Blog

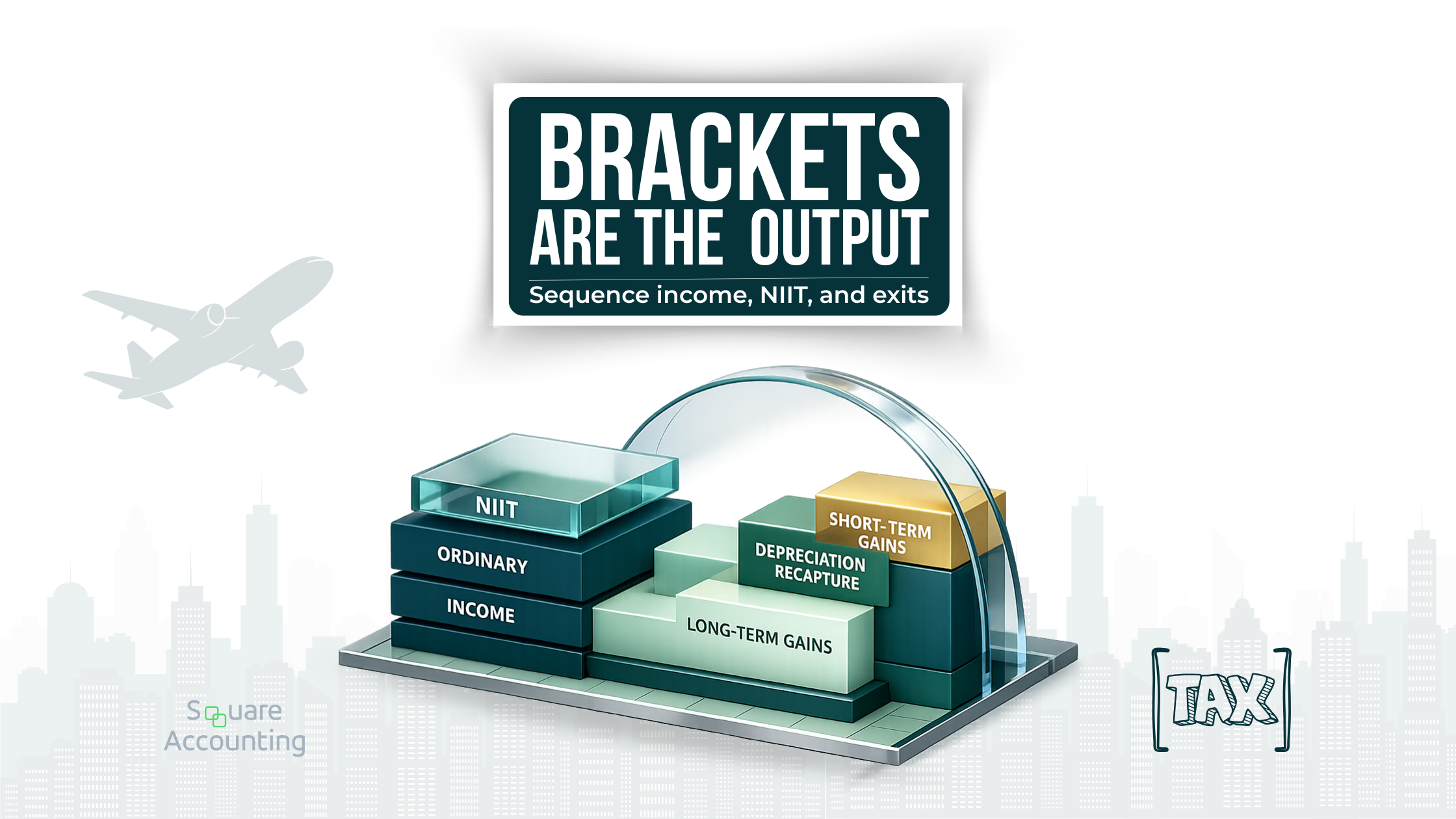

2026 Long-Term Capital Gains Tax Brackets: A Strategic Framework for High-Income Florida Taxpayers

A strategic framework for Florida high-income taxpayers to sequence capital events, manage NIIT layering, and plan real estate exits without exit-year surprises. Built for multi-year outcomes, not one-year rate chasing.

Defined Benefit and Cash Balance Plans as Long-Term Tax Deferral Vehicles

Defined benefit and cash balance plans are long-term tax deferral vehicles, not year-end tactics. Used correctly, they coordinate income, real estate, and exit planning over time.

Advanced Tax Planning Without Crossing the Line: Documentation, Intent, and Substance

Advanced tax planning is not about deductions. It is about structuring income, assets, and ownership decisions over time so tax strategies remain defensible, sustainable, and aligned with long-term goals. This guide explains how documentation, intent, and economic substance separate effective planning from costly mistakes for high-income Florida taxpayers.

