Blog

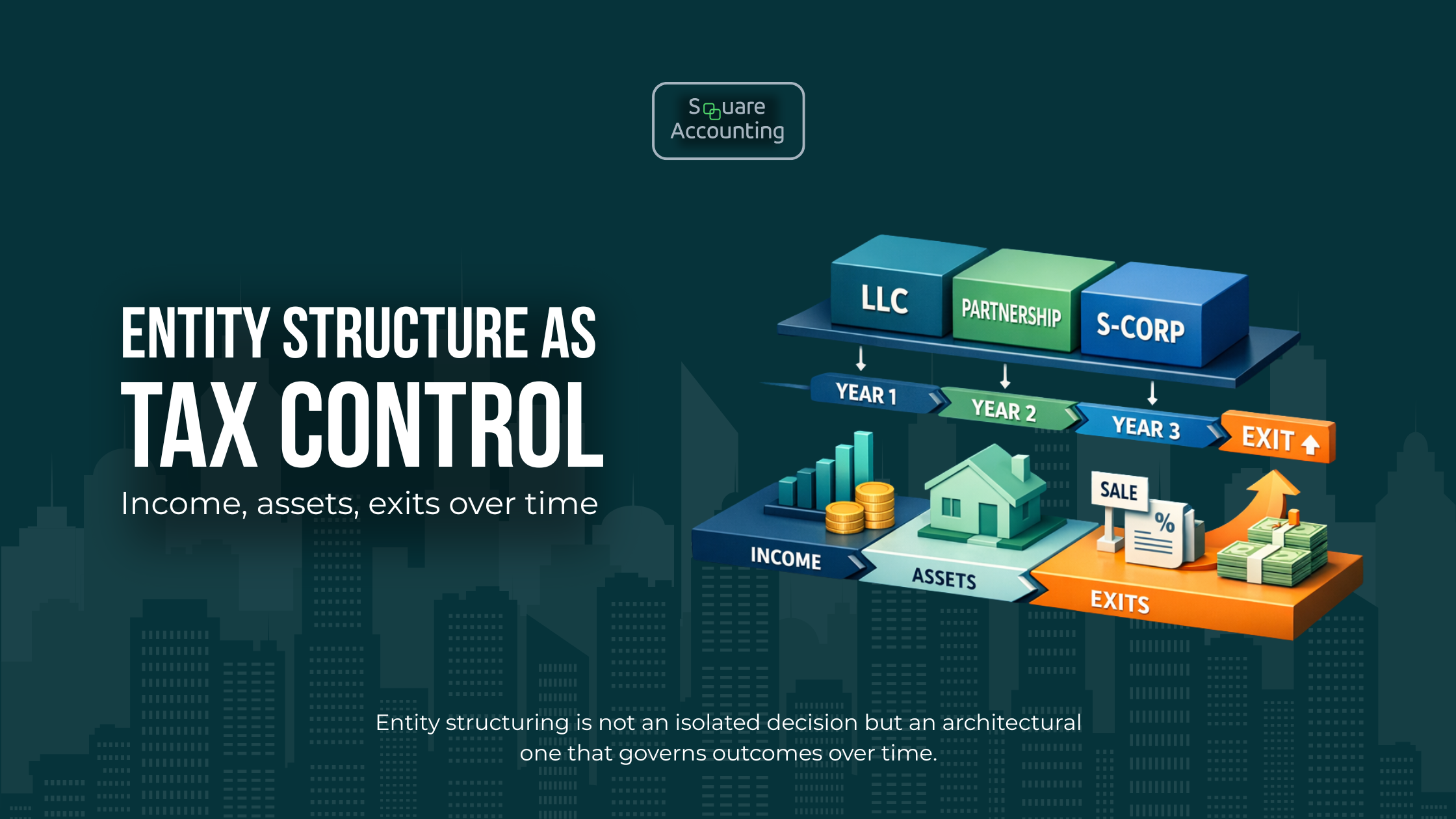

Structuring LLCs, Partnerships, and S-Corps for Long-Term Tax Control

Entity structure shapes income classification, depreciation, and exit outcomes over time. This guide examines LLCs, partnerships, and S-corps through a multi-year planning lens for Florida high earners.

Contact us

Talk to our Tax Advisor

Running your operations is demanding—your taxes shouldn’t add to the stress. Whether you need strategic tax planning or ongoing support, we’re here to help.