Advanced Tax Planning Without Crossing the Line: Documentation, Intent, and Substance

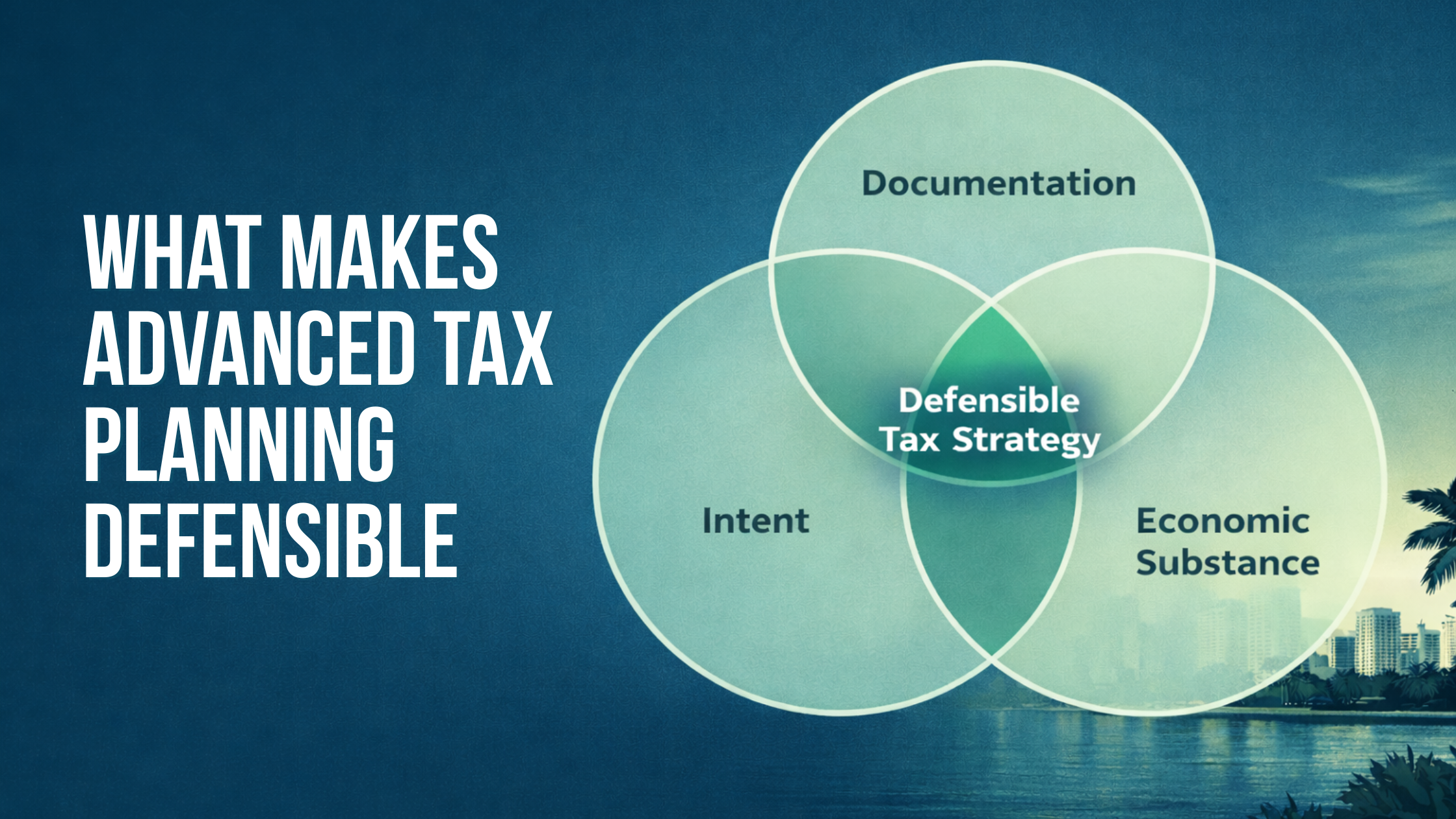

For high-income Florida taxpayers, advanced tax planning is no longer about finding another deduction. It is about building strategies that survive time, scrutiny, and transition. As income, asset complexity, and transaction size increase, the difference between effective planning and costly mistakes is rarely technical eligibility. It is documentation, intent, and economic substance.

