claimed and time has passed, optionality narrows. Fixing the structure later is usually far more expensive than getting it right upfront.

If assets are already inside your operating company, the question isn’t whether that’s “right” or “wrong.” It’s whether the current structure still supports your long-term exit and tax goals.

Situations That Require Caution or Don’t Work Well

This strategy is not universal.

It requires restraint when:

Operating income is volatile and cannot support consistent lease payments

Passive losses cannot be effectively absorbed

Assets are expected to be sold in the short term

Entity structures become complex without proportional benefit

Structure should reduce friction, not create it.

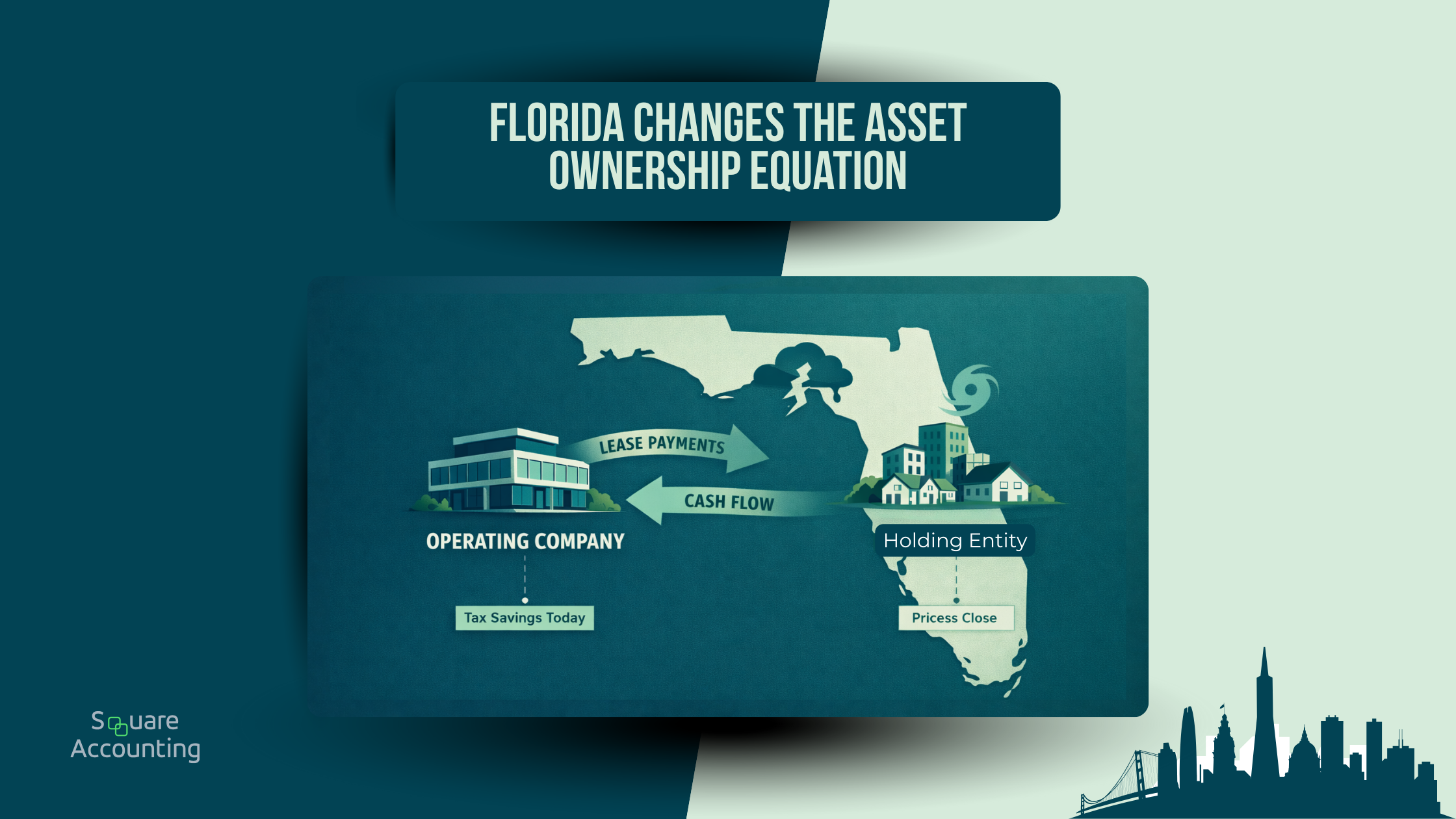

Florida-Specific Planning Considerations

Florida removes state income tax from the equation, but that does not simplify the decision. It shifts the weight elsewhere.

