Blog

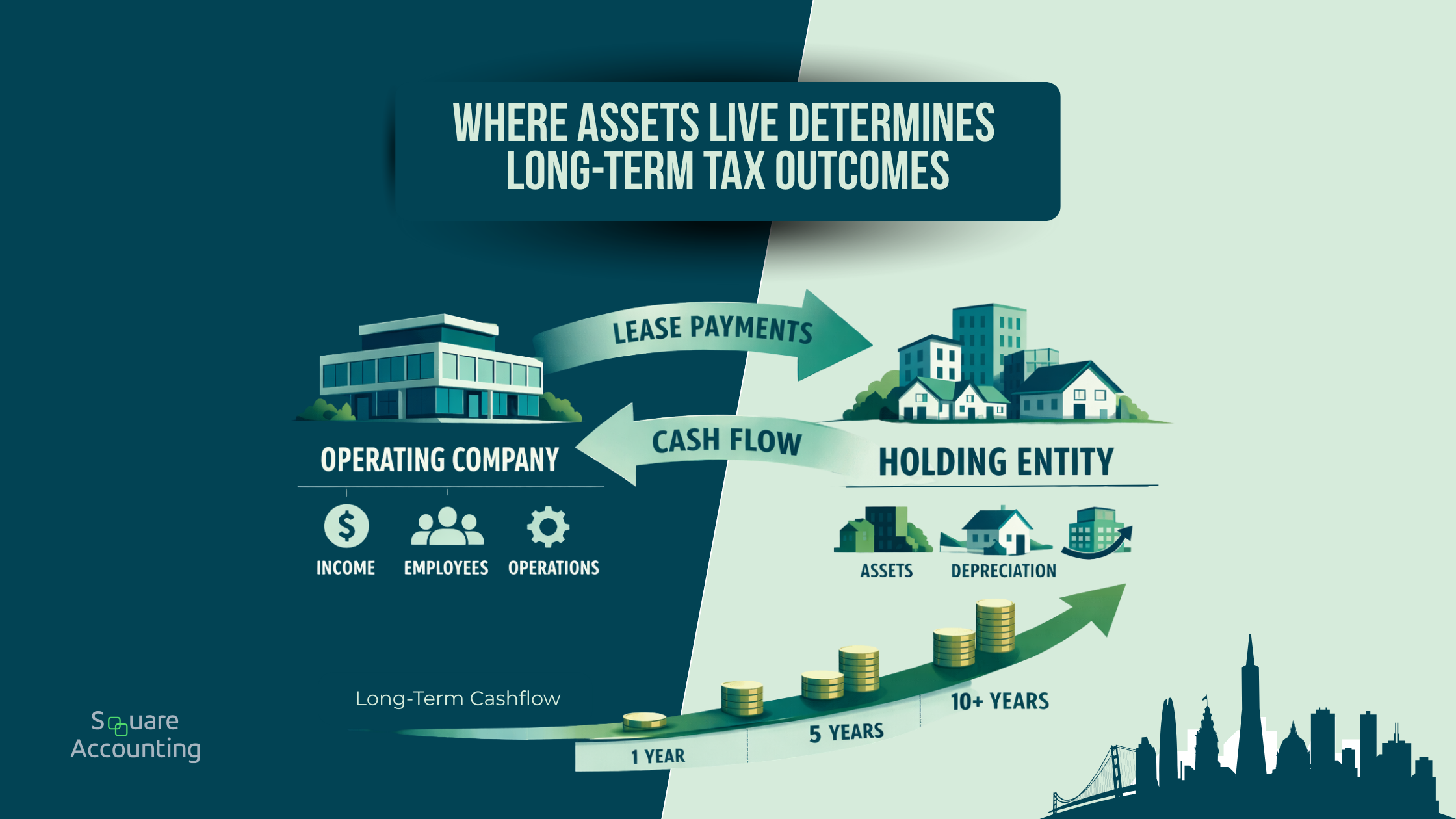

Buying Assets Inside the Operating Company vs a Holding Entity: Tax Outcomes Over 10+ Years

Buying assets inside an operating company or a separate holding entity can quietly shape tax outcomes for decades. For high-income Florida taxpayers, the real impact shows up at exit, not acquisition. This guide explains how asset placement decisions compound over 10+ years and how to structure them strategically.

Contact us

Talk to our Tax Advisor

Running your operations is demanding—your taxes shouldn’t add to the stress. Whether you need strategic tax planning or ongoing support, we’re here to help.