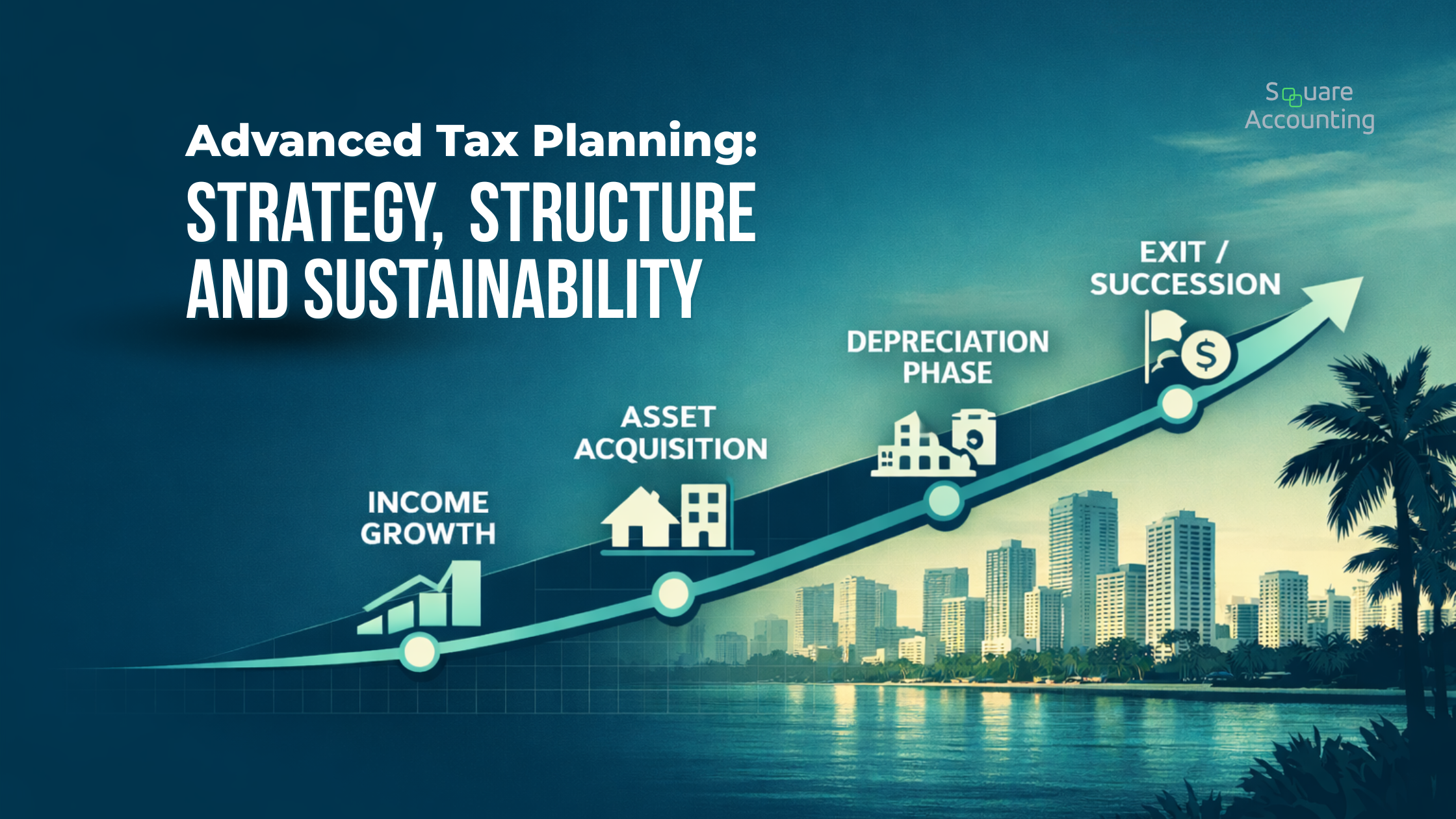

Most tax strategies fail not because they were illegal, but because they were incomplete. They were implemented without sequencing, without exit modeling, or without aligning the tax position to real economic behavior. For business owners, real estate investors, and professionals earning $250,000 or more, advanced tax planning is a long-term discipline, not a single-year optimization exercise.