Federal taxes dominate outcomes

Without state arbitrage, depreciation timing, recapture planning, and capital gains strategy matter more.

Real estate concentration risk

Florida taxpayers often hold a disproportionate share of wealth in property. Entity separation helps preserve optionality and diversification.

Property tax realities

Business and investment property does not benefit from homestead protections. Ownership structure can influence long-term carrying costs.

Insurance and casualty exposure

Storm risk, rising premiums, and coverage constraints make liability separation a structural necessity, not a theoretical one.

Florida’s tax environment changes how asset ownership decisions compound over time. A structure that works in one state may quietly underperform here.

Reframing the Decision

Buying assets inside the operating company versus a holding entity is not about maximizing this year’s write-offs. It is about engineering how income, risk, and taxes unfold over decades.

For high-income Florida taxpayers, the optimal structure:

Aligns depreciation with sustainable income

Preserves exit and refinancing flexibility

Anticipates recapture rather than ignoring it

Integrates business operations with long-term wealth planning

This decision works best when it is intentional, sequenced, and customized. Not reactive. Not trendy. And never driven by a single tax year.

Long-term tax outcomes are rarely about a single entity choice. They’re the result of sequencing, ownership design, and exit planning working together.

Frequently Asked Questions

Should I buy real estate inside my operating company or a separate LLC?

For high-income taxpayers, buying real estate inside the operating company often creates long-term limitations, even if it produces short-term tax savings. A separate holding entity typically offers better liability isolation, exit flexibility, and depreciation planning, especially when the operating business may be sold independently in the future. The correct choice depends on how long you plan to hold the asset, how you expect to exit, and how the income will be used over time.

What are the tax advantages of using a holding company for assets?

A holding company allows depreciation, cost segregation, and rental income to be separated from operating income, which improves planning flexibility. Over a 10+ year horizon, this structure often reduces friction at exit, limits exposure to depreciation recapture inside the operating business, and provides more options for refinancing, partial sales, or succession planning.

Does owning assets in a separate entity reduce taxes?

Not automatically. A holding entity does not guarantee lower taxes in any single year. Its value comes from smoothing tax outcomes over time, aligning depreciation with the right income streams, and preserving options at sale or recapitalization. Poorly structured holding entities can actually increase complexity and cost without meaningful tax benefit.

How does depreciation work when assets are leased to my business?

When a holding entity owns the asset, it claims depreciation, while the operating company deducts lease payments as an ordinary business expense. Lease terms must be structured at arm’s length to withstand scrutiny from the Internal Revenue Service. This separation allows depreciation strategies to be planned independently of operating income volatility.

Is cost segregation better in an operating company or a holding entity?

Cost segregation can be effective in either structure, but it is often more sustainable inside a holding entity. When used inside an operating company, accelerated depreciation may increase future recapture exposure at business sale. In a holding entity, cost segregation can be coordinated with rental income, refinancing plans, and longer holding periods, improving overall after-tax results.

What happens when I sell the business if it owns the real estate?

If the operating company owns the real estate, the sale often becomes more complex. Buyers may discount value, request carve-outs, or require additional restructuring. Depreciation recapture and allocation issues can materially reduce after-tax proceeds. Separating assets into a holding entity typically provides more control over timing and structure at exit.

Does Florida’s lack of state income tax change this decision?

Yes, but not in the way many assume. Without state income tax, federal tax planning, depreciation timing, and exit strategy carry more weight. Florida taxpayers also face higher relevance around real estate concentration, insurance risk, and liability exposure, which often strengthens the case for separating assets from operations.

Can I move assets into a holding company later?

In most cases, moving assets after purchase triggers taxable events, including gain recognition or recapture. While certain restructures may be possible, they are often costly and limited. This is why entity and asset placement decisions should be made before acquisition, not corrected years later.

Is leasing assets from my own company allowed?

Yes, provided the lease is properly structured, priced at fair market value, and documented. Informal or underpriced leases are a common mistake and can create audit risk, income recharacterization, or lost deductions. Proper execution matters as much as the structure itself.

Who should consider advanced asset ownership planning?

This level of planning is most relevant for:

Business owners earning $250k+ annually

Real estate investors with multiple properties or entities

Professionals planning for a future sale, retirement, or generational transfer

Florida taxpayers with significant real estate or fixed-asset exposure

For these groups, asset placement decisions often outweigh single-year tax strategies in long-term impact.