Planning for Depreciation Recapture Before You Buy the Asset

Depreciation reduces taxes today, but recapture determines outcomes later. Learn how high-income Florida investors should plan depreciation before acquiring an asset to protect long-term returns and exit flexibility.

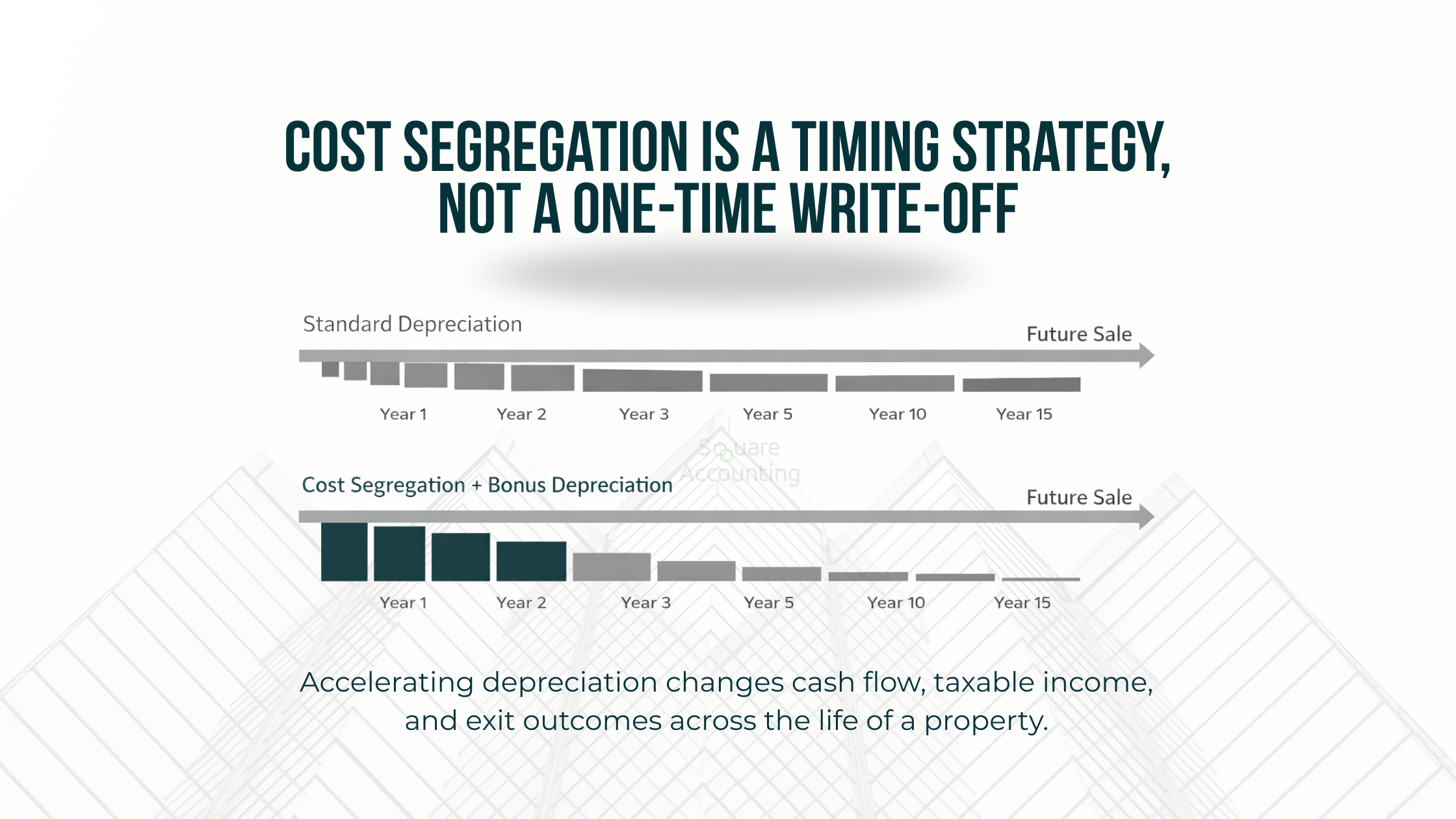

Cost Segregation as a Timing Tool, Not a One-Time Tax Play

Cost segregation is often pitched as a one-time tax savings strategy. In reality, it’s a timing decision that reshapes taxable income, cash flow, and exit outcomes over the life of a property—especially for high-income Florida investors.

Contact us

Talk to our Tax Advisor

Running your operations is demanding—your taxes shouldn’t add to the stress. Whether you need strategic tax planning or ongoing support, we’re here to help.