Key Takeaways

Advanced tax planning is evaluated over multiple years, not by isolated annual tax savings.

Documentation and economic substance determine whether strategies withstand audits and exits.

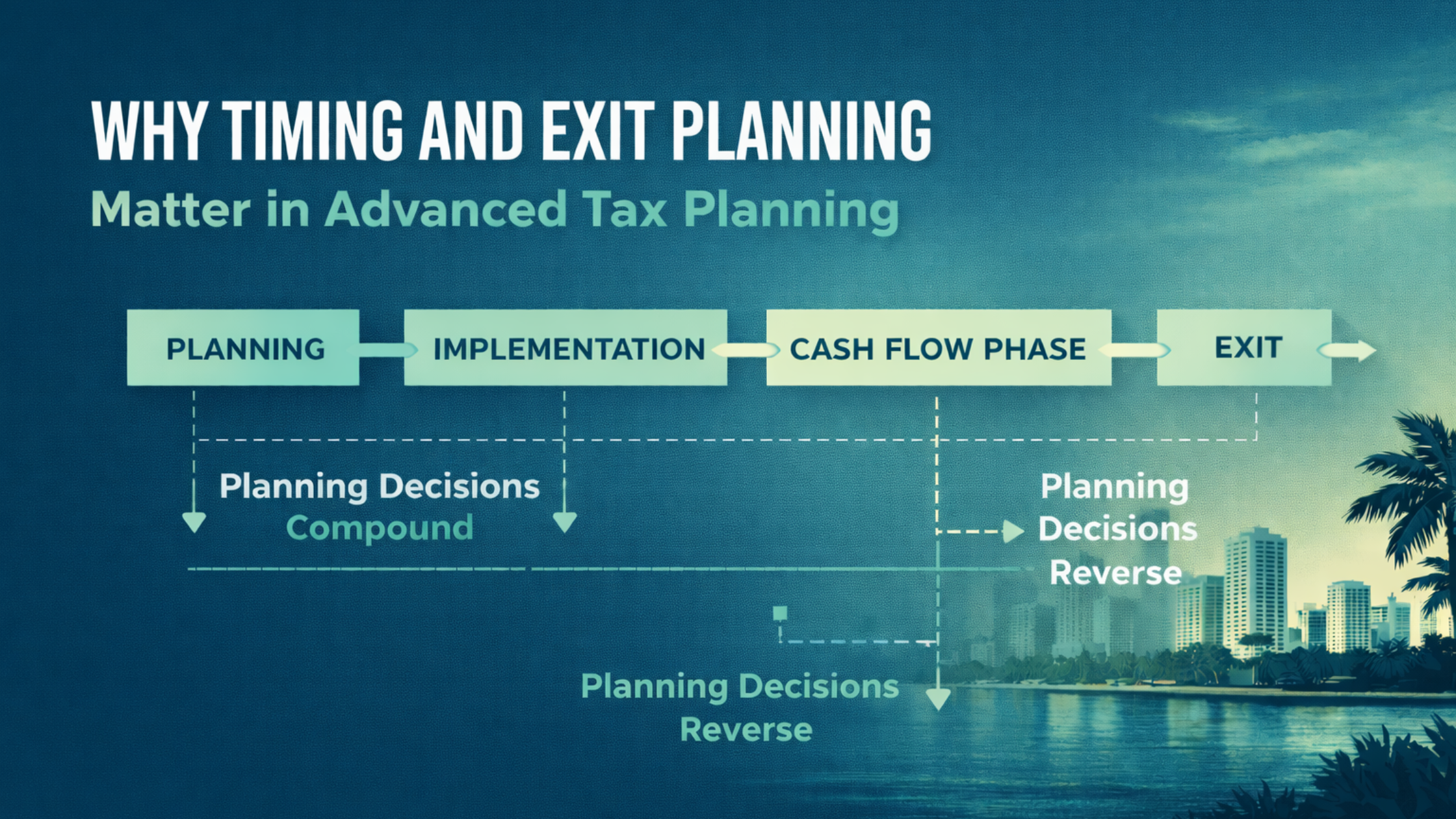

Timing and sequencing often matter more than the strategy itself.

Real estate tax benefits must be modeled alongside financing, cash flow, and recapture exposure.

Florida’s tax environment shifts planning away from rate reduction toward income characterization and durability.

