Blog

Who Owns the Asset, Who Gets the Deduction, and Why It Changes Everything

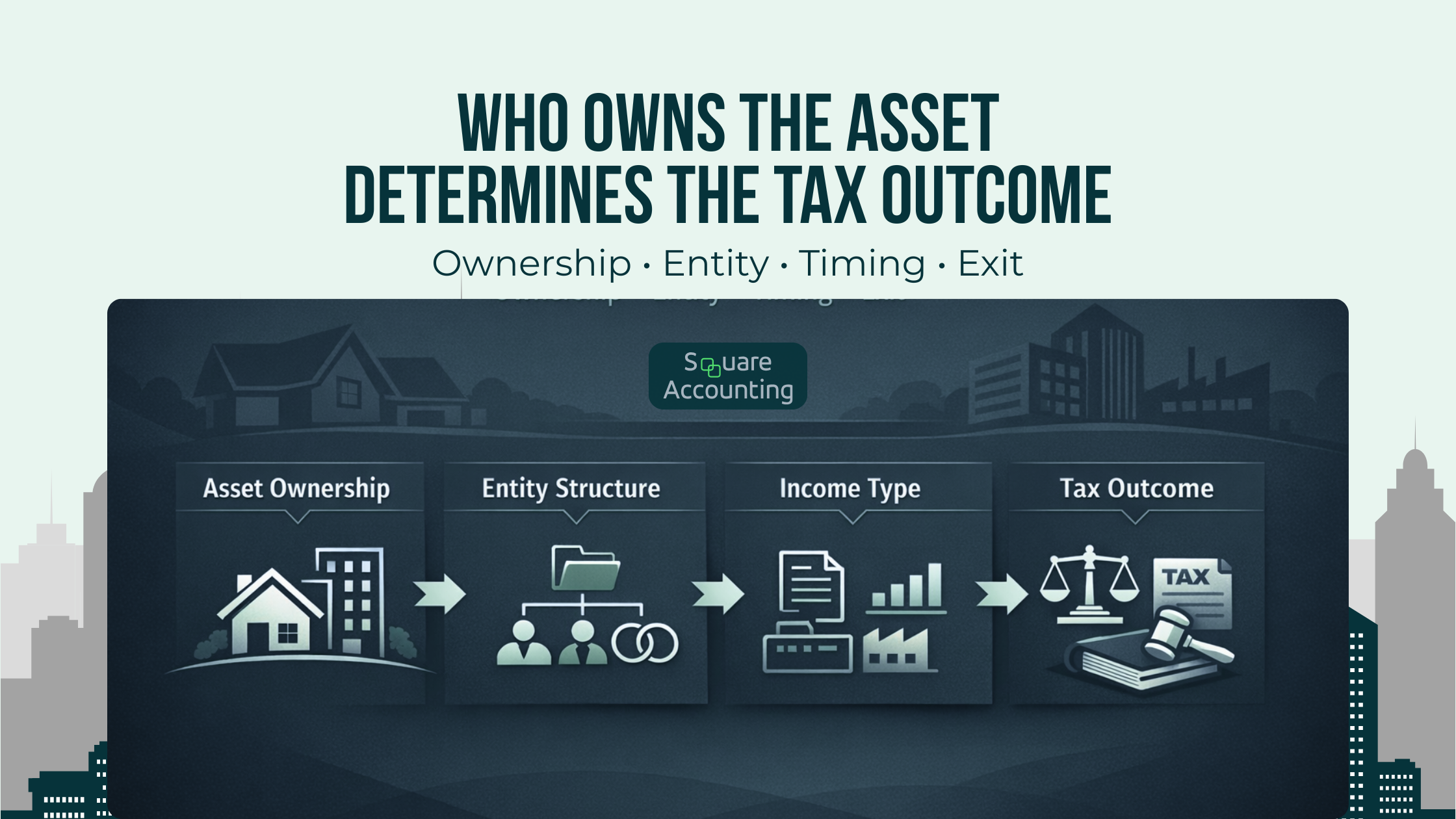

Most tax strategies fail not because deductions are unavailable, but because they are placed in the wrong hands. For high-income Florida taxpayers, asset ownership determines who gets the deduction, when it can be used, and what happens at exit. This article explains why ownership structure, entity choice, and timing change everything in long-term tax planning.

Contact us

Talk to our Tax Advisor

Running your operations is demanding—your taxes shouldn’t add to the stress. Whether you need strategic tax planning or ongoing support, we’re here to help.