Strategies that ignore exit consequences often reverse earlier tax benefits.

Review your current structure, sequencing, and long-term exposure with our advisory team.

The Real Problem High-Income Florida Taxpayers Face

Florida’s no state income tax environment creates an illusion of simplicity. While state-level planning pressure is reduced, federal tax exposure remains significant and becomes more complex as income sources diversify.

High earners frequently accumulate:

Operating business income

Real estate cash flow and depreciation

Capital gains and investment income

Pass-through allocations from multiple entities

The real risk is not paying too much tax this year. It is implementing strategies that create short-term savings but fail when income shifts, assets are sold, or ownership structures change. Advanced tax planning addresses how decisions made today affect taxable income, liquidity, and flexibility over five, ten, or twenty years.

The Real Framework: Documentation, Intent, and Economic Substance

Advanced tax planning rests on three pillars that must align.

Documentation establishes credibility. This includes contemporaneous records such as operating agreements, compensation policies, lease terms, valuations, time tracking, and planning memoranda. Documentation is not defensive paperwork added later. It is part of the strategy itself.

Intent reflects a genuine business purpose beyond tax reduction. The IRS does not require tax neutrality, but it does require that transactions serve a real economic objective.

Economic substance ensures the tax outcome matches reality. Ownership must reflect control and risk. Compensation must align with services provided. Transactions must meaningfully change the taxpayer’s financial position.

When these elements are aligned, tax efficiency is durable. When they are not, even technically allowable strategies become vulnerable.

Asset-Based Tax Planning vs Deduction-Driven Thinking

Most competing content on advanced tax planning focuses narrowly on deductions. Sophisticated planning focuses on assets.

Asset-based tax planning evaluates how real estate, equipment, and operating businesses produce taxable outcomes over time. Depreciation, amortization, basis management, and holding periods shape tax liability for years, not months.

This approach forces planners to answer questions most articles ignore:

How long will the asset be held?

How will it be financed or refinanced?

How will income be characterized during ownership?

What happens at sale, transfer, or succession?

A deduction that improves one year but complicates the next decade is not a strategic win.

Cost Segregation and Bonus Depreciation Within a Multi-Year Plan

Cost segregation and bonus depreciation remain structurally relevant tools, particularly for Florida real estate investors with commercial property or short-term rental portfolios. However, most articles treat them as automatic wins.

In reality, accelerated depreciation must be sequenced properly. It should align with:

Peak earning years

Passive activity grouping elections

Material participation status

Financing covenants and lender optics

Anticipated refinance or disposition timelines

Without this coordination, early tax benefits can be offset by depreciation recapture, reduced basis flexibility, or unintended income recognition later. Advanced tax planning evaluates whether depreciation accelerates wealth or merely shifts tax liability forward.

Active vs Passive Treatment and Ownership Structure Implications

Advanced tax planning requires precision in how income and losses are classified.

Material participation, real estate professional status, and grouping elections are frequently misapplied or poorly documented. These are not elections in name only. They must reflect actual involvement, decision-making authority, and operational reality.

Entity structure reinforces this classification. LLCs, partnerships, and S corporations each carry different implications for:

Self-employment exposure

Loss utilization

Profit allocation

Asset protection

Exit and succession flexibility

Selecting an entity solely for tax reduction, without considering control, capital flows, or future ownership changes, often creates rigidity that undermines long-term planning.

Cash Flow vs Tax Savings: A Trade-Off Many Articles Ignore

One of the most common content gaps is the failure to address liquidity.

Tax savings that impair cash flow can reduce financing options, strain operations, or force premature asset sales. For real estate investors, depreciation-driven losses may conflict with debt service requirements. For business owners, aggressive compensation strategies can limit reinvestment capacity.

Advanced tax planning prioritizes after-tax cash flow and balance sheet resilience, not just tax minimization.

Exit, Recapture, and Sustainability Over Time

Many strategies look optimal until the exit occurs.

Depreciation recapture, capital gains exposure, entity unwind costs, and installment sale limitations often reverse earlier tax benefits. Yet most articles barely mention exit modeling.

True advanced tax planning incorporates exit scenarios from the beginning. It evaluates how strategies perform not just during ownership, but at disposition, transfer, or succession. Planning that ignores the endgame is incomplete.

Content Gap Coverage: What Most Articles Get Wrong

Most content targeting advanced tax planning oversimplifies or omits critical realities.

Common gaps include:

Treating tax deferral as permanent savings

Ignoring sequencing across multiple tax years

Failing to model recapture and exit outcomes

Overlooking documentation until audit risk arises

Assuming strategies apply universally regardless of income mix or asset type

We also see high earners copying structures that worked for others without comparable facts. Advanced tax planning is inherently individualized. In many cases, restraint is the most sophisticated decision.

Designed for high-income taxpayers managing business, real estate, and exit considerations.

Florida-Specific Considerations That Change the Analysis

Florida’s tax environment reshapes advanced planning priorities.

With no state income tax, federal strategies must be more disciplined. Real estate concentration increases exposure to depreciation, casualty events, and insurance volatility. Homestead versus non-homestead classification affects property tax but also ownership flexibility.

Short-term rental activity introduces operating income considerations that can alter passive loss treatment and entity selection. Climate and insurance risks influence holding strategies and capital reserves.

In Florida, advanced tax planning emphasizes durability, income characterization, and asset protection rather than chasing marginal rate reductions.

Conclusion: Advanced Tax Planning Is Architecture, Not Tactics

Advanced tax planning is not about pushing boundaries. It is about understanding them and building within them intentionally.

For high-income Florida taxpayers, the most effective strategies integrate documentation, intent, and substance into every decision. They consider timing, entity structure, asset behavior, and exit consequences from the outset.

At Square Accounting, we approach tax planning as a multi-year architecture process. The objective is not to win a single tax year, but to create structures that continue to perform as income grows, assets evolve, and priorities change.

For business owners, real estate investors, and professionals earning $250k+ annually.

Frequently Asked Questions About Advanced Tax Planning

What is advanced tax planning?

Advanced tax planning is the process of structuring income, assets, and ownership decisions over multiple years to manage tax exposure sustainably. Unlike basic tax planning, which focuses on annual deductions or credits, advanced tax planning considers timing, sequencing, entity structure, asset behavior, and exit outcomes. For high-income taxpayers, it integrates tax strategy with real economic activity, documentation, and long-term financial goals.

How is advanced tax planning different from tax preparation?

Tax preparation reports what already happened. Advanced tax planning influences what happens next.

Preparation is backward-looking and compliance-focused. Advanced tax planning is forward-looking and strategic. It evaluates future income, acquisitions, exits, and ownership changes before they occur, allowing decisions to be sequenced in a way that improves tax efficiency while preserving flexibility and defensibility.

Is advanced tax planning legal?

Yes. Advanced tax planning is legal when strategies are supported by proper documentation, legitimate business intent, and economic substance. The risk arises when strategies exist only on paper or are implemented without a real non-tax purpose. High-income taxpayers often face issues not because a strategy was prohibited, but because it lacked substance or was poorly documented.

When should high-income earners start advanced tax planning?

Advanced tax planning should begin before income spikes, major asset acquisitions, or liquidity events. Waiting until after income is earned or a transaction closes significantly limits available options. For business owners and real estate investors, planning is most effective when it is integrated into acquisition timing, entity formation, compensation design, and exit modeling well in advance.

Does advanced tax planning still matter in Florida with no state income tax?

Yes, and in some cases it matters more.

Florida’s lack of state income tax reduces rate arbitrage opportunities, which means federal tax efficiency must be more precise. Planning often shifts toward income characterization, depreciation strategy, asset protection, and exit sustainability. Real estate concentration, short-term rental activity, insurance risk, and property tax classification also play a larger role in Florida-based planning decisions.

What are the biggest mistakes people make with advanced tax planning?

The most common mistakes include treating tax deferral as permanent savings, ignoring exit and recapture consequences, copying strategies without similar facts, and failing to document intent and substance. Another frequent issue is prioritizing tax savings over cash flow or flexibility, which can create operational or financing problems later.

Does advanced tax planning increase audit risk?

Advanced tax planning does not inherently increase audit risk when executed correctly. In fact, well-documented strategies with clear economic substance are often more defensible than aggressive, last-minute deductions. Audit risk typically increases when strategies are implemented retroactively, lack documentation, or are inconsistent with the taxpayer’s actual behavior.